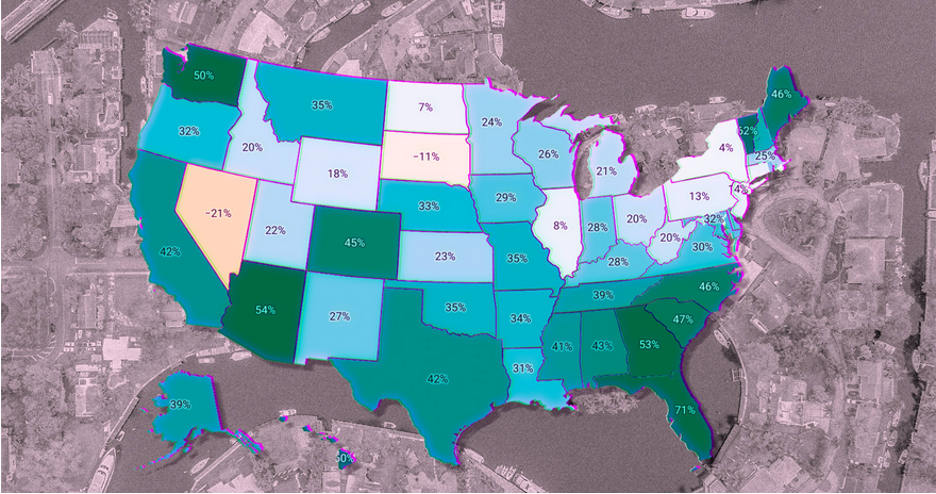

The Colorado real estate market is seeing a rapid shift as inventory climbs across the state, even amid lower interest rates. A significant new trend in some of Colorado’s largest cities may indicate a deeper, more synchronized shift in the state’s housing market than has been observed in previous cycles.

According to data from the Colorado Association of Realtors, recent analysis highlights key differences between the condo and single-family home markets, pointing to emerging trends in market segments that typically serve as entry points for new homeowners. Historically, condos have been an accessible option for first-time homebuyers and a signal for the broader market, as many buyers transition from condos to single-family homes after building equity.

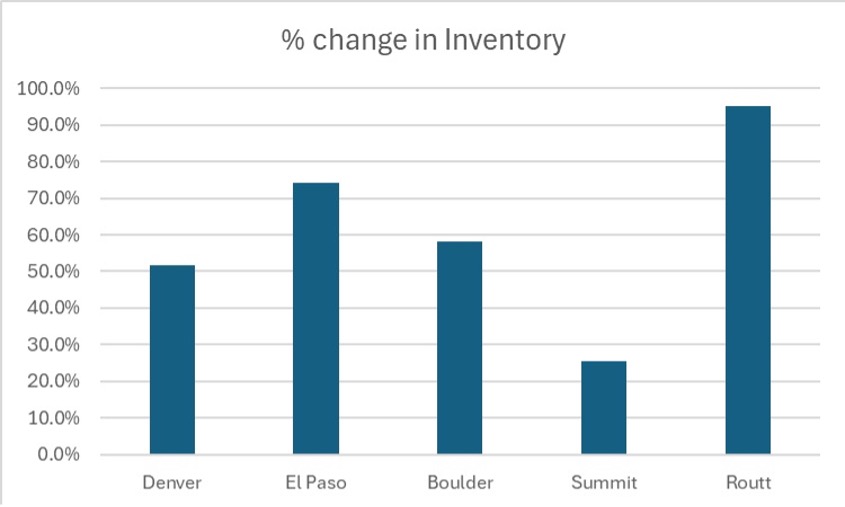

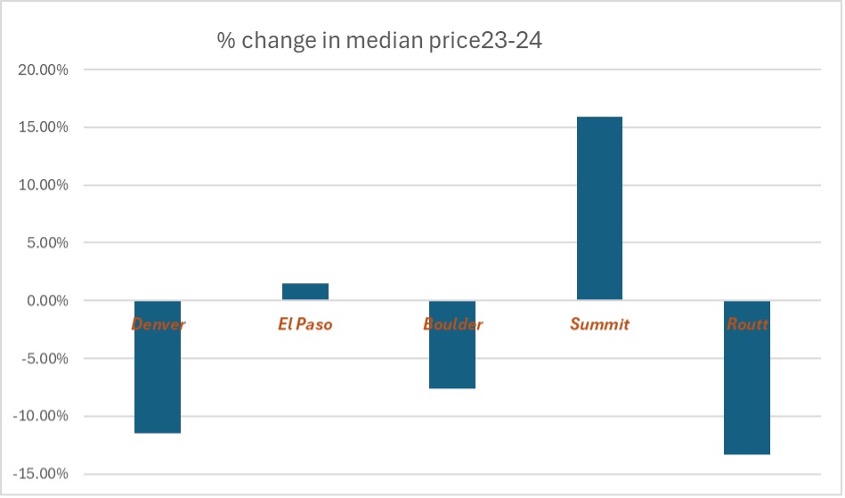

Yet, despite the recent drop in interest rates, demand for condos has unexpectedly fallen along with prices, marking a major change. August numbers reveal a stark shift: inventories are rising in several of Colorado’s main markets—Denver, El Paso (Colorado Springs), Boulder, Summit (Breckenridge), and Routt (Steamboat Springs)—while median prices have seen substantial drops in more than half of these areas.

Steamboat Springs and Ski Towns See Notable Changes

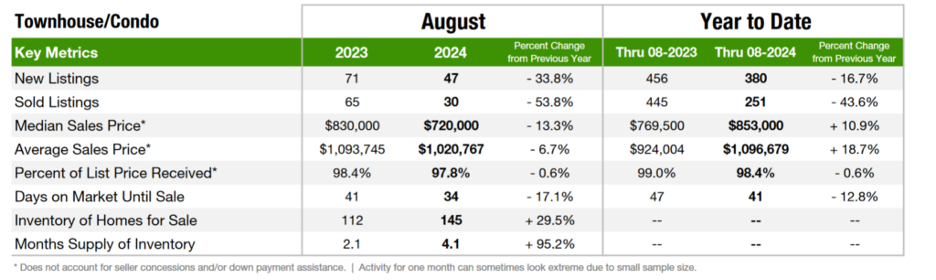

Ski resort markets, especially Steamboat Springs, have shown profound changes. Routt County’s inventory has nearly doubled year-over-year, with declines in both median and average sale prices. Sales have significantly slowed, with listings down 44% compared to last year.

Rising Inventory and Correlation Across Markets Statewide

Visual analysis further illustrates these changes: the first graph depicts the surge in condo inventory across Routt, Boulder, and El Paso Counties. The second shows how this inventory spike correlates with notable price declines. El Paso’s median prices have not dropped as sharply, yet many expect this market will eventually follow the trend.

Colorado’s different markets, previously staggered in downturns, are now highly correlated, suggesting a different dynamic than the last major housing recession in 2008. Previously, Denver and El Paso counties experienced price drops sooner than markets like Steamboat and Boulder, which lagged by six to twelve months. Now, these markets appear more synchronized, with Boulder and Steamboat nearly matching Denver’s rate of decline.

This increased market correlation suggests any downturn could be more pronounced across all regions, with declines happening simultaneously rather than sequentially. Analysts expect a potential price reset across the state as economic cooling continues.

Condos as an Indicator for Single-Family Homes

The condo market may foreshadow changes in the single-family market. Condos, with lower price points and high sensitivity to interest rates, often act as a leading indicator. Current trends in condos are expected to “trickle up” to impact single-family homes, particularly as inventory continues to increase. Denver, for instance, shows a 40% rise in days on the market and a 25% increase in months of supply, which could eventually pressure single-family home prices downward.

One exception is Routt County, where single-family inventory is down by 16.2%, which may protect single-family home prices in this area from declining as sharply as in Denver.

|

Condos: August 2024 |

||||

|

County |

months supply |

% change in Inventory |

Median condo price |

% change in median price 23-24 |

|

Denver |

4.7 |

51.6% |

$ 377,500 |

-11.50% |

|

El Paso |

4.7 |

74.1% |

$ 345,000 |

1.50% |

|

Boulder |

4.9 |

58.1% |

$ 454,500 |

-7.60% |

|

Summit |

6.9 |

25.5% |

$ 865,000 |

15.90% |

|

Routt |

4.1 |

95.2% |

$ 720,000 |

-13.30% |

Profound changes in the ski towns using the chart below for Steamboat. You can notice the huge jumps in inventory along with a decline in the median and average sales price. Furthermore look at the number of sold listings, down 44% from last year.

A New Paradigm Shift in Colorado Real Estate

Unlike the 2008 downturn, the current trend of rising correlations across diverse markets could signal a paradigm shift. If the economy experiences further downturns, analysts predict the trends seen in the condo market will accelerate, impacting single-family homes more widely. The most significant takeaway for the Colorado real estate market is that change is likely and could happen unexpectedly.

About Fairview Lending

Fairview is recognized as a leader in Colorado Hard Money and private lending for residential investment and commercial properties throughout the state. Known for deep expertise across Colorado markets, Fairview has closed thousands of loans in the Front Range, Western Slope, resort communities, and beyond. Their team, rooted in Colorado, provides direct access to decision-makers and transparent, upfront service with no hidden fees.

To learn more about Colorado Hard Money Lending or to get started on a loan, visit Fairview’s Hard Money Guide or complete the one-page loan application.

Media Contact

Company Name: Colorado Hard Money

Contact Person: Glen Weinberg

Email: Send Email

Phone: +1-303-835-9376

Country: United States

Website: www.coloradohardmoney.com