VANCOUVER, BC / ACCESSWIRE / November 12, 2024 / Kingfisher Metals Corp. (TSXV:KFR)(FSE:970)(OTCQB:KGFMF) ("Kingfisher" or the "Company") is pleased to report new drill targets generated from the 2024 field program at the HWY 37 Project in the Golden Triangle, British Columbia.

SIX NEW DRILL TARGETS:

1. Williams Porphyry Cu-Au Target

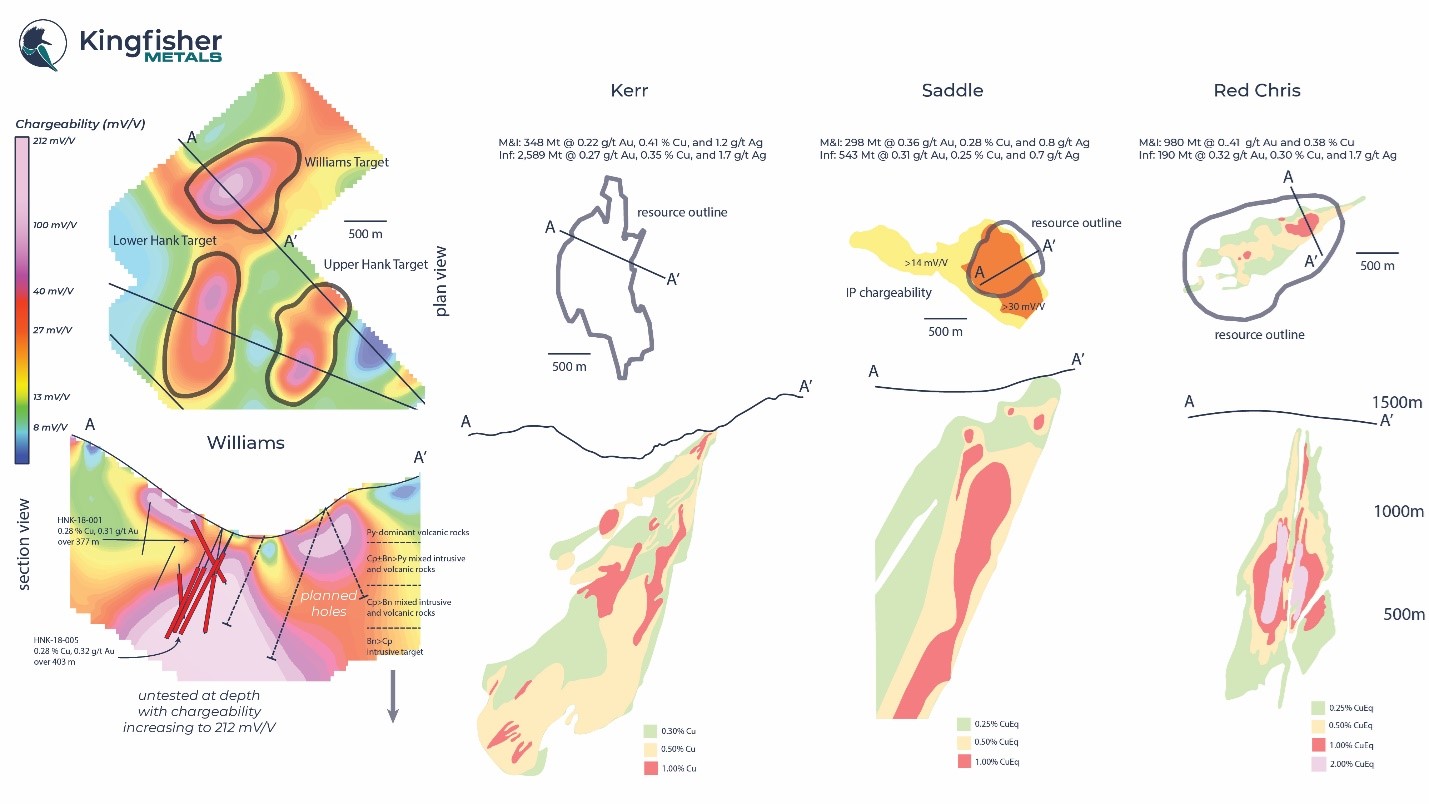

IP survey outlines and refines a chargeability anomaly (> 25 mV/V) measuring 2200 m by 1500 m to depths of over 1000 m and up to 212 mV/V below and lateral to the Williams deposit.

The anomaly is host to open-ended intercepts such as up to 0.33% Cu and 0.39 g/t Au over 347 m including 0.56 % Cu and 0.69 g/t Au over 127 m.

Proposed drill tests will explore the chargeability anomaly to identify more upper-level stocks where grade is closely tied to porphyry host and to test deeper levels with potential for elevated Cu in bornite.

2. Lower Hank Porphyry Cu-Au Target

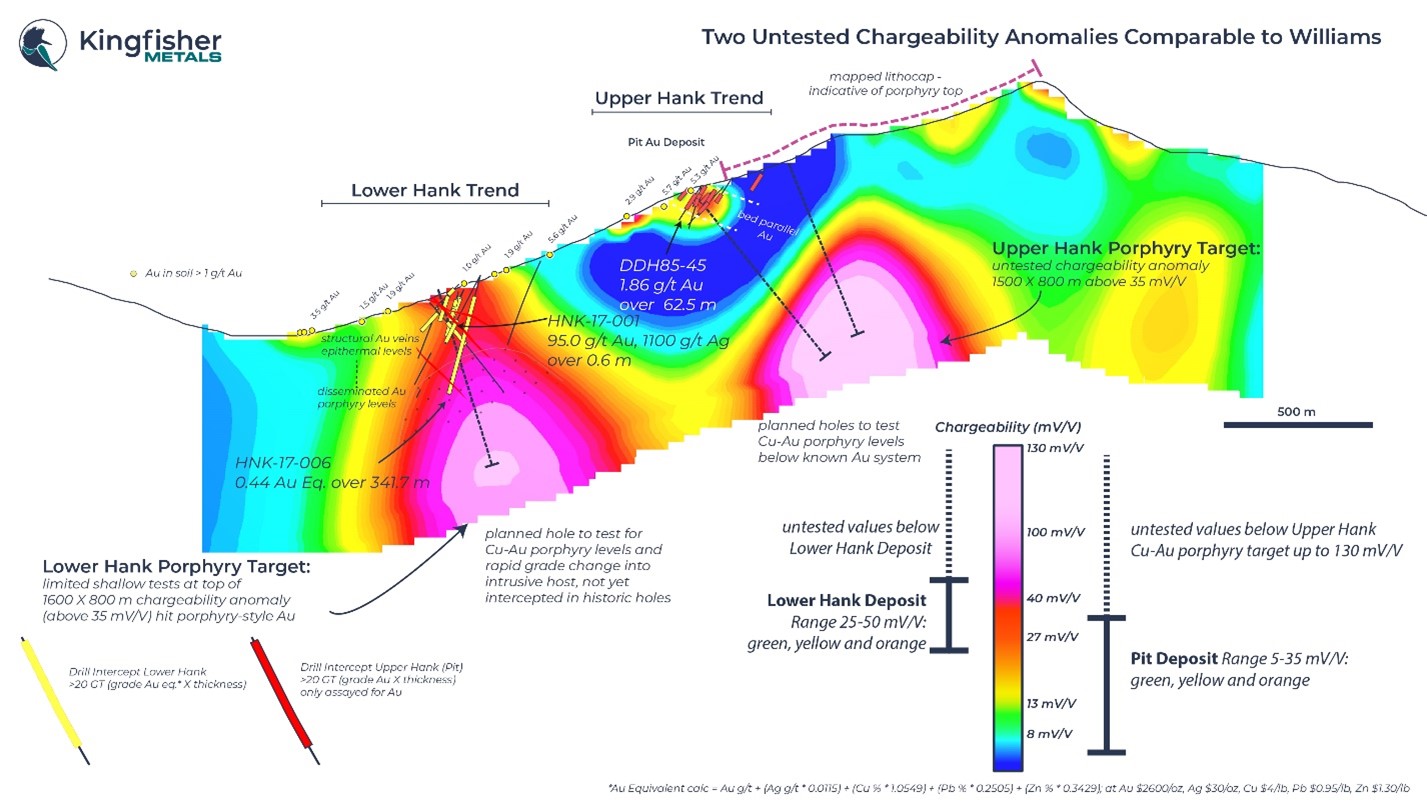

Lower Hank porphyry target anomaly measures 1600 m by 800 m greater than 35 mV/V to a depth of 850 m with peak values of 86 mV/V with the closest historical drill hole returning 342 m of 0.33 g/t Au and 3.9 g/t Ag.

Proposed drill tests will focus on source porphyry intrusions within the chargeable body, known to be associated with rapid grade change at the nearby Williams deposit.

3. Upper Hank Porphyry Cu-Au Target

Upper Hank porphyry target anomaly measures 1500 m by 800 m greater than 35 mV/V to a depth of 850 m with peak values of 129 mV/V with high-grade epithermal mineralization at Pit deposit up to 20 m of 11.63 g/t Au and 13.8 g/t Ag located above anomaly.

Evidence for telescoped system where epithermal gold superimposed on porphyry Cu-Au in close vertical proximity.

Proposed drilling at the Upper Hank anomaly will test the projection of epithermal gold systems (intermediate and high sulfidation) at surface into the porphyry target at depth.

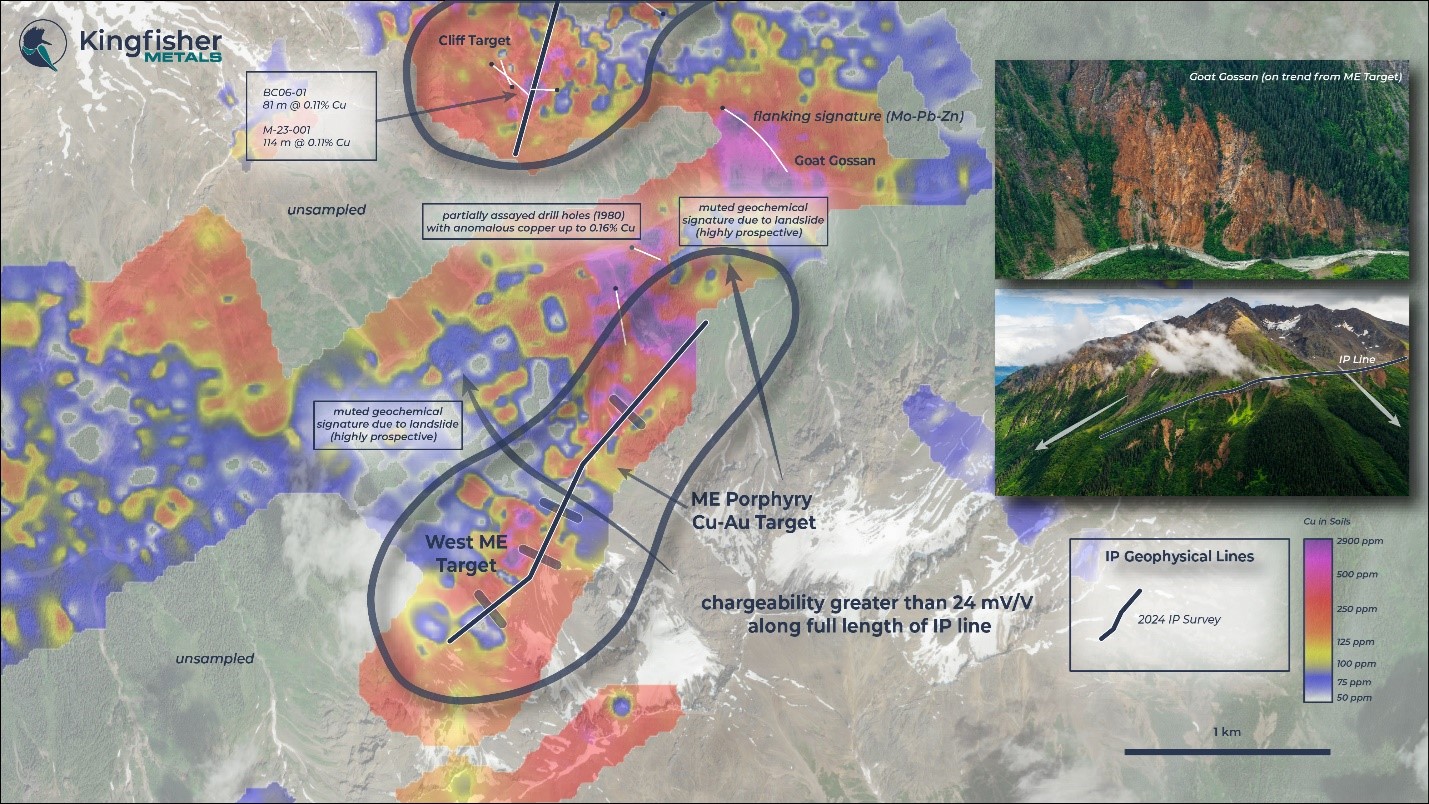

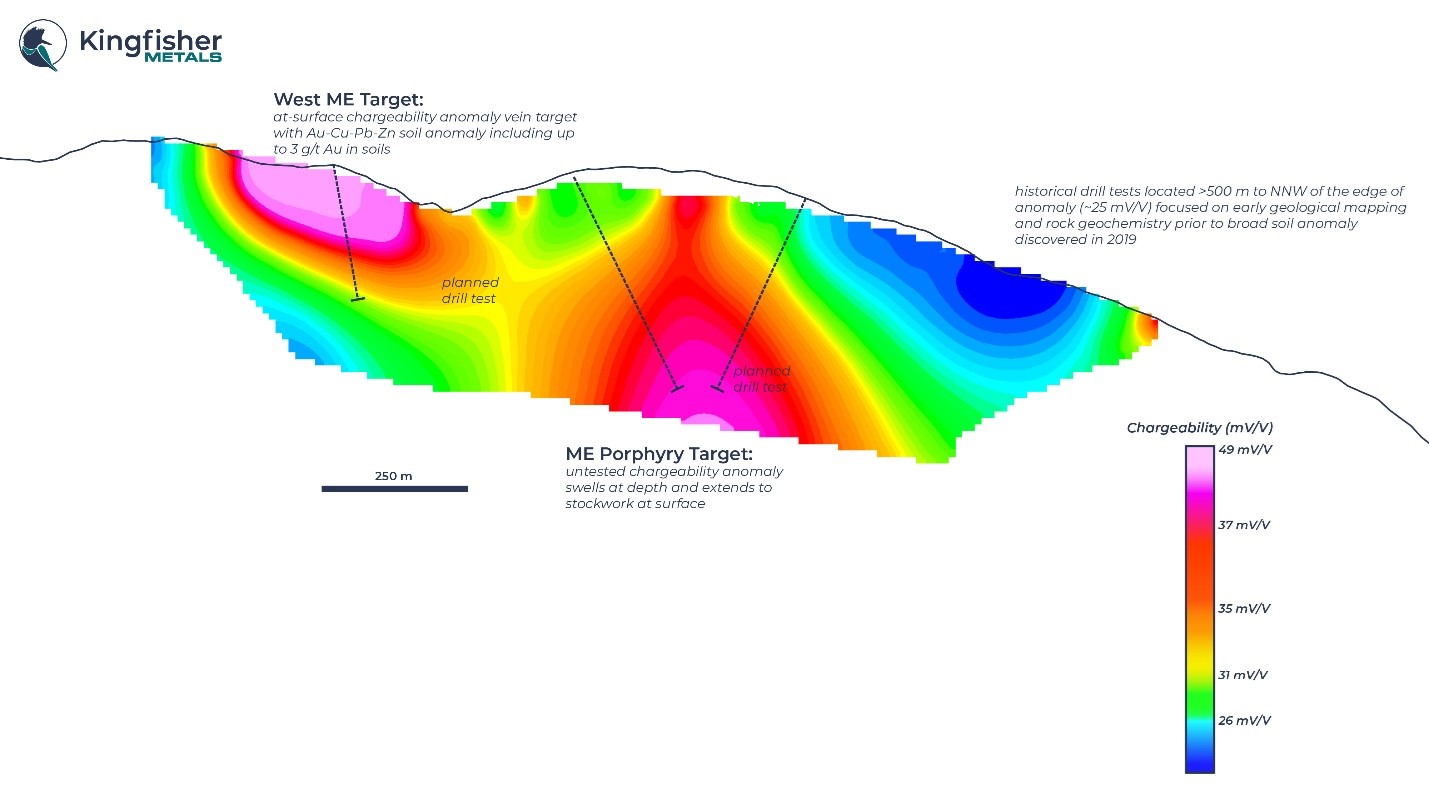

4. ME Porphyry Cu-Au Target

First-ever IP survey of the broad Cu-Au-Ag-Mo anomaly at ME outlines anomalous chargeability (>24 mV/V) across full length of line focused on mapped porphyry target.

Proposed drill tests will focus on the largest at-surface subvertical anomaly to target porphyry Cu-Au, and a second at-surface low angle anomaly associated with Au-Pb-Zn anomalism as a vein target.

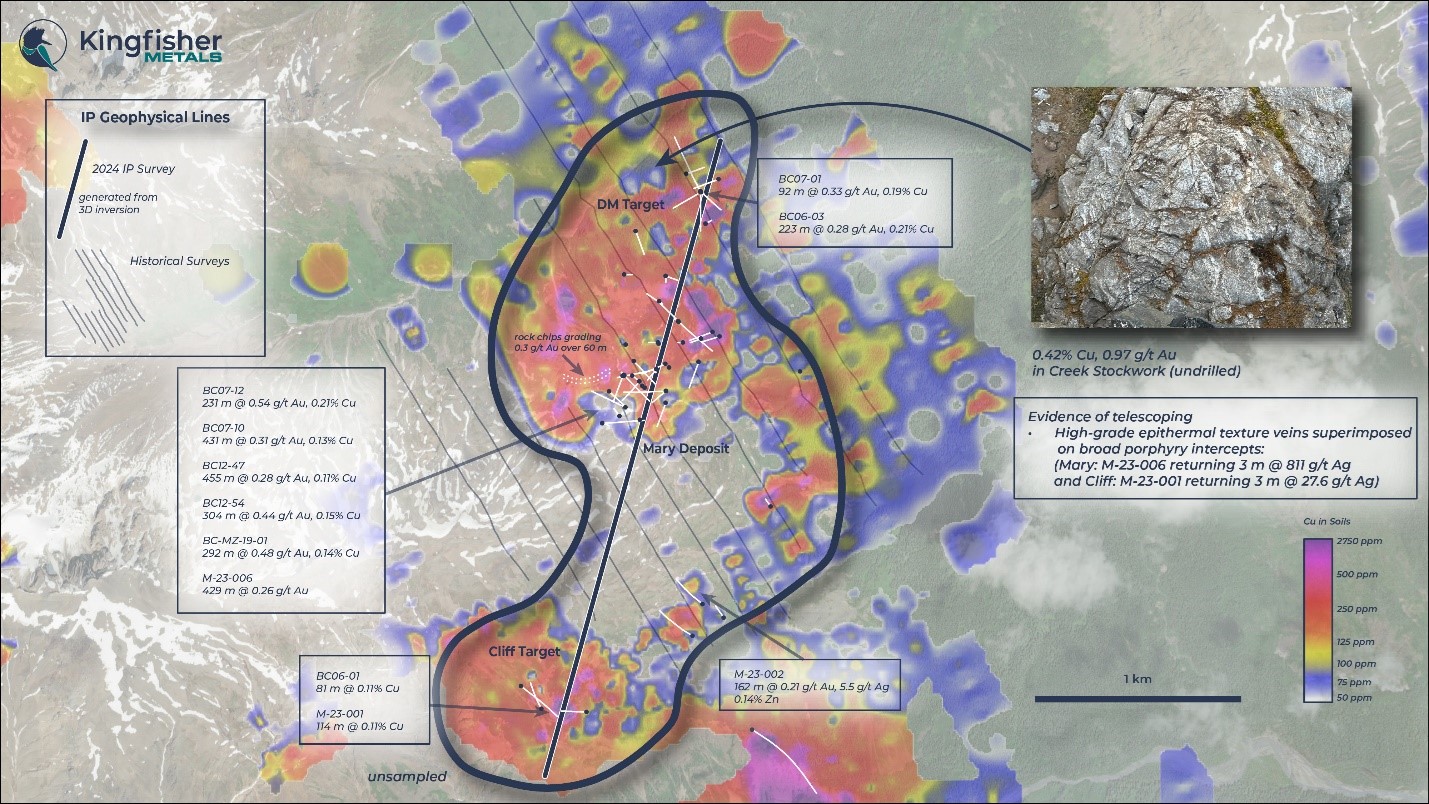

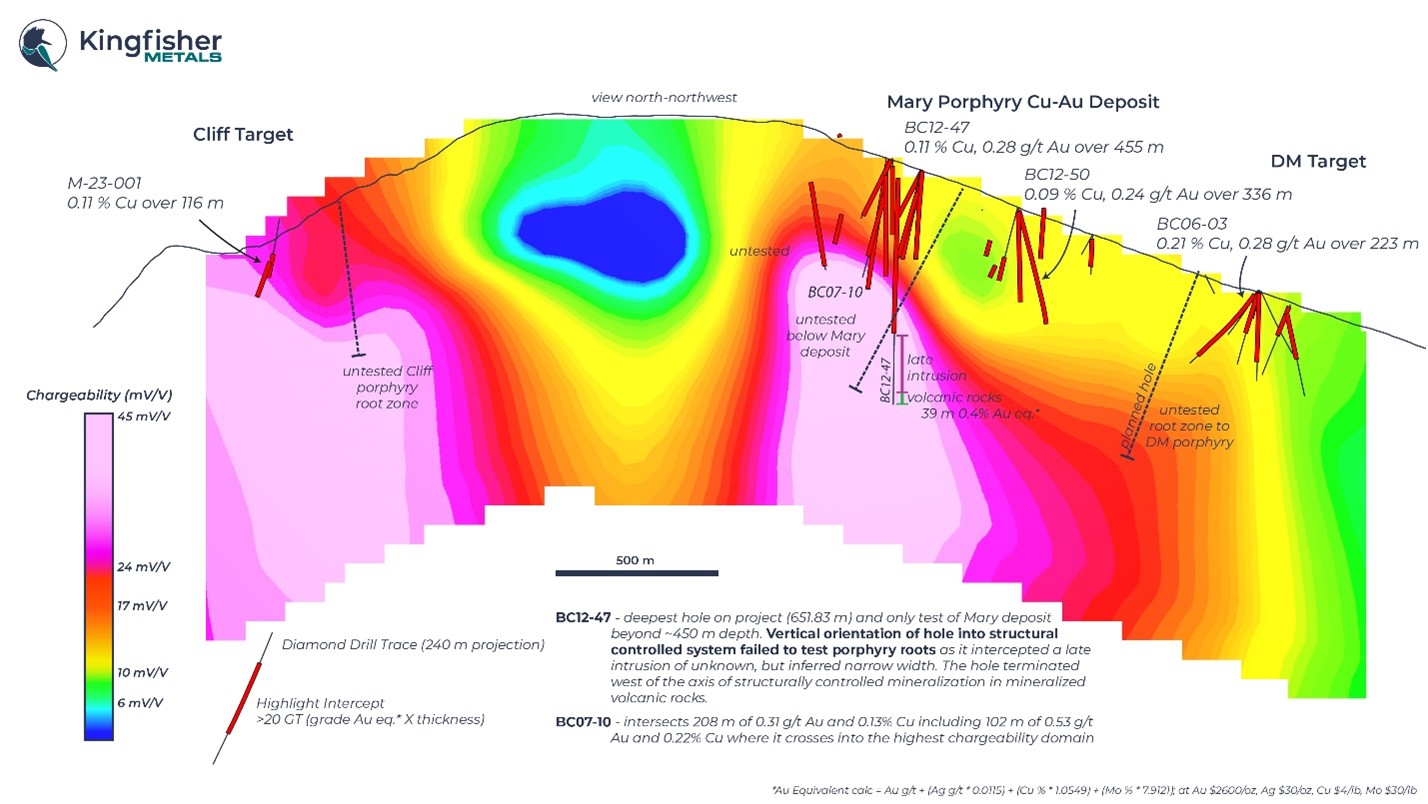

5. Mary Porphyry Cu-Au Target

A new 3D inversion product of coupled historical and new IP provide high resolution of a largely untested chargeability anomaly below Mary deposit that swells from 350 m to 750 m across at depth where relogging indicates a very high porphyry level of historical drilling, with only a single deeper test that failed to cross peak chargeability.

Proposed drilling at Mary is designed to test the open-ended northern deposit, cross over a historical intercept within anomaly (0.31 g/t Au, 0.13% Cu over 208 m, BC07-10), and drill deeper levels of peak chargeability never before tested.

On trend with Mary, the DM porphyry target intercepts are at apex of chargeability anomaly where higher relative copper:gold intercepts are associated with bornite.

Proposed drill test at DM aims to step 250 m to south of open-ended, from-surface intercepts (0.21% Cu, 0.28 g/t Au over 223 m, BC06-03) and test large chargeability anomaly below for a porphyry root zone.

6. Cliff Porphyry Cu-Au Target

New large 700 m wide and 1 km deep (> 25 mV/V) Mary-like chargeability anomaly projects to surface mineralization at Cliff porphyry now interpreted as the core target for Cliff porphyry, where flanking-type intercepts (Cu-Mo, low Au) drilled into flanks of chargeable body.

The new Cliff target area can be easily tested 350 m to NE of previous drill tests in flat alpine terrain.

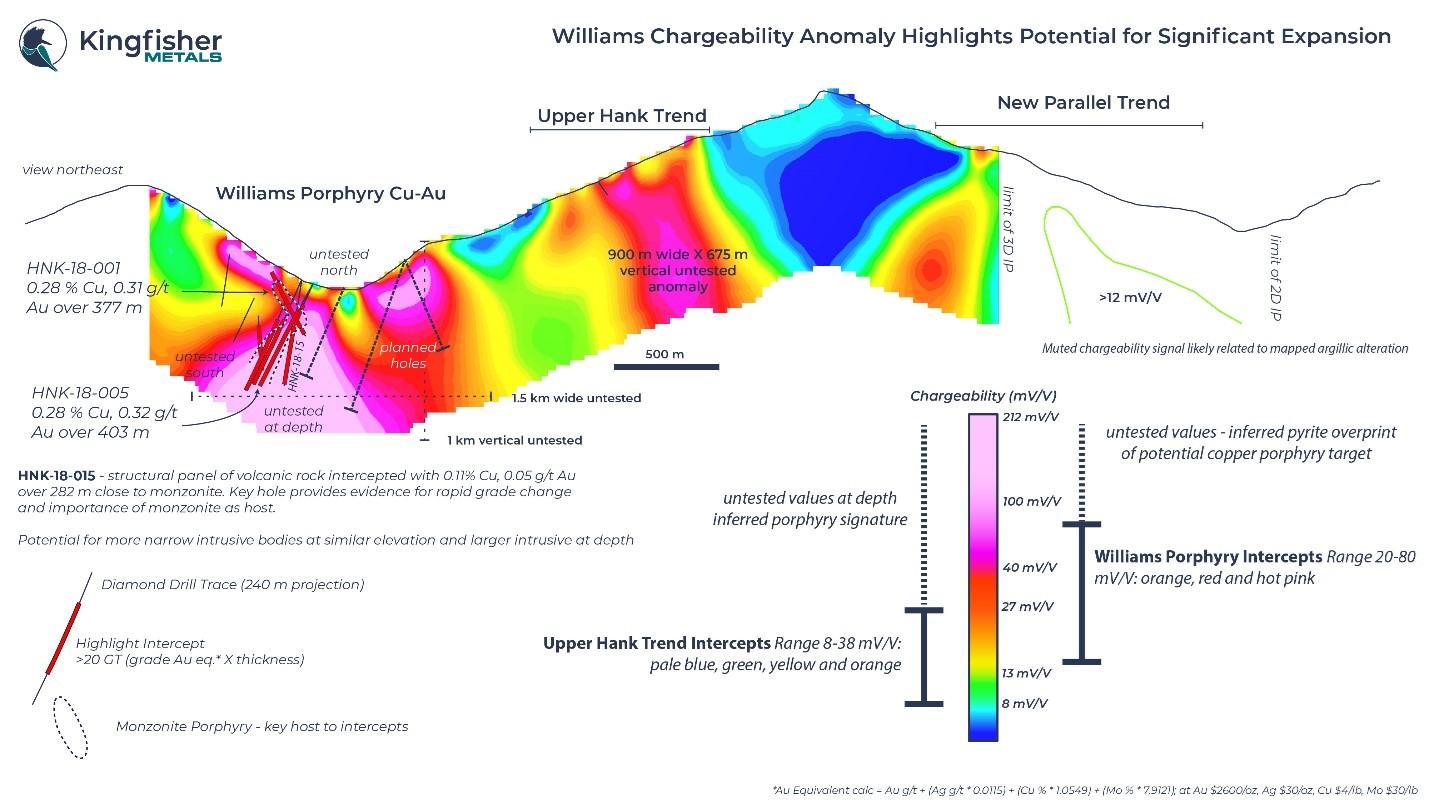

Dustin Perry, CEO states "We are incredibly pleased with our first IP survey results on the HWY 37 Project. The survey highlighted the best porphyry drill target I have seen in my career at the open Williams deposit. Williams was discovered in 2017 and has only seen 6,095 m of drilling despite returning grades comparable to significant deposits in the Golden Triangle. Previous IP surveys there outlined a broad chargeability anomaly, but survey lines were run subparallel to the trend of mineralization which limited targeting capabilities due to a lack of contrast. The new survey line is orthogonal to historical lines and when integrated into a new 3D inversion highlights the potential for significant expansion. Historical drill holes bottomed in mineralization and demonstrated potential for excellent porphyry grades with sub intervals including 127 m of 0.56% Cu and 0.69 g/t Au. Intercepts contain chalcopyrite greater than bornite and we interpret that grades have potential for improvement as bornite becomes the dominant sulfide mineral. The new IP chargeability anomaly represents the potential for discovering multiple Williams-like shallow stocks as well as a larger intrusive body at depth.

The porphyry targets we have outlined at Lower and Upper Hank are stand-alone drill targets. They overlap with both disseminated bulk tonnage and high-grade structurally hosted Au-Ag mineralization. Mapping and spectral studies in the area have outlined a strong case for telescoped porphyry-epithermal systems which leads to the possibility of abrupt and often rapid changes from the epithermal domain to porphyry Cu-Au mineralization. Given the size and cluster of anomalies at the Hank-Williams area coupled with mineralization styles, we believe there is potential to host a cluster of porphyry Cu-Au systems comparable to the Cadia area in NSW, Australia.

The single reconnaissance line we completed at the ME target reaffirmed our belief that it represents a poorly tested porphyry Cu-Au target. Historical drilling there was done from the base of slope with limited and incomplete assays in an area we interpret the drill site as too deep and laterally far from the historical stockwork showing. Mapping this year outlined trends of porphyry stockwork with Cu-Au-Ag-Mo mineralization. Observations at the base of slope at ME and the base of slope at the large Goat gossan to the NE indicate the presence of a flanking alteration character to a large NE trending porphyry system. The single IP line returned high chargeability values across the full length of the line which represents drill ready targets for 2025.

Further, a single IP line was completed at the Mary Deposit to better understand the orientation of the system, and to cover the Cliff and DM targets. Along trend to the north of Mary, rock sampling returned 0.42% Cu and 0.97 g/t Au from an untested stockwork body. Drill core review at Mary showed previously unrecognized syn-mineral intrusions comparable to those identified at Williams, and at DM showed the presence of bornite stringers. These observations along with the new IP survey led us to believe that there is significant potential for discovery to the north along this trend. The IP survey at Cliff outlined a large chargeability anomaly that trends into the slope and is essentially untested by the three shallow drill holes completed there to date.

The targets generated from this program represent a pipeline of top-notch porphyry Cu-Au drill targets in one of the most geologically prospective and active mining jurisdictions in the First World."

Summary of IP and Geological Mapping Programs

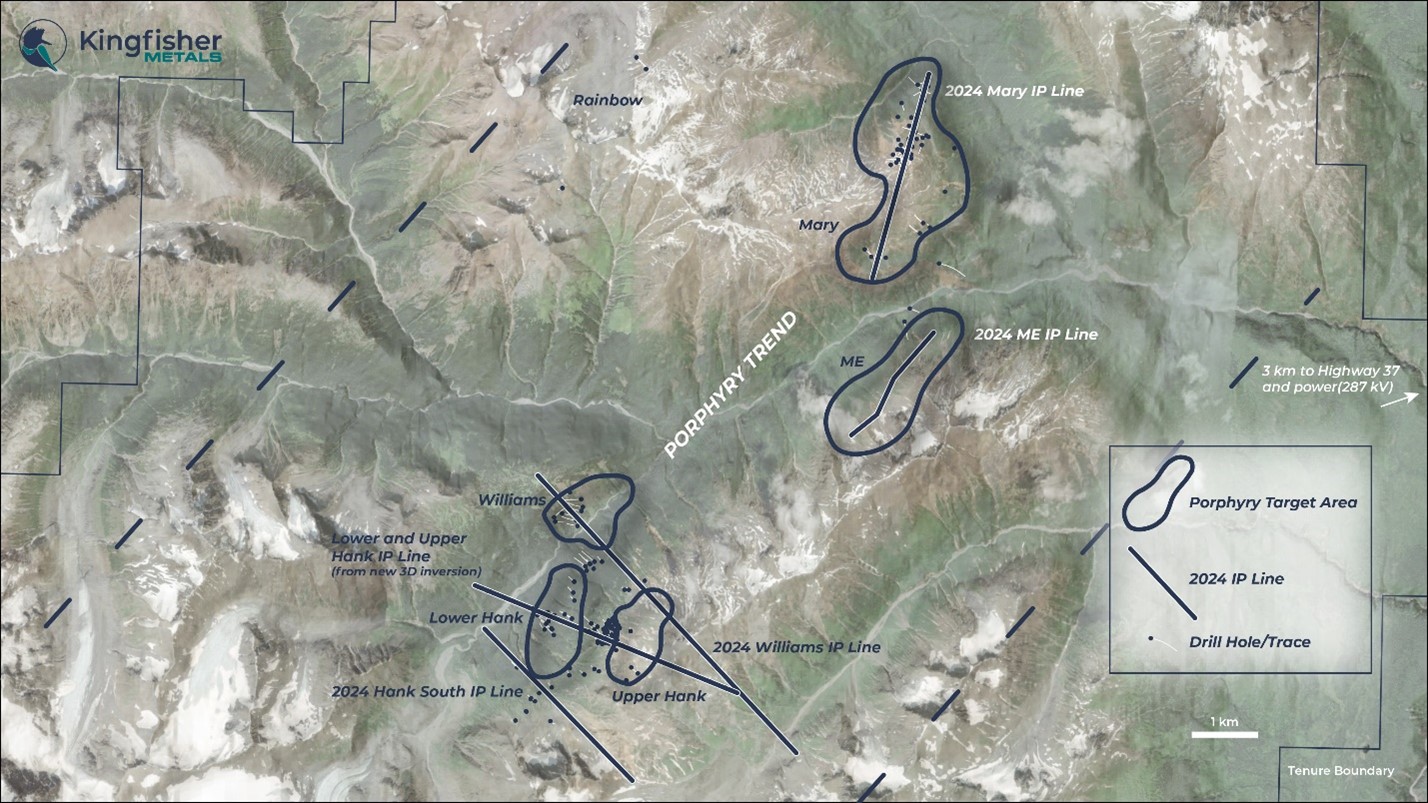

The 2024 field program at the HWY 37 and LGM projects was primarily focused on defining drill targets for the 2025 field season. Four IP geophysical lines (Figure 1) were completed on the HWY 37 project and totalled 14.14-line km. This data was then integrated with historical data to provide new 3D inversions at the Mary and Hank-Williams trends.

Mapping at HWY 37 was focused on better understanding the alteration and controls on grade at the Mary and Hank-Williams trends and at the ME Target. Between 2023 and 2024, 501 samples have been selected for spectral analysis that will be completed and interpreted over the coming months prior to the 2025 field season. This data will complement the preexisting spectral data that exists in the Hank-Williams Trend.

Limited work was completed on the LGM Project as targets are relatively early stage compared to HWY 37. A single day of mapping at the Grizzly target was completed and led the Company to believe that additional mapping will need to be completed in 2025 prior to drill targeting. Grizzly represents the top of a structurally-controlled alkalic porphyry Cu-Au system.

Williams Porphyry Cu-Au New Target

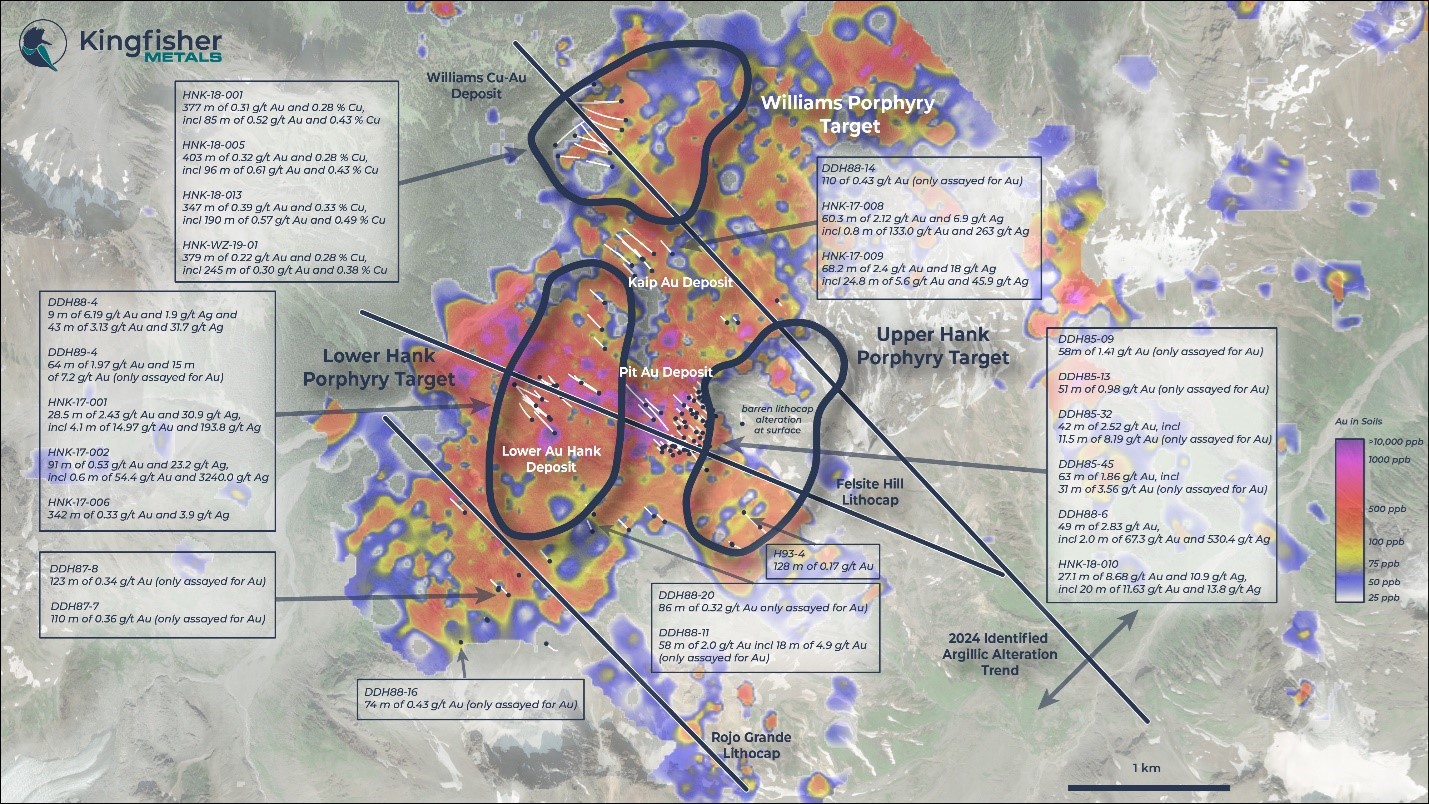

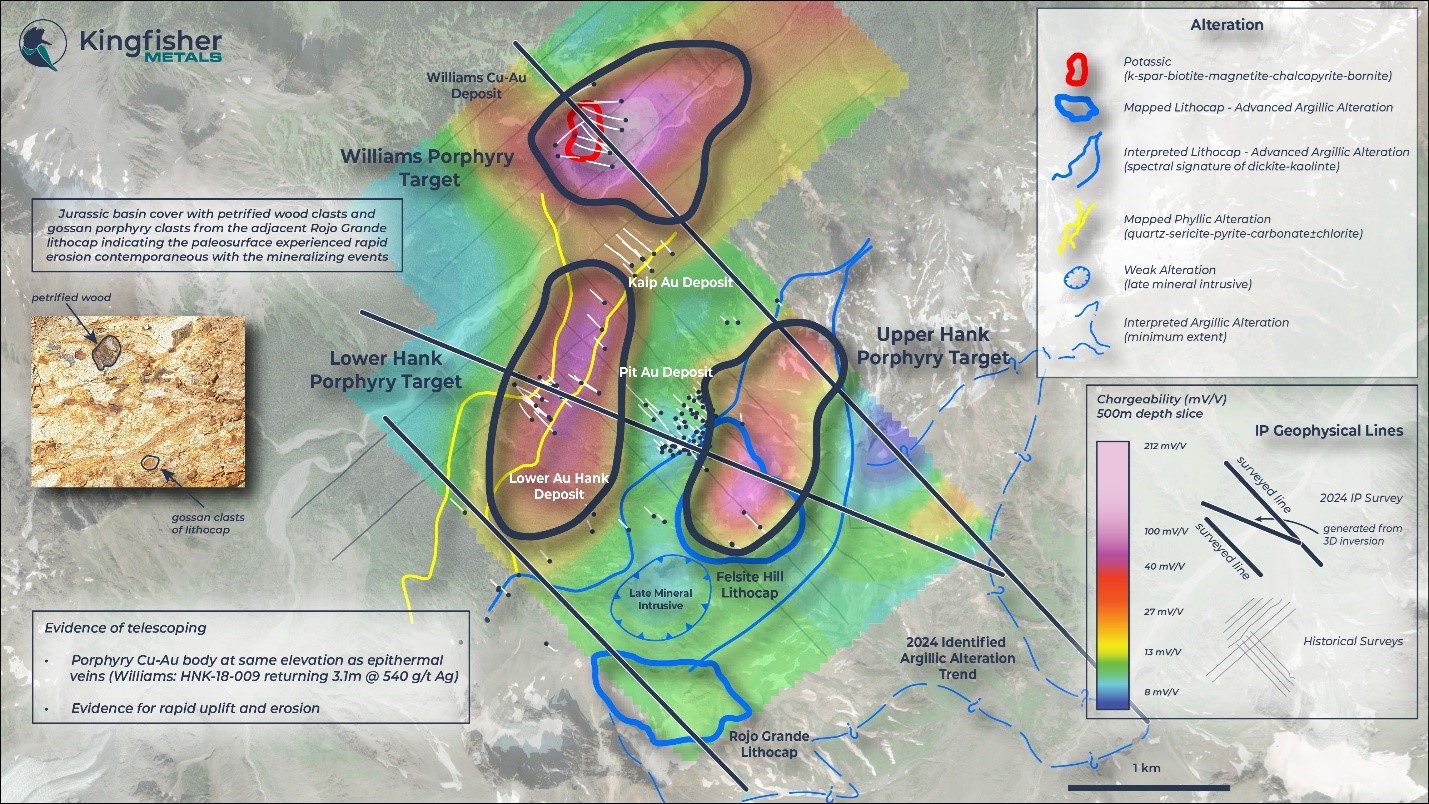

The Williams porphyry Cu-Au system, which was discovered in 2017 with the initial drill hole returning 377 m of 0.31 g/t Au and 0.28% Cu (Figure 2, 3), was the focus of a new IP survey line. The deposit drill footprint of 500 m long by 400 m wide and 500-600 m deep is within a 2.2 km long and 1.5 km wide and 1 km deep chargeable body (>25 mV/V) with values up to 212 mV/V identified by the new survey. Intercepts at Williams coincide with potassic-altered monzonite porphyry intrusion that extend to surface with abrupt grade change between intrusive host and the volcanic rocks (Figure 4). The Williams deposit is largely hosted in one structurally focused intrusion within a chargeability anomaly that is prospective to host numerous such bodies.

The historical IP survey lines at Williams were oriented NE, subparallel to the overall trend of chargeability, alteration and grade, and did not cross and capture the NE-trending character of deposit. The 2018 survey successfully identified a chargeability anomaly on two sections to the south (50 m and 350 m south of nearest drill hole), yet subsequent drilling in 2019 focused on conservative step-outs from Williams and failed to assess new chargeability results. The new Williams IP line, oriented NW, was deemed necessary in order to: fingerprint the Williams deposit, determine the width of the chargeability anomaly, add resolution to the Williams deposit area, increase depth visualization, and determine the extent of two alteration trends to the SE (the Upper Hank Trend, and a new alteration trend at southern extent of survey). The 2018 and the 2024 IP results were combined into a new 3D inversion product for targeting (e.g., Figure 4 and 5).

The 2024 results from the Williams line were successful in fingerprinting the deposit and outlining a chargeability anomaly that extends from surface to 1 km depth with a width of 1.5 km (Figure 4). The overall anomaly is ENE elongate, and is on strike with the Lower Hank Trend (Figure 3). Lateral growth potential of the copper-gold target is also indicated by new mapping that identified outcrop exposures of disseminated and vein hosted chalcopyrite and copper oxides in Hank Creek ~400 m south of this survey line including 0.23% Cu, 0.20 g/t Au, and 9.5 g/t Ag. The new survey also allowed for deeper visualization of the Wiliams deposit roots, where untested peak chargeability values were identified.

The survey results indicate a large target domain that includes two target types: 1) shallow or at-surface focused porphyry intrusions and breccia bodies, and 2) deeper-level intrusive-hosted stockwork.

The upper-level porphyry target area includes domains to the north and south of the Williams deposit and are interpreted as structurally-controlled, Williams-like stocks, such as 127 m of 0.56% Cu, 0.69 g/t Au, and 3.4 g/t Ag (HNK-18-13). This relatively shallow target domain extends from surface to depths of ~400 m and conceptualizes grade focused within multiple Williams-like porphyry stocks and breccia bodies. Grade at these upper levels is characterized by a very close association with intrusions (Figure 4) - copper and gold grades increase from background levels rapidly into the intrusions. The upper chargeable anomaly is interpreted to result from a complex of several such porphyry stocks within volcanic rocks, not the drilled extent of the Williams stock alone.

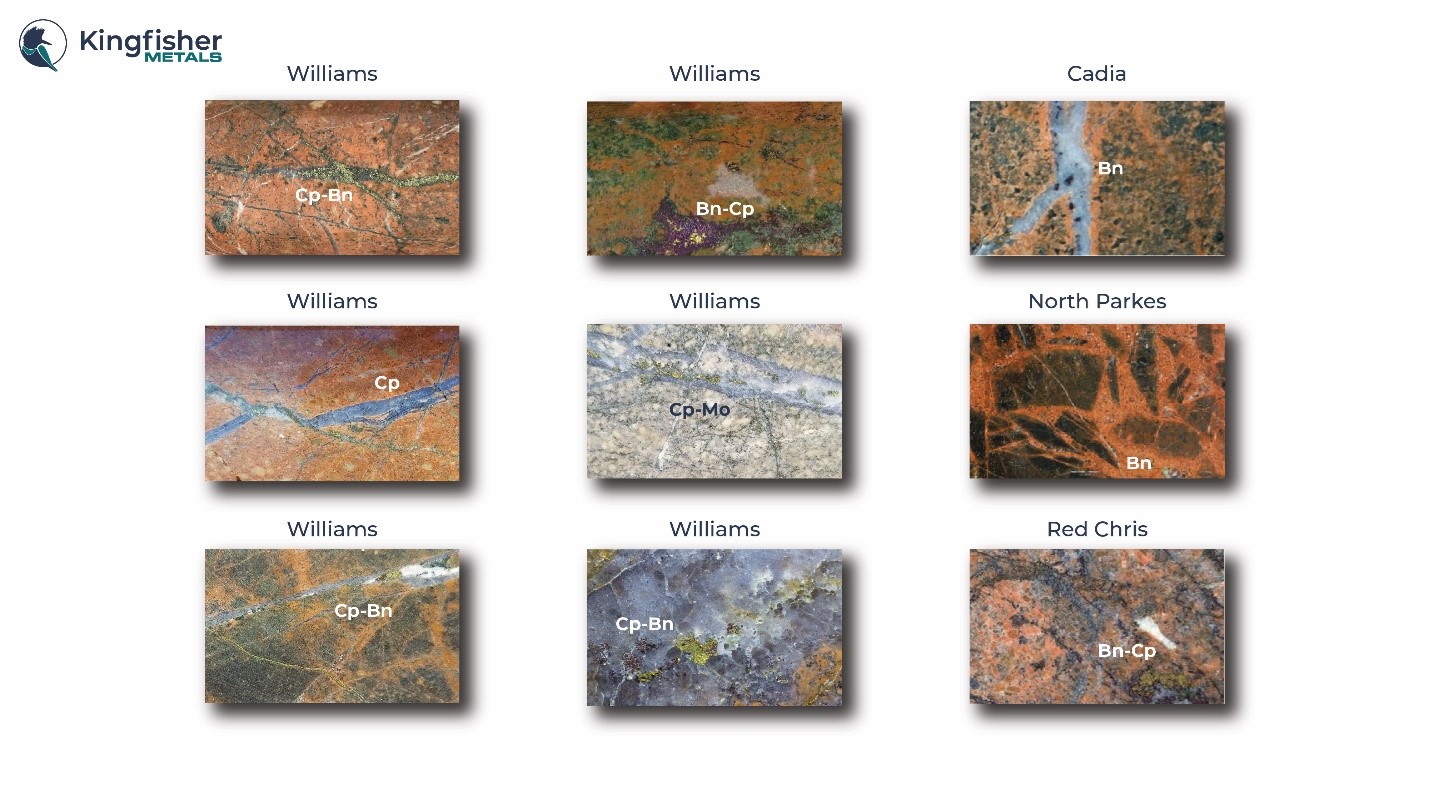

The deeper target domain spans 1 km wide and includes the peak chargeability values (212 mV/V) where there is potential for more broad, intrusive-hosted stockwork (Figure 4). From regional examples, highest relative copper grades are associated with bornite typically intercepted at deeper levels where higher temperature conditions exist. The geometry of chargeability supports this exploration concept with a marked chargeable high close to surface in volcanic rocks (pyrite>chalcopyrite), a muted mid-level response in mixed intrusions and volcanic rocks (chalcopyrite>pyrite), and a broadening root zone where bornite>chalcopyrite is conceptualized in an intrusive host (Figure 7). Given the grade at Williams and the significant scale of the anomaly, this target area has been elevated to a top priority for drilling in 2025.

Lower Hank Porphyry Cu-Au Target

A new 3D IP inversion product from coupled historical and new lines revealed a 1.6 km long by 0.8 km wide and 850 m deep anomaly (>35 mV/V) - the Lower Hank Porphyry target. The geometry of the chargeability body aligns with mapped quartz-sericite-pyrite-chlorite (phyllic and propylitic alteration) on surface (Figure 3). The anomaly is focused at shallow levels and broadens at depth, similar to the Williams chargeability anomaly. At the apex of the anomaly, historical holes intercepted high-grade gold, such as hole HNK-17-001 with 95 g/t Au, 1100 g/t Ag over 0.58 m. Deeper drilled extents that correlate with the uppermost levels of the anomaly intersect porphyry-style broad gold, such as hole HNK-17-006 with 0.44 Au Eq. over 341.7 m (Figure 5). Initial drill holes above this anomaly have only intersected volcanic rocks, and have not yet discovered the key porphyry intrusion that host mineralization at Williams. An outcrop to the southeast of the drilled area contains stockwork and disseminated style mineralization more typical in porphyry type systems (rock here returned 0.37% Cu, 0.44 g/t Au).

The top of the Williams porphyry deposit is less than 300 m vertically below epithermal gold systems at Pit and the "Boiling Zone" and at the same elevation as Au-Ag-Pb-Zn veins along the Lower Hank Trend. The presence of close vertical emplacement levels for epithermal and porphyry systems indicates a process of telescoping. This has two important exploration implications for the area: 1) new potential for porphyry targets at relative shallow levels below surface, and 2) the presence and overlap of high-grade structural gold within porphyry target domains.

Although historically a high-grade gold target, the new chargeability anomaly at the Lower Hank Porphyry target represents high potential for porphyry discovery due to: 1) the presence of overlap of epithermal gold veins (telescoping) onto porphyry systems at same elevations, 2) the target is on trend and at the same elevation as the Williams deposit, 3) a transition from structurally-controlled gold at shallow levels into broad, disseminated gold at depth typical of porphyry systems, and 4) potential for rapid grade change into mineralizing porphyry intrusions not yet discovered at this anomaly.

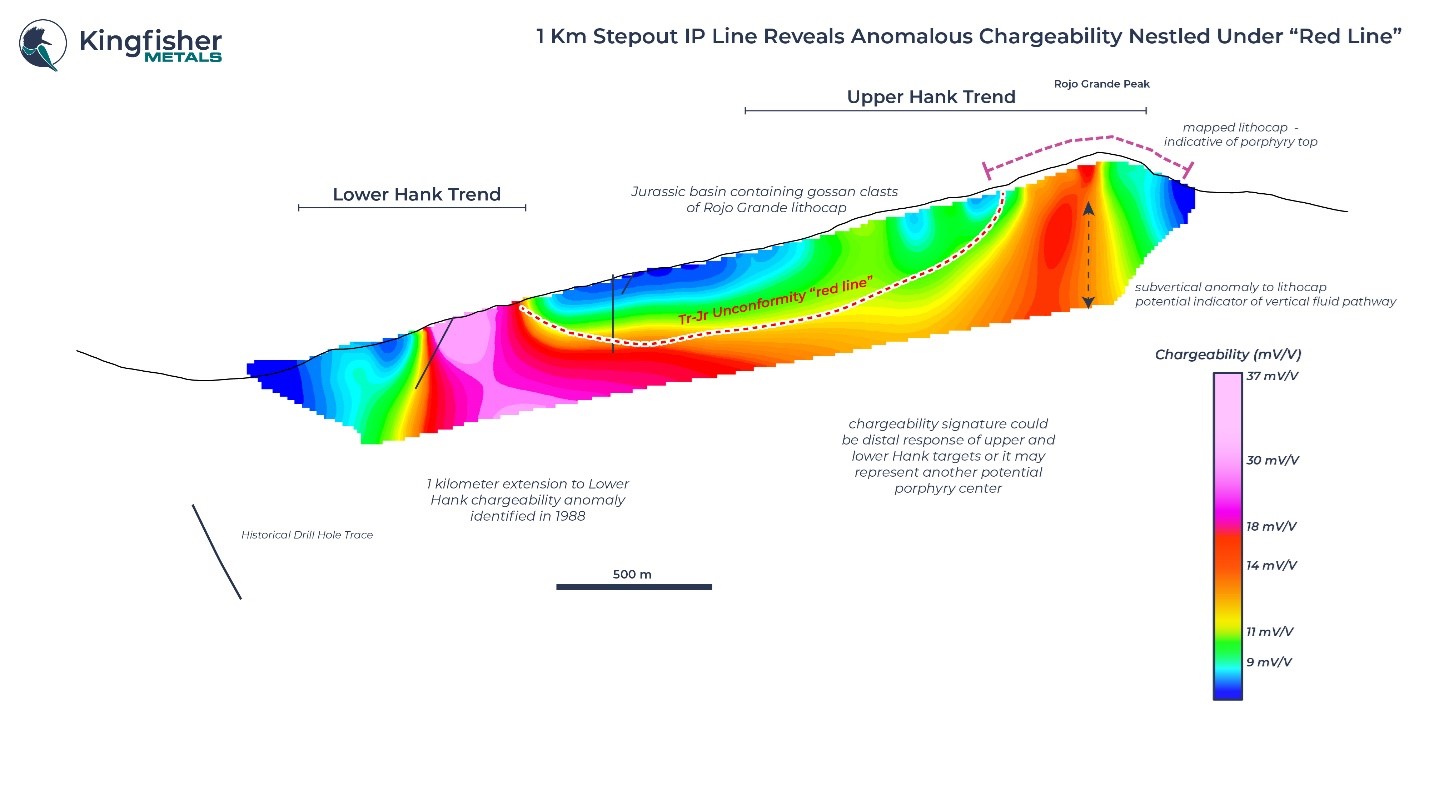

The furthest south IP line (Figure 6) was oriented NW as a 1 km step-out from the previously completed Hank IP survey. This line crosses the southern alteration extension of the Lower Hank Porphyry Cu-Au target and stretches SE to the Rojo Grande lithocap. The results obtained from this line indicate that highly anomalous chargeability exists south of the porphyry Cu-Au targets identified by the Company. Chargeability values up to 37 mV/V coalesce at depth to form a broad (>2 km) zone beneath Jurassic basin cover. The basin cover is of exploration interest as it defines the Triassic-Jurassic unconformity ("red line") where relatively unaltered rocks drape and conceal prospective units. The basin contains clasts of petrified wood indicating it formed in a subaerial setting at the paleosurface. The basin also contains oxidized gossan clasts of the Rojo Grande lithocap, indicating that it formed shortly after the mineralizing event. Historical drilling south-southwest of the surveyed line has returned anomalous gold grades that bottom in mineralization including 123 m of 0.34 g/t Au, 110 m of 0.36 g/t Au, and 74 m of 0.43 g/t Au.

Chargeability values directly under the Rojo Grande lithocap show a strong sub-vertical pattern, that may reflect a fluid flow pathway and provide a targeting vector. Given that this line was completed as a 1 km step out, more IP surveys will be required to determine if this area represents a distal response of the upper and lower Hank porphyry Cu-Au targets or a unique standalone porphyry target.

Upper Hank Porphyry Cu-Au Target

Similar to the Lower Hank Porphyry Cu-Au Target (Figure 2, 3, 5), a new 3D IP inversion product from coupled historical and new lines revealed a 1.5 km long by 0.8 km wide and 850 m deep (>35 mV/V) anomaly - the Upper Hank Porphyry target. The chargeability body lies below a mapped lithocap, indicative of porphyry tops, and below the Pit deposit where historical drilling outlined bed parallel epithermal gold horizon returning 20 m of 11.63 g/t Au and 13.8 g/t Ag and 63 m of 1.86 g/t Au.

The Upper Hank chargeability anomaly expanded from a >550 m strike length to a 1.5 km strike length, comparable to the Williams deposit chargeability anomaly. The original chargeability anomaly was identified in 2016, prior to the discovery of the nearby Williams porphyry. The initial survey visualized the anomaly accurately with NW survey lines (Figure 3), yet the anomaly remained open-ended to the north. The presence of broad gold mineralization such as 0.17 g/t Au over 128 m (hole H93-4) within lithocap-type alteration upslope of the Pit deposit is strong evidence for the presence of a large-scale porphyry target. The Company interprets the Pit deposit and the lithocap as two high-level gold targets from surface with a projection toward a Williams-like target. The new survey line was deemed critical to capture the full strike extent of this important anomaly for drill targeting.

Three target domains exist at the Upper Hank: 1) the projection of at-surface, bed parallel epithermal gold mineralization at the Pit deposit (intermediate sulfidation); 2) disseminated gold-rich or gold-only target from surface in the area of the lithocap above the anomaly (high sulfidation); and 3) intrusive-hosted porphyry Cu-Au in upper-level stocks from ~350 m drill depths below at-surface gold targets. The Upper Hank Porphyry target provides a unique opportunity to drill both high-grade gold targets and porphyry Cu-Au targets with a single hole.

The Williams IP line spans 5.8 km from uphill and west of the Williams deposit across the Upper Hank Trend and southeast across the adjacent valley where new alteration was mapped in 2024 and anomalous chargeability was identified (Figure 4). This area is interpreted to represent a new potential porphyry-epithermal trend subparallel to the Hank-Williams Trend. At the eastern end of the Williams line, no historical IP surveys or drilling had been completed. New mapping of this grassroots area in 2023-2024 outlined areas of strong argillic and quartz-sericite-pyrite-carbonate alteration that coincide with the new anomaly (Figure 4). This area also coincides with highly anomalous stream sediment values along trend up to 313 ppm Cu and 1015 ppb Au. Given the close proximity to epithermal gold and porphyry Cu-Au deposits, this region will be a high priority area in 2025 for additional IP surveys, geological mapping, and sampling.

Hank-Williams Summary

The broader Hank-Williams area represents a decades old gold exploration camp that broke the mold with the discovery of the Williams Cu-Au porphyry deposit in 2017. This discovery places the gold systems in a new context - high-grade gold emplaced at comparable levels as the earlier porphyry stocks. This new perspective, coupled with the refinement of three porphyry-scale chargeability bodies allows for a new targeting opportunity in a region of highly productive world-class porphyry systems. The new interpretation opens the potential to drill porphyry targets from surface at Williams and at relatively shallow depths at the Lower Hank Porphyry target, and to drill epithermal gold from surface into the porphyry targets at depths of ~300 m at the Upper Hank Porphyry target.

Given the high-level nature of porphyry Cu-Au mineralization intersected to date, Williams and the two Hank porphyry targets appear to represent the tops of porphyry systems that have potential for significant increases in both grade and size at depth. Compared with regional deposits of note (Figure 7), the evidence is compelling to explore the full vertical potential of these targets.

Detailed drill core photo review shows that the Williams deposit has many similarities with regional and global examples of gold-rich porphyry Cu-Au deposits such as Red Chris, Cadia, and North Parkes (Figure 8). The Company notes that mineralization at the other projects noted in the following figures is not indicative of mineralization hosted on the HWY 37 Project.

ME Porphyry Cu-Au Target

The ME porphyry Cu-Au target (Figure 9) is situated at the south end of the Mary trend and was the focus of a first-ever IP line. The area is host to NE-striking porphyry stocks that trend towards the prominent Goat gossan. Mineralization in the area is related to porphyry quartz stockwork with chalcopyrite-pyrite-molybdenite and increasing concentrations of galena, associated with a flanking porphyry position, to the north and northeast away from the IP chargeability anomalies defined in 2024. The ME Target is host to an open-ended soil geochemical anomaly (Cu-Au-Ag-Mo-Pb) that stretches over 3.5 km with grades up to 2900 ppm Cu, 3210 ppb Au, 36,500 ppb Ag, and 750 ppm Mo.

The 2024 IP reconnaissance line (Figure 10) was run on a prominent bench on the upper edge of the broad soil anomaly. The decision was made to run the single line across this location due to ease of completing the survey in a short time frame within the context of a limited IP budget. Future IP surveys should be competed to extend the current line to the NE as well as running orthogonal lines that will require line cutting. Rocks at the surface on the surveyed bench are predominantly pyritic hornfels but 10s of meters downslope of this topographic bench mineralized porphyry intrusions are identified that project to the section line.

The IP survey returned anomalous chargeability values (>24 mV/V) along the full length of the 2 km line with two distinct chargeability bodies with values up to 49 mV/V. The Company believes that these anomalies represent the projection of intrusive-hosted mineralization beneath hornfels cover.

Two historical drill holes were completed downslope of the 2024 IP anomalies in 1980. Incomplete assays are available for these holes with reports of grades up to 0.16% Cu. These drill holes were completed prior to the 2019 geochemical soil survey that outlined the broad anomaly. Mapping in 2024 indicates that these drill holes were misoriented, were located laterally far away from the interpreted core, and are too far downslope of the mapped stockwork on surface. Consistent with this, historical drill logs identified widespread sodic alteration, common in deeper flanking positions to Cu-Au porphyry systems. These holes were located over 500 m from the chargeability targets identified in 2024.

Mary Porphyry Cu-Au New Targets

The drill footprint of the Mary area spans 3 km focused along a north-northeast trend defined by the Cliff target, Mary deposit and the DM porphyry (Figure 11). Drilling at Mary began in the 1970s from surface mineralization and the first modern 2D induced-polarization survey was completed in 2012 with NWW-trending orientation (Figure 11, 12). Most holes at Mary test relatively shallow depths (300-400 m), but the first deep hole was planned following the first IP survey to drill toward the highest chargeability value that had been defined to date. This hole, BC12-47, intercepted 455 m of 0.11% Cu and 0.28 g/t Au until it cut a late, relatively unaltered monzonite dyke and terminated in volcanic rocks with 39 m of 0.4 g/t Au Eq* (Figure 12).

The 2024 survey aimed to improve resolution along the NNE axis of mineralization and extend IP coverage to the Cliff porphyry. The previous 2D sections resulted in poor coverage and low confidence in geometry of a significant chargeability anomaly identified at Mary.

The results of the new survey indicate a largely untested subvertical chargeability anomaly below Mary that swells from ~350 m width near surface to 750 m width at depth (>25 mV/V). The vertical orientation of hole BC12-47 into a structurally controlled system failed to test the porphyry at depth and failed to cross peak chargeability values. The late intrusion intercepted in the hole is interpreted to have a steep geometry (narrow width) and is not considered to be the cause of the chargeability anomaly. This hole failed to reach the core of the chargeability anomaly, located to the south, did not intercept source intrusions below Mary and failed to explain the source of the deep chargeability anomaly.

The chargeability anomaly below Mary is interpreted as a significant untested porphyry target. At the Williams deposit, grade is closely tied to both chargeability and to the distribution of structurally focused porphyry intrusions. The presence of significant grade in volcanic rocks at depth is interpreted to indicate proximity to the porphyry intrusion body below Mary. Hole BC07-10 provides evidence for such a target, where 102 m of 0.53 g/t Au and 0.22% Cu in a porphyry host are intersected in peak chargeability values at depth (Figure 12).

Along trend ~850 m from Mary, significant lateral and vertical expansion potential at the DM porphyry is also indicated. The DM porphyry is characterized by higher Cu:Au ratios compared to Mary, such as 0.21% Cu and 0.28 g/t Au over 223 m from surface. The chargeability anomaly appears to plunge from the DM porphyry at surface toward Mary, to the SW. Based on the chargeability anomaly, the DM porphyry is interpreted to have significant vertical extent beyond the ~230 m drilled extent. Off the IP section line, the presence of stockwork with 0.42% Cu and 0.97 g/t Au also indicates lateral, or width, potential (Figure 12).

Cliff Porphyry Cu-Au Target

The Cliff porphyry lies on the flanks of a new chargeability anomaly 700 m wide and 1 km deep ( > 25 mV/V) identified in the 2024 survey, similar in geometry and calibre to the anomaly centered on the Mary deposit (Figure 12). Alteration patterns, intrusive geometry and quartz stockwork abundance trends indicate a projection of the porphyry system into the slope, to the NE. Only three holes have tested the Cliff porphyry, returning up to 0.11% Cu, 66 ppm Mo over 116. The geometry of the chargeability anomaly indicates a large untested body to the NE, and the presence of high relative Mo, and low relative Au in these initial holes is consistent with the interpretation that the drilled domain is lateral to and flanking a porphyry target into the slope.

Future Drill Program Planning

Planning has begun for a 2025 drill program that will test the porphyry Cu-Au drill targets generated over the last year. Drill permits are in place across all areas where drill-ready targets exist as well as on the LGM Project to the south. The Company recognizes that the HWY 37 and LGM projects lie within the traditional territory of the Tahltan First Nation and an Exploration Agreement is in place. The Company will strive to work with Tahltan affiliated contractors. A proposed drill program will be dependent on accessing additional financing and the scale of such a program is yet to be determined.

ZTEM Update

The proposed ZTEM survey was scheduled to begin in late June to early July of this year. Equipment issues, weather delays, and scheduling issues from the contractor pushed the survey start date to mid September. The program was initiated but no flying was completed within the first 10 days of the survey so the Company made the decision to cancel the survey to avoid further potential standby days. The Golden Triangle region saw an early start to winter and the region saw near constant precipitation since that time and therefore the Company believes the decision to cancel the program at that time was the correct move.

Going forward, the Company will endeavour to complete a similar airborne electromagnetic survey at the beginning of the 2025 field season.

Qualified Person

Dustin Perry, P.Geo., Kingfisher's CEO, is the Company's Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has prepared the technical information presented in this release.

About Kingfisher Metals Corp.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia, including the Golden Triangle region. Kingfisher has two 100% owned district-scale projects and an option to earn 100% of the HWY 37 Project, that offer potential exposure to gold, copper, silver, and zinc. The Company currently has 43,201,553 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 236 358 0054

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property. This news release contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Kingfisher Metals Corp.

View the original press release on accesswire.com