VANCOUVER, BC / ACCESSWIRE / May 1, 2024 / Electric Royalties Ltd. (TSXV:ELEC)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to announce the closing of the previously announced transaction (the "Transaction") to acquire a portfolio of 18 royalty agreements and 32 lithium properties in Ontario, Canada (the "Ontario Lithium Projects" or the "OLP"). Pursuant to the Asset Purchase Agreement between the Company and 1544230 Ontario Inc., MK Exploration Services Inc. and Gravel Ridge Resources Ltd. (together, the "Vendors") dated April 8, 2024, the Company has issued 2,250,000 common shares of the Company to the Vendors and made a net cash payment of C$1,689,000 (which reflects a total cash consideration of C$1,875,000, less C$75,000 down payment provided to the Vendors in November 2023 and C$111,000 held in escrow representing cash payments and the value of shares received by the Vendors after January 1, 2024 pursuant to certain mineral property interests in the OLP).

Brendan Yurik, CEO of Electric Royalties, commented: "Northwestern Ontario is known for its lithium potential; thus we are very pleased to complete the acquisition of these prospective lithium royalties and optioned properties in that region. We have strategically selected these royalties and projects from an initial 126 projects, based on our assessment of their prospective geology and greater proximity to prospects with reported lithium resources and exploration activity.

"Current lithium market conditions have allowed us to acquire this portfolio at a relatively low cost, while doubling the size of our overall royalty portfolio. The acquisition represents a significant opportunity for Electric Royalties to grow in an accretive manner, as forecasts suggest lithium prices will rebound in the longer term."

Overview of the Ontario Lithium Projects (OLP)

The OLP portfolio consists of 18 royalties (Table 1) and 32 lithium properties (Table 2) located in the province of Ontario, Canada. 31 of the 32 properties are currently being explored by third parties pursuant to option agreements and, to the extent that the applicable option payments (yielding the Company up to $2.2 million) are made over the next two and a half years and the options are exercised, each of the properties would revert into royalty interests for Electric Royalties. Electric Royalties would retain its ownership interest in any properties that are not ultimately transferred to an optionee and would have the right to re-option, sell, or relinquish such properties.

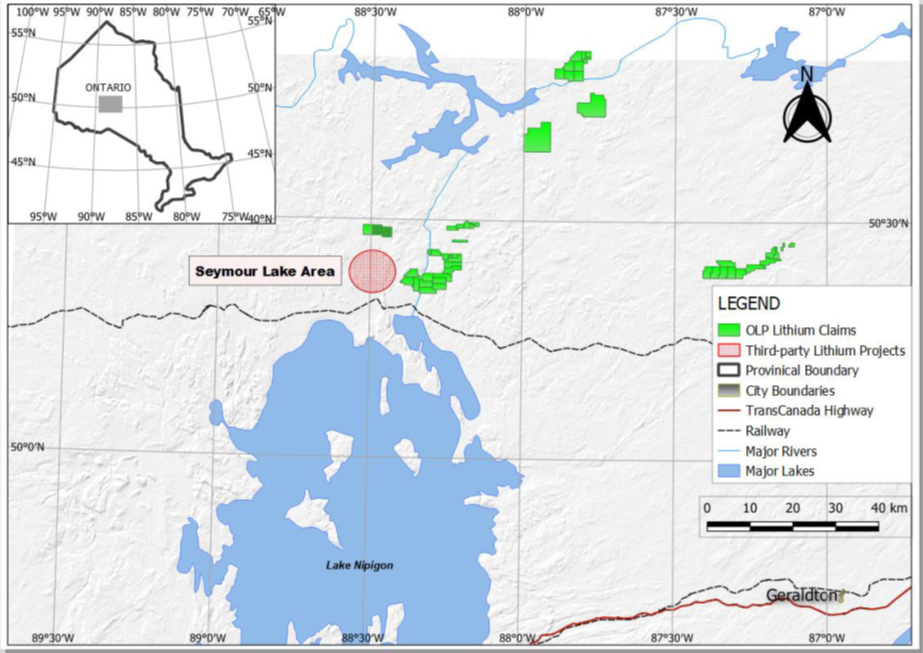

The properties cover prospective land on the same geological trends of, and surrounding, major lithium discoveries in Ontario. Six of 24 developed lithium prospects in Ontario with reported reserves or resources are located in the vicinity of these properties1. Several of these properties are adjacent to Green Technology Metals' Seymour Lake Lithium Project (on which Electric Royalties holds a 1.5% net smelter royalty interest) that hosts the Aubry deposits (see Figure 1). The Seymour Lake Lithium Project is road-accessible year-round and is envisioned as a central processing facility with the potential to add production from other deposits in the area. Green Technology Metals is currently pursuing a vertically integrated strategy with multiple mine and processing hubs supplying a central lithium conversion facility that would be built in Thunder Bay, Ontario2.

Table 1: OLP Royalties

| Operator | Operator Stock Exchange Listing | Property underlying Royalty | |

1 |

Maple Minerals (acquired by Cohiba Minerals) | n/a (private) | Rogers Creek / McCluskey |

2 |

Maple Minerals (acquired by Cohiba Minerals) | n/a (private) | Big Rock / Ottertail River SW |

3 |

Maple Minerals (acquired by Cohiba Minerals) | n/a (private) | Ottertail / Ottertail River NE / Mahamo |

4 |

Maple Minerals (acquired by Cohiba Minerals) | n/a (private) | Gathering Lake |

5 |

FE Battery Metals | CSE | Cosgrave |

6 |

Musk Metals | CSE | Allison Lake |

7 |

Electrification and Decarbonization AIE LP |

n/a (private) | Jubilee, Campus Creek, Crescent |

8 |

Lithium Triangle Resources |

n/a (private) | Root Bay |

9 |

Portofino Resources | TSX-V | Birkett |

10 |

Double O Seven Mining | n/a (private) | Separation Rapids Lithium |

11 |

Private BC Company | n/a (private) | Arrel |

12 |

Lithium One Metals | TSX-V | Otatakan Township 50% ownership |

13 |

Fifty St George | n/a (private) | Lauri |

14 |

Sultan Resources | ASX | Kember / Pakeageama |

15 |

Sultan Resources | ASX | Allison Lake / Ruddy |

16 |

Lithos Minerals | n/a (private) | Peggy Lithium |

17 |

Private BC Company | n/a (private) | Margot Lithium |

18 |

Private BC Company | n/a (private) | Barbara Lake |

Table 2: OLP Properties

| Operator | Operator Stock Exchange Listing | Property | |

1 |

Lithium Triangle Resources | n/a (private) | Allison Lake North and South |

2 |

Mosam Ventures | n/a (private) | Pakwan Lithium |

3 |

Mosam Ventures | n/a (private) | Margot Lake |

4 |

Tearlach Resources | TSX-V | Wesley Lake |

5 |

Tearlach Resources | TSX-V | Ferland Station |

6 |

Tearlach Resources | TSX-V | Margot South |

7 |

Tearlach Resources | TSX-V | McCluskey |

8 |

Private BC Company | n/a (private) | Jeanette 1 |

9 |

Forza Lithium | CSE | Jeanette 2 |

10 |

Planet Green Metals | CSE | Harrison Road |

11 |

Xplore Resources | TSX-V | Raggy / Aerial / Cathy Creek |

12 |

Xplore Resources | TSX-V | Falls / Joseph / Root Bay |

13 |

Xplore Resources | TSX-V | Root Bay North / Root Bay |

14 |

Xplore Resources | TSX-V | Root Lake |

15 |

EEE Exploration | CSE | Barbara |

16 |

Bastion Minerals | ASX | Pakwan |

17 |

Austek Resources |

n/a (private) | McCombe |

18 |

LiCan Exploration | CSE | Crescent |

19 |

LiCan Exploration | CSE | Wakeman East |

20 |

Private BC Company | n/a (private) | Maskerine / Lynxpaw / Bingo |

21 |

Mosam Ventures | n/a (private) | Sharp Lake |

22 |

Lithium One Metals | TSX-V | Adamhay |

23 |

Lithium One Metals | TSX-V | Dagny |

24 |

Altari Capital | n/a (private) | Rosyln Lithium |

25 |

Westmount Minerals | CSE | Kaba |

26 |

Redstone Resources | ASX | Greenside Lake / Witchwood |

27 |

Manning Ventures | OTC | Kaba Cu-Li |

28 |

GoldOn Resources | TSX-V | Hagarty Creek |

29 |

Solstice Gold | TSX-V | Purdom |

30 |

Solstice Gold | TSX-V | Kamuck |

31 |

Private BC Company | n/a (private) | Falcon Lake |

32 |

Electric Royalties (recently terminated by Maverick Minerals) | TSX-V | Sollas Lake / Muriel |

Figure 1: Map showing claim groups comprising the OLP in the Seymour Lake area

Currently, Canada hosts the sixth-highest lithium reserves of any country, yet 2022 production totaled an estimated 500 tonnes - an amount dwarfed by global lithium powerhouses such as Chile and Australia3. The hard-rock lithium deposits in Canada are hosted in pegmatites containing a lithium-bearing mineral known as spodumene. Lithium hosted in spodumene provides producers with greater flexibility as it can be processed into either lithium hydroxide (mainly used in high-density electric vehicle (EV) batteries) or lithium carbonate4. It also offers faster processing times and is higher quality than lithium extracted from brine as spodumene typically contains higher lithium content4. Spodumene-bearing pegmatites are often hosted in metavolcanic or metasedimentary rocks adjacent to granitic intrusions5. Many of the world's largest hard-rock lithium occurrences are found in Archean or Paleoproterozoic orogens - geological environments underlying approximately two-thirds of Ontario6.

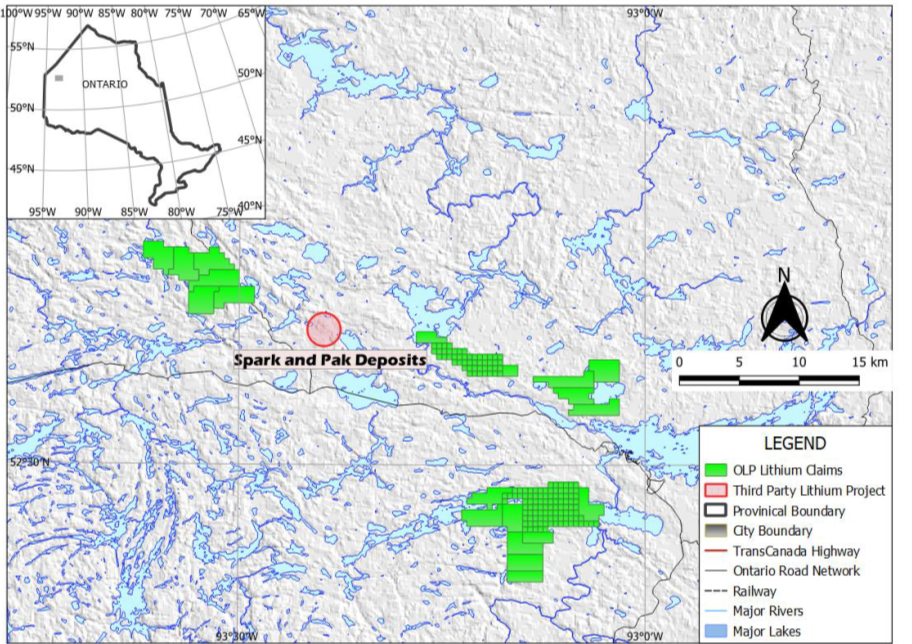

One of the most advanced and high-grade lithium projects in Ontario is Frontier Lithium's ("Frontier") PAK and Spark deposits on which a positive pre-feasibility study was recently announced7. PAK contains one of North America's highest-grade lithium resources and is one of the largest known deposits of its subtype in North America8. Further, Frontier has recently received a grant from the Ontario government to advance its understanding of the processing of lithium into battery metal products. Electric Royalties' OLP acquisition includes two large unexplored, optioned claim groupings located less than 10 kilometres from the Frontier projects and adjacent to terrane hosting geologically favourable two-mica granitic rocks (see Figure 2).

Figure 2: Map showing claim groups comprising the OLP, and Frontier Lithium's Spark and PAK deposits

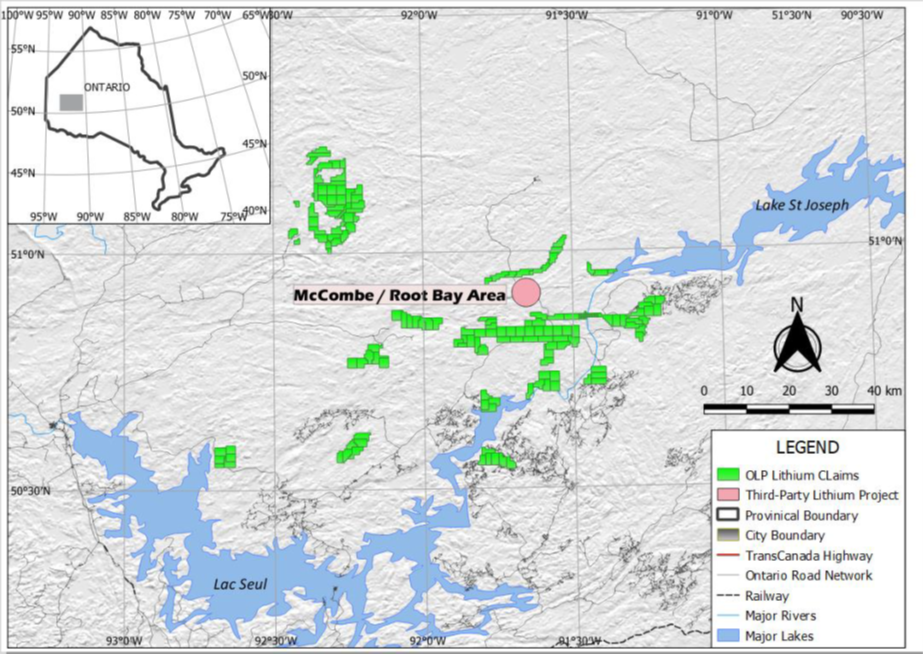

One of the most exciting new lithium exploration stories in Ontario is the emerging Root Bay project being advanced by Green Technology Metals. Drilling programs completed in the last year and a half resulted in the announcement of a 9.4 million-tonne (Mt) indicated resource grading 1.3% lithium oxide (Li2O) for Root Bay and a 4.5 Mt inferred resource grading 1.01% Li2O for the associated McCombe deposit, at a 0.2% Li2O cut-off, reported under the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (or "the JORC Code")9. The OLP includes numerous claims in this area, staked prior to the Root Bay discovery. Many of these claims are on or near to the subprovince terrane boundary, host numerous tourmaline occurrences and are on or near the Root Bay pluton10 - all of which are key exploration indicators of lithium-bearing pegmatites. One such claim in the OLP, the McCombe North Property, was optioned to Bastion Minerals and is located less than 2 kilometres from the Root Bay deposit11. Another claim group in the OLP, the Harrison Road Property located a few kilometres to the south of Root Bay, was sampled by the Ontario Geological Survey (OGS)12, and returned anomalous lithium values in lake sediments; hence, it is considered to be prospective (see Figure 3).

Figure 3: Map showing OLP claim extents in the Root Bay area

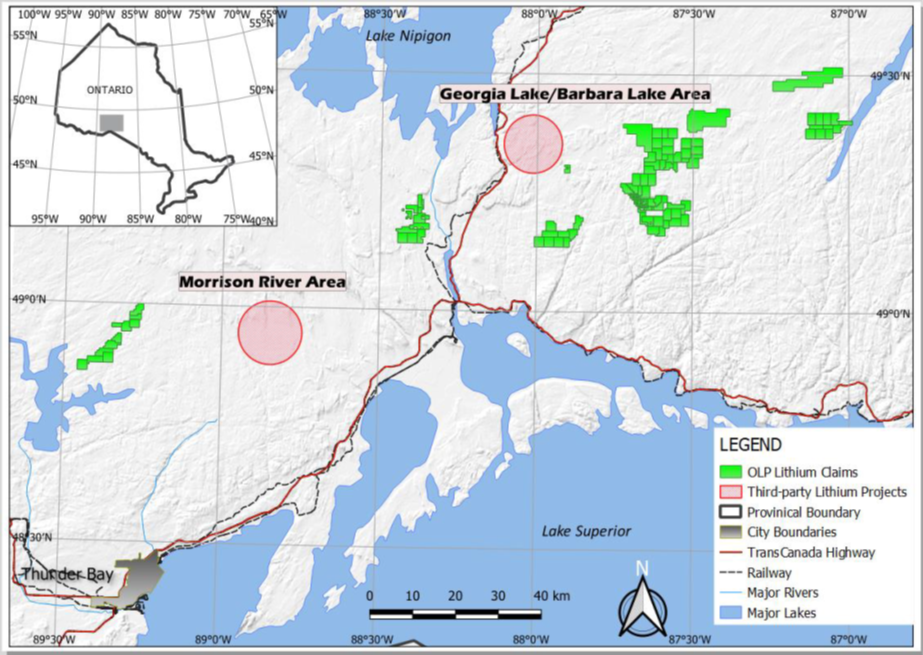

Rock Tech Lithium's Georgia Lake Project is also one of the more advanced integrated lithium development projects in Ontario. Rock Tech Lithium is, reportedly, pursuing a vertically integrated strategy which not only includes development of the Georgia Lake deposit, but also the construction of a lithium processing plant. The plan is to build a facility that is capable of processing material from various sources and is adaptable to the region's growing lithium industry13. There is tremendous exploration potential in the Georgia Lake area as it has been described as the largest concentration of rare-element mineralization in the Superior Province of Ontario14. Other companies have reported interesting results from work in the Georgia Lake district. Tearlach Resources recently announced the results of channel sampling which ranged from 1.56% Li2O over 3 meters to 4.04% Li2O over 0.7 meters in channel samples on their property15.

The OLP includes the largest land position in the Georgia Lake lithium district (see Figure 4). One of the properties, the Arrel Lithium Property, is 20 kilometres east of the Rock Tech pegmatites, and not only is underlain by a muscovite-bearing peraluminous granite but is also in contact with metasediments which make excellent hosts for pegmatites.

Figure 4: Map showing claim groups comprising the OLP in the vicinity of the Georgia Lake projects

Lithium Development in Ontario

Ontario is a province with a deep-rooted mining tradition, abundant clean hydroelectric and nuclear power, and a skilled mining workforce. The permitting environment in Ontario is rigorous, fair, and process-based, and both the federal and provincial governments are supportive of battery metal projects as shown in their recent investments and initiatives16,17.

Access to sustainable power, abundant water, and skilled personnel makes mine development and permitting easier, and it is one of the compelling reasons for Electric Royalties' interest in the OLP acquisition. The properties cover a collective area of over 1 million acres and are adjacent to some of the most prominent lithium exploration and development plays in North America.

Lithium Outlook

The shift to clean energy systems is forecast to drive a significant increase in the demand for battery metals, and this is particularly true in the case of lithium. Lithium is a key component in current and anticipated battery chemistries. According to the International Energy Agency (IEA)'s Sustainable Development Scenario (SDS), clean energy technologies will ultimately account for 90% of the demand for lithium, which could result in a 40-fold increase in demand by 204018.

New sources of lithium will need to be developed and, equally important, new processing facilities will need to be built to meet long-term demand. Finding new lithium deposits in proximity to where the metal is processed into products suitable for battery production is imperative to secure supply chains. Complex supply chains and foreign sources of supply increase the risk of exposure to physical disruption and trade restrictions, while increasing the carbon footprint of the process.

Completion of Drawdown under Convertible Credit Facility

Further to the Company's news release on April 9, 2024, it has completed the C$2,500,000 drawdown (the "Drawdown") under its C$10,000,000 amended and restated convertible credit facility with Gleason & Sons LLC (the "Lender") dated February 16, 2024 (the "Credit Facility") for working capital and to fund the cash payment of the Transaction and associated Transaction costs.

Loans drawn under the Credit Facility bear interest ("Interest") at a floating rate (United States Secured Overnight Financing Rate as published by the New York Federal Reserve ("SOFR") + 7%), with a maximum interest rate of 12.5%, with Interest payments capitalized into the principal amount and due at the maturity date (the "Maturity Date") of January 12, 2028. Prior to the Maturity Date, on at least 10 days' prior written notice to the Company and subject to all required TSX Venture Exchange approvals having been obtained, the Lender has the right to convert all or any portion of the outstanding principal amount of the Credit Facility and accrued and unpaid interest into the Company's common shares. Any outstanding principal amount with respect to a drawdown under the Credit Facility will be converted at a conversion price equal to the greater of: (i) C$0.50; (ii) a 100% premium above the 30-day volume weighted average trading price of the common shares of the Company on the TSX Venture Exchange at the time of such drawdown; and (iii) the minimum price acceptable to the TSX Venture Exchange, per common share of the Company, subject to adjustment as provided in the convertible note evidencing such drawdown. Any accrued and unpaid interest may be converted at conversion price equal to the Market Price (as defined under the TSX Venture Exchange's Policy 1.1) at the time of settlement.

The Conversion Price for the Drawdown is C$0.50, and as a result a total 5,000,000 common shares of the Company are issuable on conversion thereof. The Drawdown is subject to final TSX Venture Exchange approval.

The Credit Facility is a "related party transaction" within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Credit Facility is exempt from the valuation requirement of MI 61-101 by virtue of the exemption contained in section 5.5(b) as the Company's common shares are not listed on a specified market. The Company received disinterested shareholder approval of the Credit Facility at the Company's special meeting of shareholders held on March 19, 2024 in accordance with MI 61-101.

David Gaunt, P.Geo., a qualified person who is not independent of Electric Royalties, has reviewed and approved the technical information in this release.

________________

1 https://mndm.maps.arcgis.com/apps/webappviewer/index.html?id=66ee0efe4d3c4816963737dbdb890708

2 Green Technology Metals news release dated October 9, 2023

3 https://www.cbc.ca/news/climate/lithium-in-the-world-1.6841339

4 https://elements.visualcapitalist.com/visualizing-the-worlds-largest-lithium-producers/

5 USGS Mineral-Deposit Model for Lithium-Cesium- Tantalum Pegmatites; Scientific Investigations Report 2010-5070-O; By Dwight C. Bradley, Andrew D. McCauley, and Lisa M. Stillings

6 https://www.ontario.ca/page/about-ontario

7 NI 43-101 Technical Report Pre-Feasibility Study for the PAK Project, effective date May 31, 2023, filed under Frontier Lithium's profile at sedarplus.ca

8 Frontier Lithium news release dated September 25, 2023

9 Green Technology Metals Limited news release titled "SIGNIFICANT RESOURCE AND CONFIDENCE LEVEL INCREASE AT ROOT, GLOBAL RESOURCE INVENTORY NOW AT 24.5MT" dated October 17, 2023, Appendix A: JORC Code 2012, Table 1. The Mineral Resources are reported using open-pit mining constraints. The open-pit Mineral Resource is only the portion of the resource that is constrained within a US$4,000/t SC6 optimised shell and above a 0.2% Li2O cut-off grade. The optimised open pit shell was generated using: $4/t mining cost, $15.19/t processing costs, mining loss of 5% with no mining dilution, 55 degree pit slope angles, 75% product recovery. The September 2023 Mineral Resource Estimate is reported above 0.2% Li2O cut-off. The cut-off is based on lowest potential grade at which a saleable product might be extracted using a conventional DMS and / or flotation plant and employing a TOMRA Xray sorter (or equivalent) on the plant feed. A number of pegmatites outcrop at surface thus the mineral resource is likely to be extracted using a conventional drill and blast, haul and dump mining fleet.

10 OGS Open File Report 6099; F.W. Breaks, J.B. Selway and A.G. Tindle; 2003

11 https://www.bastionminerals.com/projects/canadian-lithium-project/

12 https://www.geologyontario.mndm.gov.on.ca/mndmfiles/pub/data/records/LakeGeochemON.html

14 Breaks, F.W., Selway, J.B. and Tindle, A.G. 2008. The Georgia Lake rare-element pegmatite field and related S-type, peraluminous granites, Quetico Subprovince, north-central Ontario; Ontario Geological Survey, Open File Report 6199, 176p

15 https://www.accesswire.com/viewarticle.aspx?id=810467&token=82fito391y0i58fbeufi

18 https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

About Electric Royalties Ltd.

Electric Royalties is a royalty company established to take advantage of the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper) that will benefit from the drive toward electrification of a variety of consumer products: cars, rechargeable batteries, large scale energy storage, renewable energy generation and other applications.

Electric vehicle sales, battery production capacity and renewable energy generation are slated to increase significantly over the next several years and with it, the demand for these targeted commodities. This creates a unique opportunity to invest in and acquire royalties over the mines and projects that will supply the materials needed to fuel the electric revolution.

Electric Royalties has a growing portfolio of 40 royalties across the world and 32 lithium properties in Ontario, Canada. The Company is focused predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to the clean energy transition via the underlying commodities required to rebuild the global infrastructure over the next several decades toward a decarbonized global economy.

For further information, please contact:

Brendan Yurik

CEO, Electric Royalties Ltd.

Phone: (604) 364‐3540

Email: Brendan.yurik@electricroyalties.com

https://www.electricroyalties.com/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor any other regulatory body or securities exchange platform, accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information and Other Company Information

This news release includes forward-looking information and forward-looking statements (collectively, "forward-looking information") with respect to the Company within the meaning of Canadian securities laws. This news release includes information regarding other companies and projects owned by such other companies, based on previously disclosed public information disclosed by those companies and the Company is not responsible for the accuracy of that information, and that all information provided herein is subject to this Cautionary Statement Regarding Forward-Looking Information and Other Company Information. Forward looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. This information represents predictions and actual events or results may differ materially. Forward-looking information may relate to the Company's future outlook and anticipated events and may include statements regarding the financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, industry trends and growth opportunities of the Company and the properties in which it holds interests.

While management considers these assumptions to be reasonable, based on information available, they may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company or these properties to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to risks associated with general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments involving the renewable energy industry; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; the mining industry generally, recent market volatility, income tax and regulatory matters; the ability of the Company or the owners of these properties to implement their business strategies including expansion plans; the optioned properties remaining under option; the optionees making option payments as and when due under the relevant option agreements; the lithium properties not being successfully explored and developed; competition; currency and interest rate fluctuations, and the other risks.

The reader is referred to the Company's most recent filings on SEDAR+ as well as other information filed with the OTC Markets for a more complete discussion of all applicable risk factors and their potential effects, copies of which may be accessed through the Company's profile page at sedarplus.ca and at otcmarkets.com.

SOURCE: Electric Royalties Ltd.

View the original press release on accesswire.com