Audited Financial Results for the Year Ended 30 June 2025

LONDON, UK / ACCESS Newswire / October 29, 2025 / Guardian Metal Resources plc (LON:GMET)(OTCQB:GMTLF), a tungsten exploration and development company focused on Nevada, U.S. is pleased to announce its consolidated audited results for the year ended 30 June 2025, for the Company and its subsidiaries (together, the "Group").

The full financial report will be available online immediately on the Company's website, and should be read in conjunction with this announcement.

Highlights from the year under review:

|

Pilot Mountain Project Pilot Mountain remained the central focus of our project development efforts during the year. Guardian Metal advanced multiple workstreams critical to the ongoing pre-feasibility study. Resource and geotechnical drilling programmes were advanced to support pit design and mine planning, while baseline studies were completed across environmental and technical disciplines to underpin key permitting next steps. Amongst intense ongoing reshoring efforts, Pilot Mountain's strategic importance within the U.S. critical metals landscape increased substantially over the period |

|

|

Tempiute Project During the year, Guardian Metal added a second co-flagship project through the acquisition of the option to purchase the historical Tempiute (Emerson) tungsten mine in Lincoln County, Nevada. A Letter of Intent was signed on 31 October 2024, with the definitive agreement completed on 27 January 2025. Since the acquisition, Guardian Metal advanced preparatory workstreams at Tempiute in support of a drilling programme that started late summer 2025. The combination of historical production, existing infrastructure, and new exploration potential establishes Tempiute as a highly complementary asset to Pilot Mountain, further strengthening Guardian Metal's ability to deliver scale within a Nevada-based tungsten production hub. |

|

|

US Market Presence Guardian Metal continued to build its profile in the United States during the period. Following the upgrade to the OTCQX Market in June 2024, the Company benefited from improved liquidity and visibility amongst U.S. investors. Institutional awareness of Guardian Metal also grew further during the year, with Maxim Group initiating research coverage and increased engagement from U.S. funds and stakeholders. Together, these steps advance Guardian Metal's strategy of aligning its capital markets presence with its U.S.-based operating footprint. |

|

|

Corporate Growth & Strategic Positioning On 8 July 2024, the Company rebranded as Guardian Metal Resources Plc, a name that reflects our sharpened focus on tungsten and our commitment to the U.S. defence metal reshoring effort. This corporate evolution was matched by growth in institutional support. On 15 August 2024, Guardian Metal announced a North American strategic financing, followed by an institutional raise completed on 6 January 2025 and a further strategic investment by UCAM LLP on 20 February 2025. The continued ability to attract institutional capital is a strong endorsement of Guardian Metal's positioning within the U.S. critical metals landscape. Finally, in June 2025, Guardian Metal was invited to join the DARPA-sponsored Critical Minerals Forum, a platform that underscores the growing recognition of the Company as a strategic participant in securing America's future mineral supply. |

|

|

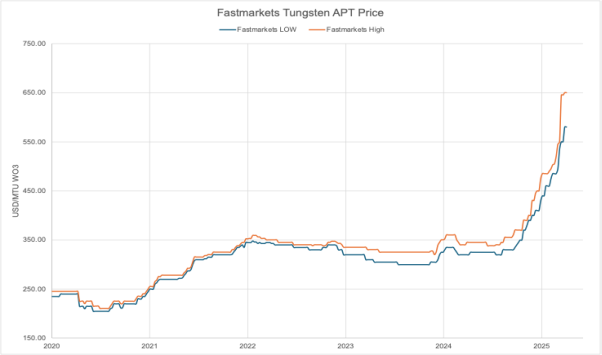

Tungsten Market The strategic importance of tungsten has increased materially during the year. On 4 February 2025, China implemented export restrictions on certain tungsten products, further tightening global supply and driving prices higher. At the same time, recognition of tungsten's critical role in defence, energy transition, and advanced technologies has grown significantly across U.S. government and industry stakeholders. Against this backdrop, Guardian Metal is positioned in the right metal, at the right time, and in the right jurisdiction to play a leading role in re-establishing secure Western supply chains. |

Corporate Developments

Financial Highlights

The Group incurred a loss for the year to 30 June 2025 of $2,711,000 (2024 - loss of $1,376,000). The loss mainly arose from salaries, consulting and professional fees along with general regulatory and administration expenses.

Cash used in operations totalled $1,122,000 and investment in its mining assets totalled $8,038,000 (2024 - $1,496,000). As at 30 June 2025, the Group had a cash balance of $1,873,000 (2024 - $3,033,000). At the date of this announcement, the Group's cash balance was $14,720,000.

Funding Activities

During the year under review a total of 18,908,700 warrants over new ordinary shares were exercised raising $4,455,305 (£3,414,479) for the Company. The Company also completed strategic fundraises issuing in total 10,478,054 new ordinary shares, raising $3,677,988 (£2,904,075) before costs for the Company.

Subsequent to reporting date on 23 July 2025, the Company completed a fundraise of $21,000,000 (approximately £15,600,000) before costs through the issue of 25,945,000 new ordinary shares to new and existing shareholders. On the same date the Company also announced that its wholly owned subsidiary Golden Metal Resources (USA) LLC had been awarded $6.2 million from the U.S. Department of War (DoW) to accelerate the development of its Pilot Mountain Project.

Board of Directors

We welcomed Ben Hodges who joined the Company as Finance Director on 12 December 2024. David Ovadia, Non-Executive Chairman, resigned from the Board on 11 December 2024. The Board takes this opportunity to thank David for his contribution to the Company over his tenure. Non-Executive Director J.T. Starzecki assumed the position of Non-Executive Chairman with effect from 11 December 2024, and in June 2025 Mr. Starzecki accepted the role of Executive Chairman.

Events after the year end

For information regarding events after the reporting date see note 19 to the financial statements.

Outlook:

Looking ahead, Guardian Metal's priorities are clear: advance Pilot Mountain and Tempiute through the next stage of technical and economic studies, supported by the financing, partnerships, and contractor base secured this year. With two co-flagship assets in Nevada, an increasingly engaged U.S. investor base and growing recognition across industry and government, Guardian Metal is well positioned to deliver on its ambition of becoming America's next tungsten producer. We also have announced that we plan to pursue a USA listing.

I would like to thank our shareholders, partners, and team for their ongoing support and commitment. Together, we are building a company that can play a pivotal role in delivering secure domestic supply of this critical mineral for defence, energy transition, and high-technology applications.

Oliver Friesen, Chief Executive Officer

28 October 2025

Click on, or paste the following link into your web browser, to view the full announcement.

http://www.rns-pdf.londonstockexchange.com/rns/1923F_1-2025-10-28.pdf

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

For further information visit www.guardianmetalresources.com or contact the following:

|

Guardian Metal Resources plc Oliver Friesen (CEO) |

Tel: +44 (0) 20 7583 8304 |

|

Cairn Financial Advisers LLP (Nominated Adviser) Sandy Jamieson/Jo Turner/Louise O'Driscoll |

Tel: +44 (0) 20 7213 0880 |

|

Tamesis Partners LLP (Lead Broker) Charlie Bendon/ Richard Greenfield |

Tel: +44 (0) 20 3882 2868 |

|

Tavistock (Financial PR) Emily Moss/Josephine Clerkin |

Tel: +44 (0) 7920 3150/ +44 (0) 7788 554035 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Guardian Metal Resources PLC

View the original press release on ACCESS Newswire