With a market cap of $31.7 billion, Lennar Corporation (LEN) is a leading homebuilder in the United States, specializing in the construction and sale of single-family and multifamily homes. It operates through multiple segments, including Homebuilding, Financial Services, Multifamily, and Fund Investments, catering to a diverse range of homebuyers. Lennar also provides mortgage financing, title, and insurance services to support its real estate operations.

Shares of the homebuilder have underperformed the broader market over the past 52 weeks. LEN stock has decreased 25.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.5%. Moreover, shares of LEN are down nearly 9% on a YTD basis, compared to SPX’s 16.5% gain.

Focusing more closely, shares of the Miami, Florida-based company have lagged behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 9.9% return over the past 52 weeks and a 6.1% YTD gain.

Shares of Lennar fell 4.2% following its Q3 2025 results on Sept. 18 as adjusted EPS of $2 missed Wall Street expectations of $2.12, and net earnings dropped sharply to $591 million from $1.2 billion a year earlier. Revenue of $8.81 billion also came in below forecasts and was down 9% year-over-year, reflecting a 9% decline in average home sales price to $383,000 and a gross margin drop to 17.5% from 22.5%. Investors were further concerned by guidance calling for flat margins (~17.5%) and lower new orders of 20,000 - 21,000 homes in Q4.

For the fiscal year ending in November 2025, analysts expect LEN’s adjusted EPS to decline 40.5% year-over-year to $8.25. The company's earnings surprise history is mixed. It beat the consensus estimates in one of the last four quarters while missing on three other occasions.

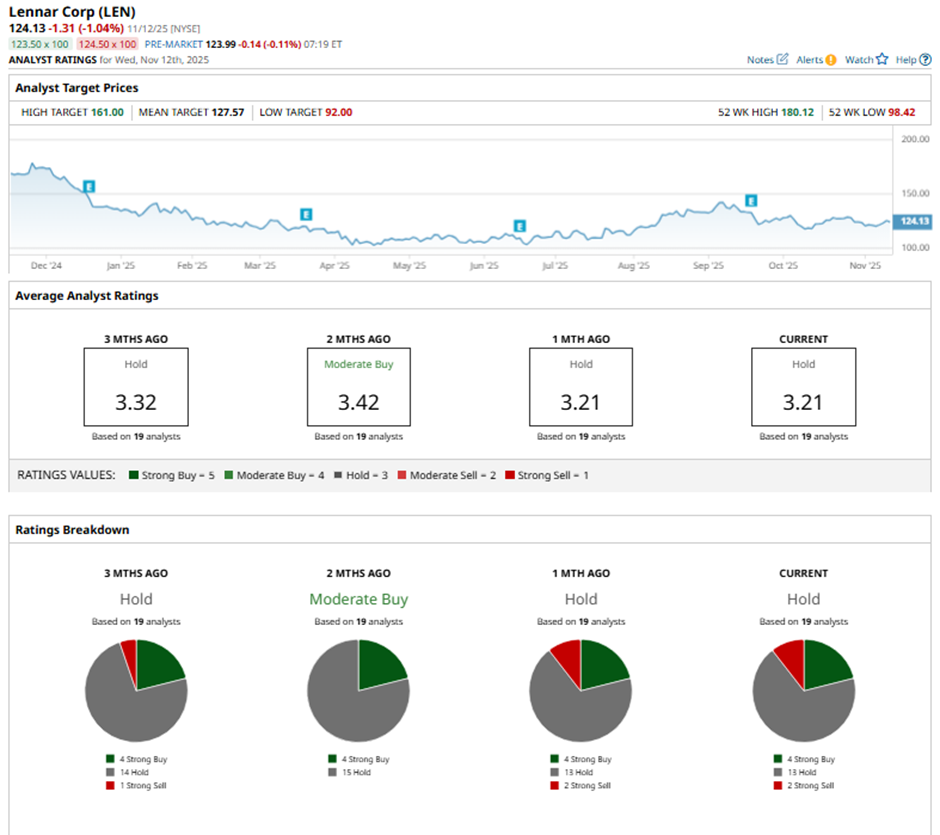

Among the 19 analysts covering the stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy” ratings, 13 “Holds,” and two “Strong Sells.”

On Sept. 22, UBS raised its price target on Lennar to $161 and maintained a “Buy” rating.

The mean price target of $127.57 represents a 2.8% premium to LEN’s current price levels. The Street-high price target of $161 suggests a 29.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- United Airlines (UAL): Hidden Behind the Shutdown Deal is a Secret Informational Arbitrage Opportunity

- AI Just Helped This 1 Tech Stock Crush Earnings. Should You Buy It Now?

- Penn Entertainment Is Breaking up With ESPN in Sports Betting Deal. Should You Sell PENN Stock Here?

- Loop Capital Says This Semiconductor Stock Is Poised for Big Gains Ahead in 2026