Glenview, Illinois-based Illinois Tool Works Inc. (ITW) designs and manufactures a broad range of innovative products and equipment. Valued at a market cap of $70 billion, the company serves customers in various markets, including food equipment, welding, automotive OEM, construction, polymers and fluids, and specialty products.

Shares of this industrial company have trailed behind the broader market over the past 52 weeks. ITW has declined 10.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.7%. Moreover, on a YTD basis, the stock is down 4.6%, compared to SPX’s 13.4% return.

Narrowing the focus, ITW has also underperformed the Industrial Select Sector SPDR Fund’s (XLI) 7.8% uptick over the past 52 weeks and 13.7% YTD rise

On Oct. 24, shares of ITW tumbled 4.5% after its mixed Q3 earnings release. The company’s EPS declined 28.1% year-over-year to $2.81, but topped the consensus estimates by 4.5%. However, on the other hand, its operating revenue improved 2.3% from the year-ago quarter to $4.1 billion, but fell short of analyst expectations by a slight margin, lowering investor confidence.

For the current fiscal year, ending in December, analysts expect ITW’s EPS to grow 2.9% year over year to $10.44. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

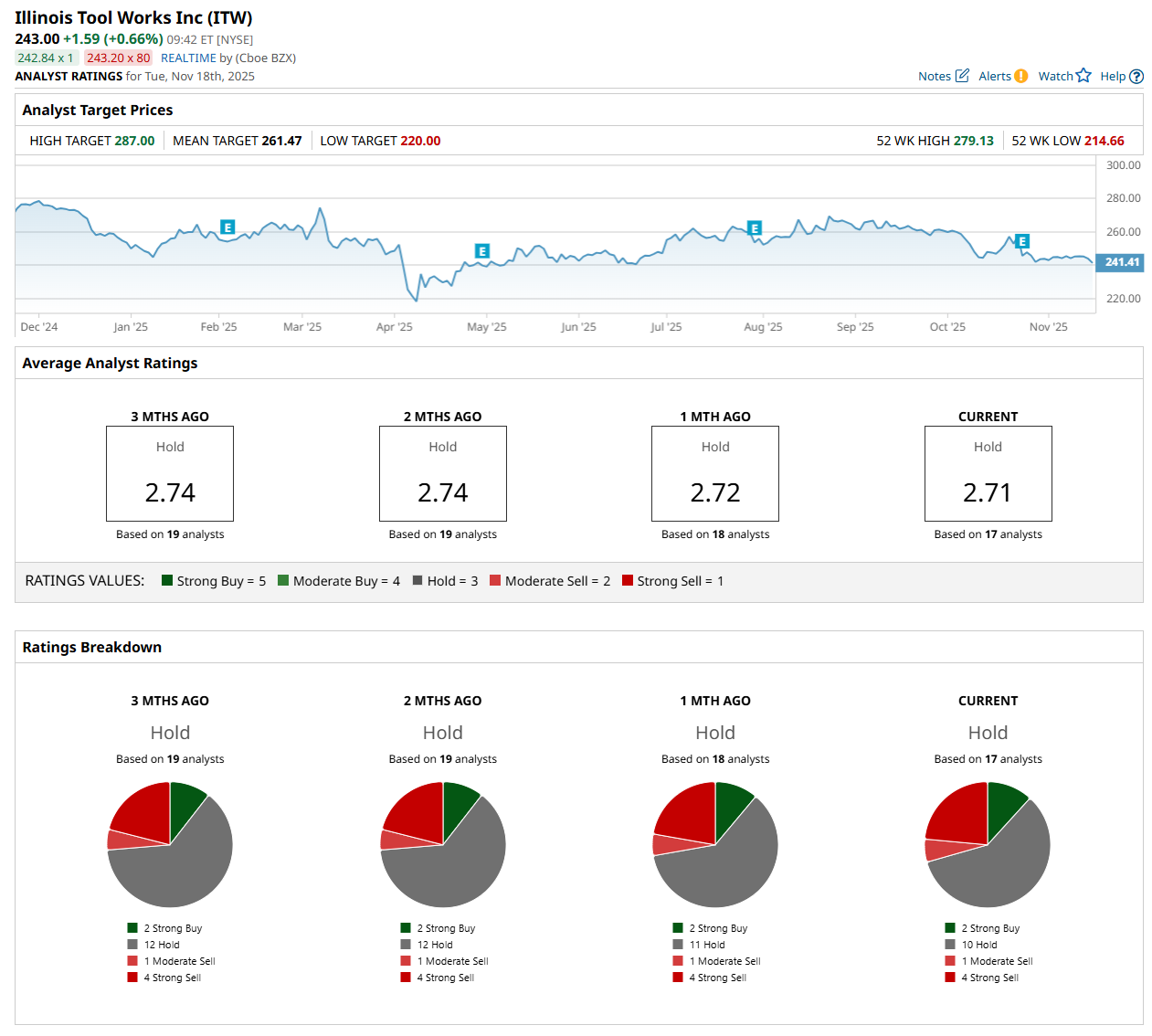

Among the 17 analysts covering the stock, the consensus rating is a "Hold,” which is based on two “Strong Buy,” 10 "Hold,” one "Moderate Sell,” and four "Strong Sell” ratings.

The configuration has remained fairly stable over the past three months.

On Oct. 27, Andrew Obin from Bank of America Corporation (BAC) maintained a "Sell" rating on ITW, with a price target of $220.

The mean price target of $261.47 represents a 7.6% premium from ITW’s current price levels, while the Street-high price target of $287 suggests an 18.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 30% in a Month, Should You Buy MicroStrategy Stock Here?

- Here Is What Options Traders Expect for NVDA Stock After Nvidia Reports Q3 Results This Week

- ‘Good News’ Is Coming for Nvidia Stock, So Buy NVDA Shares Here

- This ‘Buy’-Rated Stock Is Calling for 34% Revenue Growth and Analysts Think Shares Can Gain 48% from Here