With a market cap of $52.7 billion, Zoetis Inc. (ZTS) is a global leader in animal health, specializing in medicines, vaccines, diagnostics, and precision health solutions for both livestock and companion animals. The company serves veterinarians, livestock producers, and pet owners worldwide, with a diversified portfolio spanning vaccines, parasiticides, dermatology, anti-infectives, and advanced diagnostic services.

Shares of the Parsippany, New Jersey-based company have underperformed the broader market over the past 52 weeks. ZTS stock has decreased nearly 32% over this time frame, while the broader S&P 500 Index ($SPX) has gained 19.6%. Moreover, shares of Zoetis stock have dropped 27.3% on a YTD basis, compared to SPX's 8.7% rise.

Looking closer, shares of the animal health company have also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 2.6% dip over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $1.70, Zoetis shares tumbled 13.8% on Nov. 4 due to a revenue miss as sales came in at $2.40 billion and a cut in full-year revenue guidance to $9.40 billion - $9.48 billion. Management cited subdued demand for pet medicines and vaccines, declining vet visits, and distributor hesitancy amid consumer spending cuts as key drags on sales.

For the fiscal year ending in December 2025, analysts expect ZTS’s adjusted EPS to grow 7.1% year-over-year to $6.34. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

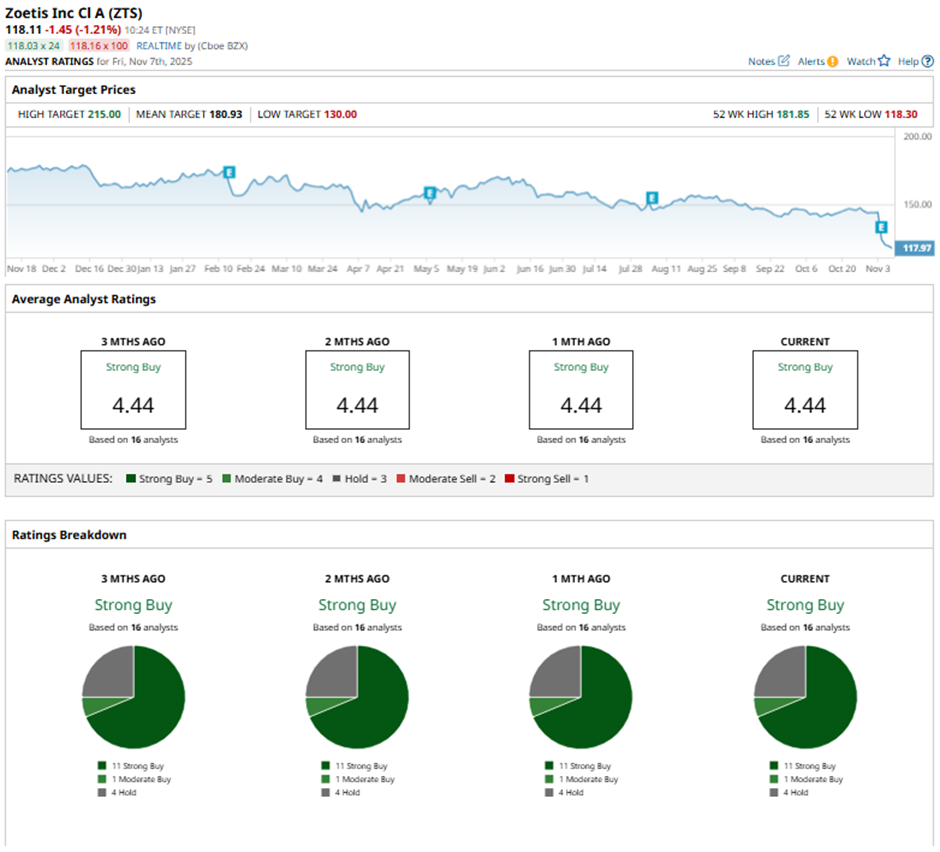

Among the 16 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.”

On Nov. 5, UBS cut its price target on Zoetis to $141 and maintained a “Neutral” rating.

The mean price target of $180.93 represents a premium of 53.2% to ZTS' current price. The Street-high price target of $215 suggests a 82% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart