Valued at a market cap of $7.5 billion, QuantumScape (QS) develops and commercializes solid-state lithium-metal batteries for electric vehicles and other applications in the United States. Earlier this week, QuantumScape announced it will move from the New York Stock Exchange to the Nasdaq, effective Dec. 23.

The solid-state battery maker will continue to trade under the ticker symbol QS with no interruption to trading activities. The voluntary transfer positions QuantumScape alongside tech-focused companies like Tesla (TSLA) and other electric vehicle innovators that call the Nasdaq home.

Chief Financial Officer Kevin Hettrich framed the move as an opportunity to better serve shareholders through Nasdaq's technology-oriented community. The exchange transfer comes as QuantumScape works to commercialize its lithium-metal battery technology designed to deliver higher energy density and faster charging than conventional lithium-ion batteries used in most electric vehicles today.

Is QuantumScape Stock a Good Buy Right Now?

QuantumScape delivered a milestone third quarter, unveiling its first real-world vehicle application and beginning to generate meaningful customer revenue for the first time in the company's history.

The highlight came at IAA Mobility in Munich, where QuantumScape, Volkswagen Group (VWAGY), Ducati, Audi, and PowerCo showcased the Ducati V21L electric race motorcycle powered by QuantumScape's QSE-5 battery technology. The demonstration is a critical inflection point as the technology moves from laboratory testing into demanding field applications.

QuantumScape achieved another key goal by shipping Cobra-based QSE-5 B1 sample cells during the quarter. These cells are part of the Ducati launch program and indicate a push toward automotive-grade production standards. QuantumScape is working with PowerCo toward series production in a car by the end of the decade, meaning by December 2029.

Notably, QuantumScape generated $12.8 million in customer billings during the third quarter, the first time the company has invoiced customers. CFO Kevin Hettrich introduced customer billings as a new operational metric to track future cash inflows. However, Hettrich stated that the figure differs from GAAP revenue due to accounting treatments for related-party transactions, such as those with Volkswagen.

QuantumScape strengthened its balance sheet by raising $263.5 million through an at-the-market equity offering, ending the quarter with $1 billion in liquidity.

Management now projects the cash runway extends through the end of the decade, a full year longer than previous guidance. Adjusted EBITDA loss came in at $61.4 million, within expectations, while full-year guidance improved to a range of $245 million to $260 million.

QuantumScape expanded its manufacturing ecosystem by signing agreements with Corning (GLW) and Murata Manufacturing (MRAAY) to scale ceramic separator production. The partnerships allow QuantumScape to leverage specialized manufacturing expertise and partner balance sheets rather than building internal capacity. Management views the capital-light model as key to efficiently scaling the technology globally.

QuantumScape also disclosed active engagement with a new top 10 global automotive manufacturer and continues to advance a joint development agreement with an existing customer announced last quarter.

The company expects these relationships to generate additional customer billings as development work progresses, though specific OEM names and timelines remain confidential pending customer announcements.

What Is the QS Stock Price Target?

QuantumScape is pre-revenue and is forecast to end 2026 with sales of $5.68 million. Moreover, analysts expect the top line to increase to $1.18 billion in 2029. The company’s free cash outflow is estimated to total $750 million through 2028. Moreover, it is forecast to report a free cash flow of $168 million in 2029.

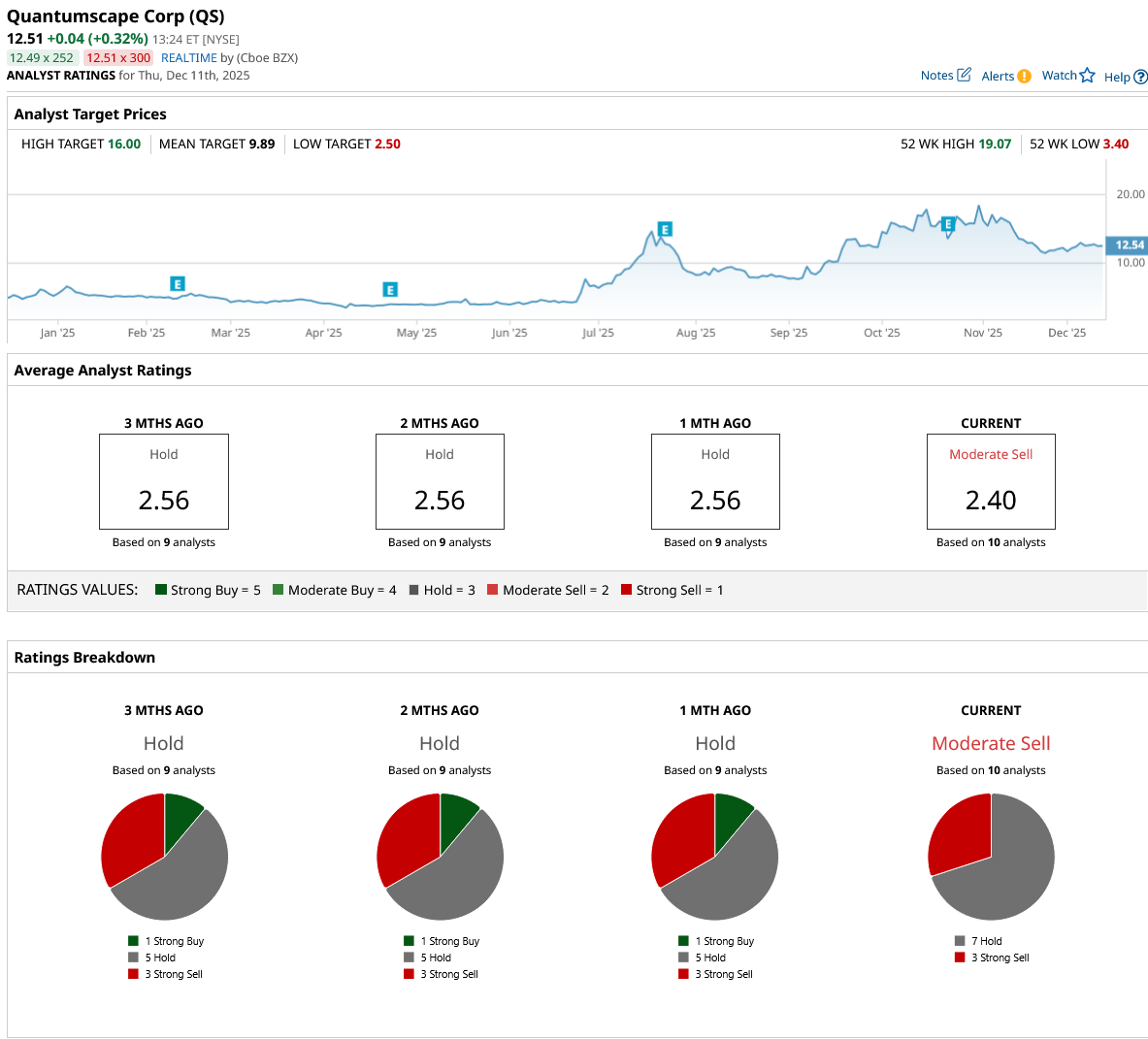

Out of the 10 analysts covering QS stock, seven recommend “Hold,” and three recommend “Strong Sell.” The average QS stock price target is $9.89, below the current price of $12.51.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart