Reston, Virginia-based Leidos Holdings, Inc. (LDOS) is a major U.S. defense, aviation, and technology solutions provider serving government and commercial clients. Its operations span national security, digital modernization, healthcare systems, and advanced engineering. Commanding a market cap of $23.6 billion, the company is known for its large federal contracts, particularly with the Department of Defense, intelligence agencies, and civilian government bodies.

Companies worth $10 billion or more are generally described as "large-cap stocks." Leidos Holdings fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the technology sector. Leidos is positioned as a key contractor in cybersecurity, mission systems, and next-generation defense technologies, with steady revenue visibility due to its long-term government agreements.

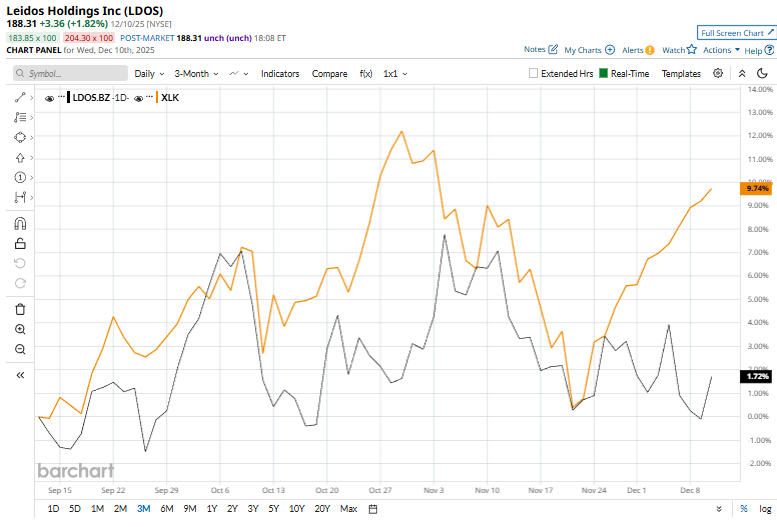

Leidos touched its 52-week high of $205.77 on Nov. 4, and is currently trading 8.5% below that peak. Meanwhile, the stock has soared 4.4% over the past three months, trailing the Technology Select Sector SPDR Fund’s (XLK) 10.1% surge during the same time frame.

The stock has gained 30.7% on a YTD basis and 17.6% over the past 52 weeks, outpacing XLK’s 27.9% gains in 2025, but lagging behind XLK’s 26.1% surge over the past year.

Meanwhile, the stock has traded above its 200-day moving average since late June and has dipped below its 50-day moving average in the last few trading sessions.

Leidos shares rose 2.1% on Dec. 4 after the company secured a new three-year, $127 million contract to continue administering Hawai'i‘s Energy and EV Charging Station Rebate programs, supporting efficiency, resilience, and clean energy adoption across the state. The company has managed the Hawai‘i Energy program since 2009, delivering more than $7 billion in statewide energy savings and issuing over 18,000 rebates in the latest program year.

When compared to its peer, Leidos has significantly outperformed Booz Allen Hamilton Holding Corporation’s (BAH) 27.7% decline on a YTD basis and 34.4% plunge over the past 52 weeks.

Among the 15 analysts covering the LDOS stock, the consensus rating is a “Moderate Buy.” Its mean price target of $216 suggests a 14.7% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jamie Dimon Has Long Been Sounding the Economic Alarm. After the Fed’s Latest Rate Cut, Can You Still Bank on JPMorgan Stock?

- Unlock Over 7% Income: Analysts Love These 2 High-Yield Dividend Stocks

- Nearly 45% of Its Float Is Being Sold Short. Should You Bet on iRobot Stock Here?

- Eric Jackson Could Make Nextdoor the Next Big Meme Stock. Should You Chase the Rally Here?