Among the high-value mature consumer discretionary stocks in the market, PepsiCo (PEP) continues to be a top pick of mine. The entrenched, mature nature of this cash flow-generating giant, with an impressive dividend yield of 3.8% and a rock-solid balance sheet most investors would dream of, should make this stock a potential anchor holding for most portfolios.

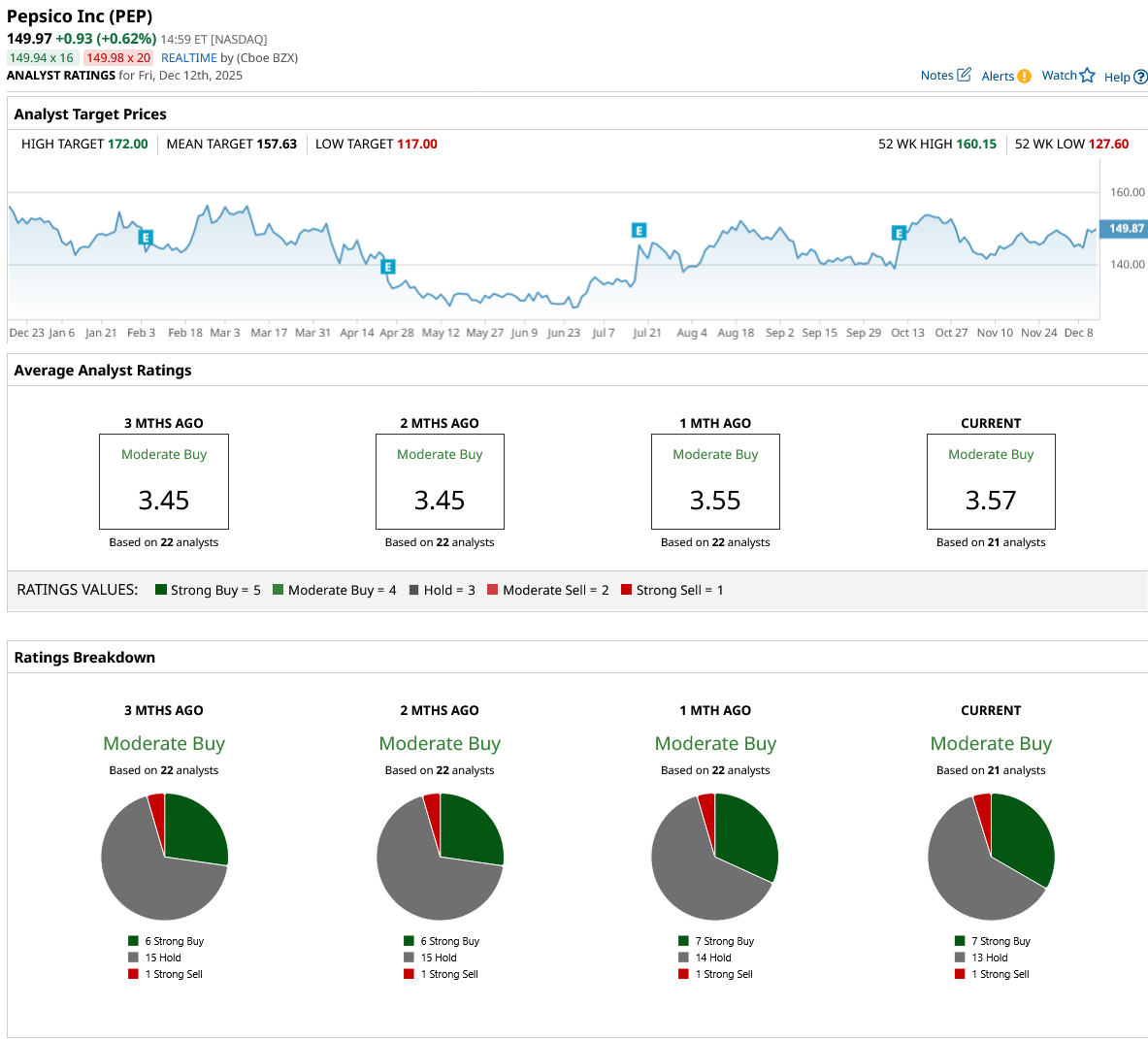

Looking at the company's stock chart above, it's clear that some investors in the market don't view this company the same way. Despite relatively strong sales and earnings growth in past quarters, investors have looked to other defensive sectors of the economy and away from consumer discretionary names. I'm not sure how long this rotation will take to fully unfold, but the company's recent bottom at the middle of this year does appear to be just that: a bottom.

As it turns out, one major Wall Street bank—J. P. Morgan—agrees. Here's why analysts at this bank think that Pepsi could actually be a unique and high-value way to play the chips (not semiconductor, but potato chips) sector right now.

A Punny Note

I'm always down for a good pun, and an analyst note that includes the term “chips that are too cheap to ignore” is one that's going to grab attention. The thing is, semiconductors have clearly become an essential staple. But in the world of carbonated beverages and salty snacks, Pepsi is one of two kings in this sector that absolutely dominate the competition.

Pepsi's underlying fundamentals, as mentioned, are extremely strong. Analysts at J.P. Morgan believe that an accelerated strategic agenda driven by improvements in marketing, productivity, and overall innovation could drive significant upside in the company's already impressive total shareholder return in 2026.

I tend to agree, given the company's relative value compared to its peers and a product mix that's increasingly looking like better value for the consumer. In terms of the sort of “affordable treats” consumers can reach for and not feel guilty about, Pepsi's beverage and snack offerings are world-class and will continue to grow globally over time.

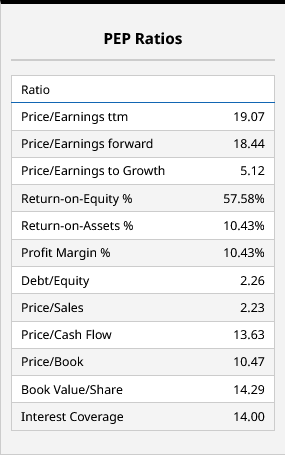

With strong organic growth and margins that continue to expand (a net margin of more than 10% is very solid for a company in this sector), I'd have to side with J.P. Morgan on this name and suggest this stock looks very cheap at just 18 times forward earnings.

What Do Other Analysts Think About PEP Stock?

There are currently 21 analysts covering Pepsi, with a “Moderate Buy” rating coming in as the consensus among this group for now.

Such a rating does correspond with an average price target, which is just 5% higher than Pepsi's current share price, implying limited upside from here. Again, I maintain that there is likely more upside than many analysts are pricing into PEP stock, given its depressed valuation relative to its own historical levels and its ability to potentially ramp up both revenue and earnings growth from here.

Indeed, if Pepsi can pick up the pace with its organic growth while adding to its distribution network and expanding into new global markets, there's lots of potential upside for investors to hang their hats on.

PEP stock looks like a solid buy to me, and I'm going to continue to pound the table on this one for now.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- JPMorgan Says This 1 Chip Stock Is a Strong Buy Now... And It’s Not What You Think It Is

- Nasdaq Futures Slip as Broadcom Results Fail to Ease AI Fears, Fed Speak on Tap

- Stocks Slip Before the Open as Oracle Dents Sentiment After Fed Cut

- Stock Index Futures Muted Amid Caution Ahead of Fed Rate Decision