As artificial intelligence gains mainstream adoption by the day, the bulk of the developments have been restricted to the software side. The applications of AI in the physical world have been primarily in automobiles and, to some extent, mobile devices. President Donald Trump’s administration is looking to change that.

Signaling that the federal government is going to"all in" on robotics over next year, Commerce Department Secretary Howard Lutnick said, “We are committed to robotics and advanced manufacturing because they are central to bringing critical production back to the United States.”

Naturally, stocks related to the industry, headlined by robotics bull Tesla (TSLA), saw their shares pop earlier this week. Aside from that, for the longer term, the global robotics market is projected to reach a size of $55.55 billion by 2032 from about $22 billion today.

So, how can investors take advantage of this secular trend? Here are three stocks to buy.

Robotics Stock #1: Serve Robotics

Founded in 2017 as a division of the on-demand delivery service/logistics platform, Postmates, Serve Robotics (SERV) designs, develops, and operates low-emission, AI-powered, self-driving sidewalk delivery robots. Its core mission is to provide “last-mile” delivery services in urban settings (primarily food delivery), enabling merchants, restaurants, and delivery platforms to outsource deliveries to autonomous robots.

Valued at a market cap of $878 million, SERV stock is down 2.4% on a YTD basis.

Serve is yet to serve profits as well, as the company’s losses for the most recent quarter almost doubled. However, revenues increased along with the number of daily active robots. In Q3 2025, Serve reported revenues of $687,000, up from $642,000 in the previous year. Losses per share came in at $0.40 per share compared to $0.24 per share in the prior year.

Net cash used in operating activities increased to $50.6 million for the first nine months of 2025. This was $15.3 million in the prior year. However, the company’s liquidity position remained solid, as it closed the quarter with a cash balance of $116.8 million, much higher than its short-term debt levels of $1.7 million.

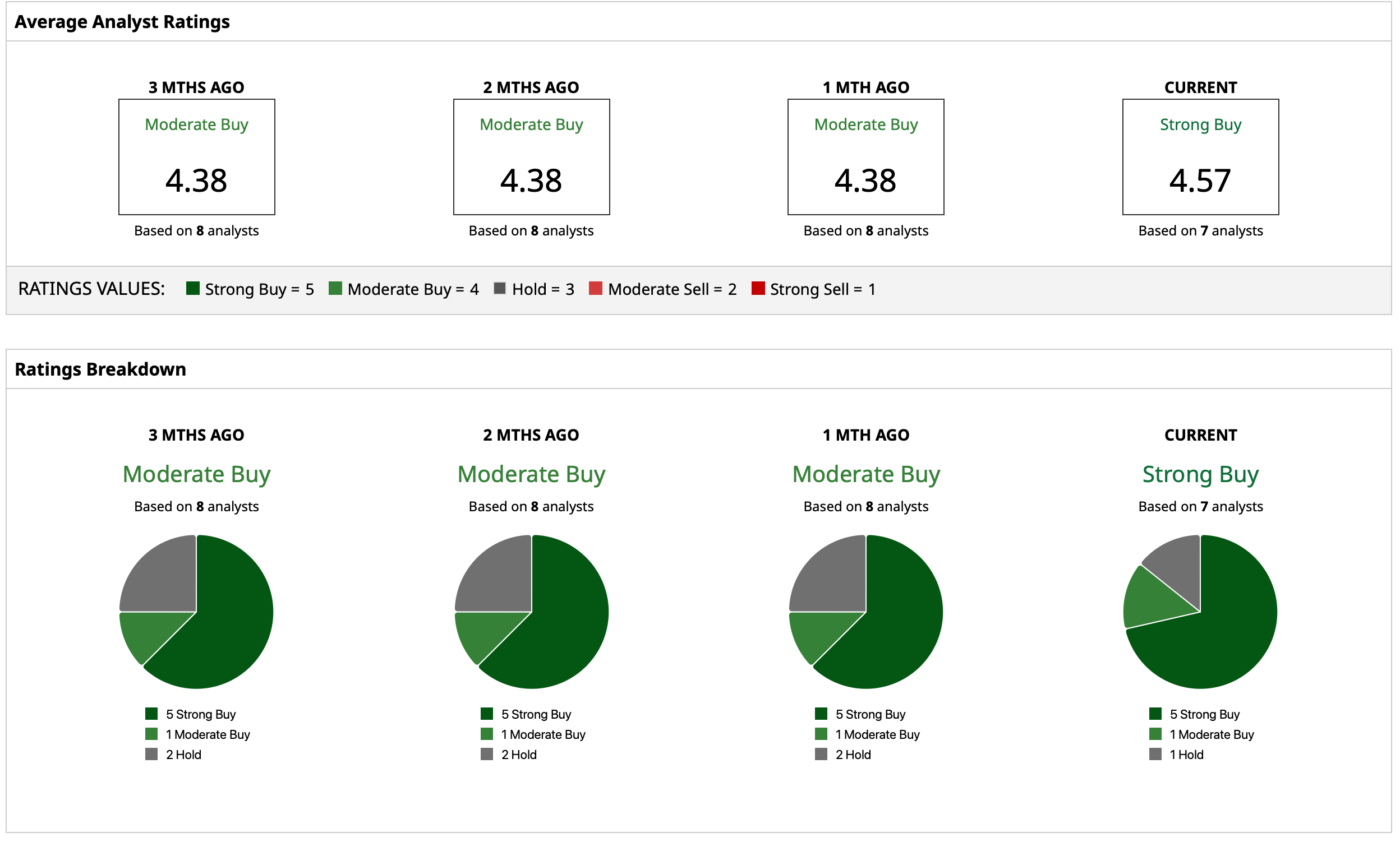

Overall, analysts have deemed the stock to be a “Strong Buy,” with a mean target price of $18.50. This denotes upside potential of about 56.8% from current levels. Out of seven analysts covering the stock, five have a “Strong Buy” rating, one has a “Moderate Buy” rating, and one has a “Hold” rating.

Robotics Stock #2: Richtech Robotics

Starting its journey in 2016 as Richtech Creative Displays, Richtech Robotics (RR) designs, manufactures, deploys, and sells robotic solutions aimed primarily at automating labor-intensive service tasks in sectors such as hospitality, restaurants, hotels, senior living centres, hospitals, casinos, retail centres, factories, and more.

Currently trading with a market cap of $632 million, RR stock is up 78.3% on a YTD basis.

However, Richtech’s latest results came in below expectations, with revenues declining and losses widening. For the first nine months of fiscal 2025, the company reported revenues of $3.6 million, which represented a yearly decline of 3.2%. Meanwhile, losses for the same period came in at $0.11 per share, up from $0.07 per share.

Net cash used in operating activities increased to $11.2 million from $2.1 million in the year-ago period. Overall, Richtech exited the June 2025 quarter with a cash balance of about $33 million, with just $40,000 of short-term debt on its books.

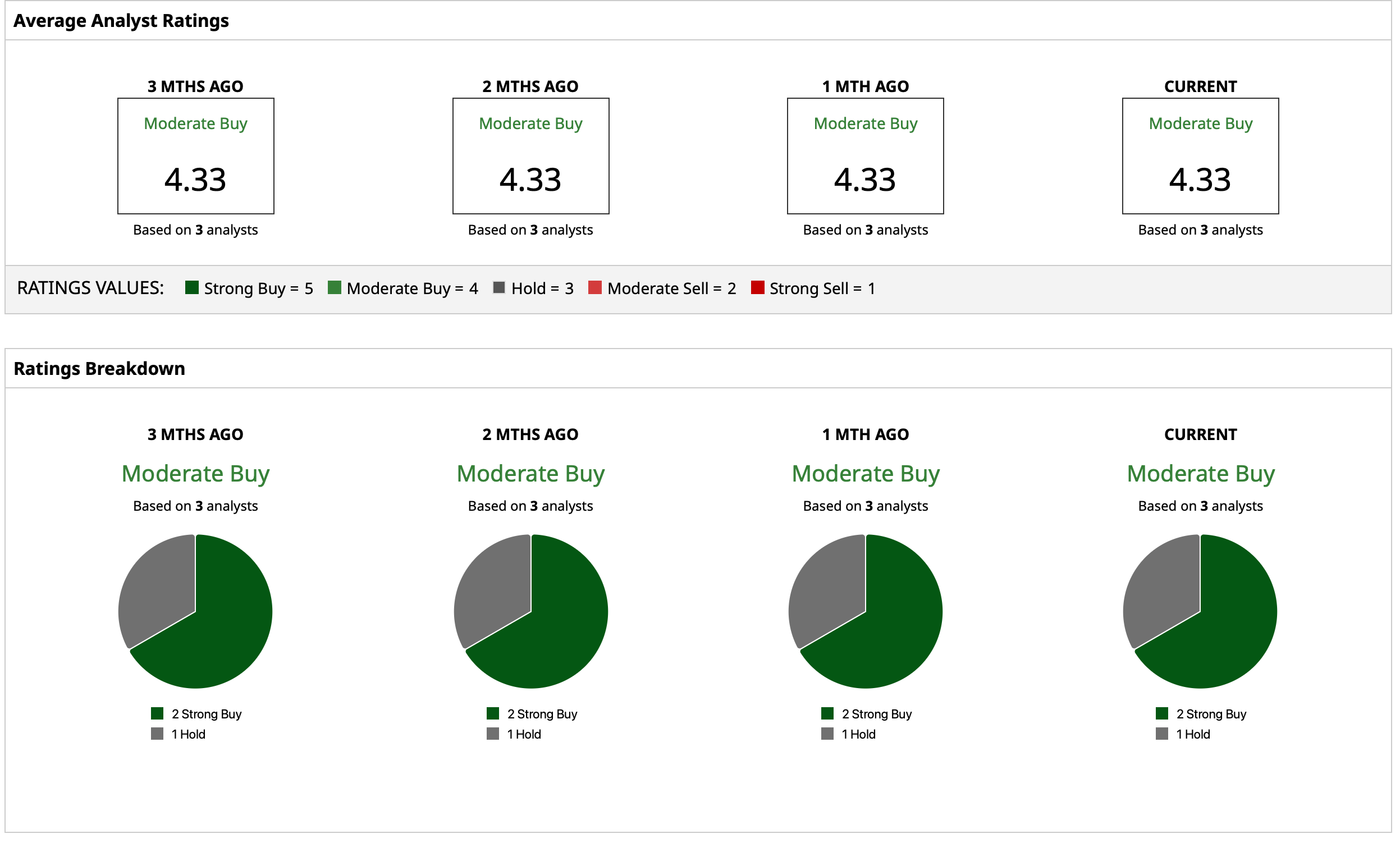

Thus, analysts remain cautiously optimistic about the RR stock, attributing to it a rating of “Moderate Buy,” with a mean target price of $4.50. This denotes upside potential of 6.6% from current levels. Out of three analysts covering the stock, two have a “Strong Buy” rating, and one has a “Hold” rating.

Robotics Stock #3: Teradyne

The last stock on this list is one of the biggest names in the robotics industry: Teradyne (TER). Founded in 1960, Teradyne designs, develops, manufactures and sells automatic test systems (ATE) — used to test semiconductors, data storage devices, circuit boards, wireless products, and complex electronics systems. Over time, the company expanded beyond test equipment into industrial automation and robotics, offering collaborative robots, autonomous mobile robots (“AMRs”), and automation solutions for manufacturing, assembly, warehouse operations, and more.

Valued at a healthy market cap of about $30.5 billion, TER stock is up 58.4% on a YTD basis.

Teradyne had a terrific Q3, with both revenue and earnings surpassing estimates. Revenues for the quarter came in at $769 million, up 18% from the previous year. Earnings went up by an even sharper 49.1% in the same period to $0.85 per share, coming in higher than the consensus estimate of $0.79 per share.

Although net cash from operations declined, it stayed positive in Q3 2025. The company reported net cash from operating activities of $49 million, down from $166.3 million in the year-ago period. Overall, Teradyne closed the quarter with a cash balance of $272.7 million, a shade higher than its short-term debt levels of $200 million.

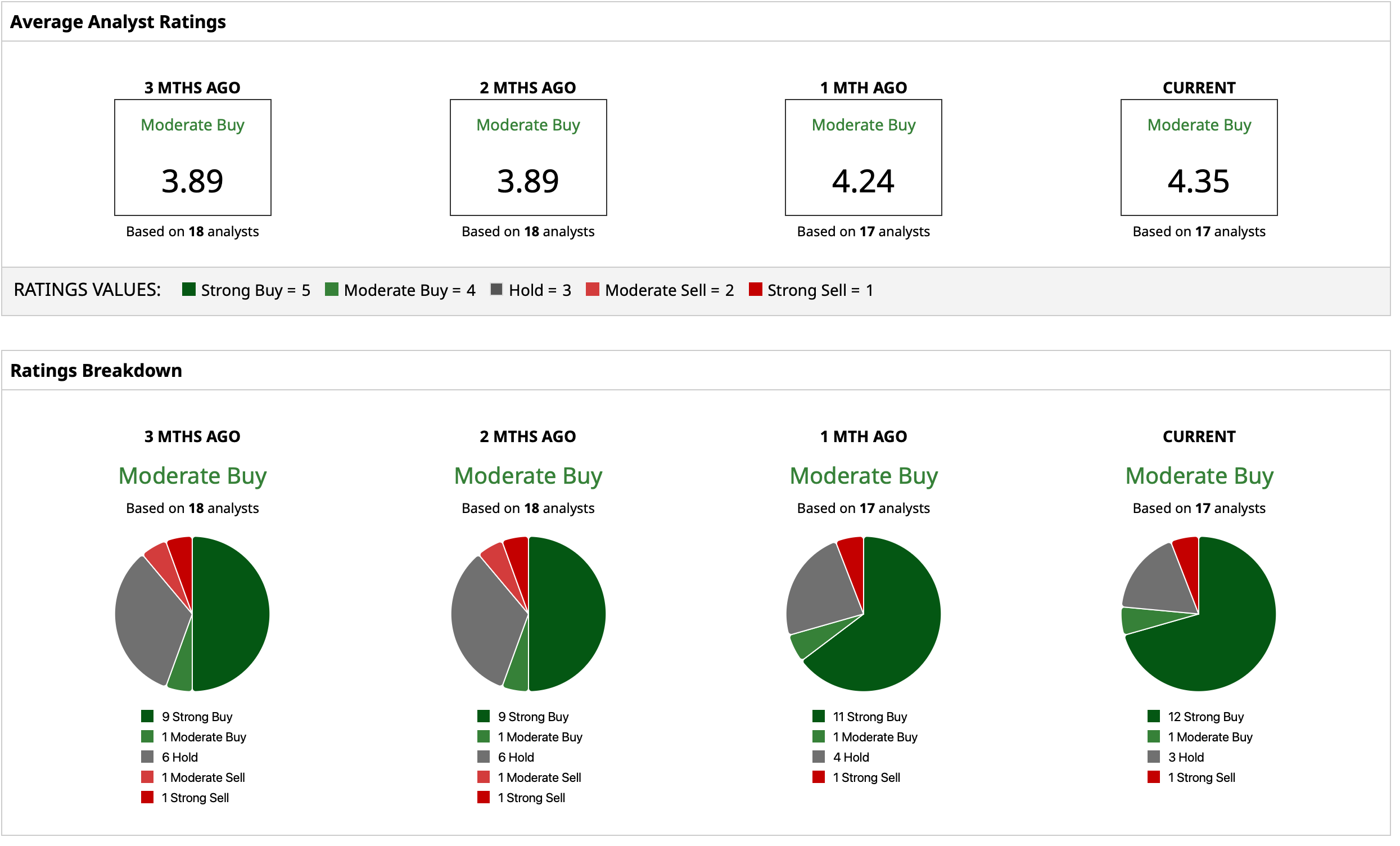

Considering this, analysts have earmarked a rating of “Moderate Buy” for the stock, with a mean target price that has already been surpassed. The high target price of $215 indicates upside potential of about 10.2% from current levels. Out of 17 analysts covering the stock, 12 have a “Strong Buy” rating, one has a “Moderate Buy” rating, three have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- TD Cowen Says This Chip Stock (Not Nvidia) Is the Best Idea for 2026

- Trump Is Doubling Down on Robotics. Does That Make Tesla Stock a Buy Here?

- The $500 Billion Reason Wells Fargo Thinks Oracle Stock Can Gain 40% from Here

- Wall Street Is Cheering Metaverse Spending Cuts at Meta Platforms, But Is META Stock a Buy Here?