Michael Burry, the famed investor behind “The Big Short,” is once again making waves on Wall Street. And this time, he’s not sounding the alarm on a looming crisis or betting against overvalued stocks. Instead, he’s placing a bullish, long-term wager on one of the most controversial and misunderstood stocks in America: Fannie Mae (FNMA).

In a recent post on his new Substack, Burry revealed that he likes FNMA and views it as a stock worth holding for at least three to five years, signaling unusually high conviction from an investor known for his contrarian instincts. His disclosure comes at a time when Fannie Mae and its sibling Freddie Mac (FMCC) have been thrust back into the spotlight amid growing speculation that President Donald Trump’s administration may move forward with a stake sale, a step that could mark the beginning of the end of more than 17 years of federal conservatorship. That has already sent FNMA shares soaring this year.

So, let’s take a closer look at the bull case for FNMA stock here.

About Fannie Mae Stock

The Federal National Mortgage Association, better known as Fannie Mae, is a government-sponsored enterprise created in 1938 to provide liquidity and stability in the U.S. housing market. Together with Freddie Mac, the company plays a vital role in the U.S. mortgage industry by purchasing mortgages from lenders and bundling them into mortgage-backed securities (MBS). Fannie Mae and Freddie Mac guarantee the MBS, giving investors confidence that they will be paid even if homeowners default on their mortgages. FNMA’s market cap currently stands at $12.4 billion.

Fannie Mae has been under federal conservatorship since 2008. Both Fannie Mae and Freddie Mac needed a government bailout in 2008 after the housing bubble burst, as they were exposed to risky loans and securities that included subprime mortgages. The companies suffered billions in losses before Congress created the Federal Housing Finance Agency and placed them into conservatorship. Notably, Fannie Mae and Freddie Mac have paid billions in dividends to the U.S. government under conservatorship, exceeding the amounts they received in the bailout, and are now profitable.

Shares of the secondary mortgage market giant have more than tripled this year, driven by speculation that the Trump administration will privatize Fannie Mae and its sibling Freddie Mac, bringing an end to federal conservatorship.

Fannie Mae Emerges as One of Michael Burry’s Top Picks

Michael Burry, known for his early bet against the U.S. housing market and for being portrayed by Christian Bale in the movie “The Big Short,” recently revealed his four stock picks. To add some context, Burry shut his hedge fund, Scion Asset Management, to outside investors last month, saying he felt “muzzled” by SEC rules, and now shares his views through his new Substack, called “Cassandra Unchained.” And one stock Burry recently revealed he’s betting big on is Fannie Mae.

“You know I own and like LULU, MOH, FOUR,” Burry wrote in a post last Wednesday. “Also FNMA, but as a pink sheet stock, it was never disclosed. These are all 3-5 year holds minimum. I will write each of these up as well as others in future posts. The 2-12B market cap range is the most fertile area as I see it today.”

The four tickers Burry posted correspond to Lululemon Athletica (LULU), Molina Healthcare (MOH), Shift4 Payments (FOUR), and Fannie Mae. The first three have appeared in Scion Asset Management’s portfolio updates over the past year or so, while Fannie Mae trades over the counter, meaning the Big Short investor’s hedge fund wasn’t required to disclose it in its 13F filings. With that, Burry’s holding in FNMA was disclosed for the first time.

Interestingly, Fannie Mae is the only one of Burry’s four recommended stocks that is up this year. FNMA shares have spiked 251.97% year-to-date. Still, Burry recommended it as a “low-priced buy” stock, as it has retreated 38.3% from its recent peak of $15.99.

While Burry said he plans to write about each of his stock picks in future posts, the bull case for Fannie Mae seems obvious, so let’s dive in.

The Bull Case for FNMA Stock

The bullish catalyst for Fannie Mae centers on its potential release from government control. The current market value of FNMA stock is depressed due to its conservatorship status. Any indications that the conservatorship situation could change have prompted traders to flock into Fannie and Freddie shares, betting the stocks could spike if the companies — and their profits — are freed from government control. Billionaire Bill Ackman has supported that thesis, arguing the stocks will soar once the U.S. government unwinds its sizable stakes.

Notably, the Federal Housing Finance Agency (FHFA), established in 2008 to oversee the struggling mortgage firms, coordinated the largest bailout in U.S. history, totaling $191 billion in taxpayer funding. In exchange, the government assumed effective ownership of Fannie and Freddie, taking control of 80% (technically 79.9%) of their shares.

The Trump administration has been considering a public offering of Fannie Mae and Freddie Mac. Trump is reportedly considering launching the offering as early as year-end or in early 2026. The plan could value the mortgage giants at over $500 billion and involve selling 5% to 15% of their shares, with the offering expected to raise around $30 billion.

Meanwhile, the government will still be the largest shareholder of the mortgage giants even after the offering. U.S. Commerce Secretary Howard Lutnick said in a CNBC interview in September that the government does not want to “sell a lot” of its stake in Fannie Mae and Freddie Mac. FHFA Director Bill Pulte said in September that the Trump administration is considering offering about 5% of each entity. Pulte reiterated that last month, adding that he expects “the president will make a decision either this quarter or early next year as it relates to the IPO.”

With that, market participants are awaiting the outcome. Still, Ackman recently said it “will take significant time” for the government to “deliberately execute” the IPO. But that isn’t a problem for Burry, as he’s already said the stock is a minimum 3-5 year hold.

What Do Analysts Expect for FNMA Stock?

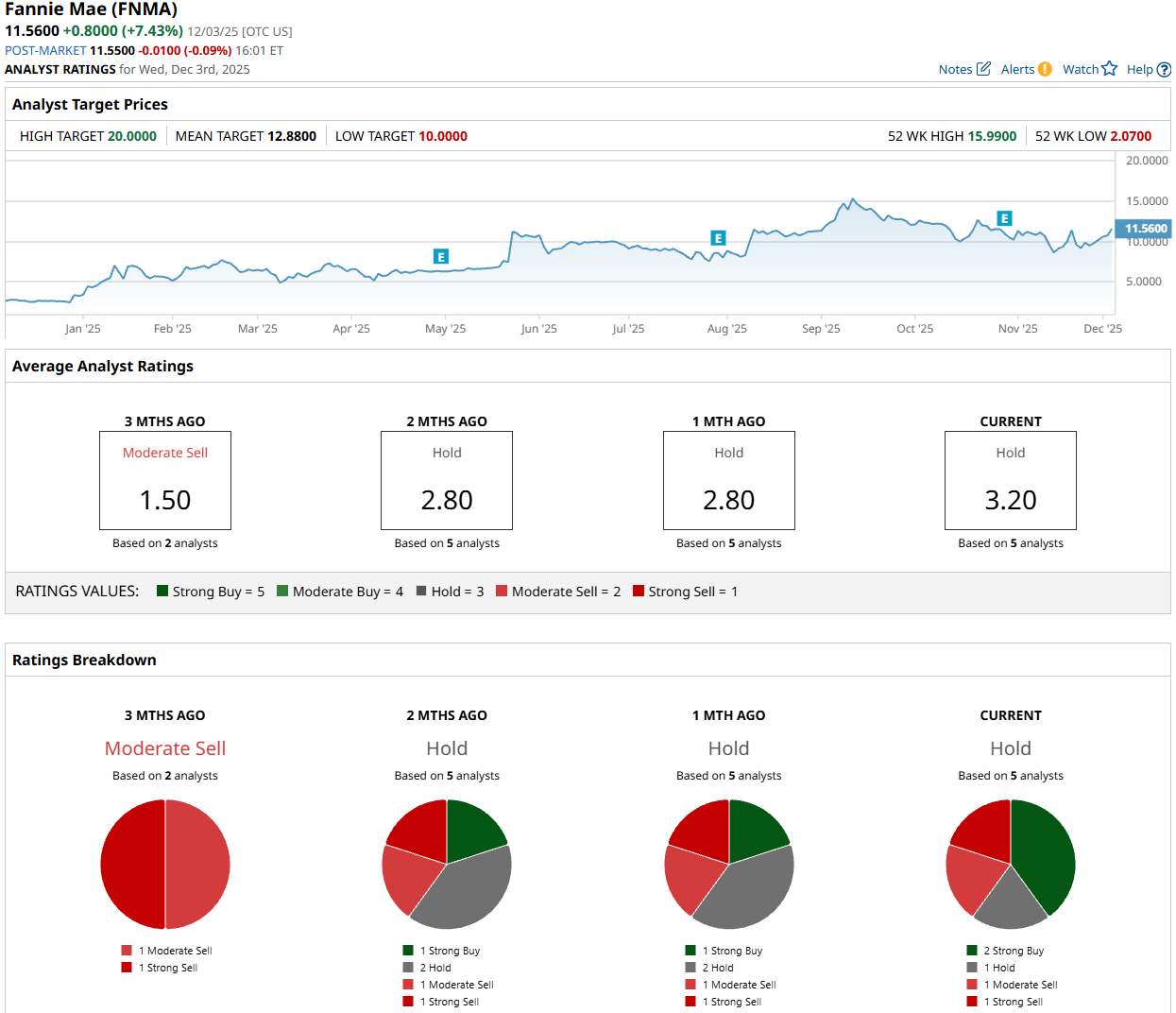

Not surprisingly, Wall Street analysts remain cautious on Fannie Mae stock after its strong rally this year. Among the five analysts covering the stock, two rate it a “Strong Buy,” one recommends holding, one gives it a “Moderate Sell” rating, and the remaining one assigns a “Strong Sell” rating. This translates to a consensus rating of “Hold.” The average price target for FNMA stock is $12.88, representing 11.4% upside potential from current levels.

Last week, Wedbush Securities double-upgraded Fannie Mae to “Outperform” from “Underperform” and raised its price target on the stock to $11.50 from $1.00. “Our rating, price target, and investment outlook are based on our analysis of the implications of a range of steps that the Trump Administration might take to recapitalize FNMA, put it on the path to leaving conservatorship, and monetize Treasury’s investments in the company,” said analyst Henry Coffey.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The $500 Billion Reason Wells Fargo Thinks Oracle Stock Can Gain 40% from Here

- Wall Street Is Cheering Metaverse Spending Cuts at Meta Platforms, But Is META Stock a Buy Here?

- As Amazon Launches the Trainium 3 Chip, Should You Buy, Sell, or Hold AMZN Stock?

- 3 Robotics Stocks to Buy Now Ahead of a White House Game-Changer