Semiconductor giant Broadcom (AVGO) is reportedly in talks with tech supergiant Microsoft Corporation (MSFT) to further bolster its artificial intelligence (AI) chip portfolio. According to a report by The Information, the two trillion-dollar behemoths are planning to co-design custom chips to meet growing demand for AI operations, amid a market fueled by competitive pressure.

This could turn out to be a major tailwind for Broadcom. Let's take a closer look at the stock ahead of its Q4 results.

About Broadcom Stock

Broadcom is a top global tech firm focused on semiconductors and infrastructure software for data centers, networking, broadband, wireless, storage, and industrial sectors. Its headquarters is in Palo Alto, California, serving as the base for leadership, research, and key operations in Silicon Valley.

Broadcom creates Ethernet chips, optical devices, AI accelerators, Wi-Fi technology, and software through acquisitions such as VMware. The company has a market capitalization of $1.89 trillion.

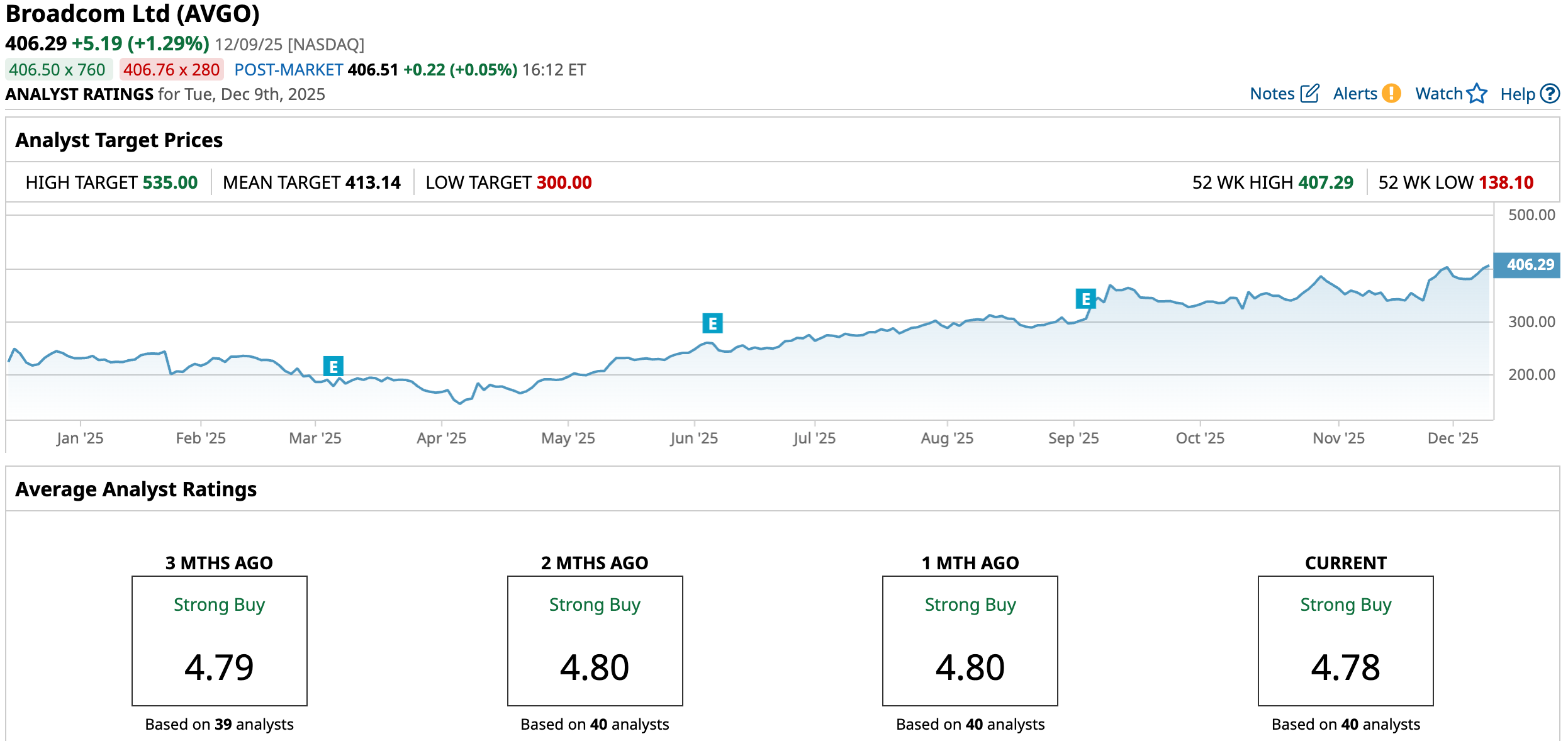

Over the past 52 weeks, Broadcom’s stock has gained 125.99%. Just for comparison, the broader Technology Select Sector SPDR Fund (XLK) has gained 23.62% over the same period. Factors, such as strong AI demand, have boosted the stock’s trajectory. Moreover, its 2023 acquisition of VMware has increased software sales, creating another tailwind. Over the past six months, its shares have surged 65.54%.

Likely due to news of talks with Microsoft, Broadcom’s stock reached a 52-week high of $407.29 on Dec. 8, riding market momentum. However, it is down 1.5% from that level.

On the other hand, Broadcom currently trades at an elevated valuation. Its trailing price-to-earnings ratio is 103.03x, significantly higher than the industry average of 31.52x.

Broadcom’s Q3 Results Were Better Than Expected

On Sept. 4, Broadcom announced its third-quarter results for fiscal 2025 (the quarter ended Aug. 3). The company reported record third-quarter revenue of $15.95 billion, up 22% year-over-year (YOY), driven by robust demand for custom AI accelerators, networking, and VMware. This was also higher than the $15.83 billion that Wall Street analysts had expected. Its Q3 AI revenue surged by 63% annually to $5.20 billion.

Also, top line gains were reflected in significant bottom line improvements. Broadcom’s non-GAAP EPS grew 36% from the prior year’s period to $1.69, surpassing the expected $1.66 figure.

The company’s adjusted EBITDA increased 30% YOY to $10.70 billion, exhibiting substantial operating leverage. For the fourth quarter of fiscal 2025, Broadcom expects revenue of approximately $17.40 billion, while adjusted EBITDA is projected to be 67% of the expected revenue.

Wall Street analysts are considerably optimistic about Broadcom’s future earnings. They expect the company’s EPS to increase by 19.2% YOY to $1.49 for the fiscal fourth quarter (which is expected to be reported on Dec. 11 after the market closes). For fiscal 2025, EPS is projected to surge 46.1% annually to $5.42, followed by a 42.3% growth to $7.71 in the next fiscal year.

What Do Analysts Think About Broadcom Stock?

Ahead of its quarterly results, several Wall Street analysts have reiterated their positive sentiments about Broadcom’s prospects. Oppenheimer analyst Rick Schafer raised the stock’s price target from $400 to $435 while maintaining an “Outperform” rating. Schafer cited the company’s AI compute/networking franchises as a tailwind, with potentially increasing Tomahawk6 volumes as an added boost.

Susquehanna analyst Christopher Rolland maintained a “Positive” rating on Broadcom and raised the price target from $400 to $450, citing growing networking demand driving near-term growth and a broader ASIC customer base fueling growth in the second half of 2026.

Morgan Stanley (MS) analysts raised the stock price target from $409 to $443 while maintaining an “Overweight” rating, expecting its AI processor revenues to grow slightly faster than NVIDIA Corporation’s (NVDA) in 2026.

UBS and Bank of Amercia analysts also see positive prospects. UBS raised its price target from $415 to $472 and maintained a “Buy” rating, while BofA increased its price target from $400 to $460 and maintained a “Buy” rating.

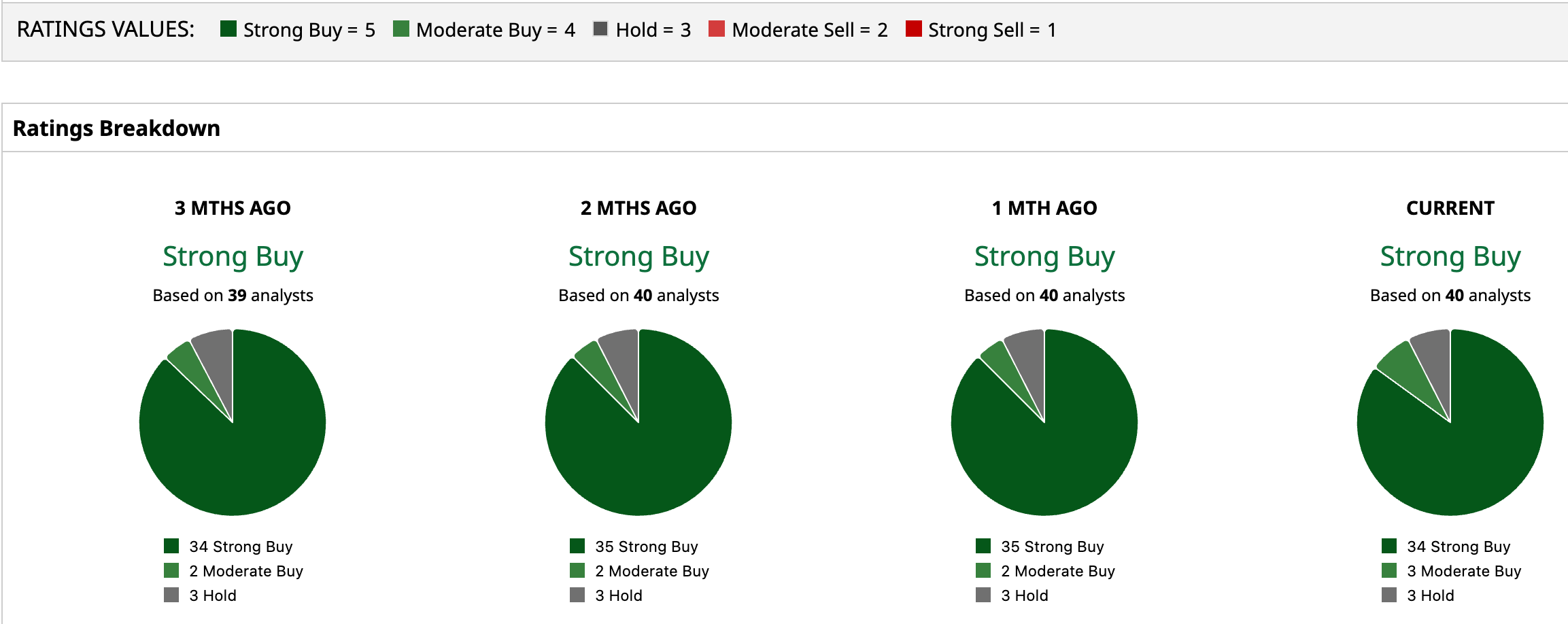

Broadcom has long been a popular name on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 40 analysts rating the stock, a majority of 34 analysts have given it a “Strong Buy” rating, three analysts rated it “Moderate Buy,” while three analysts are playing it safe with a “Hold” rating. The consensus price target of $413.14 represents a 1.69% upside from current levels. The Street-high price target of $535 indicates a 31.68% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Morgan Stanley Is Sweetening on MP Materials Stock Following ‘Historic Deal.’ Should You Buy MP Here?

- This Semiconductor Giant Is in Talks With Microsoft for Custom Chips. Should You Buy Its Stock Now?

- Is MicroStrategy Stock a Buy Now Amid the Bitcoin Rally?

- Apple Stock Marks a Solid Comeback. Is AAPL a Buy, Sell, or Hold for 2026?