Precious metals like gold have seemed like the ultimate “Trump trade.” While markets have been on tenterhooks amid all the uncertainty and geopolitical tensions, precious metals were the best-performing major asset class in 2025. While a section of the market was apprehensive about precious metals, particularly silver (SIH26), heading into 2026, prices have continued to rise.

Precious metal companies are experiencing a rally of a lifetime, thanks to the record or near-record cash flows they are generating. Companies have used these bumper cash flows to deleverage their balance sheets and increase shareholder payouts through dividends and buybacks.

Let's analyze the outlook for one particularly shiny stock, AngloGold Ashanti (AU), which has among the highest dividend yields among gold miners, as President Trump makes “gold great again.”

Gold Prices Continue to Rally

I have been bullish on gold (GCG26) for quite some time now. The stars seem to be well aligned for gold in 2026, as global uncertainty continues to bolster its safe-haven appeal. The central bank's gold-buying spree should also continue for the foreseeable future as it diversifies its holdings away from the greenback. Individual and institutional investors are also increasing their allocation to gold for diversification purposes.

President Trump’s actions in Venezuela and threats to Cuba and Greenland have ignited geopolitical tensions, and no wonder defense stocks and gold have risen this year. Fed Chair Jerome Powell's criminal indictment also triggered a buying spree in gold. While the president has issued an executive order targeting defense companies that prioritize dividends and share buybacks over innovation and production capacity, gold mining companies should continue to reward shareholders at will.

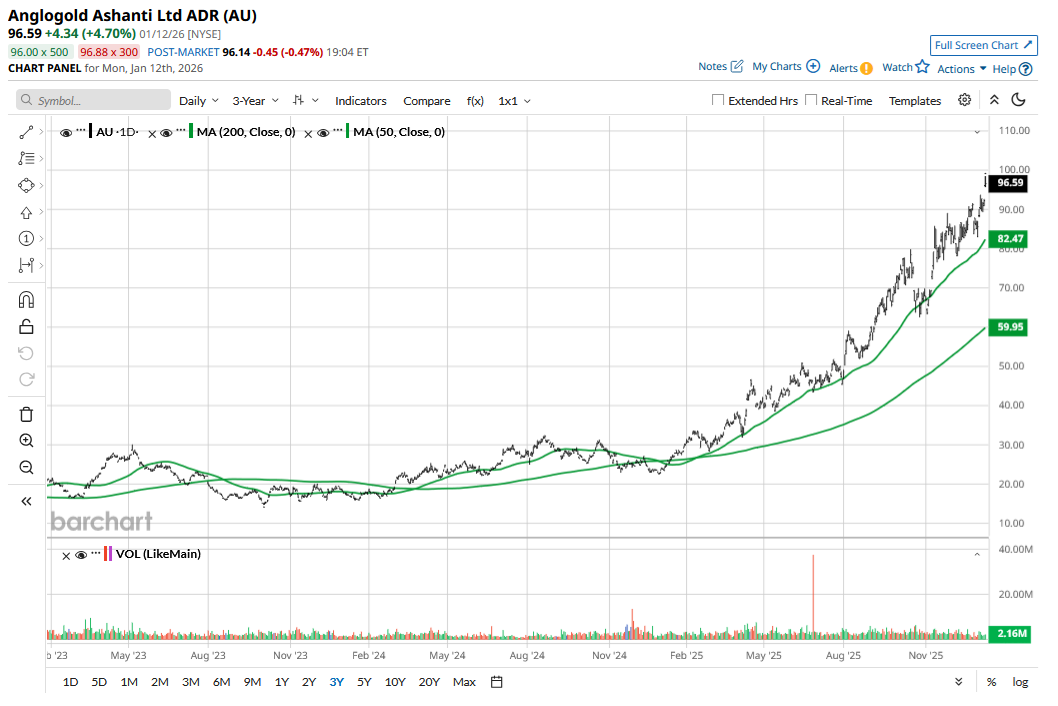

In my previous article, I had noted that it would be prudent to wait for AU stock to fall a bit before adding positions. The stock did dip from those levels but has since soared as gold prices have risen to new highs. Let's examine whether AU is still a buy or if investors would be better off staying away.

AU Stock Forecast

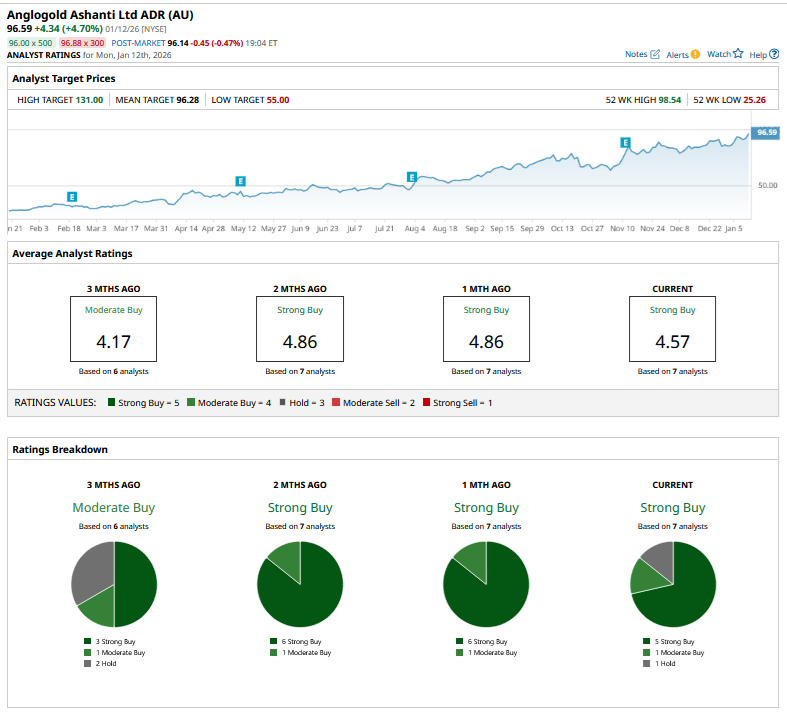

While AU has a consensus rating of “Strong Buy” from the seven analysts polled by Barchart, it has run ahead of its mean target price of $96.28. The discrepancy appears to be due to the stellar rally in AU stock and the lag effect in analysts’ actions.

However, we might see analysts raise AU’s target price to reflect the new realities. Gold prices are looking strong, which would mean stellar earnings for gold miners like AU, and analysts might take note sooner than later. AngloGold trades at a forward enterprise value-to-earnings before interest, tax, depreciation, and amortization (EV-to-EBITDA) multiple of 6.3x, which does not look high, especially considering the outlook for gold prices.

I believe, as an asset class, gold’s short-term risk-reward looks better compared to stocks, and the yellow metal should continue to see buying interest across the board. While I expect gold to see a correction sometime later this year, for now, I am tactically bullish on the precious metal as well as companies mining it. Given the positive outlook for gold prices, AU appears to be a name worth considering for the portfolio.

AngloGold Investors Can Expect a Dividend Bonanza

Apart from capital gains, AU investors can also expect a dividend extravaganza this year. The company has a generous dividend policy and currently pays a quarterly payout of 12.5 cents per share, with a commitment to pay out 50% of its annual free cash flow to investors.

Last year, AU departed from the policy and, instead of making the “true-up” payment at the end of the year, it announced additional payments while releasing its earnings for the second and third quarters of 2025. While the quarterly true-ups would mean that the annual dividend won’t be as fat as it would have otherwise been, the payout should still be quite substantial. Moreover, since gold prices are now at a much higher level than last year, AU’s 2026 dividend should also be correspondingly higher than 2025.

Overall, AU remains one of my top picks in the gold mining space, given its much-improved portfolio and balance sheet, with the dividend being the cherry on top.

On the date of publication, Mohit Oberoi had a position in: AU . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart