The price of Microsoft (MSFT) stock has dropped in recent months and the company is due to report earnings on January 28th after the market close.

To take advantage of the volatility skew around earnings, I like to use a strategy called a diagonal put spread.

This option strategy is an advanced strategy because it utilizes options over different expiration periods and different strike prices.

The strategy involves selling an out-of-the-money put for a near term expiry and then buying a put for around the same price using a later expiry.

The idea with the trade is that the stock might fall a little bit more, but should stay above the short strike price.

Let’s look at an example using Microsoft.

Microsoft Diagonal Put Spread Example

The trade I’m looking at is selling a January 30th put with a strike price of $445 and buying a February 6th put with a strike price of $435.

As of yesterday’s close, the January 30th put could be sold for around $5.05 and the February 6th put could be bought for $4.10.

The net premium received for the trade would be $95 and that is the worst case scenario on the upside – a $95 gain.

The risk on the trade is on the downside with a potential maximum loss of $905. This is calculated by taking the difference in the spread (10) multiplied by 100 and subtracting the option premium (95).

The maximum potential gain is around $600 which would occur if MSFT closes right at $445 on January 30th.

The trade will profit as long as MSFT is above $435 at expiration.

Aiming for a return of around 10-15% makes sense and I would set a similar stop loss.

The worst-case scenario is a sharp drop in MSFT stock early in the trade. For this reason, if the stock drops below $445 in the next few days, I would also consider closing the trade early to minimize losses.

The initial trade set up has a delta of 4 meaning the position is roughly equivalent to owning 4 shares of MSFT stock. Note that this delta number can change significantly as the stock starts to move.

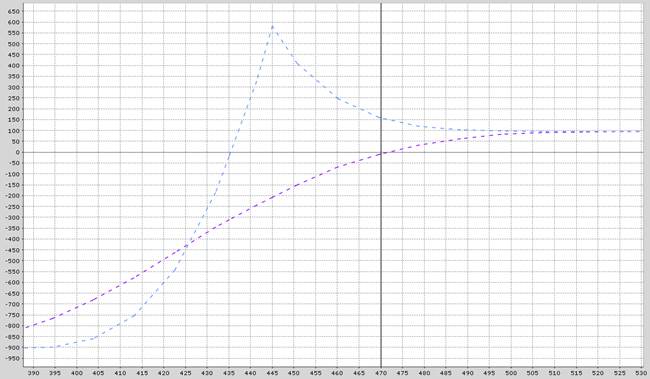

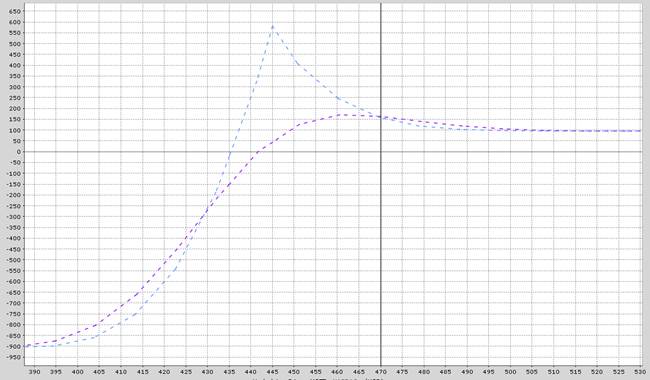

Below is the payoff graph with the blue line representing the profit or loss at expiration and the purple line being the trade as of today.

This is how the trade could look the day before earnings.

So, provided MSFT stock stays above $440 in the 10-14 days, the trade should be ok. As the trade requires the stock to not drop too much, this would not be an appropriate strategy for bearish traders.

Microsoft Company Details

The Barchart Technical Opinion rating is a 72% Sell with a Strongest short term outlook on maintaining the current direction.

Microsoft Corporation is one of the largest broad-based technology providers in the world.

The company dominates the PC software market with more than 80% of the market share for operating systems.

The company's Microsoft 365 application suite is one of the most popular productivity software globally.

It is also now one of the two public cloud providers that can deliver a wide variety of infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) solutions at scale.

Microsoft's products include operating systems, cross-device productivity applications, server applications, business solution applications, desktop and server management tools, software development tools and video games.

The company designs and sells PCs, tablets, gaming and entertainment consoles, phones, other intelligent devices, and related accessories.

Through Azure, it offers cloud-based solutions that provide customers with software, services, platforms and content.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart