The new year has started off strong for Hut 8 (HUT), with shares up more than 20% in the year to date. And while a few days doesn’t make a trend, there’s plenty of compelling evidence that supports long delta exposure with a March bull call spread in HUT stock.

A Fragmented AI Trade

It’s been an odd start for all things AI in 2026.

Hyperscaler behemoth Microsoft (MSFT) is down in the year to date, and Amazon (AMZN) is just up 1.8%.

But it’s been a quite different and bullish animal for many data center and artificial intelligence infrastructure players or those transitioning to be a part of this important theme trade.

Names like Bloom Energy (BE), Cipher Mining (CIFR), Terawulf (WULF), and Iren (IREN) are all up big in the new year.

Part of the fast-acting enthusiasm is likely tied to tax-loss harvesting which wrapped up at year’s end after severe bear markets during the fourth quarter. Given the circumstances, some might call 2026’s opening salvo a dead-cat bounce.

Still, one up and comer in the group that looks different from the rest both off and on the price chart is Hut 8 and HUT stock.

Hut 8’s 800-Pound Gorilla Deal

In some ways it’s yesterday’s news. But it would be a mistake to assume Hut 8’s deal with Fluidstack, announced in mid-December and being financially backed by Alphabet (GOOGL), is discounted or already priced into HUT stock. It isn’t.

The 15-year lease deal for a 245-megawatt AI data center that Hut 8 is developing for Fluidstack is valued at $7 billion and could balloon to $17.7 billion over time. Not only are those big numbers, the counterparty risk has all but been eliminated by Google’s financial commitment. Moreover, it validates Hut’s pivot from a volatile crypto miner into a high-margin AI infrastructure, power-first business.

Wall Street’s Rallying Cry for HUT Stock

Analysts can be notoriously slow to move or act when it comes to changing their position on a company. So when they, as a group, charge out in unison with bullish and aggressive above-the-market price target hikes, it’s worth taking notice.

The Google pact was this sort of positive disruptor for HUT stock. Upward revisions from a slew of brokers range from the low $60s to a Street-high of $85 at Benchmark.

With shares in the mid-$40 range at the time of the December announcement followed by HUT stock reaching a new multi-year high of $62.91 on Jan. 13, the analyst community has rarely looked as good, so quickly.

Despite those bullish analyst price targets and YTD gains of more than 20%, HUT’s more technical-based underpinnings are still ripe for capture.

HUT Stock Is Technically Compelling

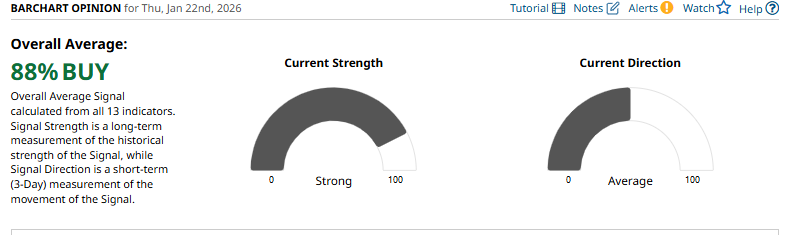

The Barchart Opinion is bullish on HUT stock and appears aligned with the aforementioned optimistic brokerage price targets that remain above the current share price.

There’s also a healthy, corrective base in HUT stock of nearly three months known as cup and handle chart pattern that’s in play for breakout traders.

After setting a multi-year high of $57.29 in mid-October, shares of HUT corrected by as much as 44%.

The bearish price cycle completed as buyers held shares to a successful test of its three-year high set in December 2024 sandwiched between the 50% and 62% Fibonacci retracement levels of HUT’s March / October rally. It marked the low for the cup pattern.

In early January, a breakout of the smaller handle consolidation in the right, upper side of the cup base was cleanly established.

Bullish follow-through buying in HUT stock marginally cleared the larger pattern while allowing shares to hit a fresh 52-week high.

Pricing a Hut 8 Bull Call Spread

For investors interested in HUT’s bullish underpinnings, the use of a slightly out-of-the-money bull call spread looks well-suited for this type of situation. Learn more about the bull call spread option strategy here.

The rationale for this type of vertical spread is that the investor expects the rally will continue to unfold in the weeks ahead, but with a tad less momentum and linear enthusiasm.

Sure, a bull call spread by construction “caps” an investor’s profit potential due to the further out-of-the-money call that’s been sold. It’s a compromise.

More importantly, the short premium collected from the sale of the call has the benefit of greatly reducing the cost to position in HUT stock with long directional (delta) exposure versus owning a simple long call.

This spread also smartly cuts down time decay (theta) and volatility (vega) risks. And it still offers an attractive risk-to-reward profile.

One bull call vertical that fits well into HUT’s above-the-market analyst price targets, Barchart’s bullish technical opinion, and a pattern breakout is the March 20 $60 / $75 bull call spread.

The March contract also has an embedded earnings event that might function as a driver for a higher share price.

Priced at $4.05 per spread, this bull call vertical will require HUT to trade above $64.05 at expiration to breakeven.

That’s a concession of course.

But by selling the much higher call, the $7.30 cost of the $60 long call has been chopped by nearly half at 44% ( $3.25 / $7.30).

Also, with 57 days of life, lesser share movement toward the breakeven level can result in profits or even an adjustment that improves the initial risk to reward profile of this vertical.

Lastly, if most of Wall Street’s price targets go underwater and HUT’s technical picture proves prescient, this bull call spread offers a max payout of $10.50 (($75 Call - $60 Call = $15) - $4.05 debit) above $75 at expiration.

The potential profit above the call sold amounts to an attractive return above 270%. And bottom line, while that is still a “cap” due to the short call, the net result might also garner an enviable hat tip from others.

On the date of publication, Chris Tyler did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 325 Million Reasons to Buy Netflix Stock Today

- Micron Insider Teyin Liu Just Bought $7.8 Million in MU Stock. Should You Buy Shares Too?

- Power Up for a Larger Rally in 1 of 2026’s Winning AI Stocks with a Bull Call Spread

- UnitedHealth Announces Plans to Rebate ACA Profits. What Does That Mean for UNH Stock as Trump Takes Aim at Insurers?