There are few certainties in the world today, from tariff issues to geopolitical flashpoints. But what remains starkly definite is AI and its rapidly increasing prevalence across industries. To power this AI adoption, semiconductor chips play an indispensable role. Chips are at the heart of the AI revolution, and in a recent note, investment banking major RBC Capital has reiterated as much.

Expecting AI to increase revenue for chip companies from $220 billion in 2025 to more than $550 billion by 2028, RBC stated in a note, “Tight supply is leading to extended visibility with managements highlighting 18-month backlogs.” Consequently, the firm has highlighted a handful of names to benefit from this tailwind for chip companies.

Particularly, three names stand out. Let's take a closer look.

Chip Stock #1: Nvidia

Indisputably the cynosure of the AI buildout, Nvidia (NVDA) is the biggest chip company in the world. In fact, with a market capitalization of $4.3 trillion, it is the biggest company in the world. Period.

Founded in 1993, Nvidia started by developing graphics processing units (GPUs) for gaming and multimedia. Its breakthrough came as GPUs evolved into massively parallel processors capable of accelerating complex computations beyond graphics, laying the foundation for its dominance in high-performance computing and AI. Over time, Nvidia expanded into markets including data center AI accelerators, professional visualization, autonomous systems, robotics, and networking, morphing from a hardware maker into a platform company that combines silicon, software, and ecosystem tools.

Outperforming the S&P 500 ($SPX), NVDA stock is up 30% over the past year.

Nvidia put up another impressive quarter for the third quarter of 2025, clearing both revenue and earnings estimates while keeping year-over-year (YOY) growth above 50% on each line. Sales came in at $57.1 billion, a 62% increase from the same period last year. EPS climbed 60% to $1.30, beating the $1.26 consensus estimate. The company's data center segment, still the biggest driver, also grew 66% YOY to $51.2 billion in revenue.

Cash generation remained very strong. Operating cash flow rose to $23.8 billion from $17.6 billion in the prior year, and free cash flow increased 65% to $22.1 billion. The company closed the quarter with $60.6 billion in cash, short-term debt below $1 billion, and long-term debt at $7.5 billion — leaving cash at more than eight times the long-term debt amount.

For the December quarter, guidance points to revenue around $65 billion, which would mean about 65.4% growth from the year before. However, the stock is trading at heady levels, well above the sector median. Its forward price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow P/CF of 42, 362, and 60.9 times do not compare well with the sector medians.

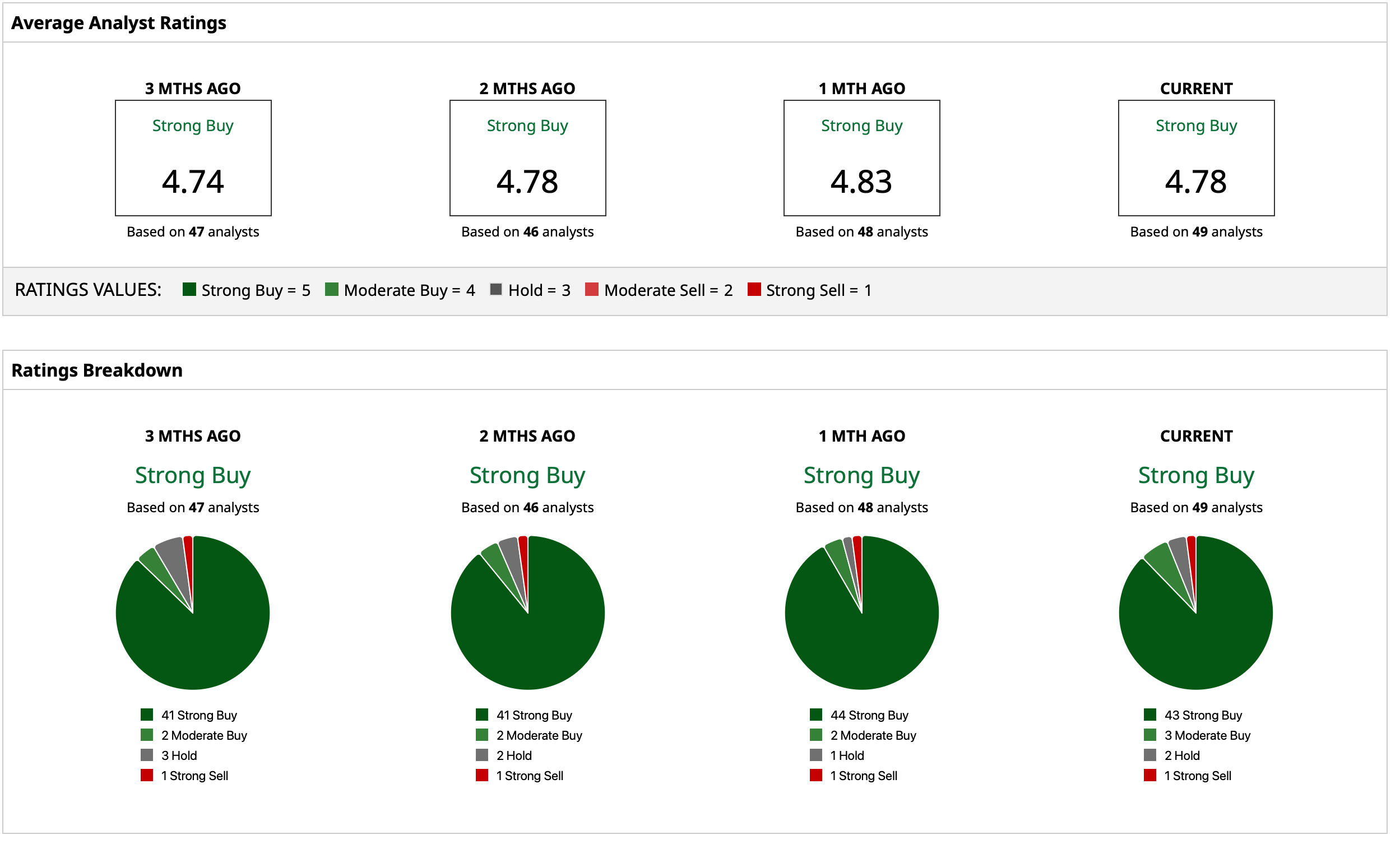

Overall, analysts have a “Strong Buy” consensus rating for NVDA stock, with a mean target price of $255.78. That denotes an upside potential of about 40% from current levels. Out of 49 analysts covering the stock, 43 have a “Strong Buy” rating, three have a “Moderate Buy” rating, two have a “Hold” rating, and one has a “Strong Sell."

Chip Stock #2: Astera Labs

Astera Labs is a semiconductor company focused on connectivity solutions for AI and cloud infrastructure. Founded in 2017, the company designs, manufactures, and sells semiconductor-based connectivity solutions that address critical data, memory, and link-level bottlenecks in modern rack-scale AI and cloud computing systems. Astera's Intelligent Connectivity Platform combines hardware and management software (COSMOS) to optimize performance across complex AI infrastructure.

Valued at a market cap of $31 billion, ALAB stock has also outperformed the S&P 500 over the past year with an uptick of 41%.

Notably, the results for the latest quarter saw the company reporting a beat on both revenue and earnings. With revenues of $230.6 million, sales more than doubled from the previous year's figure of $113.1 million. Meanwhile, earnings also followed the same trajectory, coming in at $0.49 per share compared to $0.23 per share in the year-ago period.

Shifting to cash flows, the first nine months of 2025 saw the company reporting net cash from operating activities of $224 million, up considerably from the previous year's figure of about $97 million. Overall, the company closed the quarter with a cash balance of $140.4 million with no short-term debt on its books.

For Q4 2025, Astera has guided for EPS of $0.51. However, valuation comfort has deserted this stock, with its forward P/E and P/S of 145 and 42 way above sector medians.

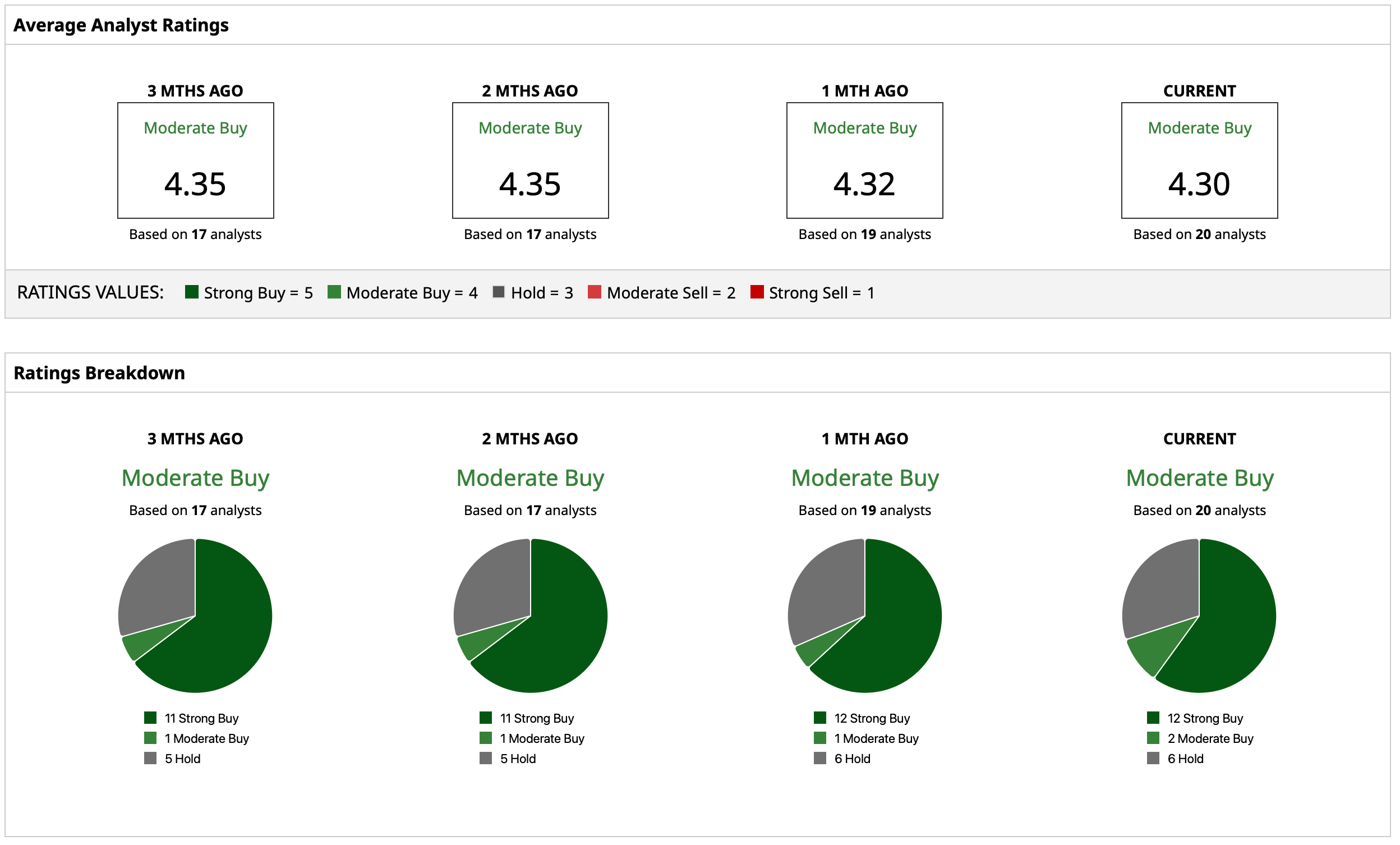

Taking all of this into account, analysts peg ALAB stock with a “Moderate Buy” consensus rating. The mean target price of $205.88 indicates upside potential of about 17% from current levels. Out of 20 analysts covering the stock, 12 have a “Strong Buy” rating, two have a “Moderate Buy,” and six have a “Hold” rating.

Chip Stock #3: Micron Technology

Concluding this list is Micron, one of the leaders in the fastest-growing segment of chip design: memory. Founded in 1978, Micron is a leading global semiconductor company that designs, manufactures, and sells memory and storage solutions, including DRAM (dynamic random access memory), SSDs, and high-bandwidth memory (HBM) and CXL memory modules. Micron also develops memory technologies like 1y DRAM and G9 NAND, supporting next-generation performance.

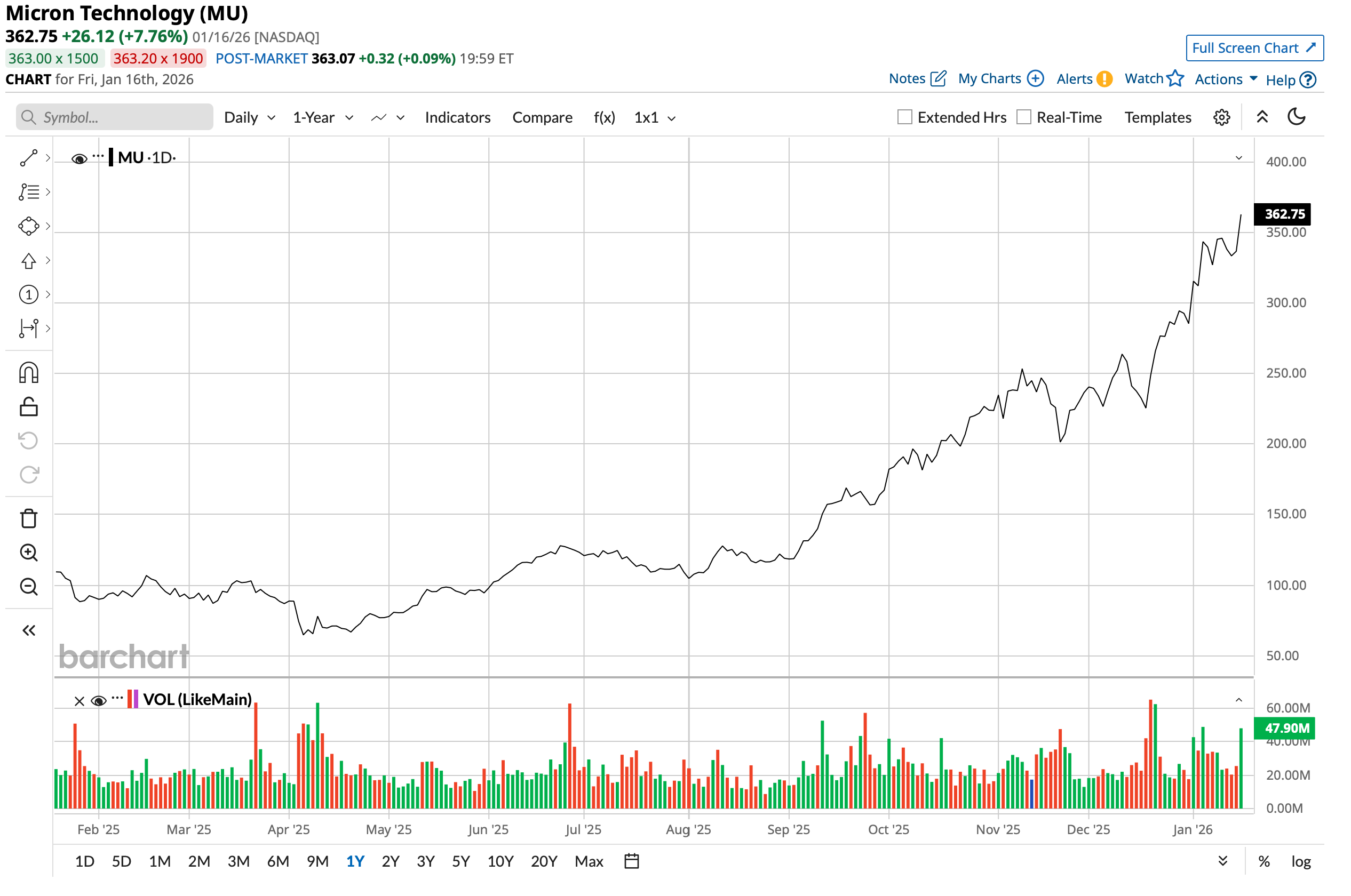

MU stock has been on fire over the past year, rising by a mammoth 256%. Its market cap is currently at $410 billion.

Unsurprisingly, the results for the most recent quarter exceeded expectations on both the revenue and earnings front. Revenues surged by 56% on a YOY basis to $13.6 billion as its largest segment of Cloud Memory Business saw revenues doubling to $5.3 billion from $2.6 billion in the year-ago period.

Meanwhile, earnings witnessed an even sharper rise of 167% in the same period to come in at $4.78 per share. That easily outpaced the consensus estimate of $3.96. Notably, the period also marked another consecutive quarter of earnings beat from the company.

Micron's net cash from operating activities stood at $8.4 billion, up from $3.2 billion in the prior year as the company closed the quarter with a cash balance of $9.7 billion. This was considerably higher than its short-term debt levels of $569 million.

In terms of guidance, Micron expects revenue to be in the range of $18.3 million to $19.1 billion for fiscal Q2 2026, the midpoint of which would denote a YOY growth rate of 132%. Similarly, the company has earmarked earnings to be between $8.22 and $8.62 per share, the midpoint of which would denote a jump of 440%.

Further, MU stock is also trading at reasonable, sometimes muted levels when compared to industry peers, despite the rally in its share price. Its forward P/E and P/S of 11.2 is below the sector median, while its forward P/S ratio stands out 10.9 times.

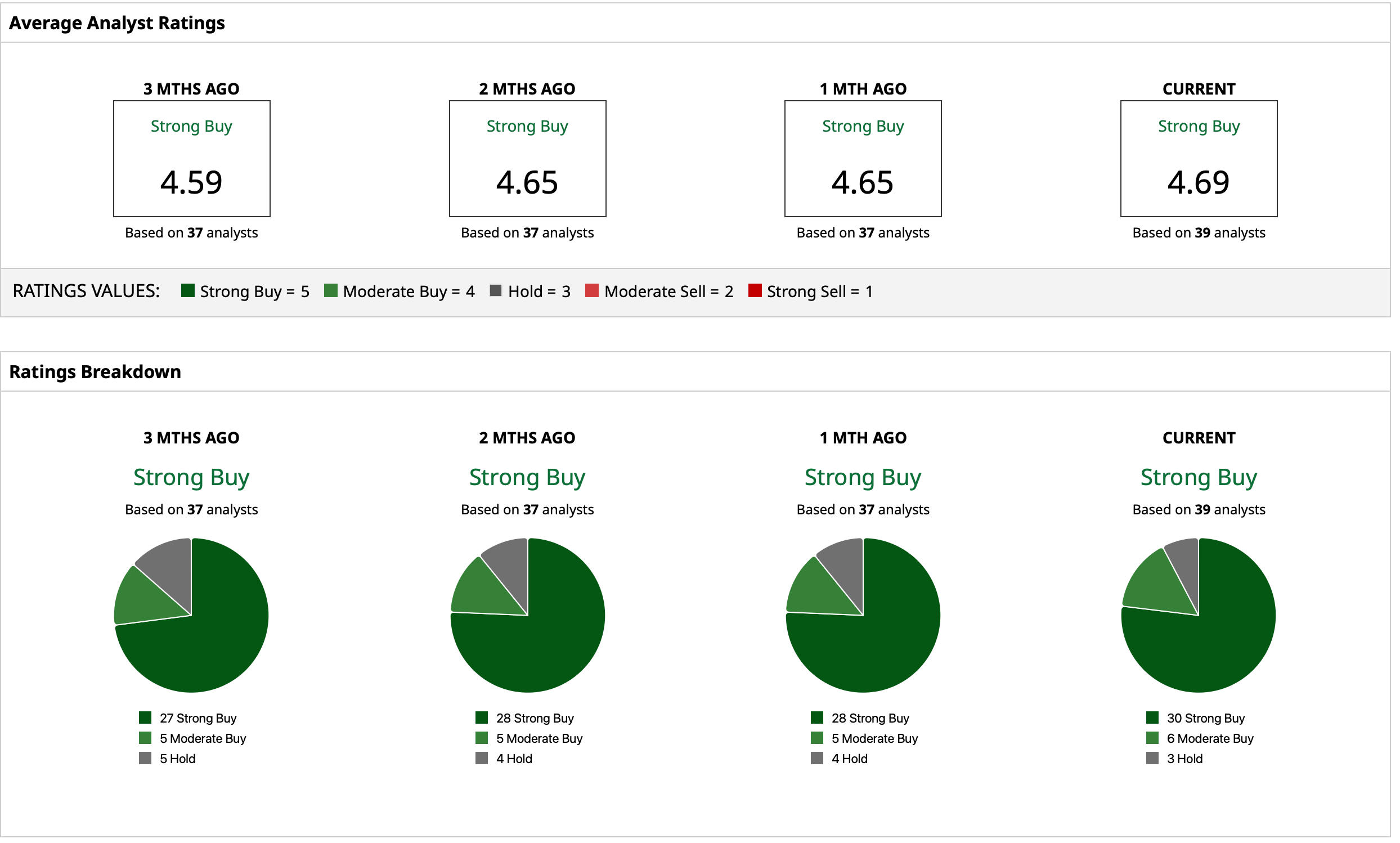

Analysts give MU an overall consensus rating of “Strong Buy,” with a mean target price of $329.92, which has already been surpassed. Meanwhile, the high target price of $500 indicates an upside potential of about 28% from current levels. Out of 39 analysts covering the stock, 30 have a “Strong Buy” rating, six have a “Moderate Buy” rating, and three have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart