USA Rare Earth (USAR) shares opened nearly 25% higher today after the U.S. government said it will invest about $1.6 billion in the critical minerals startup.

The company will issue 16.1 million shares and as much as 17.6 million warrants priced at $17.17 to the U.S. Department of Commerce, according to the press release.

At its intraday peak, USAR stock was seen trading at well over double its price at the start of 2026.

Why the U.S. Government’s Stake Isn’t Bullish for USAR Shares

While bullish on the surface, there’s reason to treat the surge in USA Rare Earth stock as an opportunity to sell.

Why? Because increasing the share count so dramatically will inevitably prove dilutive for existing shareholders.

Plus, the Nasdaq-listed firm has agreed to issue millions of warrants as well — signaling that investors' stakes could reduce further in value over the next few years.

Not to mention that USAR is also raising another $1.5 billion from private investors, which means it faces an even bigger risk of a crash as soon as these institutional partners move to de-risk.

USA Rare Earth Lacks Strong Fundamentals

President Donald Trump's administration’s stake in USA Rare Earth is a notable boost to sentiment, but the company’s fundamentals still warrant selling at current levels.

Commercial production at its Texas site is unlikely to begin until late 2028. This suggests the miner will continue to aggressively burn cash and generate no sales for another three years at least.

Moreover, USAR may have to prioritize political agenda over profit or shareholder value now that it has to answer to the Department of Commerce.

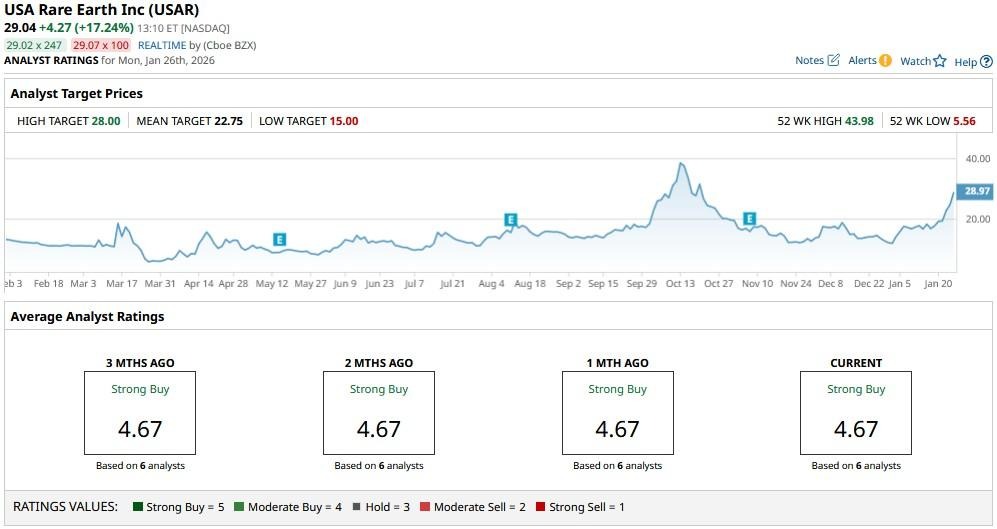

Note that USA Rare Earth shares’ 14-day relative strength index (RSI) is about to hit 80, indicating overbought conditions that often precede a sharp selloff.

How Wall Street Recommends Playing USA Rare Earth Stock

Wall Street analysts also seem to agree that USAR shares — following today’s rally — appear priced for perfection.

According to Barchart, the mean price target on USA Rare Earth stock currently sits at about $23, signaling potential downside of more than 20% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- JPMorgan Says You Should Sell This 1 Flying Car Stock Short Now

- CoreWeave Stock Is Challenging Its 200-Day Moving Average on Nvidia Investment. Should You Load Up on CRWV Here?

- As Trump Targets JPMorgan in New Debanking Lawsuit, Should You Sell JPM Stock?

- Bank of America Still Thinks Palantir Is One of the Best Stocks to Buy for 2026