Mountain View, California-based Alphabet Inc. (GOOGL) is a multinational technology conglomerate holding company offering various products and platforms. With a market cap of $4 trillion, GOOGL provides web-based search, advertisements, maps, software applications, mobile operating systems, consumer content, enterprise solutions, commerce, and hardware products.

Shares of this internet media giant have outperformed the broader market over the past year. GOOGL has gained 66.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.9%. In 2026, GOOGL’s stock rose 6.5%, surpassing the SPX’s 1.5% rise on a YTD basis.

Zooming in further, GOOGL’s outperformance is also apparent compared to the Invesco NASDAQ Internet ETF (PNQI). The exchange-traded fund has gained about 7.9% over the past year. Moreover, GOOGL’s returns on a YTD basis outshine the ETF’s 2.7% losses over the same time frame.

GOOGL's outperformance is driven by strategic moves like acquiring Intersect Power for $4.8 billion to boost clean energy and data center capacity, and rolling out AI features across its ecosystem.

On Oct. 29, 2025, GOOGL shares closed up by 2.7% after reporting its Q3 results. Its revenues stood at $102.3 billion, up 15.9% year over year. The company’s EPS increased 35.4% from the year-ago quarter to $2.87.

For the current fiscal year, ended in December 2025, analysts expect GOOGL’s EPS to grow 31.5% to $10.57 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

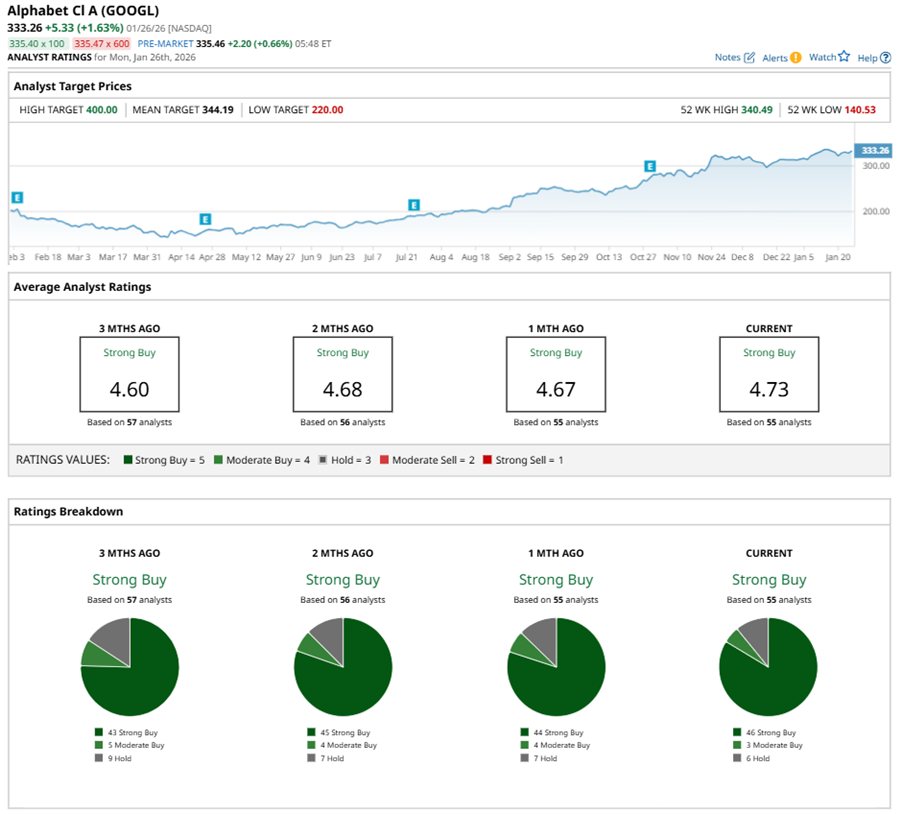

Among the 55 analysts covering GOOGL stock, the consensus is a “Strong Buy.” That’s based on 46 “Strong Buy” ratings, three “Moderate Buys,” and six “Holds.”

This configuration is more bullish than a month ago, with 44 analysts suggesting a “Strong Buy,” and four advising a “Moderate Buy.”

On Jan. 26, RBC Capital analyst Brad Erickson maintained a “Buy” rating on GOOGL and set a price target of $375, implying a potential upside of 12.5% from current levels.

The mean price target of $344.19 represents a 3.3% premium to GOOGL’s current price levels. The Street-high price target of $400 suggests an upside potential of 20%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Drops Tariff Threats on Greenland, Should You Buy This 1 Hot Rare Earths Stock?

- As Tesla’s Austin Robotaxi Launch Draws Scrutiny, Consider Buying These 2 Robotaxi Stocks Instead

- Why 1 Analyst Just Slashed Their Price Target on Oracle Stock by More than 30%

- Seagate Stock Just Hit a New All-Time High Ahead of Earnings. Should You Chase the AI Frenzy Higher?