Valued at a market cap of $106.8 billion, Comcast Corporation (CMCSA) is a media and technology company. The Philadelphia, Pennsylvania-based company provides broadband, wireless, cable television, and advertising services.

This media company has significantly lagged behind the broader market over the past 52 weeks. Shares of CMCSA have declined 21.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.9%. Moreover, on a YTD basis, the stock is down 1.5%, compared to SPX’s 1.5% uptick.

Narrowing the focus, CMCSA has also notably underperformed the iShares U.S. Telecommunications ETF’s (IYZ) 21.2% uptick over the past 52 weeks and 1.3% YTD rise.

Comcast shares plunged 3.1% on Nov. 3, after a series of analysts trimmed their price targets on the stock, reflecting rising concerns about the company’s broadband outlook. Barclays PLC (BCS) reduced its target price to $30 from $34, while Deutsche Bank Aktiengesellschaft (DB) lowered its estimate to $40 from $44. The downgrades followed Comcast’s caution that it is likely to see further broadband subscriber losses as competition intensifies from fiber-based networks and fixed wireless providers.

For the current fiscal year, ending in December, analysts expect CMCSA’s EPS to decline 2.8% year over year to $4.21. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

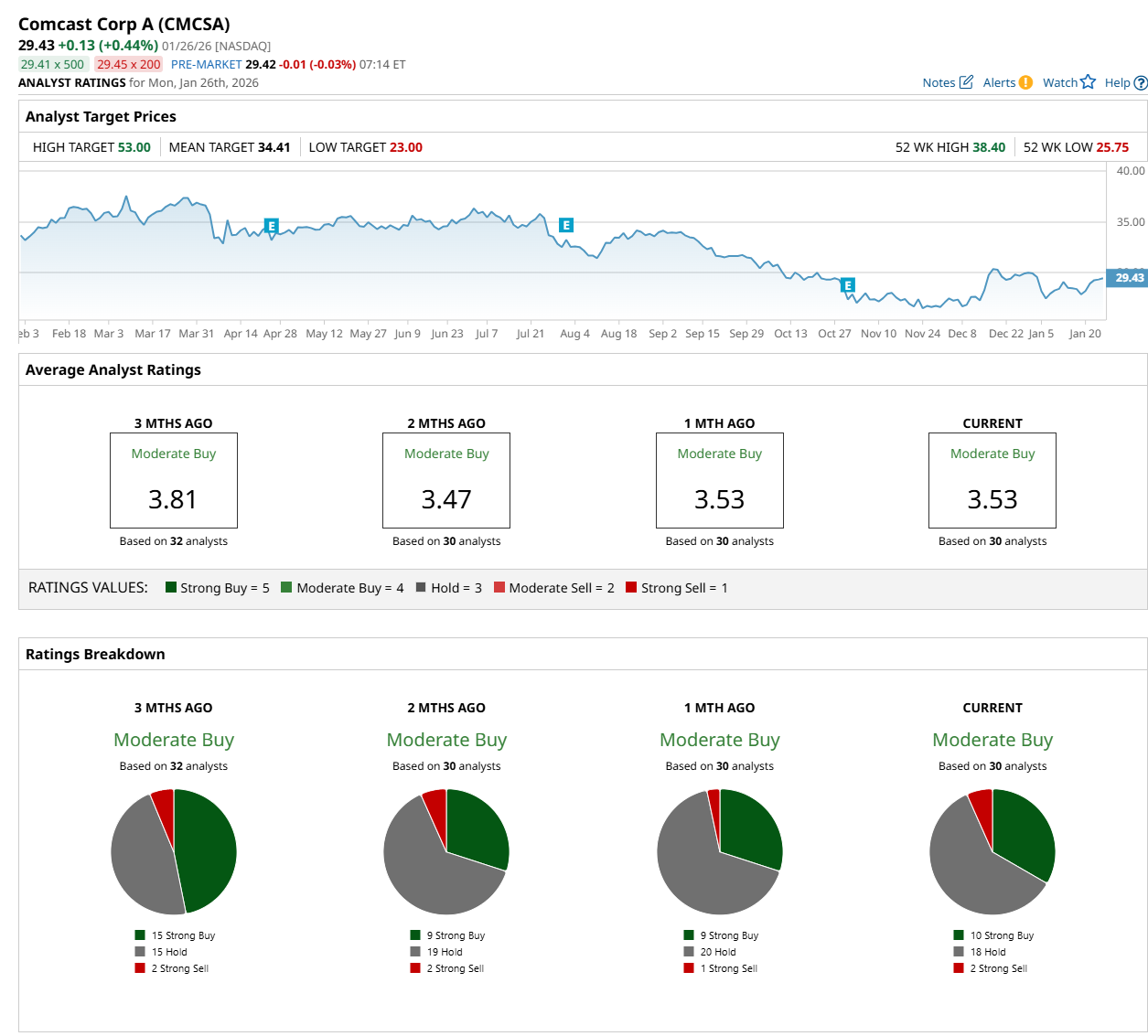

Among the 30 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 10 “Strong Buy,” 18 "Hold,” and two "Strong Sell” ratings.

The configuration has changed since last month, when nine analysts suggested a “Strong Buy” rating, and one recommended a “Strong Sell.”

On Jan. 21, Bank of America Corporation (BAC) analyst Jessica Reif Ehrlich maintained a "Buy" rating on CMCSA and set a price target of $37, indicating a 25.7% potential upside from the current levels.

The mean price target of $34.41 represents a 16.9% premium from CMCSA’s current price levels, while the Street-high price target of $53 suggests an ambitious 80.1% potential upside from the current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart