Amazon (AMZN) has been quietly reshaping its cost base since last year, moving from broad hiring freezes to targeted cuts as it adapts to faster changes in computing and retail.

Now the company is set for another round of corporate layoffs the week of Jan. 26 as part of a plan to cut about 30,000 roles, according to people familiar with the matter. That follows roughly 14,000 job cuts in October 2025 and could begin as soon as Tuesday.

This latest wave will affect teams across AWS, retail, Prime Video, HR, and more, and would exceed Amazon’s prior record of 27,000 cuts in 2022 and 2023. CEO Andy Jassy has framed these cuts as a move to reduce bureaucracy (not simply costs). In the short term, however, analysts warn that the layoffs could weigh on morale and sentiment.

Amazon Doubles Down on AI

Aside from layoffs, Amazon has announced a flurry of capital projects and investments in late 2025. Notably, the company unveiled several multi-billion-dollar projects in November–December: a $3 billion data center campus in Mississippi, $15 billion in new data centers in Indiana, $35 billion in AI-focused investments in India, and up to $50 billion toward U.S. government cloud/supercomputing contracts. These deals, the biggest announcements since AWS’s founding, underscore Amazon’s aggressive push into AI and cloud infrastructure. Investors generally view them as strategic long-term growth plays, not immediate earnings drivers. Such moves support the bull case (bigger AWS, new revenue streams) but also signal much higher capex, which can pressure free cash flow in the near term.

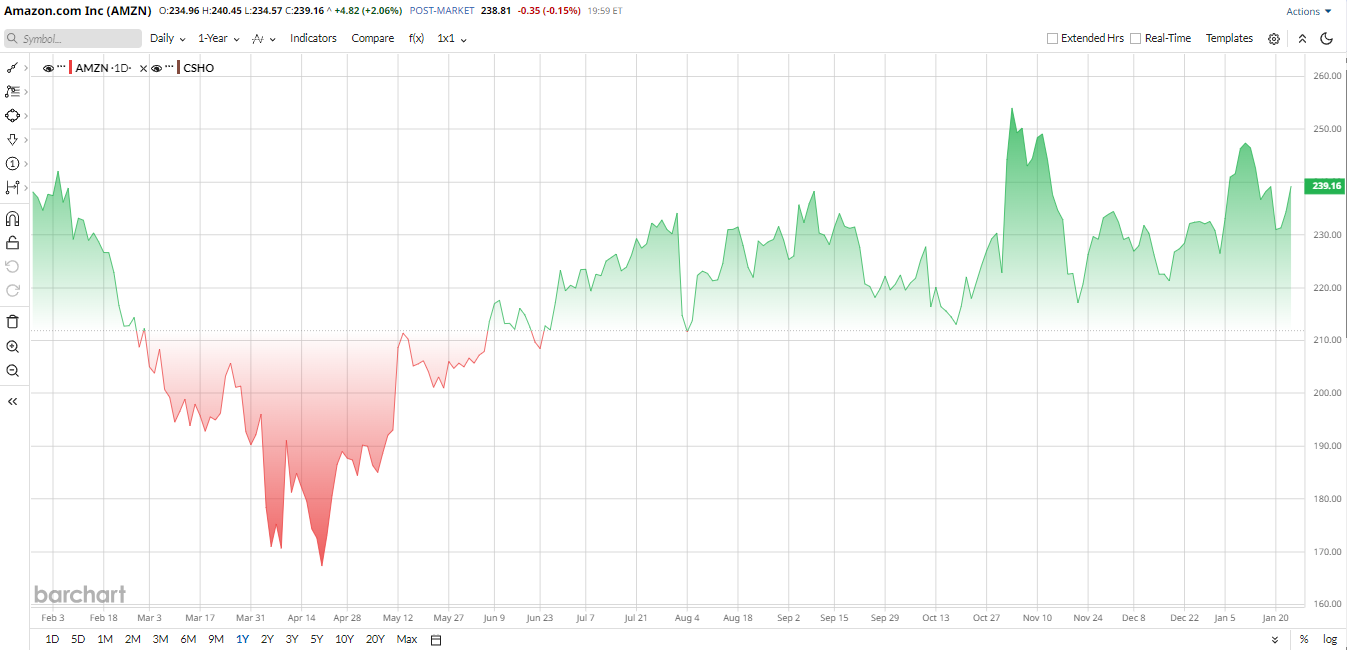

Amazon’s stock has been almost flat over the past year. Substantially underperforming the S&P 500 Index ($SPX), which more than gained 16% in the same time frame. Growth in AWS and digital advertising has driven revenue, but slower retail sales and heavy investments have kept stock gains in check.

Despite the underperformance, Amazon still trades at rich multiples. For example, its trailing price/earnings ratio is about 33×, far above the 20× median for the broader retail/e-tail sector. At the same time, that P/E is roughly on par with high-growth peers. The stock isn’t “cheap” on traditional measures, but investors accept the premium given Amazon’s scale and growth profile.

Amazon About to Report Q4 Earnings

Amazon is scheduled to report its Q4 2025 results, covering the key holiday quarter, on Feb. 5. Management has guided for net sales of $206 billion to $213 billion, broadly in line with the roughly $208 billion Wall Street consensus. For context, Amazon posted 13% year-over-year (YoY) revenue growth in the third quarter ended September, reaching $180.2 billion, with results supported by a roughly 20% jump in Amazon Web Services sales.

Analysts are looking for a similar pace of moderate growth in Q4. Strong holiday shopping activity and advertising demand are expected to support results, alongside continued momentum at AWS, which was the company’s fastest-growing segment in Q3.

AWS will be a central focus. While cloud revenue climbed about 20% in the prior quarter, heavy spending on AI-related infrastructure and hiring weighed on margins. Investors will be watching for signs of re-acceleration tied to large AI contracts, as well as guidance on server and storage capital spending in 2026.

Holiday-quarter retail trends will also be closely examined. Sales and ad revenue in December should offer insight into consumer demand and whether e-commerce activity is strengthening or softening.

Cost discipline is another key theme. Following recent layoff plans, management commentary on logistics efficiency, cloud operating costs, and hiring levels will be scrutinized. Overall, analysts view AWS and cloud adoption as long-term growth drivers, while noting near-term risks from consumer softness and elevated AI spending.

Analyst Commentary

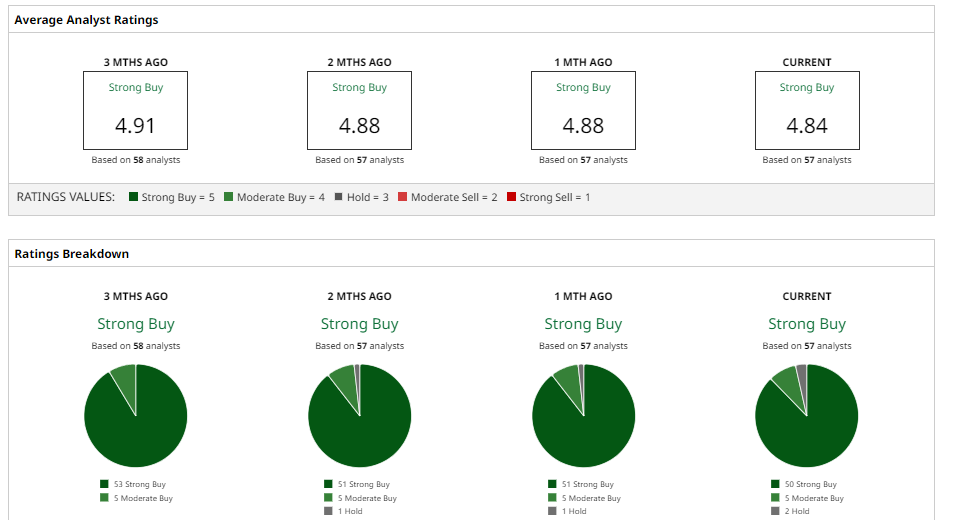

Wall Street remains largely bullish on Amazon. Several major firms have raised their targets in recent weeks; for example, Goldman Sachs now rates AMZN “Buy” with a $300 target. Analysts praise Amazon’s long-term potential, especially AWS and advertising, but note that recent cost cuts and spending temper the near-term outlook

TD Cowen and Morgan Stanley likewise have $315 targets, seeing 40% plus upside on continued AWS expansion. Barclays and other firms also have targets of $300 to $360.

Overall, the vast majority of analysts rate AMZN as a “Strong Buy,” and the 12-month average price target is set at $297, which implies an expected 23% upside.

The Bottom Line on AMZN Stock

Analysts have identified new cuts by Amazon as a short-term negative sentiment. Meanwhile, the actions of Amazon are reflective of a larger technological trend. Other competitors, such as Microsoft (MSFT), among others, have also downsized staff size yet have made huge investments in AI and cloud. To investors, the trend highlights a shift in growth-at-any-cost recruiting to efficiency and automation.

Whether these layoffs are preemptive cost measures or an indication of a slowing demand is the question in the case of Amazon. Provided Amazon can continue its expansion in AWS and advertising, and the labor cost cuts are immediately converted into better margins, the stock would be rewarded. Nonetheless, the share market might remain under tension in the coming days as long as the markets believe that the cuts are a sign of more underlying weakness.

Amazon's stock performance has not been strong compared to others, and the additional layoff announcement adds to the sense of caution. Nevertheless, the company continues to be a leader in the rapid cloud and AI businesses. Any indication of declining consumer demand will offset the savings in costs and strategic investments by investors. The next significant catalyst for AMZN stock will unquestionably be the next earnings report and any guidance on costs or investments.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Raytheon's Strong Free Cash Flow and FCF Margin Could Push RTX Stock Higher

- SoFi Is Poised to Report Strong Q4 Results. Is a Share-Price Rebound in SOFI Stock's Future?

- Dear Amazon Stock Fans, More Layoffs Are Coming This Week

- Bullish Price Surprise: Is Lands’ End’s Licensing JV the Beginning of the End or a New Beginning?