Ford Motor Company (F) is a global automotive manufacturer headquartered in Dearborn, Michigan, and one of the oldest and most established carmakers in the world. Founded in 1903 by Henry Ford, the company designs, manufactures, and sells a wide range of vehicles, including trucks, SUVs, cars, and commercial vehicles, under the Ford and Lincoln brands. Valued at $52.3 billion by market cap, the company also provides vehicle-related financing, leasing, and insurance.

Shares of this auto giant have outperformed the broader market over the past year. F has gained 32.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.9%. Over the past six months, F has soared 17.2%, surpassing the SPX’s 8.8% rise.

Narrowing the focus, F’s outperformance is apparent compared to the First Trust Nasdaq Transportation ETF (FTXR). The exchange-traded fund has gained about 10.6% over the past year. However, F’s double-digit gains over the past six months trail the ETF’s 18.9% returns over the same time frame.

On Dec. 16, Ford shares rose over 1% after the company announced it was cancelling its planned electric F-series truck and redirecting production toward gasoline and hybrid vehicles.

For FY2025 that ended in December, analysts expect F’s EPS to decline 38% to $1.14 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last three quarters.

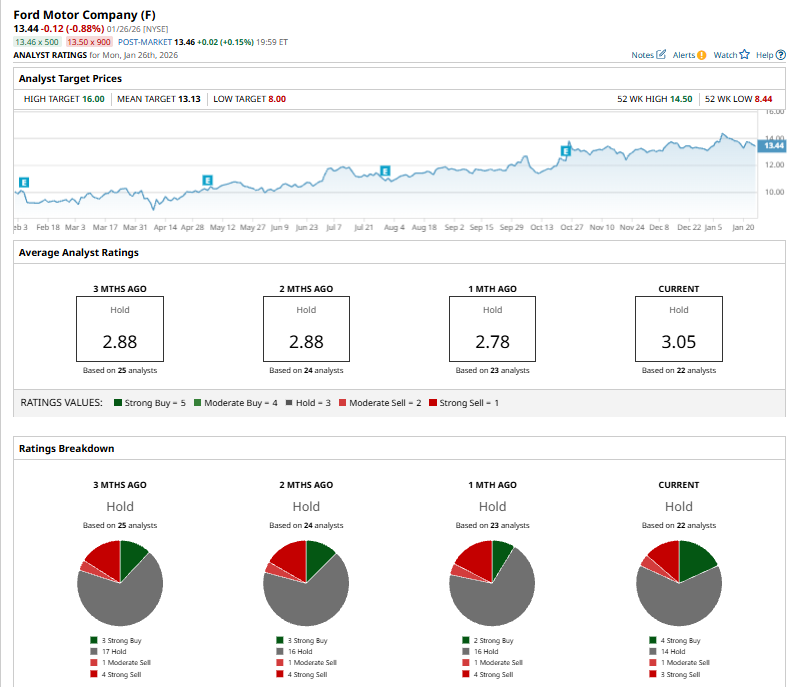

Among the 22 analysts covering F stock, the consensus is a “Hold.” That’s based on four “Strong Buy” ratings, 14 “Holds,” one “Moderate Sell,” and three “Strong Sells.”

This configuration is bullish than a month ago, with two analysts suggesting a “Strong Buy.”

On Jan. 8, Piper Sandler upgraded Ford from “Neutral” to “Overweight” and raised its price target from $11 to $16, signaling strong confidence in the company’s growth outlook. The upgrade was supported by Ford’s plans for an advanced “eyes-off” self-driving system in a future electric vehicle and a 6% increase in annual sales. The positive sentiment boosted investor confidence, pushing the stock to a new 52-week high.

While F currently trades above its mean price target of $13.13, the Street-high price target of $16 suggests a 19% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Options Flow Alert: Institutional Money Loading Up on Google Stock

- Stock Index Futures Gain on Tech Boost, FOMC Meeting and Earnings in Focus

- Microsoft Reports Q2 Earnings Jan. 28. Is MSFT Stock a Buy Before Then?

- As IonQ Snaps Up SkyWater Technology for $1.8B, Should You Buy the Quantum Computing Stock Here?