Shares of SoFi Technologies (SOFI) are under pressure ahead of the company's fourth-quarter earnings announcement on Jan. 30. The stock has fallen more than 21% from its recent peak, reflecting near-term caution. However, SoFi continues to post strong operational results, with solid growth in both revenue and earnings, and that momentum will likely reflect in its Q4 financials.

Further, SoFi’s shift toward a low-risk, fee-driven model bodes well for growth. By expanding its financial services offerings and technology platform, SoFi is reducing its dependence on interest-rate-sensitive lending income and credit risk. This is helping strengthen SoFi’s balance sheet and improve its earnings base.

SoFi’s diversified revenue stream and strong member and product growth position the company well to generate more stable cash flows over time, supporting the long-term outlook for SoFi stock.

SoFi Likely to Deliver Strong Growth in Q4

SoFi is well-positioned to deliver strong revenue growth in Q4, supported by a growing member base, expanding fee-driven revenue, and continued momentum across its lending operations. Together, these businesses will enable it to sustain strong double-digit revenue growth and drive profitability.

The company benefits from its ability to consistently attract new members while driving existing users to adopt more products. This growing engagement strengthens revenue durability and lowers reliance on any single business line. At the same time, SoFi’s capital-light, non-lending businesses are scaling rapidly and becoming a larger part of the overall revenue mix.

In the third quarter, SoFi’s financial services and technology platform segments generated $534 million in revenue, representing a 57% increase year-over-year. These segments now account for more than half of the firm's total revenue, highlighting its shift toward fee-based and platform-driven income streams. Demand for products such as SoFi Money, Invest, and Relay continues to rise, and this momentum should translate into further product growth in the coming quarters.

Fee-based revenue has been strong. In Q3, SoFi reported $409 million in fee income, up 50% from the prior year. This growth has been driven by several sources, including its loan platform business (LPB), origination and referral fees, brokerage fees, and interchange revenue. Importantly, these revenue streams tend to be less capital-intensive, improving the company’s long-term earnings stability.

SoFi’s LPB is a key growth driver. The business originates customized loans for third-party partners and moves them off its balance sheet, thereby limiting credit risk while generating recurring, high-margin revenue. Demand from partners continues to increase, suggesting a long runway for expansion in this area.

Its lending could continue to contribute meaningfully. Ongoing demand for personal, student, and home loans should support segment growth, particularly as funding costs continue to improve. SoFi ended the third quarter with $32.9 billion in deposits. Its growing deposit base lowers funding expenses and enhances overall earnings power.

SoFi’s diversified revenue model, increasing reliance on fee-based income, and strengthening platform capabilities position the company for sustained growth beyond Q4. The consensus estimate suggests that SoFi’s earnings could more than double in the fourth quarter, with analysts projecting earnings per share (EPS) of $0.12, a 140% year-over-year increase.

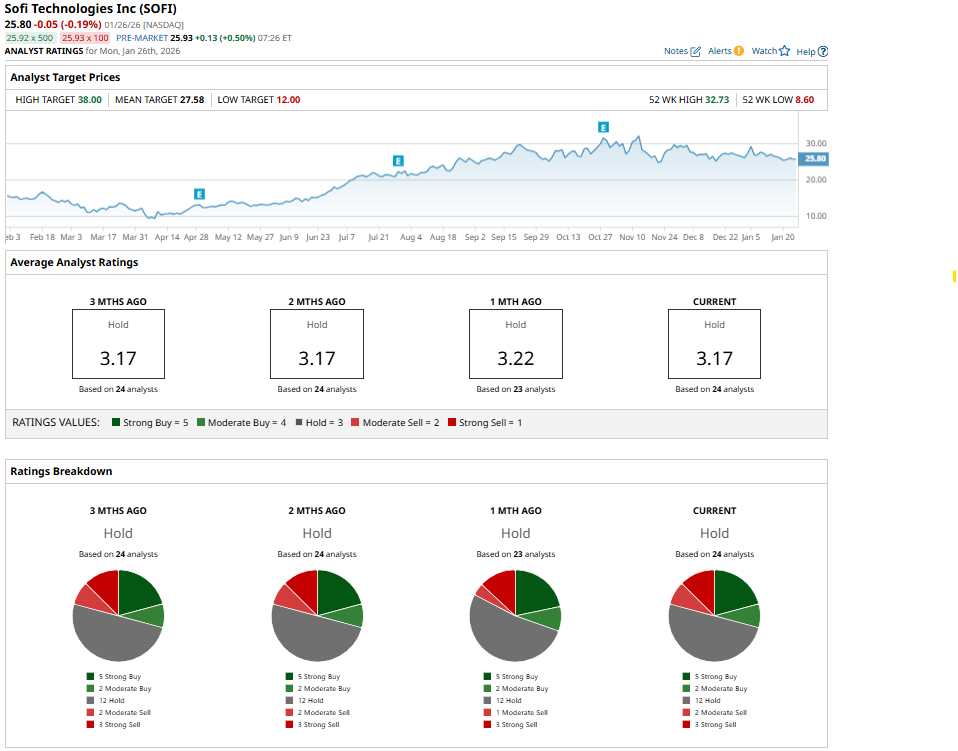

Analysts maintain a “Hold” consensus rating on SoFi stock ahead of Q4.

What’s Ahead for SoFi Stock?

While SoFi’s share price has retreated ahead of its Q4 earnings report, the company continues to execute well, delivering robust revenue growth, expanding profitability, and steadily shifting toward a more resilient, fee-driven business model.

With fee-based revenue now representing a majority of total sales, improving funding economics from a growing deposit base, and consensus expectations calling for a sharp year-over-year jump in earnings, SoFi is set to deliver strong growth in Q4.

While analysts’ “Hold” consensus rating reflects near-term caution, strong member growth, rising engagement across products, and the rapid scaling of its financial services business provide a solid base for earnings growth, which could help its share price rebound.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Raytheon's Strong Free Cash Flow and FCF Margin Could Push RTX Stock Higher

- SoFi Is Poised to Report Strong Q4 Results. Is a Share-Price Rebound in SOFI Stock's Future?

- Dear Amazon Stock Fans, More Layoffs Are Coming This Week

- Bullish Price Surprise: Is Lands’ End’s Licensing JV the Beginning of the End or a New Beginning?