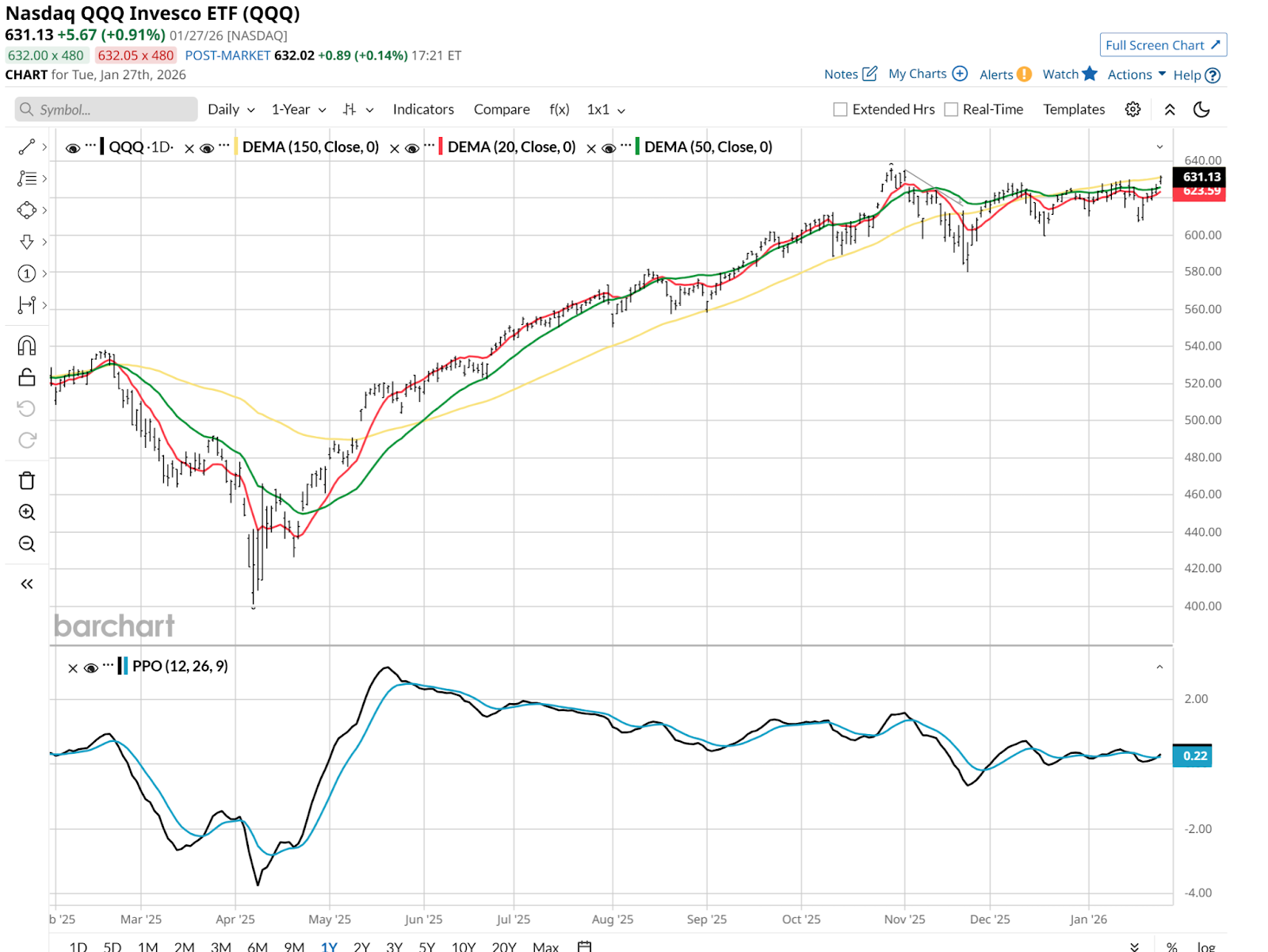

After a massive 2025 that saw the Invesco QQQ Trust ETF (QQQ) reach dizzying heights, the index spent the first few weeks of 2026 catching its breath. But look at the tape lately.

Despite hawkish whispers from the Fed and a rotation into value stocks, the QQQ has notched four straight winning days as of Jan. 26. It closed Tuesday around $631, less than 1% off its Oct. 29, 2025, high.

If it breaks through, we aren’t just looking at a bounce — we could be looking at the potential for a fresh run of another 5% to 10% higher. But as a risk manager, I don't hope for a breakout. I prepare for multiple scenarios. Here are some elements of the bull case and bear case on QQQ today.

The Bull and Bear Case for QQQ

The Case for New Highs

- The AI "Second Wave": We’ve moved past pure speculation. Companies are now reporting actual earnings growth from artificial intelligence (AI) infrastructure, and capital spending from the hyperscalers is projected to top $500 billion this year.

- Earnings Resilience: Despite higher interest rates, the top 10 holdings in the QQQ have fortress balance sheets. Q4 earnings growth for the Magnificent 7 is currently tracking near 15%, significantly outpacing the rest of the market.

- Technical Rebound: After a mid-January wobble caused by tariff fears, the index has recaptured a lot of lost ground.

The Case for a Pullback

- Valuation "Nosebleeds": At a price-to-earnings (P/E) ratio of roughly 36x, the Nasdaq-100 is priced for perfection. Any slight miss in guidance during this earnings season could trigger a violent 5% to 10% reset.

- Concentration Overload: The index is notoriously top-heavy. If just one pillar — like Nvidia (NVDA) or Apple (AAPL) — stumbles due to regulatory heat or supply chain issues, the entire index can sink even if the other 90+ stocks are doing fine.

- The Inflation "Ghost": With personal consumption expenditures (PCE) inflation data looming this Thursday, any sign that prices are staying "sticky" could force the Fed to keep rates higher for longer, which traditionally acts as gravity for high-growth tech stocks.

QQQ: Collar Guy Says What?

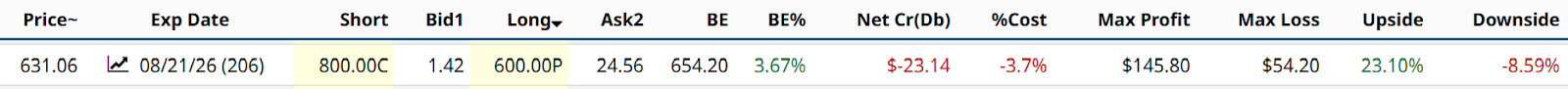

Collaring is getting tougher, given how much traffic there is chasing options, particularly covered call writing strategies. But I did find one out to August with some round numbers to boot.

That’s an $800-$600 range and just a bit of call premium to offset the put price. But the net-net is 23% upside and just 8.6% downside. Go out much further, and you get more call premium and lower your total cost to put this trade on. Or, cut the upside level and spend less. But a cost of 3.7% over nearly seven months is solid to me. Buying puts and skipping the call side for now is also a strategy.

QQQ has been lying there for a few months. But with tech earnings, a Fed meeting, and plenty of other stimuli, I would expect the months-long tug of war to resolve itself soon — in one direction or the other.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- QQQ Is Reaching for a New High. 3 Reasons Each for Bulls and Bears To Play It.

- BlackRock’s New Covered Call Bitcoin ETF Is Another Red Flag for a Dangerous Investing Trend

- With SPY Breaking Records, Is It Time to Bet on RSP?

- As Government Shutdown Panic Swirls, Consider These 2 Top-Performing Gold ETFs to Buy Now