With a market cap of $72.1 billion, Cummins Inc. (CMI) is a global power solutions company that designs, manufactures, and services engines, power systems, components, and electrified technologies across five segments: Engine, Distribution, Components, Power Systems, and Accelera. The company serves OEMs and aftermarket customers worldwide with solutions ranging from diesel and natural gas engines to batteries, fuel cells, and hydrogen technologies.

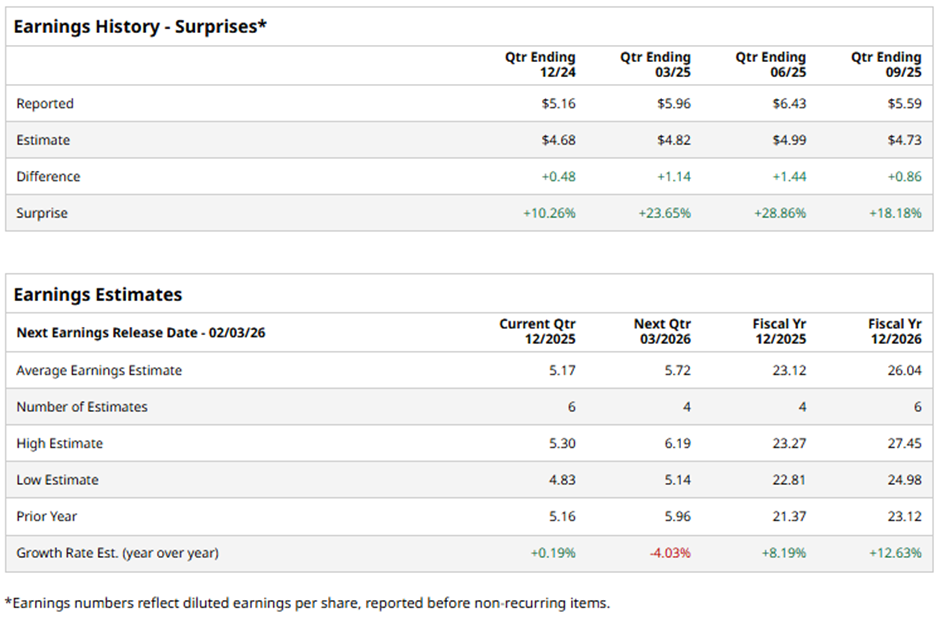

The Columbus, Indiana-based company is set to deliver its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast CMI to report an adjusted EPS of $5.17, up marginally from $5.16 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts predict the engine maker to report an adjusted EPS of $23.12, a rise of 8.2% from $21.37 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow 12.6% year-over-year to $26.04 in fiscal 2026.

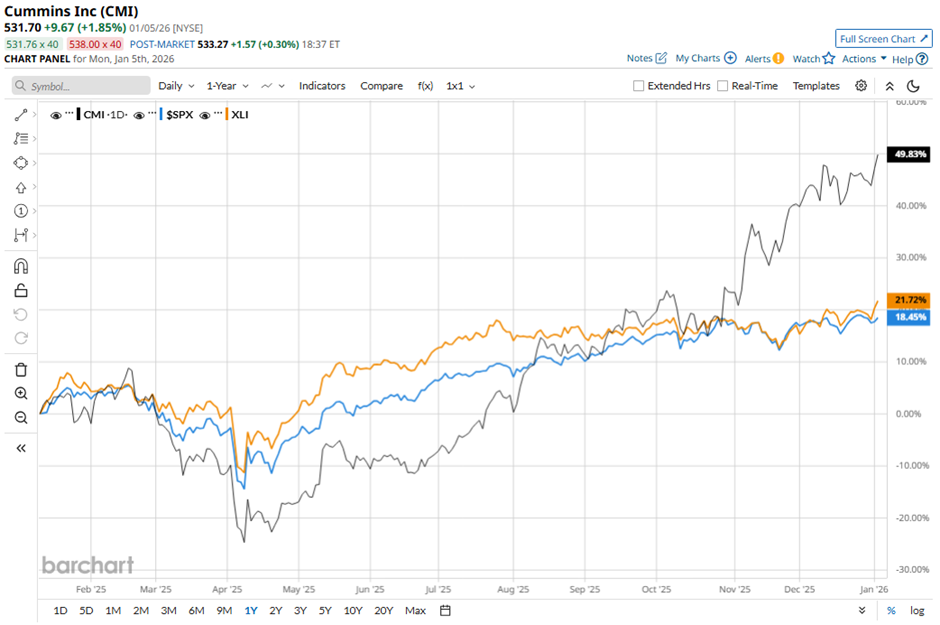

Shares of Cummins have surged 50.1% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 16.2% gain and the State Street Industrial Select Sector SPDR ETF’s (XLI) 20.4% increase over the same period.

Shares of Cummins climbed 5.4% on Nov. 6 after the company reported Q3 2025 adjusted EPS of $5.59 and revenue of $8.32 billion, both topping forecasts. Investors also reacted positively to strong operating performance in the Power Systems and Distribution segments, with Power Systems sales rising 18% to $2 billion and Distribution sales up 7% to $3.2 billion, driven largely by robust demand for backup power for data centers.

Analysts' consensus view on CMI stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 20 analysts covering the stock, 11 recommend "Strong Buy," one suggests "Moderate Buy," and eight advise "Hold." The average analyst price target for Cummins is $538.11, suggesting a potential upside of 1.2% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart