With a market cap of $14.3 billion, Ball Corporation (BALL) is a global supplier of aluminum packaging products serving the beverage, personal care, and household products industries across the United States, Brazil, and other international markets. The company specializes in manufacturing aluminum beverage containers, aerosol containers, bottles, cups, and aluminum slugs for a wide range of consumer products.

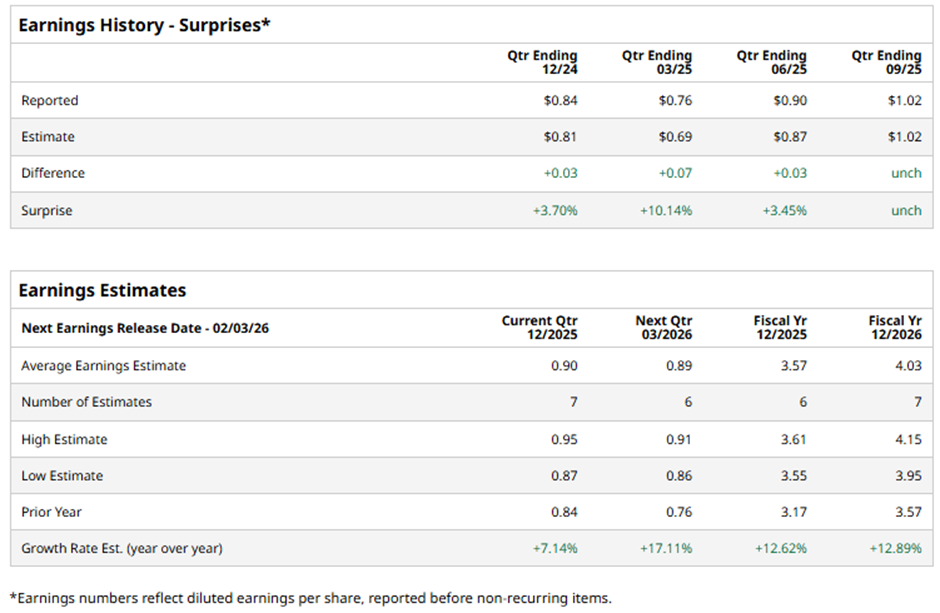

The Westminster, Colorado-based company is set to release its fiscal Q4 2025 results soon. Ahead of this event, analysts project BALL to post an adjusted EPS of $0.90, a 7.1% rise from $0.84 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in the past four quarterly reports.

For fiscal 2025, analysts forecast the aluminum packaging maker to report adjusted EPS of $3.57, up 12.6% from $3.17 in fiscal 2024. In addition, adjusted EPS is expected to increase 12.9% year-over-year to $4.03 in fiscal 2026.

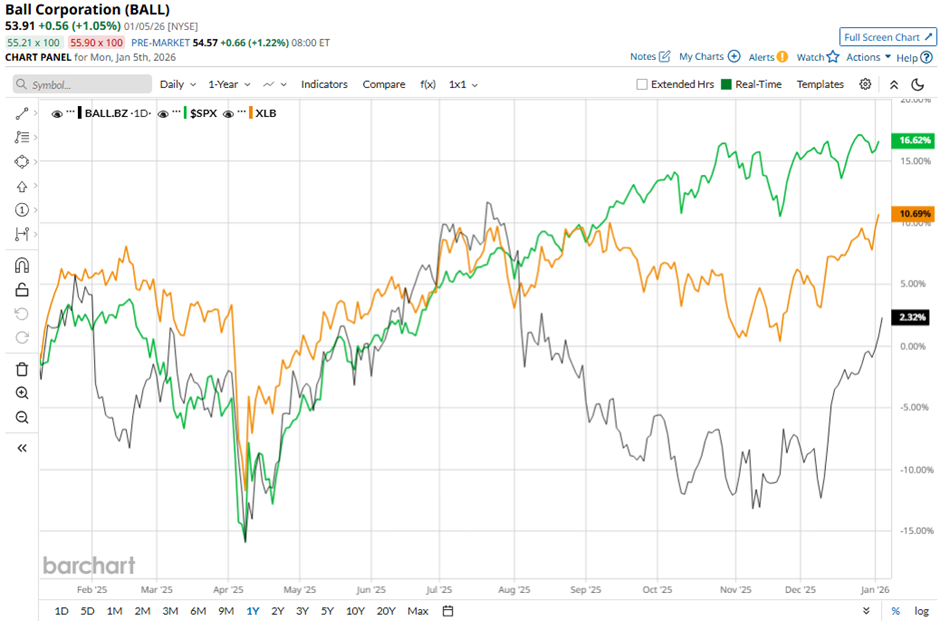

Shares of Ball Corporation have declined marginally over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 16.2% gain and the State Street Materials Select Sector SPDR ETF's (XLB) nearly 12% return over the same time frame.

Shares of Ball Corporation rose 1.5% on Nov. 4 as the company reported Q3 2025 revenue of $3.38 billion, above estimates, and reported strong demand for aluminum packaging, including a 3.9% increase in global shipments. Beverage packaging sales in North and Central America also grew to $1.64 billion from $1.46 billion a year earlier. Investors were further encouraged by Ball reaffirming its outlook for 12% - 15% earnings growth in 2025.

Analysts' consensus view on BALL stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 15 analysts covering the stock, six suggest a "Strong Buy," two give a "Moderate Buy," six recommend a "Hold," and one has a "Strong Sell." The average analyst price target for Ball Corporation is $60.08, suggesting a potential upside of 11.4% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart