With a market cap of $7.5 billion, Match Group, Inc. (MTCH) operates a global portfolio of dating and social connection platforms across four segments: Tinder, Hinge, Evergreen and Emerging, and Match Group Asia. The company owns well-known brands such as Tinder, Hinge, Match, OkCupid, and Plenty of Fish, offering services in over 40 languages to users worldwide.

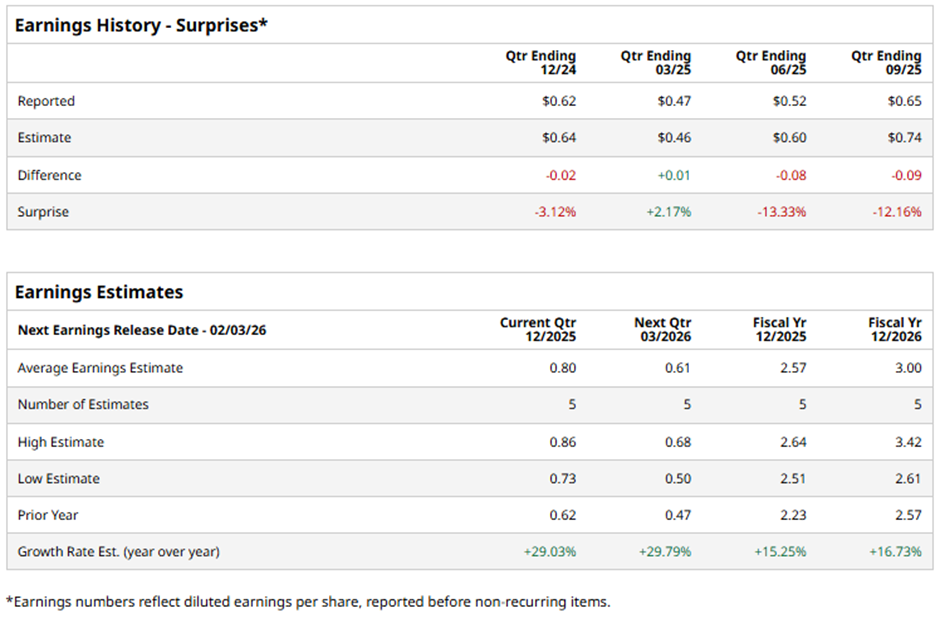

The Dallas, Texas-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts predict MTCH to report an EPS of $0.80, up 29% from the previous year's $0.62. It has surpassed Wall Street's bottom-line estimates in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast the media and internet company to post an EPS of $2.57, a rise of 15.3% from $2.23 in fiscal 2024. Moreover, the company’s EPS is projected to increase 16.7% year-over-year to $3 in fiscal 2026.

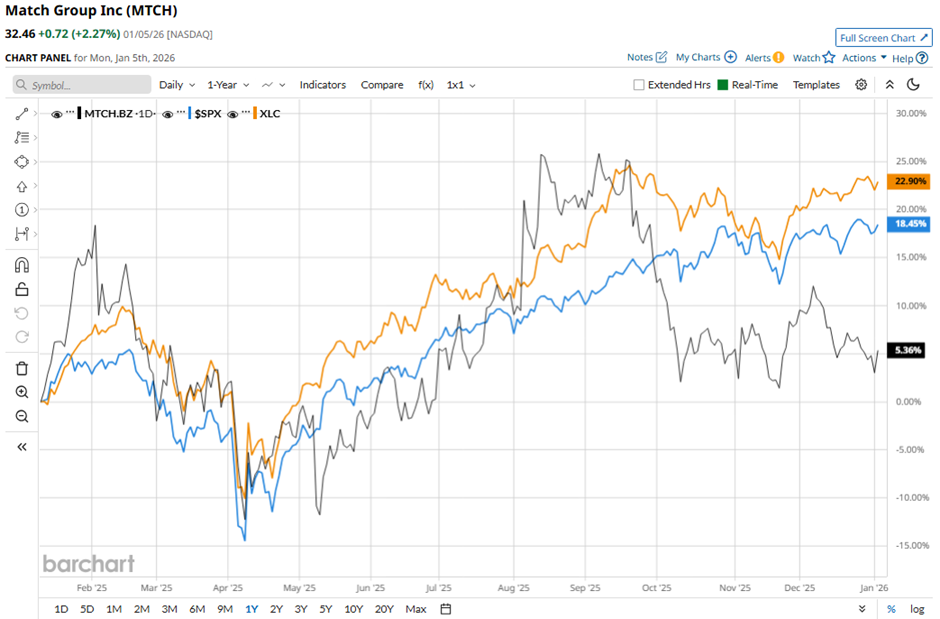

MTCH stock has decreased 2.9% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 15.9% gain and the State Street Communication Services Select Sector SPDR ETF's (XLC) 18.6% return over the same period.

Despite reporting weaker-than-expected Q3 2025 adjusted EPS of $0.82 and revenue of $914.3 million on Nov. 4, Match Group shares rose 5.2% the next day. Investors were encouraged by net income growth of 18% year-over-year to $161 million and successful execution of its $50 million reinvestment plan to accelerate product innovation and international expansion. Positive momentum from Tinder’s Chemistry and Face Check features, Hinge’s AI enhancements, and ongoing cost-savings initiatives further boosted confidence.

Analysts' consensus view on MTCH stock is cautiously optimistic, with a "Moderate Buy" rating. Out of 22 analysts covering the stock, seven give a "Strong Buy," one has a "Moderate Buy," and 14 give a "Hold" rating. The average analyst price target for Match Group is $38.37, indicating a potential upside of 18.2% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Big Pain Is Ahead for MicroStrategy Stock as Bitcoin Losses Mount. How Should You Play MSTR for January 2026?

- Should You Chase the 140% Rally in TMD Energy Stock?

- Dear SLB Stock Fans, Mark Your Calendars for January 23

- Chevron Stock Just Broke Through Resistance Levels in an Epic Move Higher. Should You Buy CVX Now?