With a market cap of $16.7 billion, Hologic, Inc. (HOLX) is a global medical technology company focused on improving women’s health through the development, manufacture, and supply of diagnostic products, medical imaging systems, and surgical solutions. The company operates across Diagnostics, Breast Health, GYN Surgical, and Skeletal Health segments to support early detection and treatment worldwide.

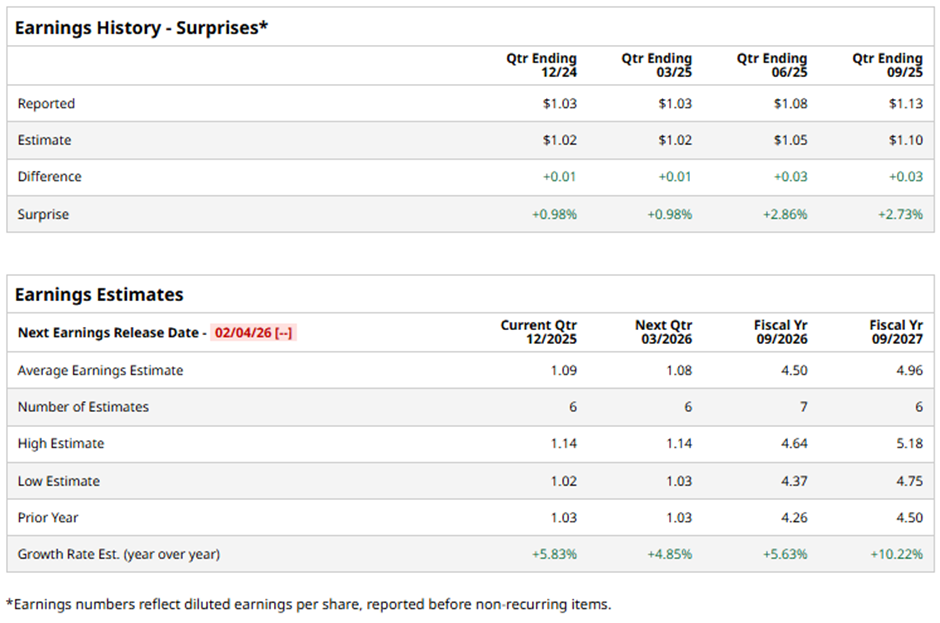

The Marlborough, Massachusetts-based company is set to unveil its fiscal Q1 2026 results soon. Ahead of this event, analysts expect HOLX to report an adjusted EPS of $1.09, up 5.8% from $1.03 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2026, analysts forecast the medical device maker to post adjusted EPS of $4.50, a 5.6% rise from $4.26 in fiscal 2025. Looking forward to fiscal 2027, adjusted EPS is expected to grow 10.2% year-over-year to $4.96.

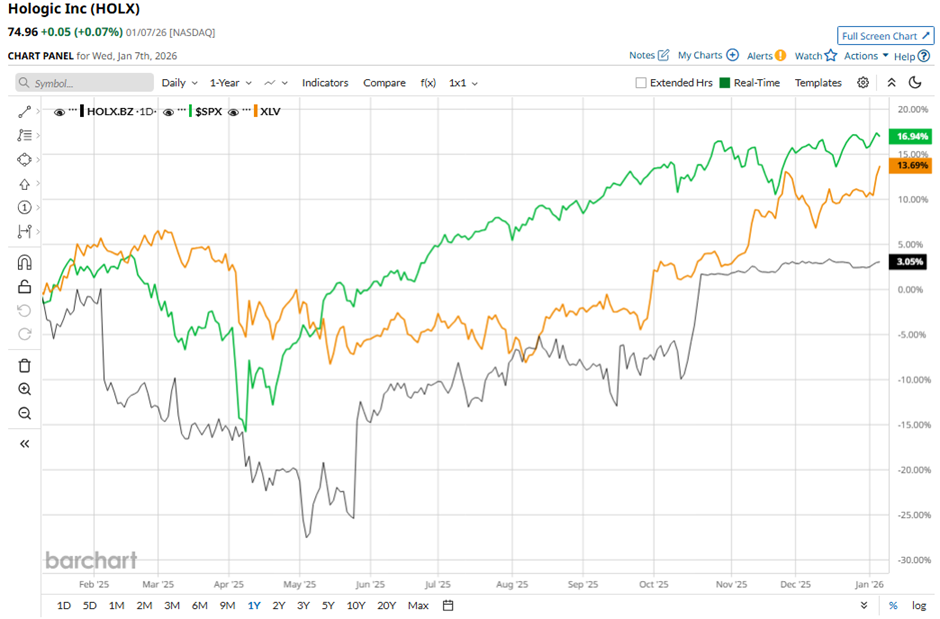

HOLX stock has risen 3.1% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 17.1% gain and the State Street Health Care Select Sector SPDR ETF's (XLV) 14.3% return over the same period.

Shares of Hologic rose marginally following its Q4 2025 results on Nov. 3 as the company reported adjusted EPS of $1.13, up 11.9% year-over-year and above Wall Street’s estimate. Revenue came in at $1.05 billion, beating expectations and rising 6.2% year-over-year, driven by strong growth in Surgical, Breast Health, and organic diagnostics (excluding COVID-19).

Analysts' consensus rating on HOLX stock is cautious, with a "Hold" rating overall. Out of 18 analysts covering the stock, opinions include one "Strong Buy” and 17 "Holds.” This configuration is less bullish than three months ago, with eight analysts suggesting a "Strong Buy." The average analyst price target for Hologic is $76.85, suggesting a potential upside of 2.5% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart