Valued at $35.9 billion by market cap, Take-Two Interactive Software, Inc. (TTWO) is a leading global video-game holding company that develops, publishes, and markets interactive entertainment across console, PC, and mobile platforms. Founded in 1993 and headquartered in New York City, the firm operates primarily through its major publishing labels Rockstar Games, 2K, and Zynga, each managing internal studios and flagship franchises.

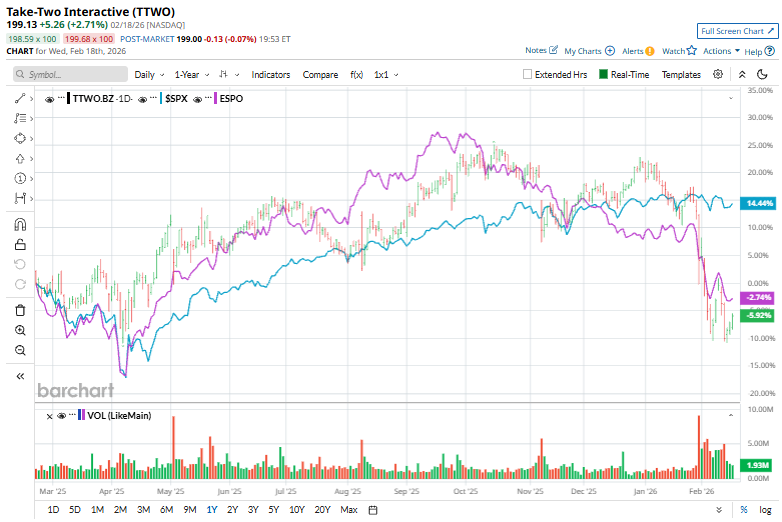

The video games giant has significantly underperformed the broader market over the past year. TTWO stock prices have tanked 8% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 12.3% gains. On a YTD basis, the TTWO is down 22.2%, trailing $SPX’s marginal rise.

Narrowing the focus, Take-Two has lagged behind the industry-focused VanEck Video Gaming and eSports ETF’s (ESPO) 3% fall over the past year and 9.9% dip in 2026.

On Feb. 4, Take-Two Interactive shares fell about 5% after the company reported its 2026 Q3 earnings. Its loss of $0.50 per share missed the $0.39 loss expected. The earnings shortfall and weaker-than-expected full-year EBITDA guidance outweighed otherwise strong results, including $ 1.7 billion in revenue, up 24.9% year over year, and upbeat Q4 sales guidance.

For the full fiscal 2026, ending in March, analysts expect TTWO to deliver an adjusted EPS of $1.87, up 233.9% year-over-year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line projections in each of the past four quarters.

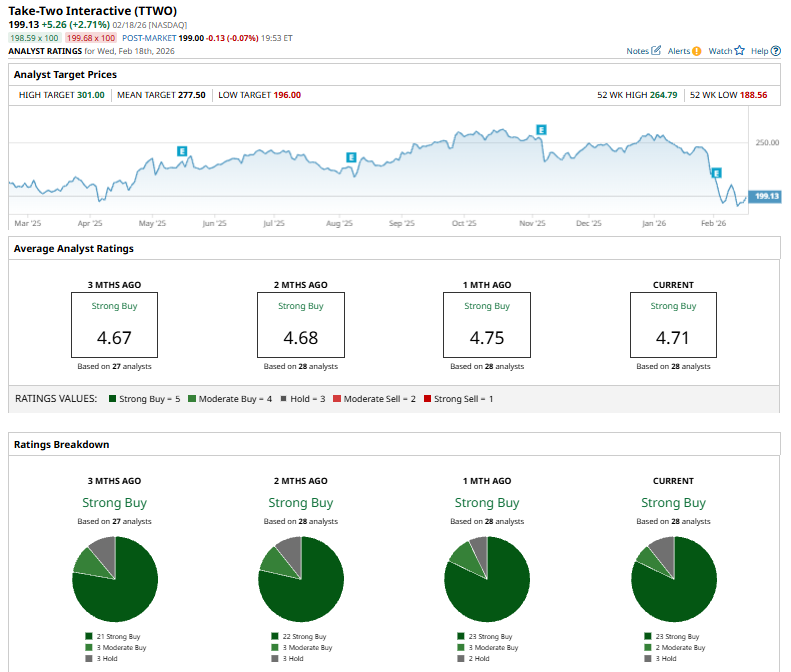

Among the 28 analysts covering the TTWO stock, the consensus rating is a “Strong Buy.” That’s based on 23 “Strong Buys,” two “Moderate Buys,” and three “Holds.”

This configuration is bullish than two months ago when the stock had 22 “Strong Buy” suggestions.

On Feb. 4, DA Davidson reiterated a “Buy” rating on Take-Two Interactive with a $300 price target after strong fiscal Q3 2026 results. Net bookings beat consensus by 11%, driven by NBA 2K, mobile titles, and stronger-than-expected GTA Online performance, while trailing-12-month revenue rose 20.3% to $6.56 billion. The company reaffirmed Grand Theft Auto VI for Nov 2026 release with marketing starting in the summer of 2026, likely pressuring near-term margins.

TTWO’s mean price target of $277.50 represents a 39.4% premium to current price levels. Meanwhile, the street-high target of $301 suggests a notable 51.2% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart