Quantitative analysts, traders, academic researchers gain access to expanded data on index options for North American, Asian-Pacific, and European markets

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, announces IvyDB Global Indices 3.1. This database offers even more options data across major indices in North America, including the United States and Canada; Europe, and Asia-Pacific, and an expanded volatility surface, enabling better assessments of shorter- and longer-term investing and hedging strategies.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211214005054/en/

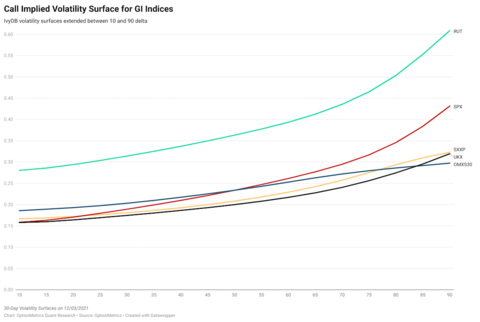

Pictured are the Implied Volatility Surface results for the 5 major indices in the United States and Europe. This chart includes 30 Day Expirations of 10-90 delta calls on December 3rd, 2021, and was developed using data from OptionMetrics’ IvyDB Global Indices 3.1. OptionMetrics’ IvyDB Global Indices 3.1 offers even more data across major indices in North America, Europe, and Asia-Pacific, and an expanded volatility surface, enabling better assessments of shorter and longer term investing and hedging strategies. (Graphic: Business Wire)

OptionMetrics IvyDB Global Indices 3.1 covers 35 major indices, representative of global markets worldwide, including S&P 500 Index, CBOE Russell 2000, VIX CBOE Market Volatility, DJ EURO STOXX50, VSTOXX, S&P 100 and 400, Nikkei 225, Hang Seng, CAC 40, Asia Nikkei, IBEX-35, KOSPI 200, MSCI Emerging Markets Index, and numerous others. It expands on OptionMetrics’ history of providing the highest quality historical data, updated daily.

A major new feature in IvyDB Global Indices 3.1 is the expanded volatility surface, enabling institutional investors to see more points deep in the money and deep out of the money as they assess shorter- and longer-term strategies, such as those surrounding weekly options. The expanded surface includes a 10-day maturity curve and new call and put delta grid points at 10, 15, 85, and 90 (expanding the curve to 10-90 from 20-80) for European, Canadian, and U.S. indices.

This new version of Global Indices now also reflects fractional, in addition to round number contract sizes, and includes a new, comprehensive forward price table for European options. Academic users will have access to even more data across the indices, through September 30, 2021, on which to base research. Institutional clients will continue to have access to daily data updates with IvyDB Global Indices 3.1.

“Index trading volume globally has been on the rise. Whether investors or researchers are looking to assess changes in the global markets, capitalize on liquidity or passive investing, or perform empirical research, IvyDB Global Indices offers the highest quality, most comprehensive historical data on which to base important decisions about leading global indices worldwide,” says OptionMetrics CEO David Hait, Ph.D.

For more information, email info@optionmetrics.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211214005054/en/

Contacts

Media Contact:

Hilary McCarthy

Clearpoint Agency

774.364.1440

Hilary@clearpointagency.com