US data reveals continued parcel volume growth during second year of pandemic as carrier revenues increase 16 percent year-over-year

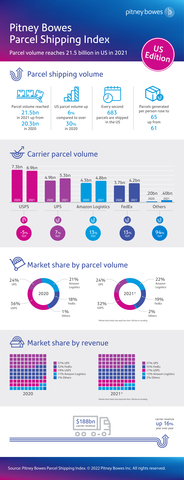

Pitney Bowes Inc. (NYSE: PBI), a global shipping and mailing company that provides technology, logistics and financial services, today released the US data for 2021 from its latest Pitney Bowes Parcel Shipping Index. Announced ahead of its usual fall schedule to meet widespread interest, the Index reveals the continuing impact of the pandemic on the shipping and logistics industries. US parcel volume grew six percent in 2021 reaching a record high of 21.5 billion, up from 20.3 billion in 2020. Carrier revenues exceeded all previous years’ figures totaling $188 billion, an increase of 16 percent from $163 billion in 2020. Pitney Bowes forecasts US parcel volume by 2027 to reach 25 - 40 billion, with a 5% - 10% CAGR from 2022-2027.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220523005364/en/

Pitney Bowes Parcel Shipping Index US data 2021 (Graphic: Business Wire)

The latest Index shows 59 million parcels were generated in the US each day in 2021 – totaling around 683 parcels per second - compared to 56 million shipped daily in 2020. Per capita parcel volume for the US rose from 62 to 65. For the first time the Parcel Shipping Index includes a ‘per household’ figure, revealing an average of 166 parcels shipped per US household during 2021.

“Last year saw the industry rocked by outside influences as carriers continued to manage the impact of the pandemic,” said Jason Dies, EVP and President Sending Technology Solutions, Pitney Bowes. “Despite these challenges, carrier revenues and parcel volumes reached a record high, showcasing the resiliency of the US consumer and the industry’s ability to absorb their growing appetite for internet retail.”

Key takeaways from the latest Index include:

-

Carrier Volume

- Parcel volume reached 21.5 billion in 2021, up from 20.3 billion in 2020, an increase of 6 percent

- By volume, USPS shipped 6.9 billion parcels in 2021 down from 7.3 billion in 2020; UPS shipped 5.3 billion parcels in 2021, up from 4.9 billion; and FedEx shipped 4.2 billion, up from 3.7 billion

- The combined parcel volume from smaller carriers outside the top four, included in the 'Others' category, grew by 94 percent

-

Carrier revenue

- Carriers collectively generated $188 billion in parcel revenue – a 16 percent increase year-over-year from $163 billion

- UPS generated the highest carrier revenue with $70 billion, followed by FedEx ($62 billion), USPS ($31.5 billion), Amazon Logistics ($22 billion), and the combined revenue from 'Others', reached $3 billion

- 'Others' grew revenue by 95 percent

- UPS generated a 16 percent increase in revenue year-over-year, FedEx 21 percent growth and USPS revenue was flat

-

Carrier market share

- By revenue, UPS generated the highest parcel market share of 37 percent followed by FedEx (33 percent), USPS (17 percent) and Amazon Logistics (12 percent)

- By volume, USPS had the highest market share (32 percent, down from 36 percent in 2020), followed by UPS (24 percent, the same as in 2020), Amazon Logistics (22 percent, up from 21 percent) and FedEx (19 percent, up from 18 percent)

-

Amazon Logistics

- Grew revenue to $22 billion – a 19 percent increase year-over-year

- Parcel volume growth slowed to 13 percent from 4.2 billion to 4.8 billion. In 2020, growth was 112 percent

- Parcels generated by Amazon reached 8.4 billion in 2021, of which 57 percent or 4.8 billion parcels were delivered by Amazon Logistics and 43 percent or 3.6 billion parcels were passed to carriers for last mile delivery. In 2020, Amazon passed 2.8 billion parcels to carriers for last mile delivery

Consumers’ online shopping behaviors continue to impact parcel volumes and carrier revenues, as some buying habits and preferences established during the pandemic remain firmly in place. BOXpoll™ by Pitney Bowes, the consumer survey on current events, culture and ecommerce logistics, found almost one in four (23 percent) US shoppers polled in April 2022 say they are shopping online more than they did earlier in 2022. Around 37 percent of all purchases made are online.

Now in its seventh year, the Index has built a reputation as one of the industry’s most reliable sources of shipping and logistics intelligence. The global Pitney Bowes Shipping Index, which includes data from 13 countries, will be launched later this year, with data for the remaining 12 countries in the Index - Canada, Brazil, Germany, UK, France, Italy, Norway, Sweden, China, Japan, Australia and India. The decision to release US data earlier was made to meet high market demand in the US. Based on proprietary and published data, the Index has become a valued industry benchmark since the inaugural report in 2015.

About the Pitney Bowes Parcel Shipping Index

The Pitney Bowes Parcel Shipping Index measures parcel volume and spend for business-to-business, business-to-consumer, consumer-to-business and consumer consigned shipments with weight up to 31.5kg (70 pounds) across Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Norway, Sweden, the United Kingdom and the United States. Population data points were sourced from Macrotrends.net. The Pitney Bowes Parcel Shipping Index spans 13 countries and represents the parcel shipping activity of 3.7 billion people.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a global shipping and mailing company that provides technology, logistics, and financial services to more than 90 percent of the Fortune 500. Small business, retail, enterprise, and government clients around the world rely on Pitney Bowes to remove the complexity of sending mail and parcels. For the latest news, corporate announcements and financial results visit https://www.pitneybowes.com/us/newsroom.html. For additional information visit Pitney Bowes at www.pitneybowes.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220523005364/en/

Contacts

John Spadafora

Pitney Bowes

M +1 518 708 3466

John.spadafora@pb.com

Marifer Rodriguez

Pitney Bowes

M +1 203 940 3718

Marifer.rodriguez@pb.com