- The U.S. Food and Drug Administration (FDA) approved CARVYKTI™ (ciltacabtagene autoleucel; cilta-cel) for the treatment of adults with relapsed or refractory multiple myeloma, marking Legend Biotech’s first product approved by a health authority

- The European Commission (EC) has granted conditional marketing authorization of CARVYKTI™ for the treatment of adults with relapsed and refractory multiple myeloma

- Legend Biotech engaged Ernst & Young LLP (US) as the company’s auditor for the fiscal year ending December 31, 2022

- Legend Biotech achieved milestone payments under its collaboration agreement with Janssen Biotech, Inc. for CARVYKTI™

Legend Biotech Corporation (NASDAQ: LEGN) (Legend Biotech), a global biotechnology company developing, manufacturing and commercializing novel therapies to treat life-threatening diseases, today reported its first quarter 2022 unaudited financial results.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220601005384/en/

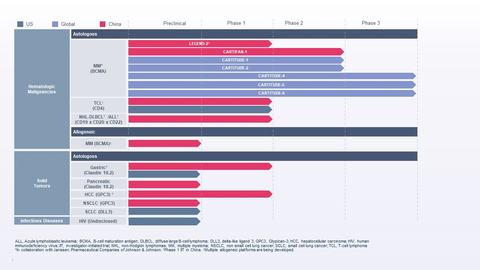

Legend Biotech's Development Pipeline May 2022 (Graphic: Business Wire)

“The year began with an exciting start as we received the company’s first-ever U.S. FDA approval for CARVYKTI™,” said Ying Huang, Ph.D., CEO of Legend Biotech. “This is the first of many cell therapies we hope to bring to patients, and we look forward to advancing the CARTITUDE clinical development program and our cell therapy pipeline over the rest of the year.”

First Quarter 2022 Highlights and Recent Events

- On February 28, 2022, the U.S. Food and Drug Administration (FDA) approved CARVYKTI™ for the treatment of adults with relapsed or refractory multiple myeloma who have received four or more prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody, marking the company’s first product approved by a health authority.

- On May 26, 2022, the European Commission (EC) granted conditional marketing authorization of CARVYKTI™ for the treatment of adults with relapsed and refractory multiple myeloma who have received at least three prior therapies, including a proteasome inhibitor (PI), an immunomodulatory agent (IMiD) and an anti-CD38 antibody, and have demonstrated disease progression on the last therapy.

- On April 21, 2022, Legend announced the achievement of a $50 million milestone under its collaboration agreement with Janssen Biotech, Inc. (Janssen) for CARVYKTI™. Legend Biotech entered into an exclusive worldwide license and collaboration agreement with Janssen to develop and commercialize CARVYKTI™ in December 2017.

- Legend Biotech engaged Ernst & Young LLP, located in the United States, as the company’s independent, registered public accounting firm for the audits of the Company’s financial statements and internal control over financial reporting for the fiscal year ending December 31, 2022.

- CARTITUDE-6 (not yet recruiting; sponsored by the European Myeloma Network), a second Phase 3 trial in frontline multiple myeloma, was posted on clinicaltrials.gov. This Phase 3, randomized, open-label study compares daratumumab, bortezomib, lenalidomide and dexamethasone (DVRd) followed by cilta-cel vs. DVRd followed by autologous stem cell transplant (ASCT) in newly diagnosed, transplant-eligible patients with multiple myeloma.

- On May 25, 2022, The FDA lifted its clinical hold of Legend Biotech’s Phase 1 clinical trial of LB1901, the company’s investigational autologous chimeric antigen receptor T-cell (CAR-T) therapy targeting malignant CD4+ T-cells for the treatment of adults with relapsed or refractory T-cell lymphoma (TCL).

- On March 23, 2022, Legend Biotech was awarded Newcomer of the Year at the tenth annual Foreign Investment Trophy ceremony hosted by Flanders Investment & Trade (FIT) for its joint investment in a state-of-the-art manufacturing facility in Flanders with Janssen Pharmaceutica N.V.

- Legend Biotech made the following management appointments: Lori Macomber, CPA, as Chief Financial Officer; Guowei Fang, Ph.D., as Senior Vice President, Global Head of Research and Early Development; and Marc L. Harrison, as Vice President and General Counsel.

Financial Results for First Quarter Ended March 31, 2022

Cash and Cash Equivalents, Time Deposits, and Short-Term Investments

As of March 31, 2022, Legend Biotech had approximately $796.0 million of cash and cash equivalents, deposits and short-term investments.

Revenue

Revenue for the three months ended March 31, 2022 was $40.8 million compared to $13.7 million for the three months ended March 31, 2021. The increase of $27.1 million was primarily due to revenue recognition from additional milestones achieved. Legend Biotech has not generated any revenue from product sales to date.

Research and Development Expenses

Research and development expenses for the three months ended March 31, 2022 were $81.3 million compared to $71.1 million for the three months ended March 31, 2021. This increase of $10.2 million was primarily due to a higher number of clinical trials with more patients enrolled and a higher number of research and development activities in cilta-cel and for other pipelines in the first quarter of 2022.

Administrative Expenses

Administrative expenses for the three months ended March 31, 2022 were $12.7 million compared to $8.7 million for the three months ended March 31, 2021. The increase of $4.0 million was primarily due to Legend Biotech’s expansion of supporting administrative functions to facilitate continuous research and development activities as well as activities to establish elements of a commercialization infrastructure.

Selling and Distribution Expenses

Selling and distribution expenses for the three months ended March 31, 2022 were $21.3 million compared to $13.4 million for the three months ended March 31, 2021. This increase of $7.9 million was primarily due to increased costs associated with commercial preparation activities for cilta-cel.

Other Income and Gains

Other income and gains for the three months ended March 31, 2022 were $1.0 million compared to $0.7 million for the three months ended March 31, 2021. The increase of $0.3 million was primarily due to more interest income earned in first quarter of 2022.

Other Expenses

Other expenses for the three months ended March 31, 2022 were $1.5 million compared to $2.0 million for the three months ended March 31, 2021. The decrease was primarily due to less foreign currency exchange loss in first quarter of 2022.

Finance Costs

Finance costs for the three months ended March 31, 2022 were $1.0 million compared to $0.04 million for the three months ended March 31, 2021. The increase was primarily due to interest for advance funding, which is comprised of interest on interest-bearing borrowings funded by Janssen under the parties’ collaboration agreement.

Fair Value Gain of Warrant Liability

Fair value gain of warrant liability for the year ended March 31, 2022 was $34.9 million caused by changes in the fair value of a warrant that Legend Biotech issued to an institutional investor through a private placement transaction in May 2021 with an initial fair value of $81.7 million at the issuance date. The warrant was assessed as a financial liability with a fair value of $87.9 million as of December 31, 2021 and a fair value of $53.0 million as of March 31, 2022.

Loss for the Period

For the three months ended March 31, 2022, net loss was $41.1 million, or $0.13 per share, compared to a net loss of $80.9 million, or $0.30 per share, for the three months ended March 31, 2021.

About Legend Biotech

Legend Biotech is a global biotechnology company dedicated to treating, and one day curing, life-threatening diseases. Headquartered in Somerset, New Jersey, we are developing advanced cell therapies across a diverse array of technology platforms, including autologous and allogenic chimeric antigen receptor T-cell, T-cell receptor (TCR-T), and natural killer (NK) cell-based immunotherapy. From our three R&D sites around the world, we apply these innovative technologies to pursue the discovery of safe, efficacious and cutting-edge therapeutics for patients worldwide.

Learn more at www.legendbiotech.com and follow us on Twitter and LinkedIn.

About CARVYKTI™ (Ciltacabtagene autoleucel; cilta-cel)

CARVYKTI™ is a BCMA-directed, genetically modified autologous T-cell immunotherapy, which involves reprogramming a patient’s own T-cells with a transgene encoding a chimeric antigen receptor (CAR) that identifies and eliminates cells that express BCMA. BCMA is primarily expressed on the surface of malignant multiple myeloma B-lineage cells, as well as late-stage B-cells and plasma cells. The CARVYKTI™ CAR protein features two BCMA-targeting single domain antibodies designed to confer high avidity against human BCMA. Upon binding to BCMA-expressing cells, the CAR promotes T-cell activation, expansion, and elimination of target cells.1

In December 2017, Legend Biotech Corporation entered into an exclusive worldwide license and collaboration agreement with Janssen Biotech, Inc. (Janssen) to develop and commercialize cilta-cel.

In February 2022, CARVYKTI™ was approved by the U.S. Food and Drug Administration (FDA) for the treatment of adults with relapsed or refractory multiple myeloma.2 In May 2022, the European Commission (EC) granted conditional marketing authorization of CARVYKTI™ for the treatment of adults with relapsed and refractory multiple myeloma.3 Cilta-cel was granted Breakthrough Therapy Designation in the U.S. in December 2019 and in China in August 2020. In addition, cilta-cel received a PRIority MEdicines (PRIME) designation from the European Commission in April 2019. Cilta-cel also received Orphan Drug Designation from the U.S. FDA in February 2019, from the European Commission in February 2020, and from the Pharmaceuticals and Medicinal Devices Agency (PMDA) in Japan in June 2020. In May 2022, the European Medicines Agency’s Committee for Orphan Medicinal Products recommended by consensus that the orphan designation for cilta-cel be maintained on the basis of clinical data demonstrating improved and sustained complete response rates following treatment.4

About Multiple Myeloma

Multiple myeloma is an incurable blood cancer that starts in the bone marrow and is characterized by an excessive proliferation of plasma cells.5 In 2022, it is estimated that more than 34,000 people will be diagnosed with multiple myeloma, and more than 12,000 people will die from the disease in the U.S.6 While some patients with multiple myeloma have no symptoms at all, most patients are diagnosed due to symptoms that can include bone problems, low blood counts, calcium elevation, kidney problems or infections.7 Although treatment may result in remission, unfortunately, patients will most likely relapse.8 Patients who relapse after treatment with standard therapies, including protease inhibitors, immunomodulatory agents, and an anti-CD38 monoclonal antibody, have poor prognoses and few treatment options available.9,10

Cautionary Note Regarding Forward-Looking Statements

Statements in this press release about future expectations, plans and prospects, as well as any other statements regarding matters that are not historical facts, constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements relating to Legend Biotech’s strategies and objectives; statements relating to CARVYKTI™, including Legend Biotech’s expectations for CARVYKTI™, such as Legend Biotech’s manufacturing and commercialization expectations for CARVYKTI™ and the potential effect of treatment with CARVYKTI™; statements about submissions for cilta-cel to, and the progress of such submissions with, the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), the Chinese Center for Drug Evaluation of National Medical Products Administration (CDE) and other regulatory authorities; the anticipated timing of, and ability to progress, clinical trials, including patient enrollment and the resumption of the Phase 1 clinical trial of LB1901; the ability to maintain and progress the conditional marketing authorization for cilta-cel granted by the EMA; the submission of Investigational New Drug (IND) applications to, and maintenance of such applications with, regulatory authorities; the ability to generate, analyze and present data from clinical trials; and the potential benefits of Legend Biotech’s product candidates. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors. Legend Biotech’s expectations could be affected by, among other things, uncertainties involved in the development of new pharmaceutical products; unexpected clinical trial results, including as a result of additional analysis of existing clinical data or unexpected new clinical data; unexpected regulatory actions or delays, including requests for additional safety and/or efficacy data or analysis of data, or government regulation generally; unexpected delays as a result of actions undertaken, or failures to act, by our third party partners; uncertainties arising from challenges to Legend Biotech’s patent or other proprietary intellectual property protection, including the uncertainties involved in the U.S. litigation process; competition in general; government, industry, and general public pricing and other political pressures; the duration and severity of the COVID-19 pandemic and governmental and regulatory measures implemented in response to the evolving situation; as well as the other factors discussed in the “Risk Factors” section of the Legend Biotech’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on March 31, 2022. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in this press release as anticipated, believed, estimated or expected. Any forward-looking statements contained in this press release speak only as of the date of this press release. Legend Biotech specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

LEGEND BIOTECH CORPORATION |

||||

CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS |

||||

Three months ended March 31 |

||||

(in thousands, US$, except share and per share data) |

2022

|

|

2021

|

|

|

|

|

||

|

|

|

||

REVENUE |

40,827 |

|

13,682 |

|

Other income and gains |

1,012 |

|

722 |

|

Research and development expenses |

(81,346) |

|

(71,072) |

|

Administrative expenses |

(12,657) |

|

(8,742) |

|

Selling and distribution expenses |

(21,302) |

|

(13,417) |

|

Other expenses |

(1,527) |

|

(2,034) |

|

Fair value gain of warrant liability |

34,900 |

|

- |

|

Finance costs |

(994) |

|

(38) |

|

|

|

|

||

LOSS BEFORE TAX |

(41,087) |

|

(80,899) |

|

|

|

|

||

Income tax expense |

- |

|

- |

|

|

|

|

||

LOSS FOR THE PERIOD |

(41,087) |

|

(80,899) |

|

Attributable to: |

|

|

|

|

Ordinary equity holders of the parent |

(41,087) |

|

(80,899) |

|

|

|

|

||

Loss per share attributable to ordinary equity holders of the parent: |

|

|

|

|

Ordinary shares – basic |

(0.13) |

|

(0.30) |

|

Ordinary shares – diluted |

(0.13) |

|

(0.30) |

|

|

|

|

||

Shares used in loss per share computation: |

|

|

|

|

Ordinary shares – basic |

308,699,034 |

|

266,293,913 |

|

Ordinary shares – diluted |

308,699,034 |

|

266,293,913 |

|

LEGEND BIOTECH CORPORATION |

||||

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

||||

March 31, 2022

|

December 31, 2021 |

|||

(in thousands, US$) |

|

|

||

|

|

|

||

NON-CURRENT ASSETS |

|

|

||

Property, plant and equipment |

156,005 |

145,724 |

||

Advance payments for property, plant and equipment |

258 |

2,168 |

||

Right-of-use assets |

7,393 |

7,186 |

||

Other non-current assets |

4,912 |

5,148 |

||

Intangible assets |

4,517 |

4,684 |

||

Time deposits |

4,726 |

4,705 |

||

|

|

|

||

Total non-current assets |

177,811 |

169,615 |

||

|

|

|

||

CURRENT ASSETS |

|

|

||

Inventories |

2,895 |

1,749 |

||

Trade receivables |

50,451 |

50,410 |

||

Prepayments, other receivables and other assets |

16,651 |

12,754 |

||

Financial assets measured at amortized cost |

29,974 |

29,937 |

||

Financial assets at fair value through profit or loss |

99,995 |

- |

||

Pledged deposits |

1,448 |

1,444 |

||

Time deposits |

283,505 |

163,520 |

||

Cash and cash equivalents |

377,786 |

688,938 |

||

|

|

|

||

Total current assets |

862,705 |

948,752 |

||

|

|

|

||

Total assets |

1,040,516 |

1,118,367 |

||

|

|

|

||

CURRENT LIABILITIES |

|

|

||

Trade and notes payables |

9,712 |

7,043 |

||

Other payables and accruals |

96,055 |

123,464 |

||

Government grants |

320 |

304 |

||

Warrant liability |

53,000 |

87,900 |

||

Lease liabilities |

883 |

911 |

||

Contract liabilities |

65,560 |

60,644 |

||

|

|

|

||

Total current liabilities |

225,530 |

280,266 |

||

|

|

|

||

NON-CURRENT LIABILITIES |

|

|

||

Contract liabilities |

245,850 |

242,578 |

||

Lease liabilities |

1,630 |

1,593 |

||

Interest-bearing loans and borrowings |

126,714 |

120,462 |

||

Other non-current liabilities |

356 |

396 |

||

Government grants |

1,873 |

1,866 |

||

|

|

|

||

March 31, 2022

|

December 31, 2021 |

|||

(in thousands, US$) |

|

|

||

Total non-current liabilities |

376,423 |

366,895 |

||

|

|

|

||

Total liabilities |

601,953 |

647,161 |

||

|

|

|

||

EQUITY |

||||

Share capital |

31 |

31 |

||

Reserves |

438,532 |

471,175 |

||

|

|

|

||

Total ordinary shareholders’ equity |

438,563 |

471,206 |

||

|

|

|

||

Total equity |

438,563 |

471,206 |

||

|

|

|

||

Total liabilities and equity |

1,040,516 |

1,118,367 |

LEGEND BIOTECH CORPORATION |

||||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||

|

Three months ended March 31 |

|||

(in thousands, US$) |

2022

|

2021

|

||

|

|

|

||

LOSS BEFORE TAX |

(41,087) |

(80,899) |

||

|

|

|

||

CASH FLOWS USED IN OPERATING ACTIVITIES |

(78,687) |

(26,787) |

||

|

|

|

||

CASH FLOWS USED IN INVESTING ACTIVITIES |

(232,500) |

(17,150) |

||

|

|

|

||

CASH FLOWS FROM FINANCING ACTIVITIES |

25 |

207 |

||

|

|

|

||

NET DECREASE IN CASH AND CASH EQUIVALENTS |

(311,162) |

(43,730) |

||

|

|

|

||

Effect of foreign exchange rate changes, net |

10 |

337 |

||

Cash and cash equivalents at beginning of the period |

688,938 |

455,689 |

||

|

|

|

||

CASH AND CASH EQUIVALENTS AT END OF THE PERIOD |

377,786 |

412,296 |

||

|

|

|

||

ANALYSIS OF BALANCES OF CASH AND CASH EQUIVALENTS |

|

|

||

Cash and bank balances |

667,465 |

462,552 |

||

Less: Pledged deposits |

1,448 |

256 |

||

Time deposits |

288,231 |

50,000 |

||

Cash and cash equivalents as stated in the statement of financial position |

377,786 |

412,296 |

||

Cash and cash equivalents as stated in the statement of cash flows |

377,786 |

412,296 |

||

____________________

1 CARVYKTI™ Prescribing Information. Horsham, PA: Janssen Biotech, Inc.

2 CARVYKTI™ (ciltacabtagene autoleucel), BCMA-Directed CAR-T Therapy, Receives U.S. FDA Approval for the Treatment of Adult Patients with Relapsed or Refractory Multiple Myeloma. Available at: https://legendbiotech.com/wp-content/uploads/2022/02/CARVYKTI%E2%84%A2-ciltacabtagene-autoleucel-BCMA-Directed-CAR-T-Therapy-Receives-U.S.-FDA-Approval-2.pdf. Last accessed: May 2022.

3 CARVYKTI® (ciltacabtagene autoleucel) Granted Conditional Approval by the European Commission for the Treatment of Patients with Relapsed and Refractory Multiple Myeloma. Available at: https://investors.legendbiotech.com/node/7431/pdf. Last accessed: May 2022.

4 European Commission. Community Register of Orphan Medicinal Products. Available at: https://ec.europa.eu/health/documents/community-register/html/o2252.htm. Last accessed: May 2022.

5 American Society of Clinical Oncology. Multiple myeloma: introduction. Available at: https://www.cancer.net/cancer-types/multiple-myeloma/introduction . Last accessed: May 2022.

6 American Cancer Society. "Key Statistics About Multiple Myeloma." Available at: https://www.cancer.org/cancer/multiple-myeloma/about/key-statistics.html. Last accessed: May 2022.

7 American Cancer Society. Multiple myeloma: early detection, diagnosis and staging. Available at: https://www.cancer.org/content/dam/CRC/PDF/Public/8740.00.pdf. Last accessed May 2022.

8 Rajkumar SV. Multiple myeloma: 2020 update on diagnosis, risk-stratification and management. Am J Hematol. 2020;95(5),548-567. doi:10.1002/ajh.25791.

9 Kumar SK, Dimopoulos MA, Kastritis E, et al. Natural history of relapsed myeloma, refractory to immunomodulatory drugs and proteasome inhibitors: a multicenter IMWG study. Leukemia. 2017;31(11):2443- 2448.

10 Gandhi UH, Cornell RF, Lakshman A, et al. Outcomes of patients with multiple myeloma refractory to CD38- targeted monoclonal antibody therapy. Leukemia. 2019;33(9):2266-2275.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220601005384/en/

Contacts

Investor:

Joanne Choi, Senior Manager, Investor Relations, Legend Biotech

joanne.choi@legendbiotech.com

Crystal Chen, Manager, Investor Relations, Legend Biotech

crystal.chen@legendbiotech.com

Press:

Tina Carter, Corporate Communications Lead, Legend Biotech

tina.carter@legendbiotech.com

(908) 331-5025