All three major sectors declined in September with residential leading the tumble

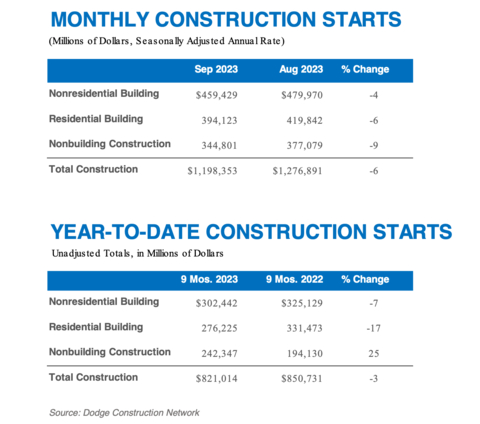

Total construction starts fell 6% in September to a seasonally adjusted annual rate of $1.2 trillion, according to Dodge Construction Network. Nonresidential starts lost 4%, residential starts declined 6%, and nonbuilding starts fell 9%.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231018001170/en/

Total construction starts fell 6% in September to a seasonally adjusted annual rate of $1.2 trillion. (Graphic: Business Wire)

Year-to-date through September 2023, total construction starts were 3% below that of 2022. Residential and nonresidential starts were down 17% and 7%, respectively; however, nonbuilding starts were up 25% on a year-to-date basis. For the 12 months ending September 2023, total construction starts were unchanged. Nonbuilding starts were 22% higher, and nonresidential building starts gained 3%. Conversely, on a 12-month rolling basis, residential starts posted a 16% decline.

“Risks continue to mount for the construction sector,” said Richard Branch, chief economist for Dodge Construction Network. “Over the last 12 months, construction starts have essentially froze as rates increased and credit tightened. The industry needs further adjusting as rates are expected to stay higher for longer, along with the potential for higher energy costs and continued political uncertainty. A return to broad-based growth in construction starts is still some time away.”

Nonbuilding

Nonbuilding construction starts decreased in September, falling 9% to a seasonally adjusted annual rate of $345 billion. Highway and bridge starts lost 15% and environmental public works starts fell 29%. Not all sectors fell, however: miscellaneous nonbuilding starts rose 4%, and utility/gas plant starts gained 14%. Year-to-date through September, nonbuilding starts were up 25%. Utility/gas plants rose 58%, and miscellaneous nonbuilding starts were up 23%. Highway and bridge starts gained 13%, and environmental public works rose 16%.

For the past 12 months ending in September 2023, total nonbuilding starts were 22% higher than that of September 2022. Utility/gas plant and miscellaneous nonbuilding starts rose 35% and 22%, respectively. Highway and bridge starts, in addition to environmental public works starts, were both up 18% on a 12-month rolling sum basis.

The largest nonbuilding projects to break ground in September were the $4.5 billion Sun Zia transmission line across Arizona and New Mexico, the $525 million fourth phase of the Cedar Springs wind farm in Converse County, Wyoming, and the $485 million Prospect Lake Clear Water Center in Fort Lauderdale, Florida.

Nonresidential

Nonresidential building starts fell 4% in September to a seasonally adjusted annual rate of $459 billion. Commercial starts rose 6% due to strength in data center work (classified as an office structure in the Dodge database) and retail. Institutional starts fell 8% in September despite a healthy gain in education starts, and manufacturing starts declined 13%. On a year-to-date basis through September, total nonresidential starts were 7% lower than that of 2022. Institutional starts gained 5%, while commercial and manufacturing starts fell 6% and 31%, respectively.

For the past 12 months ending in September 2023, total nonresidential building starts were 3% higher than that ending September 2022. Manufacturing starts were 8% lower. Institutional starts improved by 8%, and commercial starts gained 4%.

The largest nonresidential building projects to break ground in September were the $2.5 billion Hyundai/SK EV battery plant in Cartersville, Georgia, a $1.1 billion prison in Elmore, Alabama, and the $1 billion Microsoft data center in Mount Pleasant, Wisconsin.

Residential

Residential building starts fell 6% in September to a seasonally adjusted annual rate of $394 billion. Single family starts gained 1%, while multifamily starts lost 17%. On a year-to-date basis through September 2023, total residential starts were down 17%. Single family starts were 19% lower, and multifamily starts were down 12%.

For the past 12 months ending in September 2023, residential starts were 16% lower than in 2022. Single family starts were 22% lower, while multifamily starts were down 5% on a rolling 12-month basis.

The largest multifamily structures to break ground in September were the $385 million first phase of the South Pier Residential Towers in Tempe, Arizona, the $275 million first phase of the Casa Bella Condominiums in Miami, Florida, and the $260 million Chapel Block mixed-use development in Philadelphia, Pennsylvania.

Regionally, total construction starts in September fell in the Northeast, Midwest, South Atlantic and West regions, but rose modestly in the South Central.

Watch Chief Economist Richard Branch discuss September Construction Starts here.

About Dodge Construction Network

Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem. Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231018001170/en/

Contacts

Amy Roepke | Dodge Construction Network | Amy.Roepke@construction.com