Resilient growth in revenue and operating margin in a global environment of increased uncertainty and inflexions in many sectors of activity

Regulatory News:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230726345901/en/

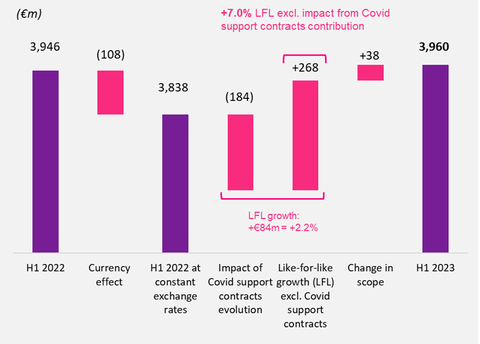

Analysis of first-half 2023 revenue growth (Graphic: Teleperformance)

The Board of Directors of Teleperformance (Paris:TEP), a global leader in digital business services, met today and reviewed the consolidated financial statements for the six months ended June 30, 2023. The Group also announced its first-half 2023 financial results.

Resilient growth in revenue and operating results

-

H1 2023 revenue :

€3,960 million

up + 7.0% like-for-like*

up + 2.2% like-for-like including the impact of lower revenue from Covid support contracts

- Recurring EBITDA: €807 million, for margin of 20.4%, up 30 bps vs. H1 2022

- Recurring EBITA: €577 million, for margin of 14.6%, up 30 bps vs. H1 2022

A solid and responsible business model

- In early July, Teleperformance announced that its operations in 72 countries had been certified as “Best Employers” by the Great Place to Work® Institute, up eight countries from 2022. 99% of Group employees now work in a country certified as a Great Place to Work®;

- In April and May 2023, Teleperformance signed three agreements with unions in Colombia, Romania and Poland. The Group also announces today that the Colombian government has officially closed its investigation into employees’ working conditions at Teleperformance Colombia, without any findings against the company;

- The Group’s Board was further strengthened today with the co-optation to the Board of Directors of Kevin Niu, who is a Canadian national and an AI entrepreneur, to replace Wai Ping Leung, who has resigned.

Outlook for 2023

-

As macro-economic challenges are expected to continue in the second half of the year, Teleperformance is adjusting its 2023 annual objectives as following:

- Like-for-like growth, excluding the impact of Covid support contracts, of +6% to +8%

- Recurring EBITA margin is confirmed at 16%, representing a 50 basis‑point increase vs. 2022

- The Majorel acquisition process is on track, with the anti-trust clearance processes expected to be finalized during Q4 2023

* At constant scope of consolidation and exchange rates

Commenting on this performance, Teleperformance Chairman and Chief Executive Officer Daniel Julien said: “Despite a challenging and uncertain macro-economic environment, Teleperformance continues to deliver a healthy growth, further improvement on its industry leading operating margins and strong free cash flow. Our second-half growth level will be directly correlated to the macro dynamic of typical seasonal activities in key sectors like Healthcare, Retail and Technology.

On the ESG front, we are very pleased to announce that the Colombia government has officially closed its investigation into the employees’ working conditions at Teleperformance Colombia, without any findings against the company. Further, our Board has been strengthened with the co-optation of Kevin Niu, who is a Canadian citizen with a PhD in quantic physics from Harvard University and an AI entrepreneur. This decision comes at an opportune time when our Transformation teams are engaged in a number of AI projects globally, including in Gen AI the adoption of which nevertheless remains marginal today.

Lastly, the closing of the Majorel acquisition is on track and we continue to work with the relevant authorities for their documentation requirements.”

INTERIM FINANCIAL HIGHLIGHTS

€ millions |

H1 2023 |

|

H1 2022 |

|

|

€1=US$1.08 |

|

€1=US$1.09 |

|

Revenue |

3,960 |

|

3,946 |

|

Reported growth |

+0.4% |

|

|

|

Like-for-like growth On a like-for-like basis excluding “Covid contracts” |

+2.2% |

|

|

|

+7.0% |

|

|

||

EBITDA before non-recurring items |

807 |

|

792 |

|

% of revenue |

20.4% |

|

20.1% |

|

EBITA before non-recurring items |

577 |

|

566 |

|

% of revenue |

14.6% |

|

14.3% |

|

EBIT |

446 |

|

438 |

|

Net profit – Group share |

271 |

|

274 |

|

Diluted earnings per share (€) |

4.59 |

|

4.60 |

|

Net free cash flow |

309 |

|

315 (1) |

(1) Including loans granted

FIRST-HALF AND SECOND-QUARTER 2023 REVENUE

CONSOLIDATED REVENUE

Consolidated revenue amounted to €3,960 million in the first six months of 2023, delivering a year-on-year increase of +2.2% like-for-like (at constant exchange rates and scope of consolidation). Growth for the half year was dampened by the expected non-recurring impact of the year-on-year decline in the contribution from Covid support contracts in 2023 compared with 2022 (-€184 million in the first half). Adjusted for this impact, like-for-like growth stood at +7.0% for the half.

Reported growth was +0.4%. At a negative €108 million, the currency effect was highly unfavorable with an increased volatility over the second quarter, led by declines in the Colombian peso, Egyptian pound, Argentine peso and Indian rupee against the euro. Changes in the scope of consolidation added +€38 million to revenue, reflecting the consolidation of PSG Global Solutions from November 1, 2022 (+€31 million) and of Capita Translation & Interpreting from January 1, 2023 (+€7 million).

The like-for-like growth was robust in a still uncertain economic and geopolitical environment. It also outpaced most of the major market contenders, thanks to the resilience of Teleperformance’s client portfolio as well as its diversity in terms of regions, sectors, and lines of business. The social media and entertainment, financial services, travel and transportation services and government agency (excluding Covid support contracts) verticals all enjoyed vibrant growth over the first half. Business growth was particularly strong in the EMEA region, even as it slowed in the United States.

The sustained fast expansion in offshore solutions continued to exert downward pressure on the Group’s revenue growth over the first half, a trend that is expected to remain operative over the last half of the year. The growth in offshore activities nevertheless had a positive impact on the Group’s margins.

During the first half, major contracts were signed later than planned due to hesitancy among certain clients, particularly in the financial services industry in the United States last spring. These new contracts should contribute more fully to the Group’s growth in the second half of the year, even though the environment remains volatile.

Specialized Services also continued to expand at a sustained pace, led by the still very fast rebound in TLSContact’s visa application management business post-Covid and the brisk growth in LanguageLine Solutions’ online interpretation business.

Second-quarter 2023 revenue came to €1,954 million, for a year-on-year like-for-like increase of +5.3% (excluding Covid support contracts). On a reported basis, revenue declined by -1.5% over the quarter, impacted (i) by the deeply unfavorable currency effect (-€96 million), stemming primarily from the decline against the euro in the Colombian peso, the US dollar, the Egyptian pound, the Argentine peso, the Indian rupee and most other operating currencies; and (ii) by changes in the scope of consolidation following the consolidation of PSG Global Solutions and Capita Translation & Interpreting.

The slowdown in growth excluding Covid support contracts from the first quarter’s +8.6% gain mainly reflected the less favorable prior-year comparatives (+11.1% in Q1 2022 and +14.5% in Q2 2022), both in the Core Services & D.I.B.S. activities, particularly in the EMEA region, and in Specialized Services. In addition, the US market has cooled over the first half with a lower performance in a certain number of sectors, such as retailing, technologies and telecoms.

REVENUE BY ACTIVITY

|

H1 2023 |

H1 2022 |

% change |

||

€ millions |

|

|

Like-for-like |

On a like-for-like

|

Reported |

CORE SERVICES & D.I.B.S.* |

3,297 |

3,412 |

-0.2% |

+5.3% |

-3.4% |

North America & Asia-Pacific |

1,255 |

1,264 |

+0.3% |

+0.3% |

-0.8% |

LATAM |

788 |

803 |

+4.3% |

+4.3% |

-1.8% |

Europe & MEA (EMEA) |

1,254 |

1,344 |

-3.4% |

+10.8% |

-6.7% |

SPECIALIZED SERVICES |

663 |

534 |

+17.2% |

+17.2% |

+24.1% |

TOTAL |

3,960 |

3,946 |

+2.2% |

+7.0% |

+0.4% |

|

Q2 2023 |

Q2 2022 |

% change |

||

€ millions |

|

|

Like-for-like |

On a like-for-like

|

Reported |

CORE SERVICES & D.I.B.S.* |

1,612 |

1,700 |

+0.0% |

+3.3% |

-5.2% |

North America & Asia-Pacific |

609 |

636 |

-0.2% |

-0.2% |

-4.3% |

LATAM |

392 |

421 |

+1.6% |

+1.6% |

-6.7% |

Europe & MEA (EMEA) |

611 |

643 |

-0.9% |

+7.7% |

-5.0% |

SPECIALIZED SERVICES |

342 |

284 |

+17.4% |

+17.4% |

+20.4% |

TOTAL |

1,954 |

1,984 |

+2.5% |

+5.3% |

-1.5% |

* Digital Integrated Business Services

** Excluding the impact of lower revenue from Covid support contracts

- Core Services & Digital Integrated Business Services (D.I.B.S.)

Core Services & D.I.B.S. revenue amounted to €3,297 million in first-half 2023, representing a year-on-year like-for-like gain of +5.3% excluding the impact of lower revenue from Covid support contracts. Like-for-like growth was virtually unchanged, at -0.2%, while reported revenue was down -3.4% due primarily to the decline against the euro in the Colombian peso, the Egyptian pound, the Argentine peso and the Indian rupee.

The robust like-for-like growth excluding Covid support contracts was chiefly attributable to the strength and diversity of the Group’s client portfolio. Business is expanding steadily in Europe, while the North American market slowed compared with last year. The strongest results were reported in the social media, financial services, travel and transportation services, healthcare and government agency verticals. Content moderation and customer acquisition were the best‑performing service lines over the period.

In the second quarter alone, Core Services & D.I.B.S. revenue totaled €1,612 million, representing like-for-like growth excluding Covid support contracts of +3.3%. On a like-for-like basis, revenue was unchanged year-on-year, while reported revenue was down -5.2% due primarily to the decline against the euro in most currencies and the impact of lower revenue from Covid support contracts

The slowdown in like-for-like growth excluding Covid support contracts from the first quarter’s +7.3% gain mainly reflected the more unfavorable prior-year comparatives, particularly in the EMEA region, and the weaker performance in the LATAM region. The strengthening of the Mexican peso against the US dollar has considerably reduced Mexico’s attractiveness compared with other offshore regions.

- North America & Asia-Pacific

Regional revenue came to €1,255 million in first-half 2023, virtually unchanged like-for-like (+0.3%) compared with last year. On a reported basis, sales edged down -0.8%, reflecting the unfavorable currency effect from the increase in the Indian rupee and Philippine peso against the euro, which offset the slight uptick in the US dollar over the period. In the second quarter alone, revenue was stable (-0.2%) on a like-for-like basis.

Like-for-like growth in North America remained limited throughout the first half due to the steady acceleration of growth in offshore activities in India and the Philippines to the detriment of US onshore business. The resulting deflationary impact pushed down regional revenue. In addition, a certain number of verticals, such as telecoms, technologies and retailing, experienced a slowdown over the period.

In the Asia-Pacific region, revenue rose robustly in China, led by the swift start-up of new contracts in the financial services and travel sectors.

Across the region as a whole, the content moderation (Trust & Safety) and customer acquisition activities expanded at a steady pace.

On the other hand, the delays last spring in signing major contracts in the US financial services vertical led to a revenue shortfall in the second quarter. Their ramp-up should contribute positively to the region’s growth in the second half, even though economic conditions remain uncertain.

- LATAM

First-half 2023 revenue for the LATAM region amounted to €788 million, a year-on-year increase of +4.3% like-for-like. Reported revenue ended the period down -1.8%, primarily due to the decline against the euro in the Colombian and Argentinian pesos. Like-for-like revenue growth in the second quarter alone came to +1.6%.

Business growth was robust in Peru and Colombia, where the content moderation (Trust & Safety )activity pursued its fast expansion.

Mexico’s diminished appeal compared with other offshoring locales, due to the strengthening of the peso against the US dollar, weighed on regional growth throughout the first half. The slower growth also reflected an unfavorable basis of comparison over the period.

The Group’s businesses enjoyed particularly vibrant growth across the region in the social media and online entertainment sectors. The financial services vertical continued to expand at a satisfactory pace. Growth in these markets, as well as in transportation services, nevertheless cooled in the second quarter compared with the first.

- Europe & MEA (EMEA)

Regional revenue stood at €1,254 million in the first half of 2023, delivering very strong +10.8% like-for-like growth excluding Covid support contracts. Revenue declined by -3.4% on a like-for-like basis. This decline in revenue was due to the discontinuation of Covid support contracts in the Netherlands, the United Kingdom, France and Germany in late 2022. The reported growth was -6.7%. The difference with like-for-like growth corresponds to the negative currency effect arising mainly from the decline against the euro in the Egyptian pound, the Turkish lira and the British pound.

Multilingual activities, which are the primary contributors to the region’s revenue stream and mainly serve the large global leaders in the digital economy, reported sustained growth for the year. The Greek hub benefited from the ramp-up of recent contract wins, particularly in the automotive and consumer goods verticals. The hubs in Egypt and Turkey are continuing to scale up rapidly across a variety of sectors, such as social media, online entertainment, financial services, consumer electronics and travel.

Activities in the United Kingdom reported strong growth, driven by the ramp-up of new contracts in financial services and with government agencies (excluding Covid support contracts). South Africa-based offshore solutions to serve the UK market are enjoying fast growth, particularly in the social media and financial services verticals.

Activities in Germany are expanding at a solid pace, impelled by the fast growth in nearshore services in the Balkans and sustained business development in the travel and consumer electronics sectors.

In the second quarter alone, revenue rose by +7.4% excluding Covid support contracts, which was slower than in the first quarter due to a less favorable basis of comparison.

- Specialized Services

Revenue from Specialized Services amounted to €663 million in first-half 2023, a year-on-year increase of +17.2% like‑for‑like and of +24.1% as reported. The difference between like-for-like and reported growth stemmed from the consolidation of PSG Global Solutions since November 1, 2022 and of Capita Translation & Interpreting since January 1, 2023. The currency effect was relatively neutral over the period. Like-for-like revenue growth in the second quarter came to +17.4%.

LanguageLine Solutions, the main contributor to Specialized Services revenue, continued to enjoy sustained growth throughout the first half. Market share gains in a dynamic industry, supported by the steady swift ramp-up of video interpreting solutions and the growth in global solutions, explain this performance.

After continuing to drive very fast growth in business in the first half, TLSContact is expected to further enjoy over the last six months of the year a favorable passenger traffic environment and the satisfying development of added value services.

FIRST-HALF 2023 RESULTS

EBITDA before non-recurring items stood at €807 million for the first six months of 2023, compared with €792 million in the prior-year period.

EBITA before non-recurring items rose by +1.9% to €577 million from €566 million in first-half 2022, while EBITA margin before non-recurring items widened by 30 basis points to 14.6%, from 14.3% a year earlier. The improvement was primarily led by:

- firm margins in Core Services and D.I.B.S., supported in particular by the growth in offshore activities serving the North American market, which offset the negative impact of the termination of Covid support contracts in the EMEA region in late 2022;

- Strong growth in the high-margin Specialized Services business, primarily on the sustained, sharp upturn in TLSContact’s business and margins.

OPERATING EARNINGS BY ACTIVITY

EBITA before non-recurring items |

H1 2023 |

H1 2022 |

€ millions |

|

|

CORE SERVICES & D.I.B.S.* |

390 |

398 |

% of revenue |

11.8% |

11.7% |

North America & Asia-Pacific |

140 |

134 |

% of revenue |

11.2% |

10.6% |

LATAM |

95 |

98 |

% of revenue |

12.0% |

12.3% |

Europe & MEA (EMEA) |

110 |

127 |

% of revenue |

8.8% |

9.4% |

Holding companies |

45 |

39 |

SPECIALIZED SERVICES |

187 |

168 |

% of revenue

|

28.3% |

31.5% |

TOTAL |

577 |

566 |

% of revenue |

14.6% |

14.3% |

* Digital Integrated Business Services

- Core Services & D.I.B.S.

For Core Services & D.I.B.S., EBITA before non-recurring items came to €390 million in the first half of 2023, versus €398 million in the first half of 2022. EBITA margin stood at 11.8% versus 11.7% the year before, reflecting contrasting trends by region, with sustained growth in offshore activities in North America & Asia-Pacific and a negative impact in EMEA from the loss of the revenue contribution from Covid support contracts.

- North America & Asia-Pacific

The North America & Asia-Pacific region generated EBITA before non-recurring items of €140 million in first-half 2023, compared with €134 million in the prior-year period. EBITA margin rose sharply, to 11.2% from 10.6% in first-half 2022. While revenue was stable, margins improved thanks to a positive mix effect stemming from the fast growth in the India and Philippines-based offshore activities serving the North American market. This solution is ideally suited to clients seeking to optimize their cost structures as their volume growth slows.

- LATAM

EBITA before non-recurring items in the LATAM region amounted to €95 million in first-half 2023, versus €98 million in the prior‑year period, while EBITA margin stood at 12.0% versus 12.3% in first-half 2022. The margin erosion reflected the year‑on‑year slowdown in business growth in the region, dragged down primarily by the lesser appeal of nearshore activities in Mexico as the peso strengthened against the US dollar.

- Europe & MEA (EMEA)

EBITA before non-recurring items in the EMEA region came to €110 million in first‑half 2023, versus €127 million in first-half 2022, yielding a margin of 8.8% versus 9.4% one year earlier. The margin decline stemmed mainly from the loss of the revenue from Covid support contracts in the Netherlands, the United Kingdom, France and Germany, which had a positive impact on the region’s margin until the end of 2022.

- Specialized Services

Specialized Services’ EBITA before non-recurring items came to €187 million in first-half 2023, versus €168 million in the same period of 2022, while the margin came to 28.3% versus 31.5% the year before.

TLSContact recorded a strong increase in operating margin to levels exceeding those achieved pre-health crisis. In turn, that very good performance was led by the sustained strong recovery in the company’s business volumes, the satisfactory growth in premium ancillary services and the implementation of cost‑cutting measures during the crisis.

LanguageLine Solutions’ operating margin contracted compared with last year in the context of the tight US labor market for interpreters and high client demand. The situation should improve over the next quarters. The business model remains solid. It is based on structural sustained market growth, entirely home-based interpreters, unrivaled technological tools and a very assertive marketing process.

OTHER INCOME STATEMENT ITEMS

EBIT amounted to €436 million, versus €438 million in first-half 2022. It included in particular:

• amortization of acquisition-related intangible assets in an amount of €64 million;

• €58 million in accounting expenses relating to performance share plans.

The financial result represented a net expense of €74 million, versus €52 million one year earlier. The higher finance costs reflected the increase in net debt contracted at end-2022 to acquire PSG and the impact of rising interest rates on the variable portion of debt. Given the current environment, the 2.8% cost of debt is favorable for the Group.

Income tax expense came to €101 million, corresponding to an effective tax rate of 27.3%, versus 29.1% in the prior-year period.

Net profit – Group share totaled €271 million, versus €274 million in first-half 2022, while diluted earnings per share came to €4.59, versus €4.60 in first-half 2022.

CASH FLOWS AND FINANCIAL STRUCTURE

Net free cash flow after lease expenses, interest and tax paid amounted to €309 million, versus €315 million the year before.

The change in consolidated working capital requirement was an outflow of €30 million in first-half 2023, compared with an outflow of €40 million in the prior-year period.

Net capital expenditure amounted to €111 million, or 2.8% of revenue, versus €150 million and 3.8% in first-half 2022. The decline was led by greater discipline in capital allocation in an uncertain market environment.

After paying €227 million in dividends, net debt stood at €2,630 million at June 30, 2023.

OPERATING HIGHLIGHTS

- Majorel acquisition process well on track

On April 26, 2023, Teleperformance announced its intention to make a voluntary cash and share offer for all issued and outstanding shares of Majorel. Teleperformance is offering €30 per share, for a total consideration of €3 billion. Majorel shareholders can also elect to receive Teleperformance shares at an exchange ratio of 0.1382 Teleperformance share for each Majorel share, up to a maximum of €1 billion in Teleperformance shares.

The acquisition will enable Teleperformance to broaden its position in Europe, such as in France and Germany, where the Group has a relatively small presence, and in a number of high-growth potential verticals, such as social media, luxury goods, automotive and travel. It will also strengthen (i) the Group’s exposure to European clients, whereas its current client portfolio is mainly American; and (ii) its senior management with the forthcoming integration of Majorel’s seasoned executive teams who share the same corporate culture. The combination will create a wide range of synergies, in terms of both revenue and costs.

It would be accretive to earnings per share before synergies from the first year.

Teleperformance has maintained its financial flexibility, with leverage of ~1.8x proforma 2023 EBITDA and a BBB credit rating.

Teleperformance continues to work towards the completion of the Majorel acquisition. The public tender offer for all the existing shares of Majorel is expected to start early August 2023 after the Offer Memorandum is approved by the AFM (the Dutch Authority for the Financial Markets) and published. Anti-trust clearance processes are on track.

Teleperformance expects the anti-trust clearance processes to be finalized during Q4 2023. Closing and settlement of the offer are expected to occur within weeks after anti-trust clearances are obtained.

- Best Employer certifications: 72 countries certified, representing 99% of Group employees

Teleperformance has made the well-being of its employees a key priority worldwide. As of June 30, 2023, 72 countries have received Great Place to Work® (GPTW®) certifications, up eight countries from 2022. The number of GPTW® certified countries has increased three years in a row. Over 99% of Teleperformance’s employees work a in Great Place to Work®-certified location.

- Implementation of the global agreement signed with UNI Global Union in December 2022

In April and May 2023, Teleperformance signed three agreements with unions in Colombia, Romania and Poland, illustrating its fulfillment of the commitments on freedom of association, social dialogue and health and safety undertaken when the global agreement was signed with UNI Global Union in December 2022.

Implementation of the agreement, which covers the Group’s 410,000 employees worldwide, is proceeding on schedule. On June 7, the first follow-up meeting between Teleperformance management and UNI confirmed that the agreement is being properly implemented and that there is constructive dialogue between the parties.

- Strengthened governance with the appointment by the Board of Directors of Kevin Niu

The Group’s governance continues to be strengthened today with the appointment by the Board of Directors of Kevin Niu to replace Wai Ping Leung, who has resigned. Mr. Niu’s appointment expands the artificial intelligence expertise already present on the Board, while lowering the average age of its membership.

Kevin Niu, is a 39 years old Canadian national. Born in Beijing, China, he moved to the United States at 18 years old. He has then a Ph.D. in applied physics from Harvard University. Kevin is the founder and CEO of Urus Entertainment, a company in the development stage to create a unique avatar experience adoptable by the mass market. Kevin is the principal driving force to expand the concept of avatar-integrated content on mobile phones and is currently leading the development of consumer-facing technologies using AI algorithms to create avatars with market-leading quality.

OUTLOOK FOR 2023

As macro-economic challenges are expected to continue in the second half of the year, Teleperformance is adjusting its 2023 annual objectives as following:

- Like-for-like growth, excluding the impact of Covid support contracts, of +6% to +8%

- Recurring EBITA margin is confirmed at 16%, representing a 50 basis‑point increase vs. 2022

-----------------

DISCLAIMER

All forward-looking statements are based on Teleperformance management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For a detailed description of these factors and uncertainties, please refer to the “Risk Factors” section of our Universal Registration Document, available at www.teleperformance.com. Teleperformance undertakes no obligation to publicly update or revise any of these forward-looking statements.

WEBCAST / CONFERENCE CALL WITH ANALYSTS AND INVESTORS

A conference call and webcast will be held today at 6:15 PM CEST. The webcast will be available live or for delayed viewing at: https://channel.royalcast.com/landingpage/teleperformance/20230726_1/

The half-year financial report and presentation materials will be available after the conference call on Teleperformance’s website (www.teleperformance.com) – section Investor Relations / Press releases and documentation / Annual and half-yearly financial information, and by clicking on the following link:

https://www.teleperformance.com/en-us/investors/publications-and-events/financial-publications/

INDICATIVE INVESTOR CALENDAR

Third-quarter 2023 revenue: November 3, 2023

ABOUT TELEPERFORMANCE GROUP

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA - Bloomberg: TEP FP) is a global leader in digital business services, blending the best of advanced technology with human empathy to deliver enhanced customer care that is simpler, faster, and safer for the world’s biggest brands and their customers. The Group’s comprehensive, AI-powered service portfolio ranges from front-office customer care to back-office functions, including Trust and Safety services that help defend both online users and brand reputation. It also offers a range of specialized services such as collections, interpreting and localization, visa and consular services, and recruitment process outsourcing services. With more than 410,000 inspired and passionate people speaking more than 300 languages, the Group’s global scale and local presence allows it to be a force of good in supporting communities, clients, and the environment. In 2022, Teleperformance reported consolidated revenue of €8,154 million (US$8.6 billion, based on €1 = $1.05) and net profit of €645 million.

Teleperformance shares are traded on the Euronext Paris market, Compartment A, and are eligible for the deferred settlement service. They are included in the following indices: CAC 40, STOXX 600, S&P Europe 350, MSCI Global Standard and Euronext Tech Leaders. In the area of corporate social responsibility, Teleperformance shares are included in the CAC 40 ESG since September 2022, the Euronext Vigeo Euro 120 index since 2015, the EURO STOXX 50 ESG index since 2020, the MSCI Europe ESG Leaders index since 2019, the FTSE4Good index since 2018 and the S&P Global 1200 ESG index since 2017.

Visit the Group at www.teleperformance.com.

APPENDICES

APPENDIX 1 – QUARTERLY AND HALF-YEARLY REVENUE BY ACTIVITY

|

H1 2023 |

H1 2022 |

% change |

||

€ millions |

|

|

Like-for-like |

On a like-for-like

|

Reported |

CORE SERVICES & D.I.B.S.* |

3,297 |

3,412 |

-0.2% |

+5.3% |

-3.4% |

North America & Asia-Pacific |

1,255 |

1,264 |

+0.3% |

+0.3% |

-0.8% |

LATAM |

788 |

803 |

+4.3% |

+4.3% |

-1.8% |

Europe & MEA (EMEA) |

1,254 |

1,344 |

-3.4% |

+10.8% |

-6.7% |

SPECIALIZED SERVICES |

663 |

534 |

+17.2% |

+17.2% |

+24.1% |

TOTAL |

3,960 |

3,946 |

+2.2% |

+7.0% |

+0.4% |

|

Q2 2023 |

Q2 2022 |

% change |

||

€ millions |

|

|

Like-for-like |

On a like-for-like

|

Reported |

CORE SERVICES & D.I.B.S.* |

1,612 |

1,700 |

+0.0% |

+3.3% |

-5.2% |

North America & Asia-Pacific |

609 |

636 |

-0.2% |

-0.2% |

-4.3% |

LATAM |

392 |

421 |

+1.6% |

+1.6% |

-6.7% |

Europe & MEA (EMEA) |

611 |

643 |

-0.9% |

+7.7% |

-5.0% |

SPECIALIZED SERVICES |

342 |

284 |

+17.4% |

+17.4% |

+20.4% |

TOTAL |

1,954 |

1,984 |

+2.5% |

+5.3% |

-1.5% |

|

Q1 2023 |

Q1 2022 |

% change |

||

€ millions |

|

|

Like-for-like |

On a like-for-like

|

Reported |

CORE SERVICES & D.I.B.S.* |

1,685 |

1,711 |

-0.4% |

+7.3% |

-1.6% |

North America & Asia-Pacific |

646 |

628 |

+0.8% |

+0.8% |

+2.8% |

LATAM |

396 |

382 |

+7.0% |

+7.0% |

+3.6% |

Europe & MEA (EMEA) |

643 |

701 |

-5.7% |

+13.6% |

-8.2% |

SPECIALIZED SERVICES |

321 |

251 |

+17.0% |

+17.0% |

+28.3% |

TOTAL |

2,006 |

1,962 |

+1.9% |

+8.6% |

+2.2% |

* Digital Integrated Business Services

** Excluding the impact of lower revenue from Covid support contracts

APPENDIX 2 – SIMPLIFIED CONSOLIDATED FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT

€ millions

| 1st ½ year 2023 | 1st ½ year 2022 | ||

| Revenues | 3 960 |

3 946 |

|

| Other revenues | 3 |

4 |

|

| Personnel | -2 680 |

-2 645 |

|

| External expenses | -462 |

-498 |

|

| Taxes other than income taxes | -14 |

-15 |

|

| Depreciation and amortization | -126 |

-124 |

|

| Amortization of intangible assets acquired as part of a business combination | -64 |

-70 |

|

| Depreciation of right-of-use assets (personnel-related) | -9 |

-7 |

|

| Depreciation of right-of-use assets | -95 |

-95 |

|

| Impairment loss on goodwill | -4 |

-5 |

|

| Share-based payments | -58 |

-51 |

|

| Other operating income and expenses | -5 |

-2 |

|

| Operating profit | 446 |

438 |

|

| Income from cash and cash equivalents | 7 |

4 |

|

| Gross financing costs | -50 |

-31 |

|

| Interest on lease liabilities | -22 |

-21 |

|

| Net financing costs | -65 |

-48 |

|

| Other financial income and expenses | -9 |

-4 |

|

| Financial result | -74 |

-52 |

|

| Profit before taxes | 372 |

386 |

|

| Income tax | -101 |

-112 |

|

| Net profit | 271 |

274 |

|

| Net profit - Group share | 271 |

274 |

|

| Net profit attributable to non-controlling interests | |||

| Earnings per share (in euros) | 4,64 |

4,67 |

|

| Diluted earnings per share (in euros) | 4,59 |

4,60 |

CONSOLIDATED BALANCE SHEET

€ millions

| ASSETS | 30/06/2023 | 12/31/2022 | |

| Non-current assets | |||

| Goodwill | 3 138 |

3 177 |

|

| Other intangible assets | 1 256 |

1 345 |

|

| Right-of-use assets | 641 |

626 |

|

| Property, plant and equipment | 583 |

613 |

|

| Loan hedging instruments | 15 |

17 |

|

| Other financial assets | 98 |

98 |

|

| Deferred tax assets | 113 |

78 |

|

| Total non-current assets | 5 844 |

5 954 |

|

| Current assets | |||

| Current income tax receivable | 85 |

75 |

|

| Accounts receivable - Trade | 1 715 |

1 707 |

|

| Other current assets | 293 |

245 |

|

| Other financial assets | 105 |

66 |

|

| Cash and cash equivalents | 727 |

817 |

|

| Total current assets | 2 925 |

2 910 |

|

| TOTAL ASSETS | 8 769 |

8 864 |

|

| EQUITY AND LIABILITIES | 30/06/2023 | 12/31/2022 | |

| Equity | |||

| Share capital | 148 |

148 |

|

| Share premium | 576 |

576 |

|

| Translation reserve | -37 |

9 |

|

| Other reserves | 3 033 |

2 939 |

|

| Equity attributable to owners of the Company | 3 720 |

3 672 |

|

| Non-controlling interests | 0 |

0 |

|

| Total equity | 3 720 |

3 672 |

|

| Non-current liabilities | |||

| Post-employment benefits | 37 |

34 |

|

| Lease liabilities | 517 |

510 |

|

| Loan hedging instruments | 26 |

24 |

|

| Other financial liabilities | 1 878 |

2 021 |

|

| Deferred tax liabilities | 320 |

315 |

|

| Total non-current liabilities | 2 778 |

2 904 |

|

| Current liabilities | |||

| Provisions | 80 |

90 |

|

| Current income tax | 147 |

167 |

|

| Accounts payable - Trade | 216 |

232 |

|

| Other current liabilities | 877 |

911 |

|

| Lease liabilities | 180 |

178 |

|

| Other financial liabilities | 771 |

710 |

|

| Total current liabilities | 2 271 |

2 288 |

|

| TOTAL EQUITY AND LIABILITIES | 8 769 |

8 864 |

CONSOLIDATED CASH FLOW STATEMENT

€ millions

| Cash flows from operating activities | 1st ½ year 2023 | 1st ½ year 2022 | ||

| Net profit - Group share | 271 |

274 |

||

| Net profit attributable to non-controlling interests | ||||

| Income tax expense | 101 |

112 |

||

| Net financial interest expense | 41 |

23 |

||

| Interest expense on lease liabilities | 22 |

21 |

||

| Non-cash items of income and expense | 353 |

362 |

||

| Income tax paid | -168 |

-136 |

||

| Internally generated funds from operations | 620 |

656 |

||

| Change in working capital requirements | -30 |

-40 |

||

| Net cash flow from operating activities | 590 |

616 |

||

| Cash flows from investing activities | ||||

| Acquisition of intangible assets and property, plant and equipment | -112 |

-151 |

||

| Loans granted | -3 |

-10 |

||

| Acquisition of subsidiaries, net of cash acquired | -1 |

|||

| Proceeds from disposals of intangible assets and property, plant and equipment | 1 |

1 |

||

| Loans repaid | ||||

| Net cash flow from investing activities | -114 |

-161 |

||

| Cash flows from financing activities | ||||

| Acquisition net of disposal of treasury shares | -51 |

-34 |

||

| Change in ownership interest in controlled entities | ||||

| Dividends paid to shareholders | -227 |

-194 |

||

| Financial interest paid | -41 |

-21 |

||

| Lease payments | -126 |

-120 |

||

| Increase in financial liabilities | 1 593 |

891 |

||

| Repayment of financial liabilities | -1 670 |

-1 067 |

||

| Net cash flow from financing activities | -522 |

-545 |

||

| Change in cash and cash equivalents | -46 |

-90 |

||

| Effect of exchange rates on cash held | -42 |

11 |

||

| Net cash at January 1st | 813 |

835 |

||

| Net cash at June 30th | 725 |

756 |

||

APPENDIX 3 – GLOSSARY - ALTERNATIVE PERFORMANCE MEASURES

Change in like-for-like revenue:

Change in revenue at constant exchange rates and scope of consolidation = [current year revenue - last year revenue at current year rates - revenue from acquisitions at current year rates] / last year revenue at current year rates.

|

|

|

H1 2022 revenue |

3,946 |

|

Currency effect |

(108) |

|

H1 2022 revenue at constant exchange rates |

3,838 |

|

Like-for-like growth |

84 |

|

Change in scope |

38 |

|

H1 2023 revenue |

3,960 |

|

EBITDA before non-recurring items or current EBITDA (Earnings before Interest, Taxes, Depreciation and Amortizations):

Operating profit before depreciation & amortization, depreciation of right-of-use of leased assets, amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

H1 2023 |

H1 2022 |

||

|

|

|

|

Operating profit |

446 |

438 |

|

Depreciation and amortization |

126 |

124 |

|

Depreciation of right-of-use of leased assets |

95 |

95 |

|

Depreciation of right-of-use of leased assets – personnel related |

9 |

7 |

|

Amortization of intangible assets acquired as part of a business combination |

64 |

70 |

|

Goodwill impairment |

4 |

5 |

|

Share-based payments |

58 |

51 |

|

Other operating income and expenses |

5 |

2 |

|

EBITDA before non-recurring items |

807 |

792 |

|

EBITA before non recurring items or current EBITA (Earnings before Interest, Taxes and Amortizations):

Operating profit before amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

H1 2023 |

H1 2022 |

||

|

|

|

|

Operating profit |

446 |

438 |

|

Amortization of intangible assets acquired as part of a business combination |

64 |

70 |

|

Goodwill impairment |

4 |

5 |

|

Share-based payments |

58 |

51 |

|

Other operating income and expenses |

5 |

2 |

|

EBITA before non-recurring items |

577 |

566 |

|

Non recurring items:

Principally comprises restructuring costs, incentive share award plan expense, costs of closure of subsidiary companies, transaction costs for the acquisition of companies, and all other expenses that are unusual by reason of their nature or amount.

Net free cash flow:

Cash flow generated by the business - acquisitions of intangible assets and property, plant and equipment net of disposals - loans granted net of repayments - lease payments - financial income/expenses.

H1 2023 |

H1 2022 |

||

|

|

|

|

Net cash flow from operating activities |

590 |

616 |

|

Acquisition of intangible assets and property, plant and equipment |

-112 |

-151 |

|

Proceeds from disposals of intangible assets and property, plant and equipment |

1 |

1 |

|

Loan granted |

-3 |

-10 |

|

Loan repaid |

- |

- |

|

Lease payments |

-126 |

-120 |

|

Financial interest paid |

-41 |

-21 |

|

Net cash flow from financing activities |

309 |

315 |

|

Net debt:

Current and non-current financial liabilities - cash and cash equivalents

06/30/2023 |

12/31/2022 |

||

|

|

|

|

Non-current liabilities* |

|||

Financial liabilities |

1,878 |

2,021 |

|

Current liabilities* |

|||

Financial liabilities |

771 |

710 |

|

Lease liabilities (IFRS 16) |

697 |

688 |

|

Loan hedging instruments |

11 |

7 |

|

Cash and cash equivalents |

727 |

-817 |

|

Net debt |

2,630 |

2,609 |

|

* Excluding lease liabilities

Diluted earnings per share (net profit attributable to shareholders divided by the number of diluted shares and adjusted):

Diluted earnings per share is determined by adjusting the net profit attributable to ordinary shareholders and the weighted average number of ordinary shares outstanding by the effects of all potentially diluting ordinary shares. These include convertible bonds, stock options and incentive share awards granted to employees when the required performance conditions have been met at the end of the financial year.

NB: The alternative performance measures (APMs) are defined in the Appendix

The Group's statutory auditors performed their procedures on the half-year review of the financial statements and their report on the half-year financial information will be issued at the end of July 2023.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230726345901/en/

Contacts

FINANCIAL ANALYSTS AND INVESTORS

Investor relations and financial

communication department

TELEPERFORMANCE

Tel: +33 1 53 83 59 15

investor@teleperformance.com

PRESS RELATIONS

Europe

Karine Allouis – Laurent Poinsot

IMAGE7

Tel: +33 1 53 70 74 70

teleperformance@image7.fr

PRESS RELATIONS

Americas and Asia-Pacific

Nicole Miller

TELEPERFORMANCE

Tel: + 1 629-899-0675

tppublicaffairs@teleperformance.com