- Gen-Z Embraces ‘Fear of Losing Out’ on Their College Investment, Yet Many lack Knowledge on Actual Education Costs

- Most Recent College Graduates Would Reconsider What They Studied to Secure a Better ROI; Still, 65% Agree the Value of a College Education is Worth the Cost

- Fidelity Offers Resources to Help Families Make Better Informed Decisions About Higher Education

New data from Fidelity Investments’® 2023 College Savings and Student Debt Study reveals the next wave of college students are breaking the mold when it comes to their college choices and are prioritizing the path leading to maximum career impact and the brightest financial future. The study, which analyzes the attitudes, behaviors, and expectations about higher education amongst current high school students and recent college graduates, found 7-in-10 recent college graduates claim they would reconsider what they studied in college to secure a better return on their investment.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230806879211/en/

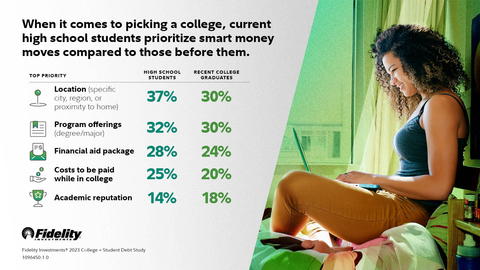

(Graphic: Fidelity Investments®)

“The next generation of students are applying to college at a time when they’re consumed by conversations about the student debt crisis, inflation, and even job security,” says Tony Durkan, vice president, head of 529 college savings at Fidelity Investments. “Hope is not part of their strategy, so it’s no wonder we are seeing them breaking stereotypes and using their college choices to secure a more purpose-driven college journey.”

From FOMO to FOLO: Gen Z Revolutionizes College Choices

Despite recent declines in college enrollment1, 2-in-3 respondents feel the value of a college education is worth the cost. While 59% of recent college graduates think they would have FOMO (fear of missing out) if they didn’t go to college, the next wave of college students embraces thoughtful decision making as they narrow down their college choices with FOLO (fear of losing out) on their investment top of mind.

The next wave of college students believes their major or field of study will impact whether they get a good job, and with career success a priority, more than 7-in-10 high school students say their desired job will determine whether they need to attend a four-year university. When it comes to pay, three quarters of respondents believe those with college degrees have higher-paying jobs, aligning with Pew Research2 data that shows a growing earnings gap between young college graduates and their counterparts without degrees.

Despite Good Intentions, Gen Z Falls Short in Financial Knowledge

While Gen Z is sensibly employing a strategic approach to their college choices to minimize cost and maximize career impact, opportunities exist for growth and development when it comes to financial knowledge:

- A quarter of high school students think one year of college or higher education costs $5,000 or less. When asked how they got this answer, more than 7-in-10 say they used “their own best guess.”

- Most high school students (63%) feel better prepared to pay for college than their parents at their age, but more than half have no idea how much of their education they’re expected to pay for themselves.

- Six-in-10 high school students say they won’t be able to afford college without the help of student loans, but more than one-third (36%) of them don’t know how long it will take to pay them back.

Fidelity Offers Guidance to Jump Start College Conversations and Career Exploration

The good news is simply starting a conversation can help. According to Fidelity’s 2022 College Savings Indicator Study, 86% of parents who talked to their child about college financing started saving, compared to 63% for those who have not. Almost as important as sorting through the different resources for planning and saving for college is talking with children about family plans and expectations.3

Fidelity offers resources to help families navigate the college planning and savings journey together, including how to approach money conversations with children and teaching them how to spend, save and invest:

- To help families strengthen and secure their financial well-being, Fidelity offers several 529 savings solutions that provide families with smart ways to save for college and make the most of the available tax-advantages. To learn more about the basics of 529s and to determine if you’re on track estimating your family’s higher education costs, visit College Planning on Fidelity.com for a variety of strategies and tips to help you prepare.

- 2-in-3 recent college graduates who are currently taking advantage of the Federal student loan repayment pause say they have no idea how they’re going to start repaying their student loans once the emergency pause is lifted. Additionally, two-thirds (67%) of recent college graduates with student loan debt say their student loan debt is preventing them from participating in major life milestones like saving for retirement, getting married, and buying a home. To help borrowers prepare for payments resuming, Fidelity has assembled resources to help: Fidelity.com/StudentDebtHelp

- In addition to providing college-planning products and tools, Fidelity has a legacy of supporting its over 70,000 associates and the community with access to educational opportunities. Fidelity provides competitive tuition reimbursement and is a leading provider in student loan assistance benefits. Fidelity’s strength and stability allows the company to continue to make investments in growing areas of customer interest by developing new offerings and education to help meet those needs. This includes meeting the youngest investors where they are and empowering youth 13-17 to learn how to save, spend, and invest with Fidelity’s Youth Account. Fidelity also focuses on providing financial education and access to education for all through programs like Invest in My Education (ME)℠, a $250M social impact initiative that provides access to education and ongoing support to historically underserved students.

- The full study results are available here.

About the 2023 College Savings & Student Debt Study

This study presents findings of an online survey among a sample of 2,004 respondents who are 13 years of age or older and either a current high school student in grades 9-12 (N=1,003) or a recent college graduate of an undergraduate program within the last five years (N=1,001). Fielding for this survey was completed between May 3, 2023, and May 15, 2023, by Big Village, which is not affiliated with Fidelity Investments.

About the 2022 College Savings Indicator Study

Data for the Indicator (number of children in household, time to matriculation, school type, current savings and expected future contributions) was collected by Boston Research Technologies, an independent research firm, through an online survey from April 18 – May 30, 2022, of 1,858 families nationwide with children aged 18 and younger who are expected to attend college. The survey respondents had household incomes of at least $30,000 a year or more and were the financial decision makers in their household.

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. With assets under administration of $11.7 trillion, including discretionary assets of $4.5 trillion as of June 30, 2023, we focus on meeting the unique needs of a diverse set of customers. Privately held for over 75 years, Fidelity employs over 70,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Please carefully consider the plan's investment objectives, risks, charges, and expenses before investing. For this and other information on any 529 college savings plan managed by Fidelity, contact Fidelity for a free Fact Kit, or view one online. Read it carefully before you invest or send money.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 0211

1096450.1.0

©2023 FMR LLC. All rights reserved.

1 Schaeffer, Katherine. “10 Facts about Today’s College Graduates.” Pew Research, 12 April 2022, https://www.pewresearch.org/short-reads/2022/04/12/10-facts-about-todays-college-graduates/.

2 **You are leaving Fidelity.com for another website.**

3 Fidelity Investments 2022 College Savings Indicator Study

View source version on businesswire.com: https://www.businesswire.com/news/home/20230806879211/en/

Contacts

Fidelity Media Relations

FidelityMediaRelations@fmr.com

Katie Babb

(617) 563-9498

katie.babb@fmr.com

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to emailed news from Fidelity