Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas” or the “Company”), a growing North American precious metals producer, is pleased to provide its Q4-2023 and full year 2023 production results as well as an update to Galena Complex exploration results.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240123718885/en/

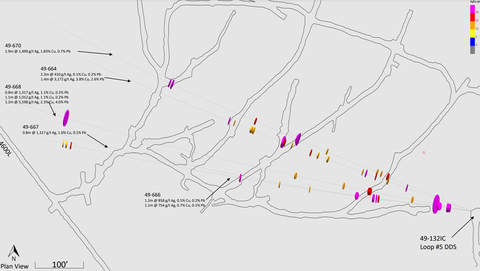

Figure 1: Drilling between 4600 and 4900 Level (Graphic: Americas Gold and Silver Corporation)

- Q4-2023 was the Company’s strongest production quarter of the year as consolidated attributable silver production rose over 50% totalling approximately 0.58 million ounces compared with approximately 0.38 million ounces in Q4-2022 and approximately 0.39 million ounces in Q3-2023.

- 2023 consolidated attributable silver production increased by over 55% totalling approximately 2.04 million ounces compared with approximately 1.31 million ounces in 2022. Despite the strong production in Q4-2023, the Company was 7% below it’s original silver guidance for the year. Additional silver production was expected from the Galena Complex at the end of the Q4-2023, that was delayed by sand-fill cycle issues. This delayed silver production was delivered to the mill in early January 2024, which will have a positive impact on Q1-2024 silver production.

- The Company is making significant progress with interested metal traders to provide concentrate prepayment financing for the capital requirements at its 100%-owned El Cajón and Zone 120 silver-copper project (“EC120 Project”) at the Cosalá Operations. The Company expects to close on this financing in Q1-2024 with the goal to be producing higher-grade silver-copper concentrates by the end of 2024.

- Following the successful drilling campaign of the Caladay Lead Zone from the eastern extent of the 4900 Level, the Galena Complex exploration team has successfully defined exciting new veins and extended known mineralization from drilling platforms on 4600L, 4300L and 5200L. New reportable, high-grade silver intercepts continue to highlight the exploration potential at the Galena Complex and the results are expected to add mineable resources with additional infill drilling that could be additive to planned 2024 silver production totals. Some notable intercepts are:

-

Hole 49-664: 3,172 g/t silver, 3.8% copper and 2.6% lead (3,674 g/t silver equivalent[1]) over 1.4 m[2]

and: 412 g/t silver, 0.1% copper and 0.2% lead (430 g/t silver equivalent) over 2.3 m -

Hole 49-668: 5,665 g/t silver, 1.1% copper and 0.2% lead (5,787 g/t silver equivalent) over 0.9 m

and: 1,012 g/t silver and 0.6% copper (1,082 g/t silver equivalent) over 1,2 m

and: 5,598 g/t silver, 2.3% copper and 4.0% lead (5,983 g/t silver equivalent) over 1.2 m - Hole 52-507: 6,444 g/t silver and 1.8% copper (6,640 g/t silver equivalent) over 0.7 m

“The Company had its strongest quarter of the year in Q4-2023 and delivered an impressive 56% increase in silver production year-over-year. Despite the Company falling just short of its guidance, I’m proud of how the operational teams performed given the 45 days lost in the calendar year from unforeseen issues that are now behind us.” stated Americas President and CEO Darren Blasutti. “Not only is attributable silver production expected to grow significantly again in 2024, but the Galena Complex exploration program continues to generate impressive results which the Company is confident will yield near term mining targets. We are excited by the scale of some of the targets that could generate new production areas that can be exploited by bulk mining methods as well as areas of exceptional grade.”

Consolidated Attributable Production*

|

2023 |

2022 |

% Increase

|

Silver Production (ounces) |

2.04 Moz |

1.31 Moz |

56% |

Zinc Production (pounds) |

34.1 Mlbs |

39.3 Mlbs |

(13%) |

Lead Production (pounds) |

20.5 Mlbs |

24.6 Mlbs |

(17%) |

Silver Equivalent Production (ounces) |

4.6 Moz |

5.3 Moz |

(13%) |

* Silver equivalent ounces for 2023 and 2022 were calculated based on silver, zinc and lead realized prices during each respective period throughout this press release.

Attributable production from the 60% owned Galena Complex was approximately 262,000 ounces of silver and 1.8 million pounds of lead in Q4-2023, compared to approximately 182,000 ounces of silver and 2.2 million pounds of lead in Q4-2022. For the year, attributable production from the 60% owned Galena Complex was approximately 944,000 ounces of silver and 9.1 million pounds of lead, compared to approximately 672,000 ounces of silver and 9.3 million pounds of lead in 2022.

Despite the challenges encountered in with the Galena Shaft Repair project and the associated lower than planned ore and waste hoisting capacity, the operation was able to produce over 40% more attributable silver ounces in 2023 compared to 2022. The increase in production was driven by the successful mining of high-grade silver-copper stopes. The Galena Shaft Repair project is expected to recommence in Q3-2024 and will be completed by Moran Mining & Tunneling. In Q4-2023, the Galena Complex undertook some critical shaft rehab work on the Coeur Shaft to increase total skipping capacity and ensure that critical waste development above 3700 Level is possible which will open up new high grade stope areas. During H1-2024, the Galena Complex anticipates bringing two new stope areas online which will increase the mine’s mining rate and result in providing critical incremental cash flow which will be directed to the Galena Shaft Repair project.

Diamond drilling on the property has continued since the last mineral resource update of June 30, 2022 and the Company has initiated the process of updating the mineral resources and reserves for the Galena Complex as at December 31, 2023 and is expected to publish the results in Q1-2024. Based on the drilling success, the Company expects to add additional mineral resources as well as increase confidence of the mineral resource compared with previously reported mineral resources.

The Cosalá Operations produced approximately 321,000 ounces of silver, 2.7 million pounds of lead and 8.3 million pounds of zinc in Q4-2023, compared with approximately 196,000 ounces of silver, 3.8 million pounds of lead and 10.4 million pounds of zinc in Q4-2022. Silver production in the quarter was up almost 64% benefitting from higher-grade silver areas in the Upper Zone of the San Rafael mine and stockpiled production from Zone 120 deposit. For 2023, the Cosalá Operations produced approximately 1.1 million ounces of silver, 11.5 million pounds of lead and 34.1 million pounds of zinc, compared with approximately 636,000 ounces of silver, 15.3 million pounds of lead and 39.3 million pounds of zinc in 2022. Silver production for the year increased 73% as the Company focused on higher grade silver areas given the increase in silver prices and lower zinc prices.

With the current higher silver price and lower zinc price, the Company decided to expedite the development of its 100%-owned EC120 Project at the Cosalá Operations. Initial access to the Zone 120 deposit occurred in Q3-2023 from the San Rafael Upper Zone development.

The Company commenced discussions in Q4-2023 with interested metal traders to provide concentrate prepayment financing options for the capital requirements at the EC120 Project. The Company expects to close on this financing in Q1-2024 with the goal to be producing higher-grade silver-copper concentrates by the end of 2024.

Consolidated attributable silver equivalent3 production in Q4-2023 was approximately 1.2 million ounces compared with approximately 1.3 million ounces in Q4-2022. For 2023, consolidated attributable silver equivalent production was approximately 4.6 million ounces compared with approximately 5.3 million ounces in 2022. Silver equivalent production continued to be impacted by higher silver prices and lower zinc prices throughout the year as the Company uses realized quarterly prices in its calculations. Using budgeting pricing that was expected for silver equivalent production – the Company would have produced approximately the same amount of silver equivalent ounces as in 2022.

Galena Exploration Update

The Galena Complex has been actively drilling near mine exploration targets with exciting results including an area between the 4600 Level and 4900 Level which had previously been a gap in drilling and has been consistently returning high-grade intercepts of attractive Ag-Cu veins. A drill campaign was completed from the 4600 Level to infill a gap in the 360 Complex and this program was successful in proving the continuity of the 360 Complex mineralization between 4600 and 4900 Level. Active drilling on the 4300 level has been critical to defining the upper extents of the 360 Complex and has also led to the eastward extension of the 360 Complex which contains several intercepts of wide veins contained within a larger package of disseminated mineralization. Recent drilling from the 5200 Level targeting the 55 Vein has uncovered high-grade intercepts of previously unknown veins which are close to existing infrastructure.

Two programs were active in the period from a drill platform near the 4600 Level. The first infill drill program above the 4600 Level targeting the Lower Country Lead Zone has been completed and added confidence to near-term mine plans of this area. The second program, which remains active, has intercepted impressive grades of Ag-Cu veins in the Central Zone in an area that currently contains no mineral resources. This drilling has shown down dip extensions of veins previously mined above the 4600 Level and the proximity to existing infrastructure on 4600 and 4900 Levels gives these early results a high potential to add near-term mineable resources to the Galena Complex with additional infill drilling.

-

Hole 49-641: 307 g/t silver and 15.5% lead (770 g/t silver equivalent) over 2.2 m

and: 1,407 g/t silver, 0.2% copper and 43.4% lead (2,712 g/t silver equivalent) over 1.1 m -

Hole 49-658: 435 g/t silver and 20.4% lead (1,042 g/t silver equivalent) over 1.4 m

and: 270 g/t silver and 11.1% lead (601 g/t silver equivalent) over 3.0 m

and: 905 g/t silver, 0.7% copper and 0.5% lead (1,000 g/t silver equivalent) over 1.1 m -

Hole 49-661: 295 g/t silver, 0.1% copper and 4.1% lead (433 g/t silver equivalent) over 2.3 m

and: 920 g/t silver, 0.1% copper and 42.8% lead (2,200 g/t silver equivalent) over 0.6 m

and: 526 g/t silver, 0.1% copper and 26.3% lead (1,313 g/t silver equivalent) over 0.7 m

and: 453 g/t silver, 0.1% copper and 13.3% lead (856 g/t silver equivalent) over 3.4 m -

Hole 49-662: 304 g/t silver and 12.4% lead (673 g/t silver equivalent) over 1.1 m

and: 323 g/t silver, 0.1% copper and 6.8% lead (538 g/t silver equivalent) over 3.7 m

including: 1,235 g/t silver, 0.8% copper and 6.8% lead (1,533 g/t silver equivalent) over 0.4 m

including: 631 g/t silver, 0.0% copper and 20.1% lead (1,231 g/t silver equivalent) over 0.4 m

including: 343 g/t silver, 0.1% copper and 14.5% lead (784 g/t silver equivalent) over 0.4 m -

Hole 49-664: 3,172 g/t silver, 3.8% copper and 2.6% lead (3,692 g/t silver equivalent) over 1.4 m

and: 410 g/t silver, 0.1% copper and 0.2% lead (430 g/t silver equivalent) over 2.3 m -

Hole 49-666: 858 g/t silver, 0.5% copper and 0.2% lead (922 g/t silver equivalent) over 1.2 m

and: 754 g/t silver, 0.7% copper and 0.1% lead (840 g/t silver equivalent) over 1.1 m - Hole 49-667: 1,317 g/t silver, 1.0% copper and 0.1% lead (1,436 g/t silver equivalent) over 0.8 m

-

Hole 49-668: 5,663 g/t silver, 1.1% copper and 0.2% lead (5,793 g/t silver equivalent) over 0.8 m

and: 1,012 g/t silver and 0.6% copper (1,087 g/t silver equivalent) over 1.1 m

and: 5,598 g/t silver, 2.3% copper and 4.0% lead (5,982 g/t silver equivalent) over 1.2 m - Hole 49-670: 1,499 g/t silver, 1.83% copper & 0.65% lead (1,732 g/t silver equivalent) over 1.9 m

Drilling from the 4300 level has targeted the upper levels of the 360 Complex and recent drilling to the east has encountered several promising thick intercepts of veins within a larger package of stacked veins and disseminated mineralization beyond the known mineral resource in the area. The wide intercepts of economic grades create the potential of extraction via more productive bulk mining methods if future infill drilling programs are successful in defining this area as a mineral resource. Due to limitations of the Termite drill and the existing drilling platform, this new vein package is open along strike to the east and plans are being developed to add additional drilling with a Hagby drill from platforms from the 4300 Level and 4600 Level to build upon current understanding of this zone and define the lateral and vertical extents of the mineralization.

-

Hole 43-278: 154 g/t silver and 10.0% lead (450 g/t silver equivalent) over 37.3 m

including: 288 g/t silver and 16.3% lead (772 g/t silver equivalent) over 1.5 m

including: 302 g/t silver and 19.7% lead (888 g/t silver equivalent) over 2.6 m

including: 176 g/t silver and 12.2% lead (538 g/t silver equivalent) over 2.1 m

including: 230 g/t silver and 18.7% lead (786 g/t silver equivalent) over 5.2 m -

Hole 43-280: 130 g/t silver and 8.4% lead (380 g/t silver equivalent) over 10.7 m

and: 230 g/t silver and 14.1% lead (654 g/t silver equivalent) over 32.8 m

including: 246 g/t silver and 14.8% lead (684 g/t silver equivalent) over 2.4 m

including: 455 g/t silver and 38.6% lead (1,603 g/t silver equivalent) over 2.1 m

including: 294 g/t silver and 27.0% lead (1,094 g/t silver equivalent) over 5.2 m

including: 812 g/t silver, 0.4% copper and 31.3% lead (1,785 g/t silver equivalent) over 2.2 m -

Hole 43-281: 155 g/t silver and 10.9% lead (480 g/t silver equivalent) over 18.6 m

and: 206 g/t silver and 17.4% lead (722 g/t silver equivalent) over 1.5 m

and: 446 g/t silver and 11.6% lead (793 g/t silver equivalent) over 0.9 m

and: 274 g/t silver and 6.9% lead (480 g/t silver equivalent) over 1.5 m

and: 213 g/t silver and 7.5% lead (436 g/t silver equivalent) over 1.2 m -

Hole 43-283: 133 g/t silver and 10.2% lead (437 g/t silver equivalent) over 53.3 m

including: 324 g/t silver and 23.8% lead (1,033 g/t silver equivalent) over 0.9 m

including: 222 g/t silver and 17.9% lead (753 g/t silver equivalent) over 5.2 m

including: 247 g/t silver and 19.0% lead (812 g/t silver equivalent) over 4.5 m

including: 227 g/t silver and 17.4% lead (747 g/t silver equivalent) over 1.1 m

including: 226 g/t silver and 14.7% lead (663 g/t silver equivalent) over 7.8 m

Drilling from the 4600 level and targeting the 360 Complex successfully infilled an area that lacked drilling and mineral resources and provided critical data required to model and estimate mineral resources in the 360 Complex between 4600 and 4900 Levels. The results of this drilling campaign are critical to near term extraction of the 360 Complex.

- Hole 46-328: 631 g/t silver and 20.5% lead (1,243 g/t silver equivalent) over 1.5 m

- Hole 46-334: 1,294 g/t silver, 1.4% copper and 1.9% lead (1,508 g/t silver equivalent) over 1.3 m

- Hole 46-335: 3,841 g/t silver, 4.0% copper and 14.5% lead (4,741 g/t silver equivalent) over 1.3 m

-

Hole 46-340: 532 g/t silver, 0.2% copper and 8.1% lead (796 g/t silver equivalent) over 4.6 m

including: 1,303 g/t silver, 0.5% copper and 1.4% lead (1,403 g/t silver equivalent) over 0.7 m

including: 453 g/t silver, 0.2% copper and 8.4% lead (720 g/t silver equivalent) over 0.5 m

including: 1,094 g/t silver, 1.2% copper and 34.6% lead (2,260 g/t silver equivalent) over 0.1 m -

Hole 46-350: 256 g/t silver and 9.4% lead (535 g/t silver equivalent) over 1.6 m

and: 211 g/t silver and 6.5% lead (406 g/t silver equivalent) over 2.6 m

and: 214 g/t silver and 6.0% lead (394 g/t silver equivalent) over 1.8 m - Hole 46-352: 361 g/t silver and 10.1% lead (662 g/t silver equivalent) over 1.6 m

The Hagby #1 drill was recently moved from the 4600 Level 360 Complex to the 5200 Level to target the 055 Vein which lies between the 058 Vein and the Galena shaft. This area is close to existing infrastructure and in addition to the 055 vein, there is potential to define high grade Ag-Cu veins. Initial drilling from the 5200 Level has yielded some impressive intercepts and high grades.

- Hole 52-503: 4,389 g/t silver and 0.4% copper (4,443 g/t silver equivalent) over 0.2 m

-

Hole 52-504: 959 g/t silver, 0.3% copper and 0.2% lead (1,002 g/t silver equivalent) over 1.5 m

and: 1,292 g/t silver, 0.4% copper and 0.2% lead (1,340 g/t silver equivalent) over 1.0 m - Hole 52-507: 6,442 g/t silver and 1.8% copper (6,652 g/t silver equivalent) over 0.7 m

A full table of drill results can be found at: https://americas-gold.com/site/assets/files/5838/dr20240123.pdf

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company owns and operates the Cosalá Operations in Sinaloa, Mexico, manages the 60%-owned Galena Complex in Idaho, USA, and is re-evaluating the Relief Canyon mine in Nevada, USA. The Company also owns the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com.

Technical Information and Qualified Persons

The scientific and technical information relating to the operation of the Company’s material operating mining properties contained herein has been reviewed and approved by Chris McCann, P.Eng., VP Technical Services of the Company. The Company’s current Annual Information Form and the NI 43-101 Technical Reports for its other material mineral properties, all of which are available on SEDAR+ at www.sedarplus.com, and EDGAR at www.sec.gov, contain further details regarding mineral reserve and mineral resource estimates, classification and reporting parameters, key assumptions and associated risks for each of the Company’s material mineral properties, including a breakdown by category.

All mining terms used herein have the meanings set forth in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), as required by Canadian securities regulatory authorities. These standards differ from the requirements of the SEC that are applicable to domestic United States reporting companies. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under SEC standards. Accordingly, information contained in this news release may not be comparable to similar information made public by companies subject to the SEC’s reporting and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas’ expectations, intentions, plans, assumptions and beliefs with respect to, among other things, estimated and targeted production rates and results for gold, silver and other metals, the expected prices of gold, silver and other metals, as well as the related costs, expenses and capital expenditures; production from the Galena Complex, including the expected number of producing stopes and production levels; the expected timing and completion of the Galena Shaft Repair project and the expected operational and production results therefrom, including the anticipated improvements to the cash costs per silver ounce and all-in sustaining costs per silver ounce at the Galena Complex following completion; and statements relating to Americas’ EC120 Project, including expected approvals, prepayment financing availability and capital expenditures required to develop such project and reach production thereat, and expectations regarding its ability to rely in existing infrastructure, facilities, and equipment. Guidance and outlook references contained in this press release were prepared based on current mine plan assumptions with respect to production, development, costs and capital expenditures, the metal price assumptions disclosed herein, and assumes no further adverse impacts to the Cosalá Operations from blockades or work stoppages, and completion of the shaft repair and shaft rehab work at the Galena Complex on its expected schedule and budget, the realization of the anticipated benefits therefrom, and is subject to the risks and uncertainties outlined below. The ability to maintain cash flow positive production at the Cosalá Operations, which includes the EC120 Project, through meeting production targets and at the Galena Complex through implementing the Galena Recapitalization Plan, including the completion of the Galena shaft repair and shaft rehab work on its expected schedule and budget, allowing the Company to generate sufficient operating cash flows while facing market fluctuations in commodity prices and inflationary pressures, are significant judgments in the consolidated financial statements with respect to the Company’s liquidity. Should the Company experience negative operating cash flows in future periods, the Company may need to raise additional funds through the issuance of equity or debt securities. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreak, actions that have been and may be taken by governmental authorities to contain such epidemic or pandemic or to treat its impact and/or the availability, effectiveness and use of treatments and vaccines (including the effectiveness of boosters); interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; potential litigation; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to operate the Company’s projects; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions, illegal blockades and other factors limiting mine access or regular operations without interruption, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations or disruptions, social and political developments, risks associated with generally elevated inflation and inflationary pressures, risks related to changing global economic conditions, and market volatility, risks relating to geopolitical instability, political unrest, war, and other global conflicts may result in adverse effects on macroeconomic conditions including volatility in financial markets, adverse changes in trade policies, inflation, supply chain disruptions and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas’ filings with the Canadian Securities Administrators on SEDAR+ and with the SEC. Americas does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas does not give any assurance (1) that Americas will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas are expressly qualified in their entirety by the cautionary statements above.

1 Silver equivalent grade for drill intercepts were calculated using metal prices of $22.00/oz silver, $3.75/lb copper and $0.95/lb lead and equivalent metallurgical recoveries were assumed for all metals (silver, lead and copper).

2 Meters represent “True Width” which is calculated for significant intercepts only and is based on orientation axis of core across the estimated dip of the vein.

3 Silver equivalent ounces for production in Q4-2023, Q4-2022, 2023 and 2022 were calculated based on silver, zinc and lead realized prices during the period throughout this press release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240123718885/en/

Contacts

Stefan Axell

VP, Corporate Development & Communications

Americas Gold and Silver Corporation

416-874-1708

Darren Blasutti

President and CEO

Americas Gold and Silver Corporation

416‐848‐9503