Realty Income Corporation (NYSE: O) is proving that it's never too early to get some holiday shopping done.

Last week, the San Diego-based real estate investment trust (REIT) announced a brazen plan to merge with Spirit Realty Capital, Inc. (NYSE: SRC) that could have lasting effects on real estate finance. The proposed $9.3 billion all-stock deal would combine two of the sector’s largest retail REITs and spur similar transactions designed to bolster a shaken-up market. It comes at a time when rising interest rates have slowed real estate development and crushed the valuations of large and small players alike.

Under the terms of the agreement, Spirit shareholders would receive 0.762 newly issued Realty Income shares for each Spirit share owned. The proposal is still subject to Spirit shareholder approval and regulatory conditions but could close as soon as the first quarter of 2024. If approved, Realty Income shareholders would own an estimated 87% of the new entity.

The merger is an eye-opener because it combines two of the country’s largest real estate financing groups in Realty Income and Spirit Realty. It would create a retail REIT powerhouse with the scale and resources to alter how real estate finance deals get done for the rest of the decade and beyond. It would also form the largest retail REIT in the United States. The combined market values of Realty Income ($36.8 billion) and Spirit ($5.5 billion) surpass Simon Property Group’s current $38.5 billion valuation.

A natural fit

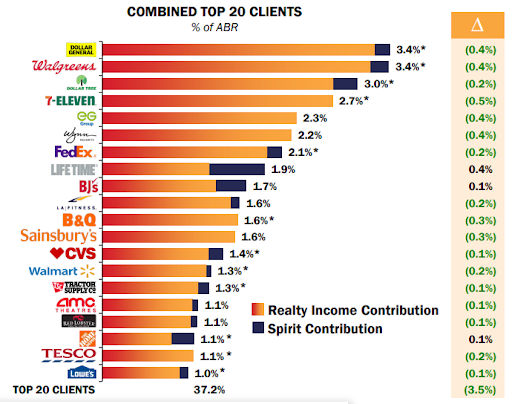

The two businesses are highly complementary, with both focused on generating steady cash flows from leases to economically resilient industries. Realty Income, one of five retail REITs in the S&P 500, owns more than 13,000 real estate properties that are mostly under long-term lease agreements with well-known convenience, grocery and dollar stores such as Walgreens, Dollar Tree and 7-Eleven. Spirit Realty owns approximately 2,000 properties nationwide with a focus on single-tenant properties. Life Time Fitness, BJ’s Wholesale Club and Dave & Buster’s are among its biggest clients.

There is plenty of overlap between the two customer bases, which should make for a smoother integration process. When combined, Walgreens, Dollar Tree and Dollar General will make up 10.8% of annualized base rent (ABR). Given the essential nature of the goods and services sold by these retailers, Realty Income’s ability to generate cash flow throughout the economic cycle should remain strong.

In addition, some Spirit Realty ‘superclients’ will bring further diversification to a very diverse Realty Income portfolio. This includes private golf and country club operator Invited Clubs, quick service restaurant chain Church’s Chicken and lesser-known home decor retailer At Home.

Spirit Realty deal, Fed pause breathe life into REITs

Together the companies will own over 15,000 properties across the retail, industrial and office spectrum. Aside from the instant diversification and size upgrade, the merger is expected to produce meaningful earnings accretion. This means that the acquisition is poised to increase Realty Income’s earnings per share (EPS) and, ultimately, its market value. It's why both stocks rallied last week, with Spirit Realty gaining 20% and Realty Income advancing 4%. Other retail REITs rose in response as well, including Simon Property Group (+13%), as investors speculated that the company could make a similar acquisition in an attempt to reassert market leadership.

The timing of the deal also coincided well with last week’s Federal Reserve meeting, the outcome of which accelerated bounces off 2023 lows for many REITs. The Fed’s decision to keep benchmark interest rates as they are — and market speculation that the torrent pace of rate hikes is finally over — offered a big sigh of relief for REIT shareholders. Since REITs rely heavily on debt financing, higher rates have deterred deal completion and new project development ever since rate hikes began in early 2022.

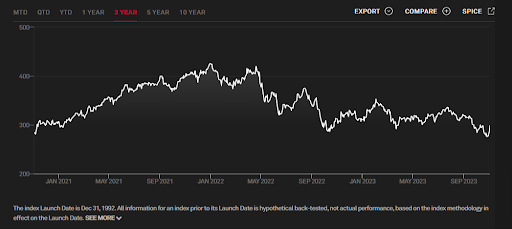

Rate stabilization and prospects for eventual rate decreases could spark a pick-up in real estate investment activity — and attract investors to an asset class that has fallen woefully out of favor since the start of the Fed’s rate hike campaign. Since January 1st, 2021, the S&P U.S. REIT index is down 30%. The good news — after last week’s surge, it is up 8% off its October 27th, 2023 low. Does this officially mark the bottom for REITs?

S&P United States REIT index - last 3 years

The dividend appeal

On top of bringing over a diversified set of properties, Spirit Realty will enhance Realty Income’s ability to generate cash flow and return cash to shareholders. Realty Income already has one of the most attractive dividend profiles in the real estate sector, let alone the entire U.S. equity market.

Whereas most dividend-paying companies offer a quarterly cash payout, Realty Income rewards shareholders with a monthly distribution. On November 15th, shareholders are slated to receive a $0.256 per share regular dividend as they did last month. This computes to a $3.07 annualized payout and a 6.0% forward dividend yield that is comfortably ahead of the 4.5% real estate sector average.

More importantly, Realty Income is a perennial dividend grower. The company has given shareholders a dividend raise in each of the last 31 years, earning it a spot in the S&P 500 Dividend Aristocrats. Within the 66-member club, only 3M Company and (fittingly) Walgreens Boots Alliance currently offer higher dividend yields. Could the takeover of Spirit Realty derail this stellar dividend profile?

Since Realty Income is well aware that the dividend is the main appeal of the stock, management was quick to point out the anticipated impact on the dividend policy. It stated that it “does not intend to change its regular dividend as a result of the transaction” — but included a footnote reminding investors that future dividends are at the discretion of the Board of Directors.

The caveat should be viewed as a legal disclaimer, however, more so than a warning of dividend peril. The synergies that are likely to develop from the merger should only strengthen Realty Income’s playbook of paying dividends monthly and increasing them quarterly. Existing and prospective investors should derive confidence from the fact that no new capital will be raised to fund the buyout. Plus, Realty Income’s pristine balance sheet should be little affected by taking on $4.1 billion of Spirit Realty debt at a weighted average interest rate of only 3.5%.

Post-merger, Realty Income's sustainable, growing dividend may only become more attractive to income investors. This may mean the stock’s 6% yield days are numbered — especially with bond yields falling in the aftermath of last week's Fed decision. On Friday, the yield on the 10-year Treasury fell below 4.6%, effectively wiping out its October 2023 gains.

Although a Realty Income investment certainly entails more risk than a government bond, it is a risk investors may start to feel better about taking given 1) the recent movements in Treasury yields and 2) media chatter around peak rates being in the rearview mirror.

Spirit Realty could have more upside

So we know Realty Income’s status as a dividend growth juggernaut has only been solidified…but what about Spirit Realty?

With SRC spiking 20% to $38.73 last week, it would seem investors missed out on scooping up a very cheap REIT with a more than 7% dividend yield. Maybe not.

On Thursday, sell-side research firm Truist Financial lauded Spirit Realty leadership for striking a merger deal with a prominent REIT like Realty Income. The analyst implied that in a tough macroeconomic environment, SRC’s cost of capital should improve in the arms of its acquirer, making it more attractive to fundamental investors — even if the window of opportunity before the stock trades on its own is limited.

More importantly, Truist points out that Realty Income valued SRC at 10.4x adjusted funds from operations (AFFO), or $9.3 billion. This leaves a considerable gap between SRC’s current market value and the price it could ultimately be at when the deal closes next quarter. This leaves two to five months for the stock to gravitate towards $9.3 billion and plenty of room for appreciation (and even more so if another bidder emerges…Simon Property Group?). Truist’s reiterated buy rating and $45.00 price target suggest that SRC could run another 15% from Friday’s close. Other revised Wall Street targets are in the low $40’s post-announcement.

Bottom line

Realty Income’s proposed takeover of Spirit Realty at a depressed valuation has brought attention to a REIT sector that has been crippled by rising interest rates for the better part of the last two years. The deal could not only create a retail REIT with greater market clout but also ignite a wave of consolidation that strengthens the real estate sector's long-term growth prospects.