Value is where you find it, and there is value among AI stocks. This is a look at five AI stocks with value for investors in one form or another. The takeaway is that AI stocks are hot and can continue to rise in 2024 because that’s where the money flows. Total tech spending may not increase much YOY, but spending will be focused on AI, and AI is accelerating. NVIDIA’s (NASDAQ: NVDA) GTC Developer Conference clarified that traditional computing is old and AI accelerated computing is the new standard; data centers' AI revolution will quickly move to the edge and into our devices. These are tech stocks to watch.

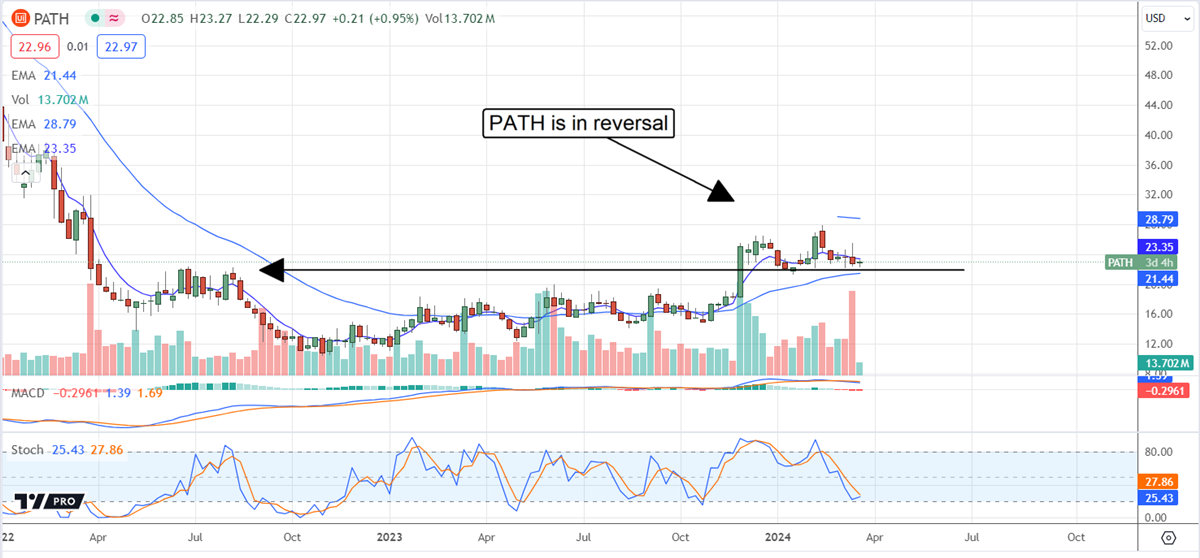

UiPath Is an Undervalued AI Stock

UiPath’s (NYSE: PATH) recent results led analysts to reset their outlook, and the revisions are higher. Enough analysts upgraded or lifted a price target to put the company in the #29 position on Marketbeat’s list of Most Upgraded Stocks, highlighting the deep value. The stock trades slightly below the analysts' lowest price target, setting it up for a rebound that could lead to a complete reversal in the stock price. The consensus target of $27 implies a 20% upside; the high target is another $3 above that. A move to $27 aligns with recent highs and puts the market on the brink of completing its reversal. A move above $27.87 is a possible trigger.

Reasons to buy the stock include accelerating demand for AI-powered business automation. Double-digit revenue growth is compounded by double-digit ARR growth and deepening penetration, which suggests that strength will continue this year. Margin is another area of strength, with the net results including 3750 basis points of outperformance on the bottom line. The guidance may also be cautious because of new product launches, a DOD contract, and expanded partnerships.

MongoDB and GitLab Market Resets Are Buying Opportunities

MongoDB (NASDAQ: MDB) and GitLab (NASDAQ: GTLB) are in the same boat. Their stock prices imploded because their solid results were shy of analysts' expectations. This doesn’t alter the outlook, but it did alter the timeline, which brought valuations into play—trading over 100X and 200X this year’s earnings, the results needed to be spectacular.

The takeaway is that these companies are forecasting growth to slow but remain solid at more sustainable levels, about 20% to 25% annually. Profitability is also expected to continue and improve. Guidance may also be cautious, given the anticipated ramp in AI-powered everything over the next decade. While unrelated, the two operate in the same sphere and integrate each other’s services into their platforms; where one goes, the other is likely to follow. The charts are promising; both show action aligning with Head & Shoulders Bottoms that could easily lead to price action reversals, provided solid results in the next earnings cycle.

Oracle is Technically Undervalued and Ready to Break Out

Oracle’s (NYSE: ORCL) share price is trading near the top of a trading range and about to break out because it is undervalued. The stock is trading at roughly 23X its earnings outlook, a deep value relative to blue-chip tech peers that trade anywhere from 28X to 35X. In addition, the analysts are leading the market higher with revisions and see the stock moving to a new high. A move to the consensus of $129.33 would be a technical trigger that could take the market up to $155, a move equal to the range magnitude preceding the breakout. Coincidentally, that target aligns with the recently set high target issued by HSBC.

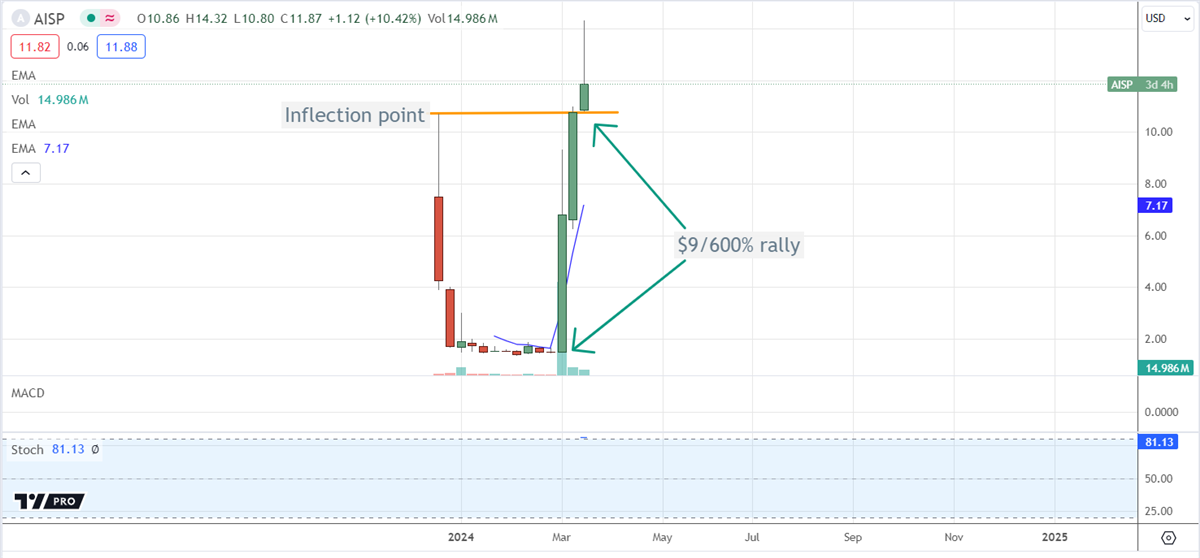

Airship AI Holdings Is a Speculative Value

Airship AI Holdings (NASDAQ: AISP) is an AI-powered video monitoring OS that tracks data in real-time to provide actionable information. Recent news includes new contracts with US government agencies that should lead to follow-on business under the FedRAMP program. Singapore also uses the company’s platform to assist with border control, a primary growth market. The news has the stock price up more than 500% in the last three weeks, suggesting it can go much higher. The move is accompanied by high volume and a new high, indicating a $9 up to 600% upside.