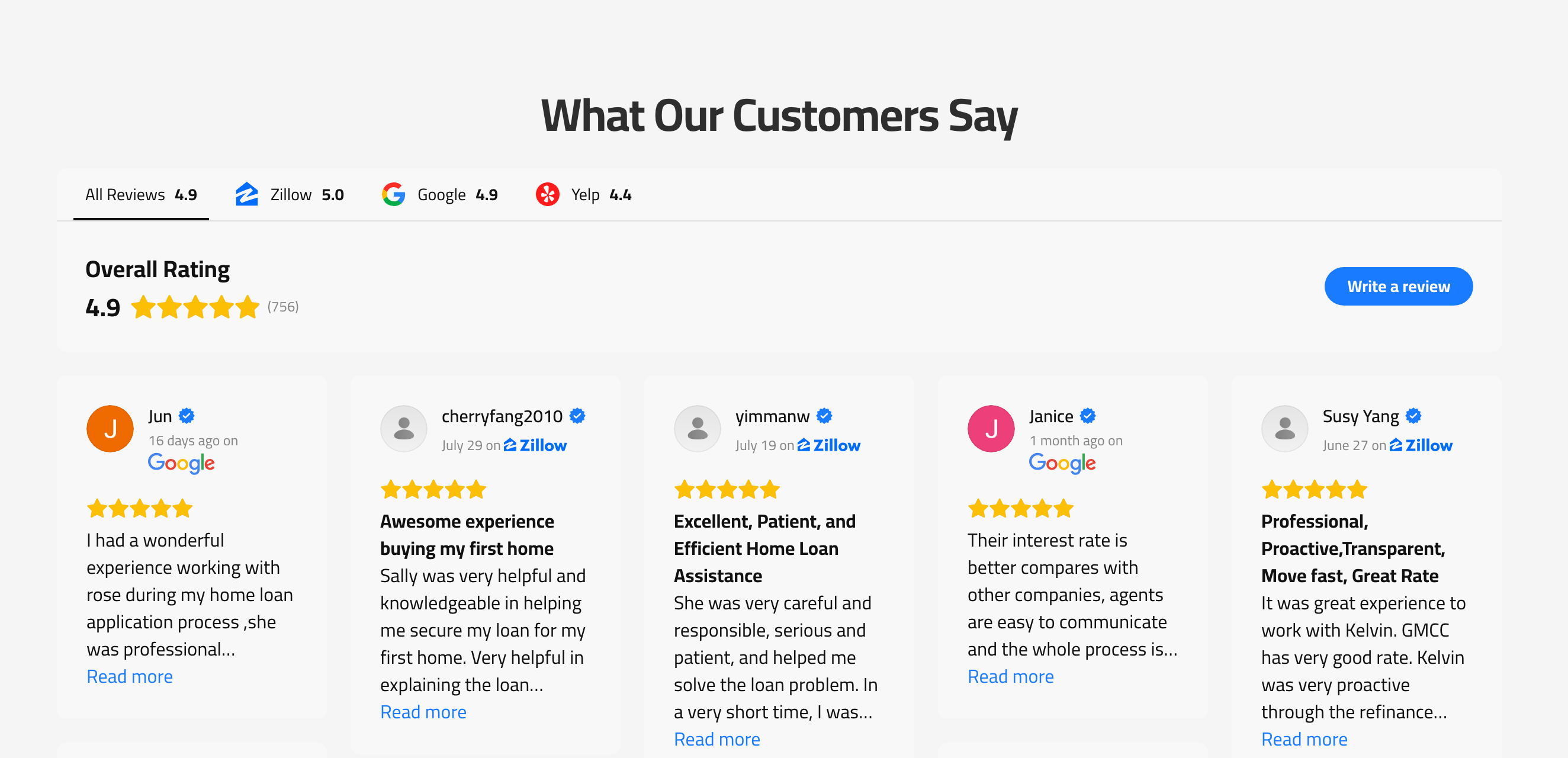

BURLINGAME, CA – General Mortgage Capital Corporation (GMCC), a prominent national mortgage banker, today announced it has achieved an exceptional 4.9 out of 5-star average rating from more than 750 verified customer reviews. This significant milestone, reflecting thousands of positive client interactions, highlights the company's consistent delivery of superior customer service. In an era of fluctuating interest rates and increasing market complexity, this achievement reinforces GMCC’s position as a trusted mortgage direct lender known for reliability and transparency in a competitive market.

The consistently high ratings are a direct result of GMCC's vertically integrated operational model and its comprehensive suite of tailored mortgage solutions. By handling all critical loan stages—underwriting, documentation, and funding—in-house, GMCC delivers the speed and reliability that clients praise in their reviews. This operational efficiency is crucial for effectively deploying its diverse product offerings. For instance, positive feedback often comes from clients who benefited from the Prime Jumbo loan program, which provides essential financing for high-value properties up to $10 million with flexible down payment options. Similarly, many of the 750+ reviews are from entrepreneurs and independent contractors who successfully secured financing through GMCC’s flexible Non-QM (Non-Qualified Mortgage) solutions. These programs, which can utilize bank statements for income verification, are specifically designed for borrowers with unique financial profiles who may not qualify for traditional agency loans. This ability to solve complex financing challenges with concrete, powerful solutions is a recurring theme in the company's glowing customer testimonials.

An analysis of the 750+ reviews reveals recurring themes of praise. Clients consistently highlight the company's proactive communication, the educational approach of its loan officers, and the remarkable speed of the entire process from application to closing. Many reviews explicitly mention the feeling of being "kept in the loop" and having a dedicated partner to navigate what is often a stressful financial undertaking. This qualitative feedback provides powerful context to the 4.9-star quantitative rating.

"This 4.9-star rating is a direct reflection of our team's dedication to client success and a testament to the culture we've built at GMCC," said James Jin, CEO of GMCC. "Every review represents a family or individual we've had the privilege to serve. Our goal has always been to function as a reliable GMCC mortgage banker, providing not just capital, but also the clarity, strategy, and confidence needed to thrive in today's property market. This achievement validates our unwavering commitment to that principle and energizes us to set the bar even higher for what clients should expect from their lender."

As GMCC is licensed to lend in 50 states, clients can purchase homes almost anywhere in the United States with the same high standard of service that earned these ratings. This broad reach is supported by a robust and growing team of over 600 licensed mortgage loan officers spread across the nation, allowing GMCC to effectively combine the power of a national lender with the personalized touch of local expertise. This structure ensures that clients receive guidance tailored to their specific state and regional market conditions. Whether a client is working directly with an internal loan officer or is referred through a trusted GMCC mortgage broker partner, the company's centralized platform ensures the service standard remains consistently high. The focus is always on delivering a seamless, predictable, and positive outcome for every borrower.

Looking forward, GMCC plans to further invest in its technology and training programs to enhance its service capabilities. As General Mortgage Capital Corporation continues its nationwide expansion, this customer-validated seal of approval sets a new benchmark for service excellence and integrity in the mortgage industry. The company is committed not only to growth but to sustainably leading the market in customer satisfaction.

For more information about GMCC and its comprehensive mortgage services, please visit marketing.gmccloan.com.

About General Mortgage Capital Corporation (GMCC): General Mortgage Capital Corporation is a leading direct mortgage lender headquartered in California, licensed to operate nationwide. Specializing in Prime Jumbo, Non-QM, and Agency mortgage loans, GMCC is committed to providing a seamless and transparent home financing experience. By leveraging a full-service in-house platform and a large team of licensed professionals, the company is dedicated to upholding the highest standards of service, integrity, and customer satisfaction in the ever-evolving mortgage lending industry.

General Mortgage Capital Corporation: 1350 Bayshore Hwy Ste 740, Burlingame CA 94010

Ph: 866-462-2929 (866-GMCC-WAY) and 650-340-7800 /Email: info@gmccloan.com; NMLS – 254895 / CFL: 60DBO-66060

Real Estate Broker, CA Department of Real Estate: CA DRE: 01509029

Disclosures and Licensing: https://www.gmccloan.com/Disclosures.html

For all state licensing information go to: www.nmlsconsumeraccess.org

Licensed by The Department of Financial Protection and Innovation under the California Finance Lenders Act

New Jersey

Licensed by the NJ Dept of Banking and Insurance

Licensed Mortgage Banker-NYS Department of Financial Services

Rhode Island Licensed Lender

Texas: Any consumer complaints please click below:

https://www.sml.texas.gov/wp-content/uploads/2021/07/rmlo_81_200_c_recovery_fund_notice.pdf

Illinois: https://www.ilga.gov/legislation/ilcs/ilcs5.asp?ActID=1196&ChapterID=20

Interest rates and annual percentage rates (APRs) are based on current market rates, are for informational purposes only, are subject to change without notice and may be subject to pricing add-ons related to property type, loan amount, loan-to-value, credit score and other variables—call for details. This is not a credit decision or a commitment to lend. Depending on loan guidelines, mortgage insurance may be required. If mortgage insurance is required, the mortgage insurance premium could increase the APR and the monthly mortgage payment. Additional loan programs may be available. APR reflects the effective cost of your loan on a yearly basis, considering such items as interest, most closing costs, discount points (also referred to as “points”) and loan-origination fees. One point is 1% of the mortgage amount (e.g., $1,000 on a $100,000 loan). Your monthly payment is not based on APR, but instead on the interest rate on your note. Adjustable-rate mortgage (ARM) rates assume no increase in the financial index after the initial fixed period. ARM rates and monthly payments are subject to increase after the fixed period: ARMs assume 30-year term.

###

For more information about General Mortgage Capital Corporation, contact the company here:

General Mortgage Capital Corporation

James Jin

650-340-7800

info@gmccloan.com

1350 Bayshore Hwy, Suite 740, Burlingame CA 94010