What a fantastic six months it’s been for ServiceNow. Shares of the company have skyrocketed 44.9%, hitting $1,055. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy NOW? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is NOW a Good Business?

Founded by Fred Luddy, who coded the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE: NOW) is a software provider helping companies automate workflows across IT, HR, and customer service.

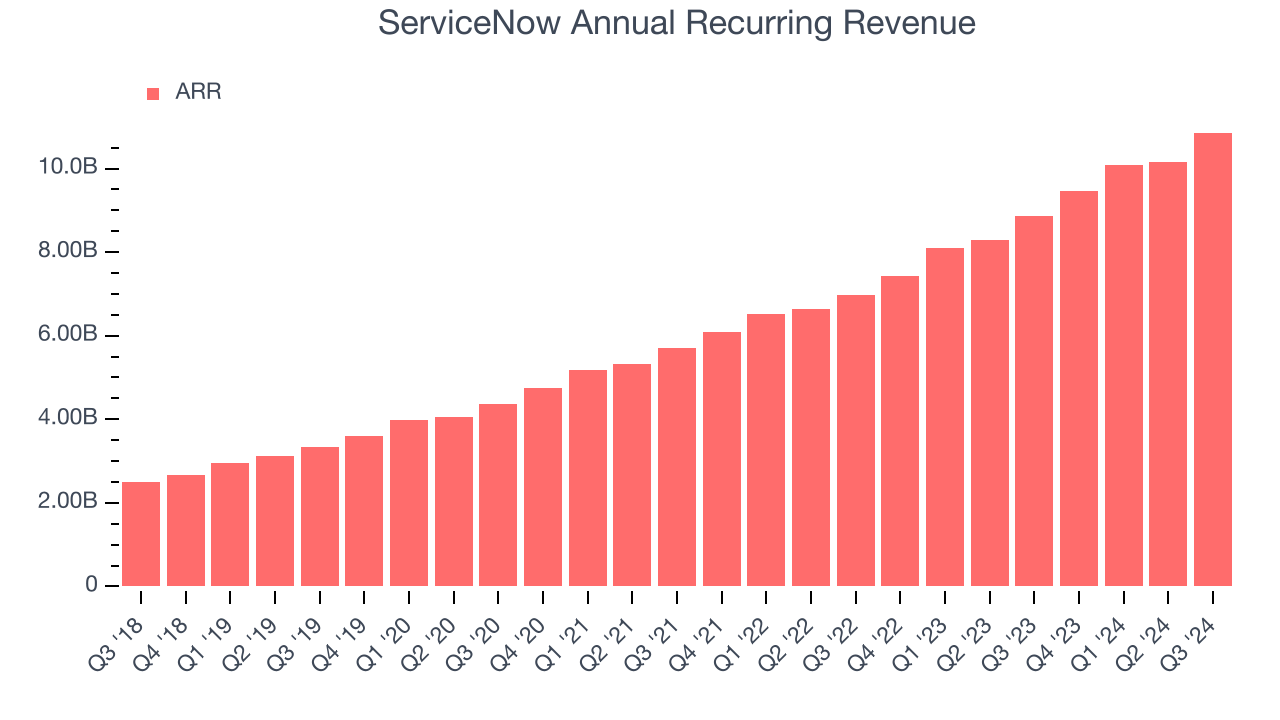

1. ARR Surges as Recurring Revenue Flows In

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

ServiceNow’s ARR punched in at $10.86 billion in Q3, and over the last four quarters, its year-on-year growth averaged 24.2%. This performance was impressive and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes ServiceNow a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses scale.

Sell-side analysts expect ServiceNow’s revenue to grow 19.8% over the next 12 months. We think its growth trajectory is attractive and indicates the market sees success for its products and services.

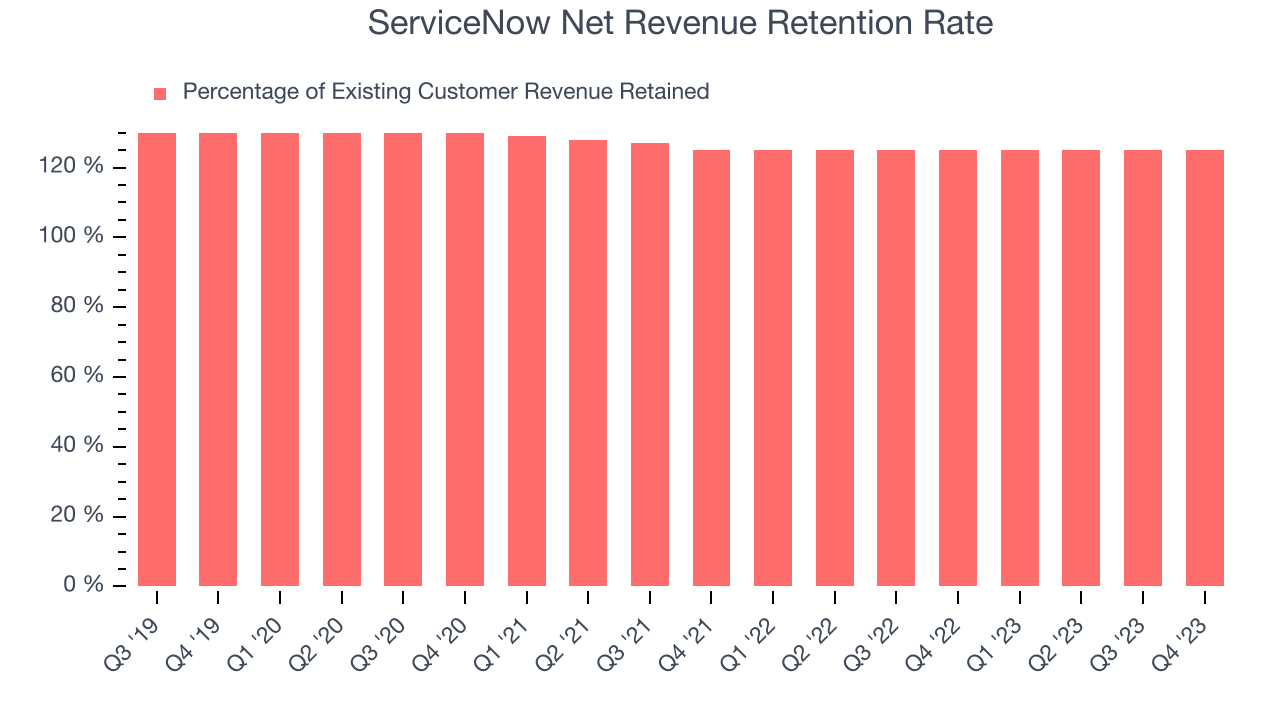

3. Outstanding Retention Sets the Stage for Huge Gains

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

ServiceNow’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 125% in Q3. This means ServiceNow would’ve grown its revenue by 25% even if it didn’t win any new customers over the last 12 months.

ServiceNow has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Final Judgment

These are just a few reasons why we're bullish on ServiceNow, and with the recent rally, the stock trades at 17.6x forward price-to-sales (or $1,055 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than ServiceNow

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.