What a brutal six months it’s been for Vital Farms. The stock has dropped 24.7% and now trades at $30.44, rattling many shareholders. This might have investors contemplating their next move.

Following the drawdown, is now the time to buy VITL? Find out in our full research report, it’s free.

Why Is VITL a Good Business?

With an emphasis on ethically produced products, Vital Farms (NASDAQ: VITL) specializes in pasture-raised eggs and butter.

1. Elevated Demand Drives Higher Sales Volumes

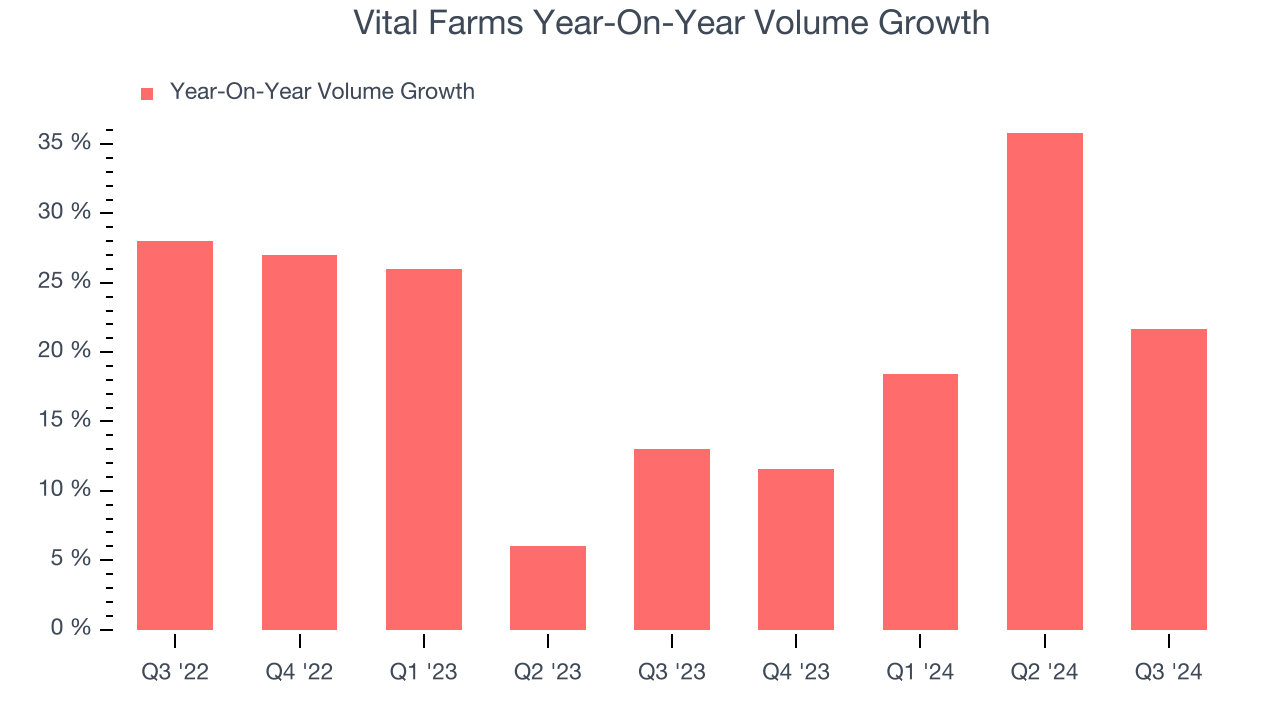

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Vital Farms’s average quarterly volume growth of 19.9% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

2. Long-Term EPS Growth Is Outstanding

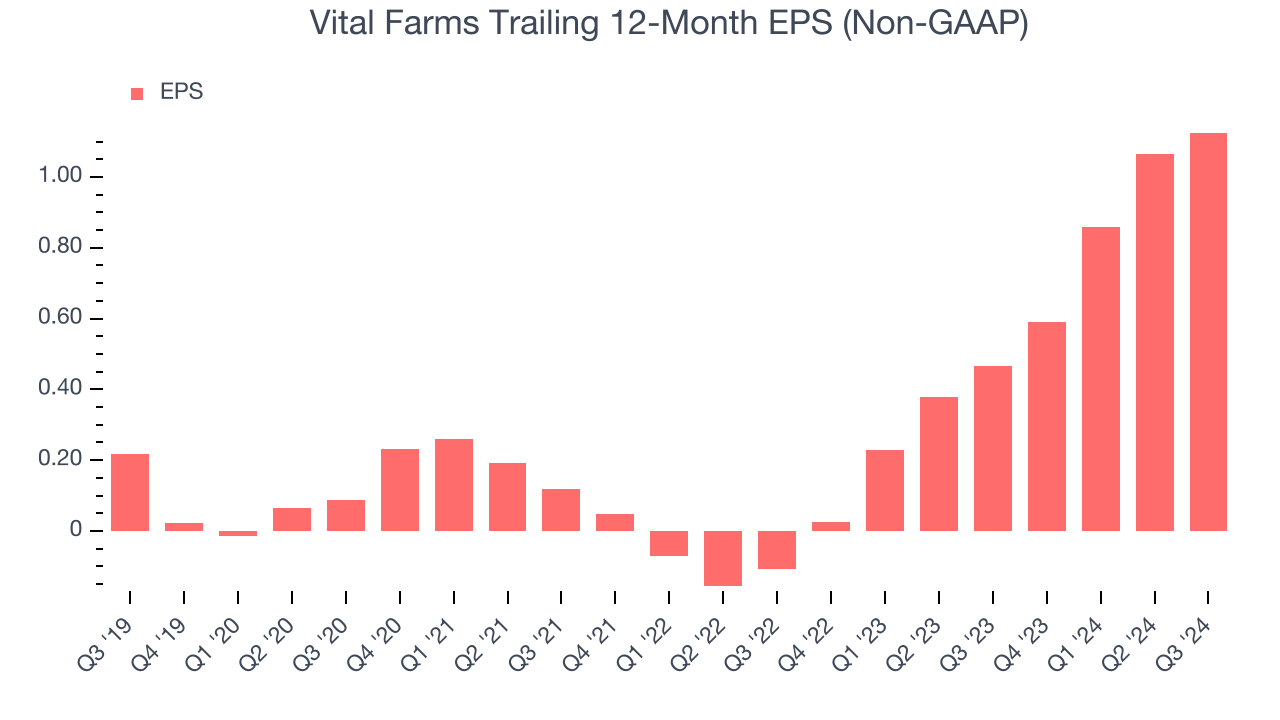

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Vital Farms’s EPS grew at an astounding 112% compounded annual growth rate over the last three years, higher than its 34.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. Increasing Free Cash Flow Margin Juices Financials

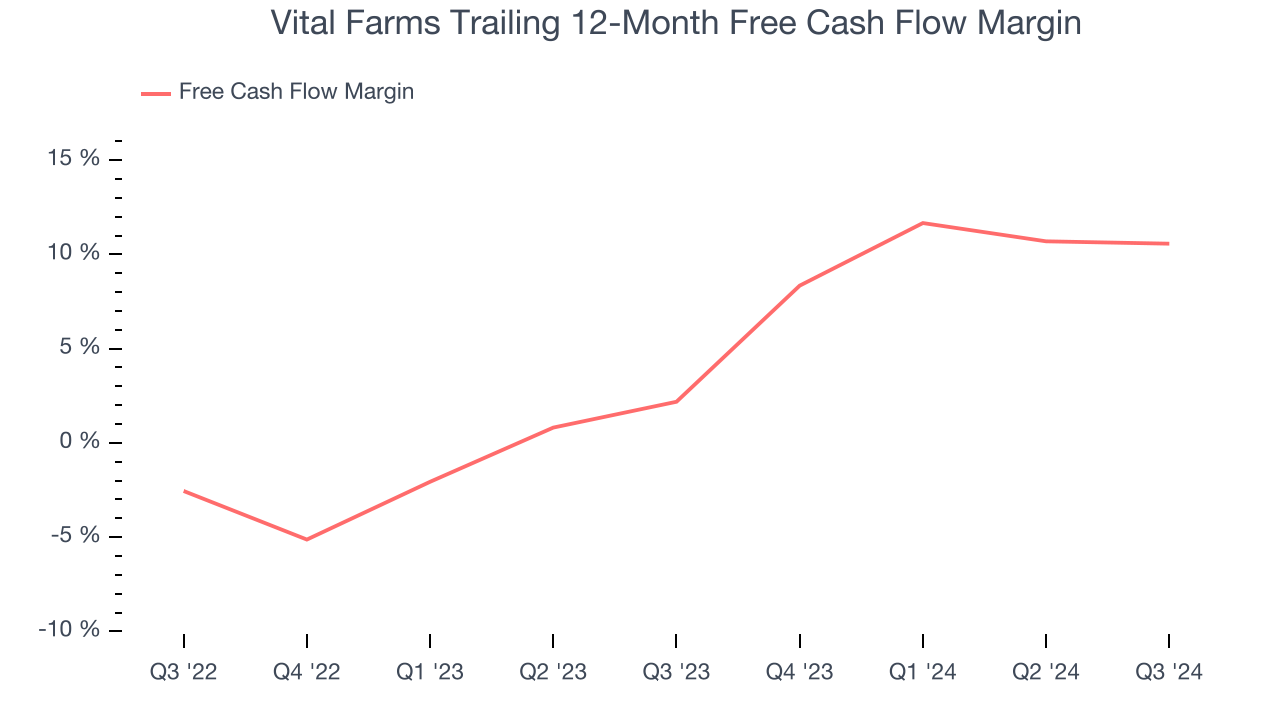

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Vital Farms’s margin expanded by 8.4 percentage points over the last year. This is encouraging because its free cash flow profitability rose more than its operating profitability, suggesting it’s becoming a less capital-intensive business. Its free cash flow margin for the trailing 12 months was 10.6%.

Final Judgment

These are just a few reasons Vital Farms is a high-quality business worth owning. After the recent drawdown, the stock trades at 29.3x forward price-to-earnings (or $30.44 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Vital Farms

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.