Heartland Express has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 10.3% to $12.56 per share while the index has gained 13%.

Is there a buying opportunity in Heartland Express, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We don't have much confidence in Heartland Express. Here are three reasons why HTLD doesn't excite us and a stock we'd rather own.

Why Is Heartland Express Not Exciting?

Founded by the son of a trucker, Heartland Express (NASDAQ: HTLD) offers full-truckload deliveries across the United States and Mexico.

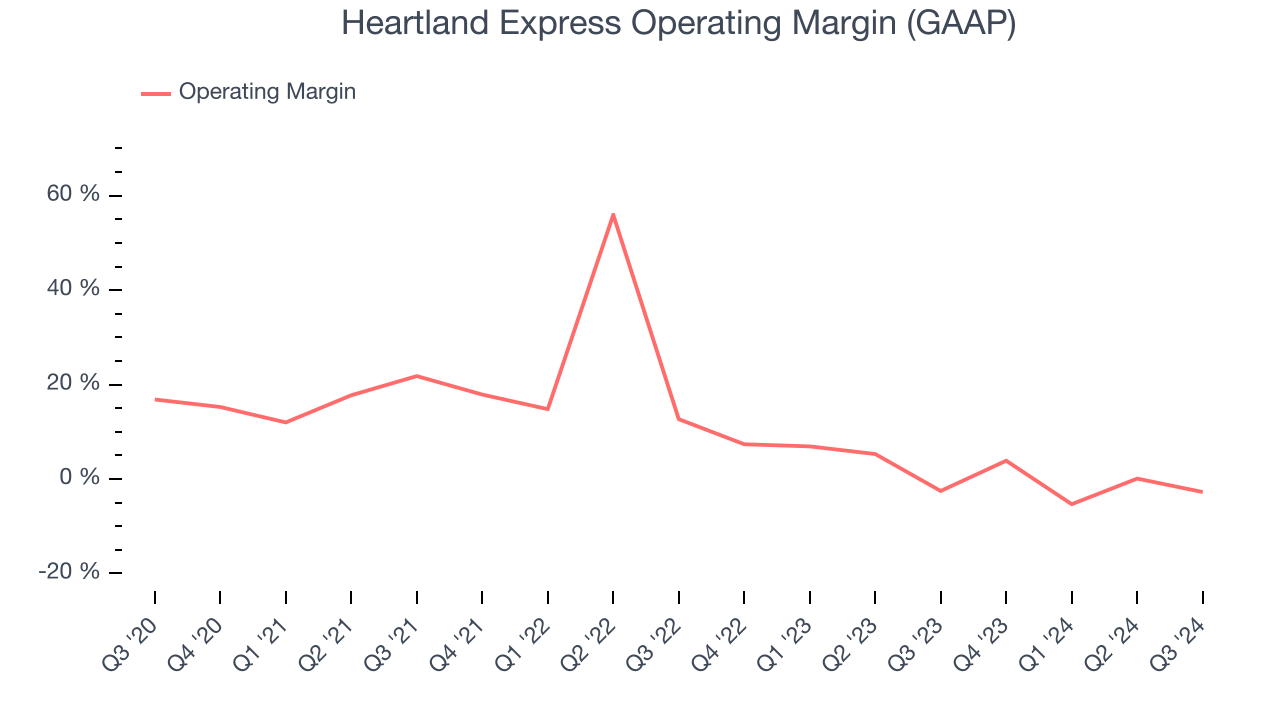

1. Operating Margin Falling

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, Heartland Express’s operating margin decreased by 14.3 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Heartland Express become more profitable in the future. Its operating margin for the trailing 12 months was breakeven.

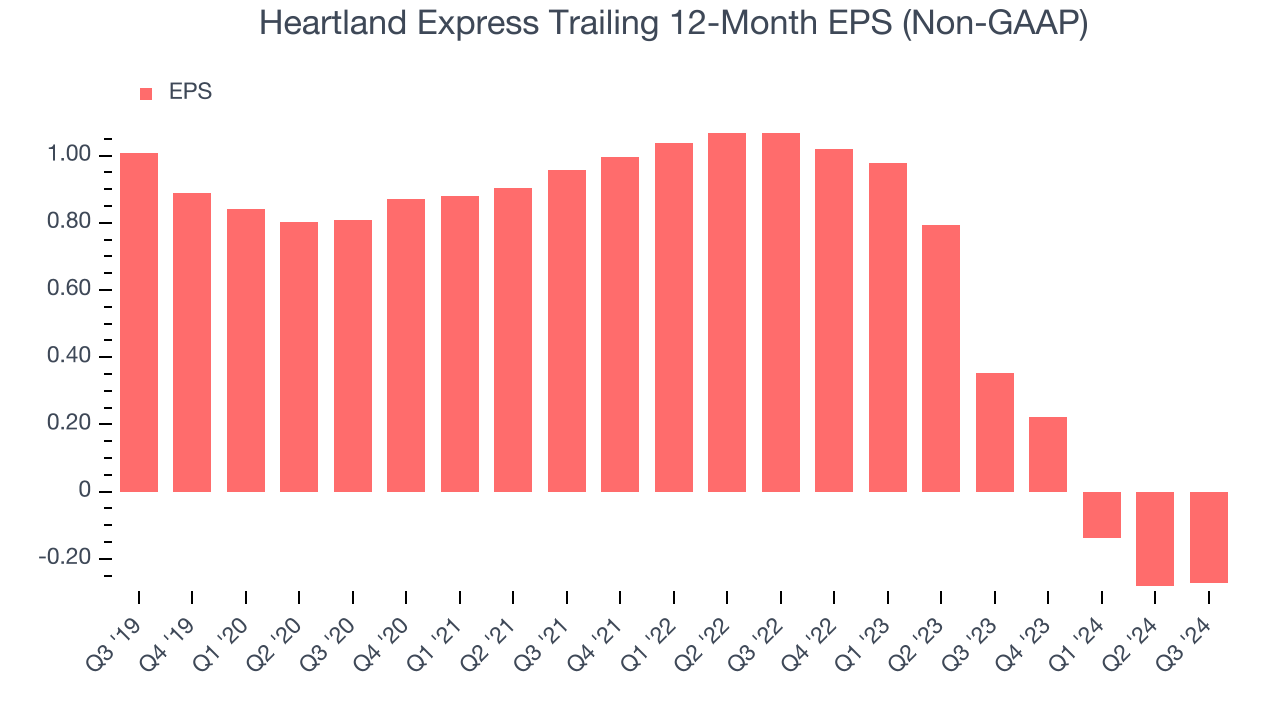

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Heartland Express, its EPS declined by 17.8% annually over the last five years while its revenue grew by 13.4%. This tells us the company became less profitable on a per-share basis as it expanded.

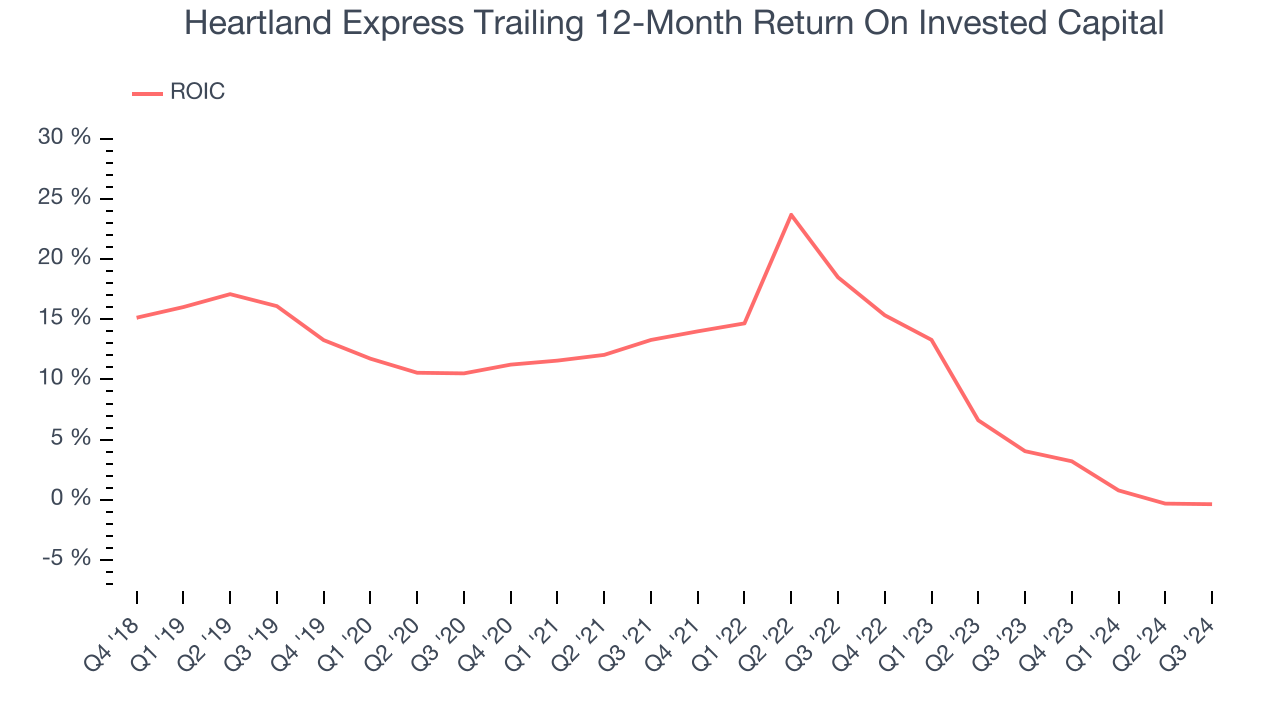

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, Heartland Express’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Heartland Express isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 20x forward EV-to-EBITDA (or $12.56 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. We’d suggest looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Like More Than Heartland Express

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.