Banking software provider Q2 (NYSE: QTWO) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 12.9% year on year to $175 million. The company expects next quarter’s revenue to be around $179.6 million, close to analysts’ estimates. Its GAAP loss of $0.20 per share was 8.5% above analysts’ consensus estimates.

Is now the time to buy Q2 Holdings? Find out by accessing our full research report, it’s free.

Q2 Holdings (QTWO) Q3 CY2024 Highlights:

- Revenue: $175 million vs analyst estimates of $173.5 million (in line)

- EPS: -$0.20 vs analyst estimates of -$0.22 (8.5% beat)

- EBITDA: $32.61 million vs analyst estimates of $29 million (12.4% beat)

- Revenue Guidance for Q4 CY2024 is $179.6 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $123 million at the midpoint, above analyst estimates of $118.2 million

- Gross Margin (GAAP): 50.9%, up from 47.9% in the same quarter last year

- Operating Margin: -7.3%, up from -14.9% in the same quarter last year

- EBITDA Margin: 18.6%, up from 12.7% in the same quarter last year

- Market Capitalization: $5.20 billion

“We achieved solid bookings success across our business lines in the third quarter, highlighted by six Enterprise and Tier 1 deals, including three with Top 50 U.S. banks,” said Q2 Chairman and CEO Matt Flake.

Company Overview

Founded in 2004 by Hank Seale, Q2 (NYSE: QTWO) offers software-as-a-service that enables small banks to provide online banking and consumer lending services to their clients.

Banking Software

Consumers these days are accustomed to frictionless digital experiences from online shopping to ordering food or hailing a cab. Financial services firms are notoriously risk averse in adopting modern software, often lacking the resources or competency to develop the digital solutions in-house. That drives demand for software as a service platforms that allows banks and other finance institutions to offer the digital services without having to run or maintain them.

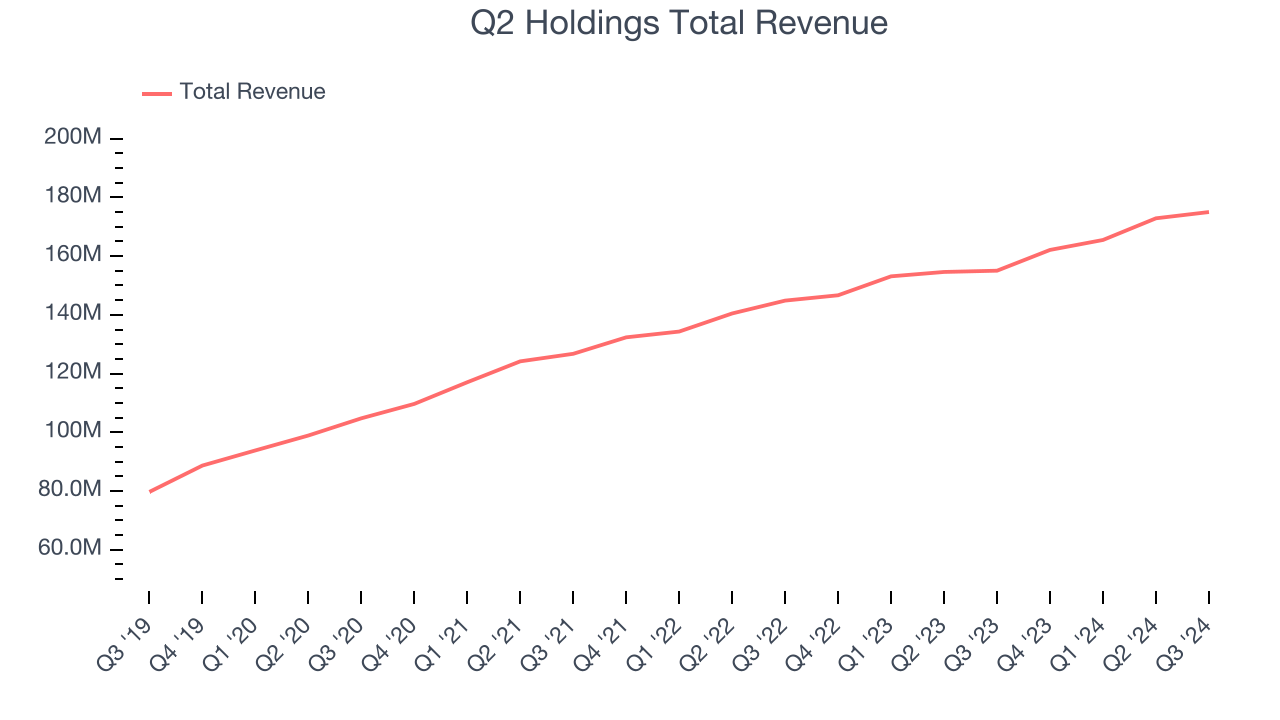

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Q2 Holdings’s sales grew at a sluggish 12.3% compounded annual growth rate over the last three years. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Q2 Holdings’s year-on-year revenue growth was 12.9%, and its $175 million of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 10.8% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.9% over the next 12 months, a slight deceleration versus the last three years. This projection is still above the sector average and illustrates the market sees some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Q2 Holdings is efficient at acquiring new customers, and its CAC payback period checked in at 41.7 months this quarter. The company’s performance indicates relatively solid competitive positioning, giving it the freedom to invest its resources into new growth initiatives.

Key Takeaways from Q2 Holdings’s Q3 Results

We were impressed by how significantly Q2 Holdings blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 3.9% to $94 immediately following the results.

Indeed, Q2 Holdings had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.