As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at sales and marketing software stocks, starting with Sprout Social (NASDAQ: SPT).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 22 sales and marketing software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 0.6% above.

Luckily, sales and marketing software stocks have performed well with share prices up 16% on average since the latest earnings results.

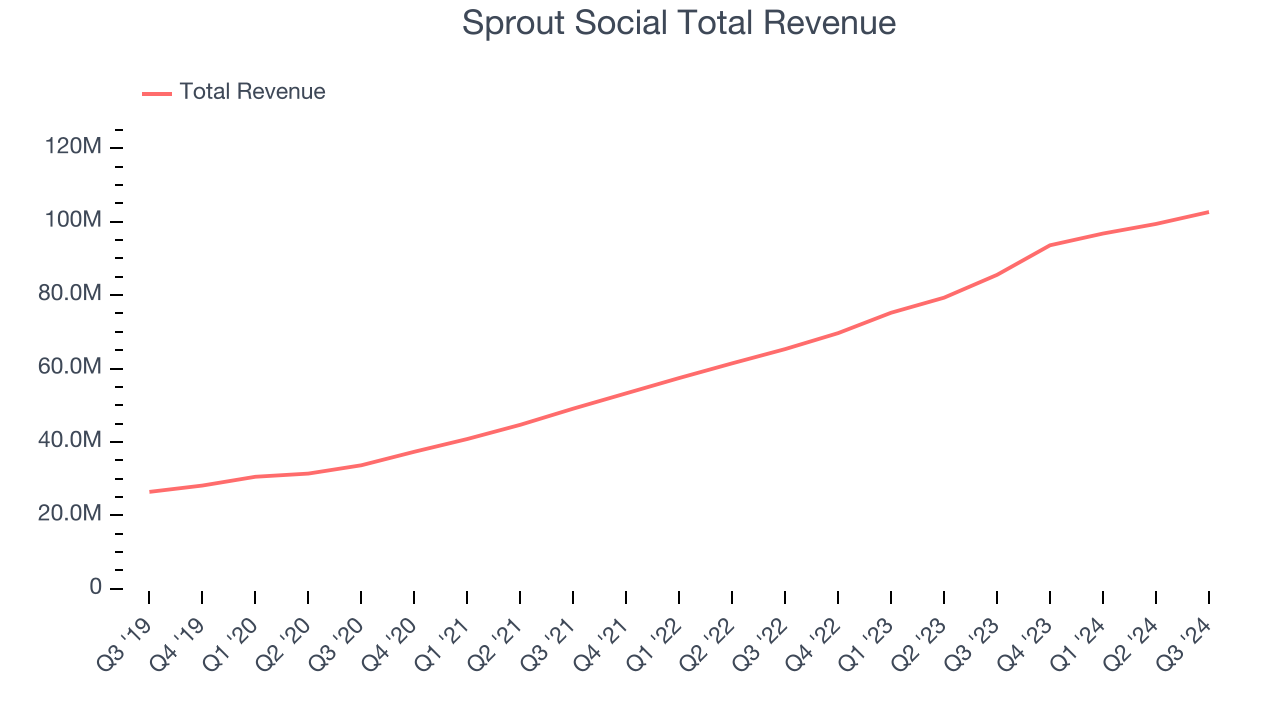

Sprout Social (NASDAQ: SPT)

Founded by Justyn Howard and Aaron Rankin in 2010, Sprout Social (NASDAQ: SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

Sprout Social reported revenues of $102.6 million, up 20% year on year. This print exceeded analysts’ expectations by 0.6%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

“The Sprout team delivered a solid third quarter, driving 20% revenue growth and 31% growth in cRPO as we executed our strategy across key company metrics. Sprout continues to focus on product leadership and expanding our competitive position within the Enterprise segment as these customers leverage the power of Social to drive their digital strategies,” said Ryan Barretto, CEO.

Interestingly, the stock is up 4.3% since reporting and currently trades at $32.33.

Is now the time to buy Sprout Social? Access our full analysis of the earnings results here, it’s free.

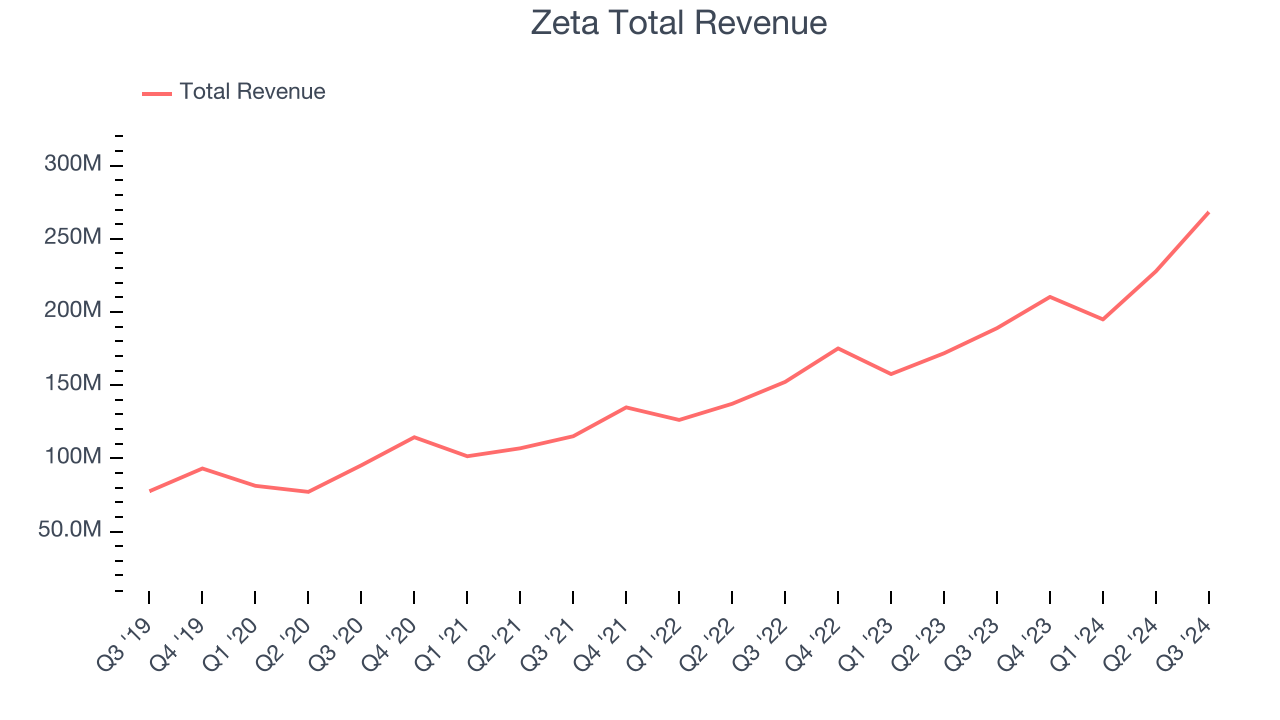

Best Q3: Zeta (NYSE: ZETA)

Co-founded by former Apple CEO John Scully, Zeta Global (NYSE: ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $268.3 million, up 42% year on year, outperforming analysts’ expectations by 6.3%. The business had a stunning quarter with a solid beat of analysts’ billings estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

Zeta scored the fastest revenue growth and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 42.5% since reporting. It currently trades at $21.15.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Sprinklr (NYSE: CXM)

Initially focused only on social media management, Sprinklr (NYSE: CXM) is a leading provider of unified customer experience management software.

Sprinklr reported revenues of $200.7 million, up 7.7% year on year, exceeding analysts’ expectations by 2.2%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

Interestingly, the stock is up 4.1% since the results and currently trades at $8.98.

Read our full analysis of Sprinklr’s results here.

GoDaddy (NYSE: GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE: GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1.15 billion, up 7.3% year on year. This result met analysts’ expectations. It was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ bookings estimates.

The stock is up 26.1% since reporting and currently trades at $203.90.

Read our full, actionable report on GoDaddy here, it’s free.

AppLovin (NASDAQ: APP)

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ: APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin reported revenues of $1.20 billion, up 38.6% year on year. This result surpassed analysts’ expectations by 5.9%. Overall, it was an exceptional quarter as it also logged an impressive beat of analysts’ EBITDA estimates.

The stock is up 90.6% since reporting and currently trades at $321.30.

Read our full, actionable report on AppLovin here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.