What a fantastic six months it’s been for Paycor. Shares of the company have skyrocketed 77.1%, hitting $20.35. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Paycor, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the momentum, we don't have much confidence in Paycor. Here are three reasons why we avoid PYCR and a stock we'd rather own.

Why Is Paycor Not Exciting?

Found in 1990 in Cincinnati, Ohio, Paycor (NASDAQ: PYCR) provides software for small businesses to manage their payroll and HR needs in one place.

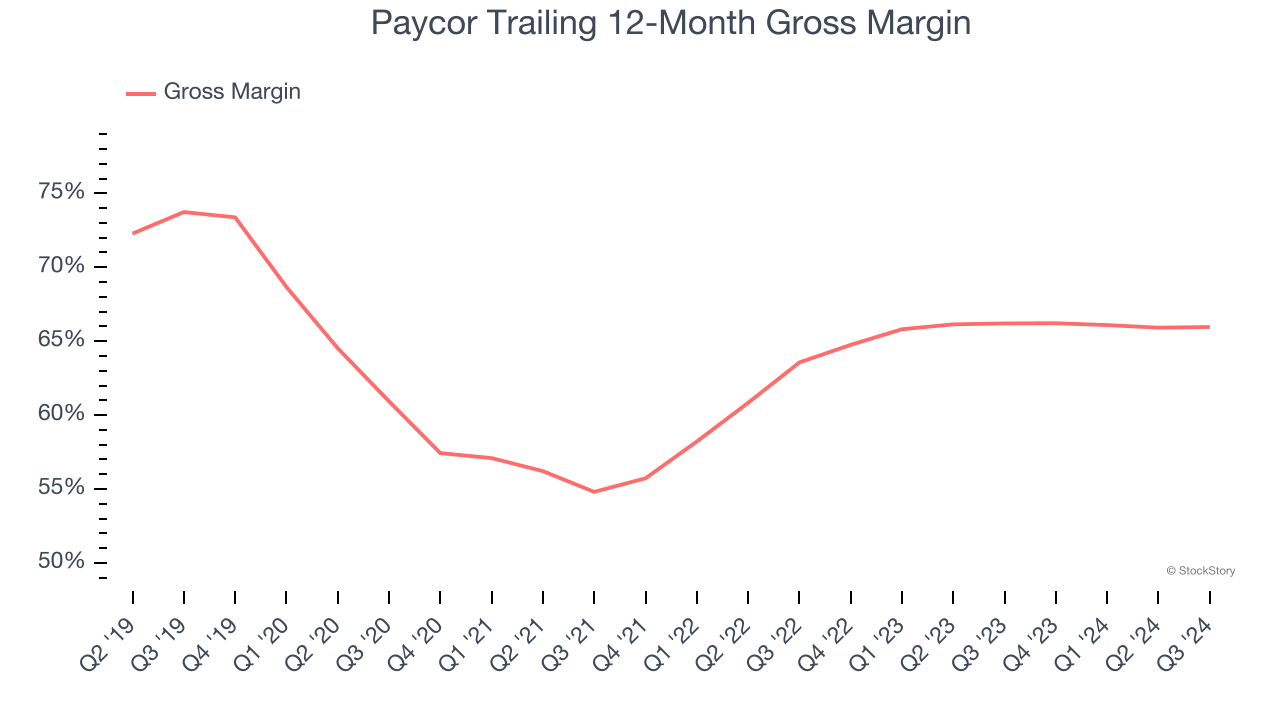

1. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Paycor, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Paycor’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 66% gross margin over the last year. Said differently, Paycor had to pay a chunky $34.04 to its service providers for every $100 in revenue.

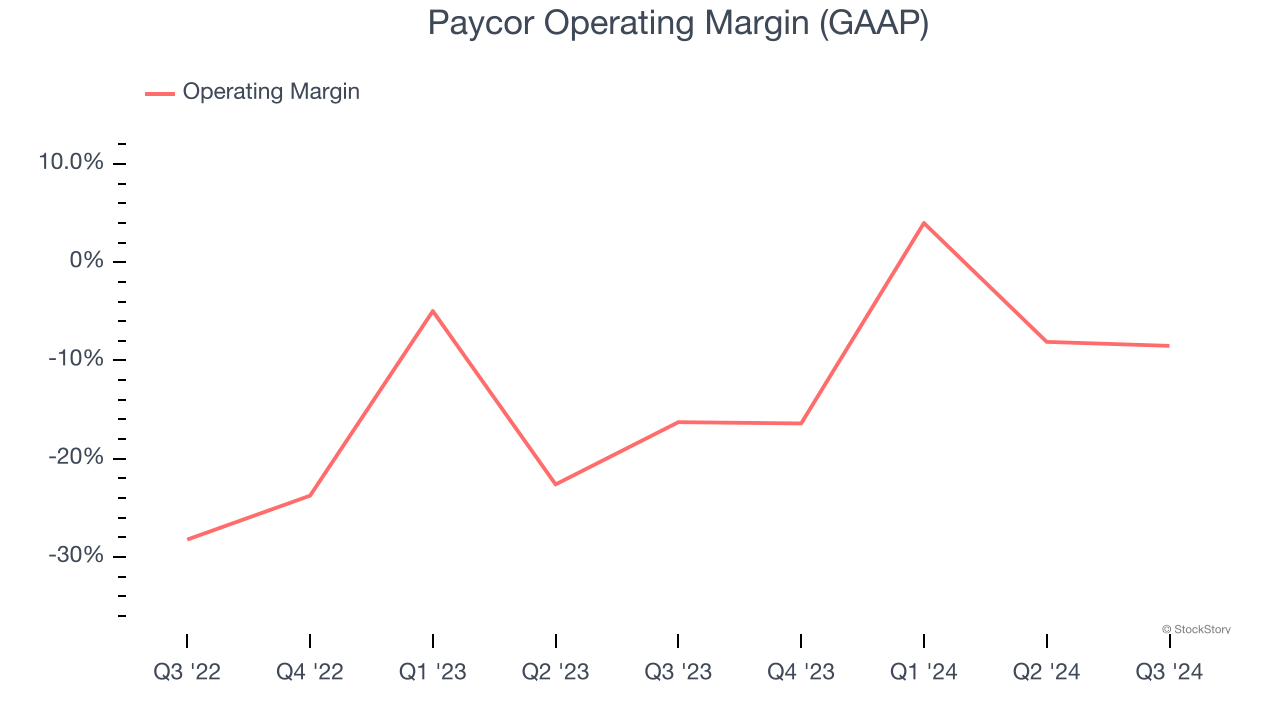

2. Operating Losses Sound the Alarms

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Paycor’s expensive cost structure has contributed to an average operating margin of negative 6.8% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Paycor reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

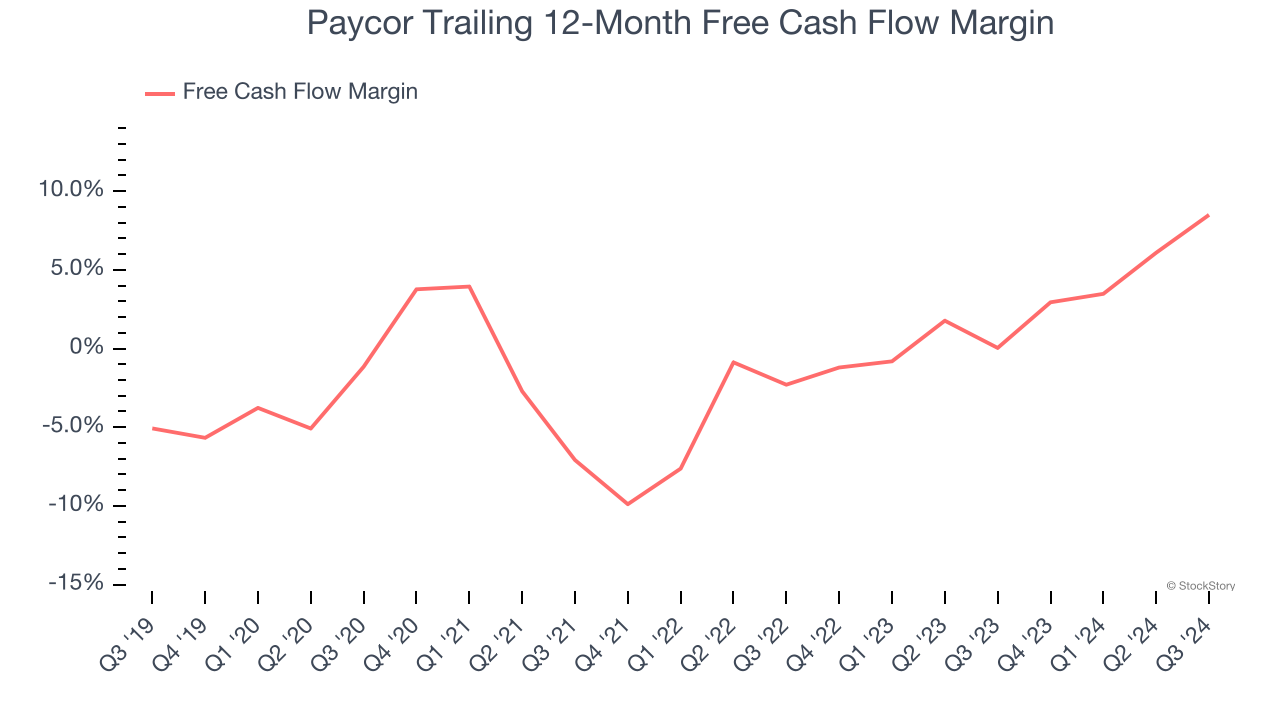

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Paycor has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.5%, subpar for a software business.

Final Judgment

Paycor’s business quality ultimately falls short of our standards. After the recent rally, the stock trades at 4.9× forward price-to-sales (or $20.35 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Paycor

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.