Work management software maker Asana (NYSE: ASAN) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 10.4% year on year to $183.9 million. The company expects next quarter’s revenue to be around $188 million, close to analysts’ estimates. Its non-GAAP loss of $0.02 per share was 70.4% above analysts’ consensus estimates.

Is now the time to buy Asana? Find out by accessing our full research report, it’s free.

Asana (ASAN) Q3 CY2024 Highlights:

- Revenue: $183.9 million vs analyst estimates of $180.7 million (10.4% year-on-year growth, 1.8% beat)

- Adjusted EPS: -$0.02 vs analyst estimates of -$0.07 ($0.09 beat)

- Adjusted Operating Income: -$7.63 million vs analyst estimates of -$18.49 million (-4.1% margin, large beat)

- Revenue Guidance for Q4 CY2024 is $188 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: -32.7%, up from -38.1% in the same quarter last year

- Free Cash Flow was -$18.18 million, down from $12.76 million in the previous quarter

- Net Revenue Retention Rate: 96%, down from 98% in the previous quarter

- Billings: $176.8 million at quarter end, up 10% year on year

- Market Capitalization: $3.61 billion

“The launch of AI Studio is the birth of a new category, unlocking a massive Total Addressable Market (TAM) and growth opportunity for the company,” said Dustin Moskovitz, co-founder and chief executive officer of Asana.

Company Overview

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE: ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

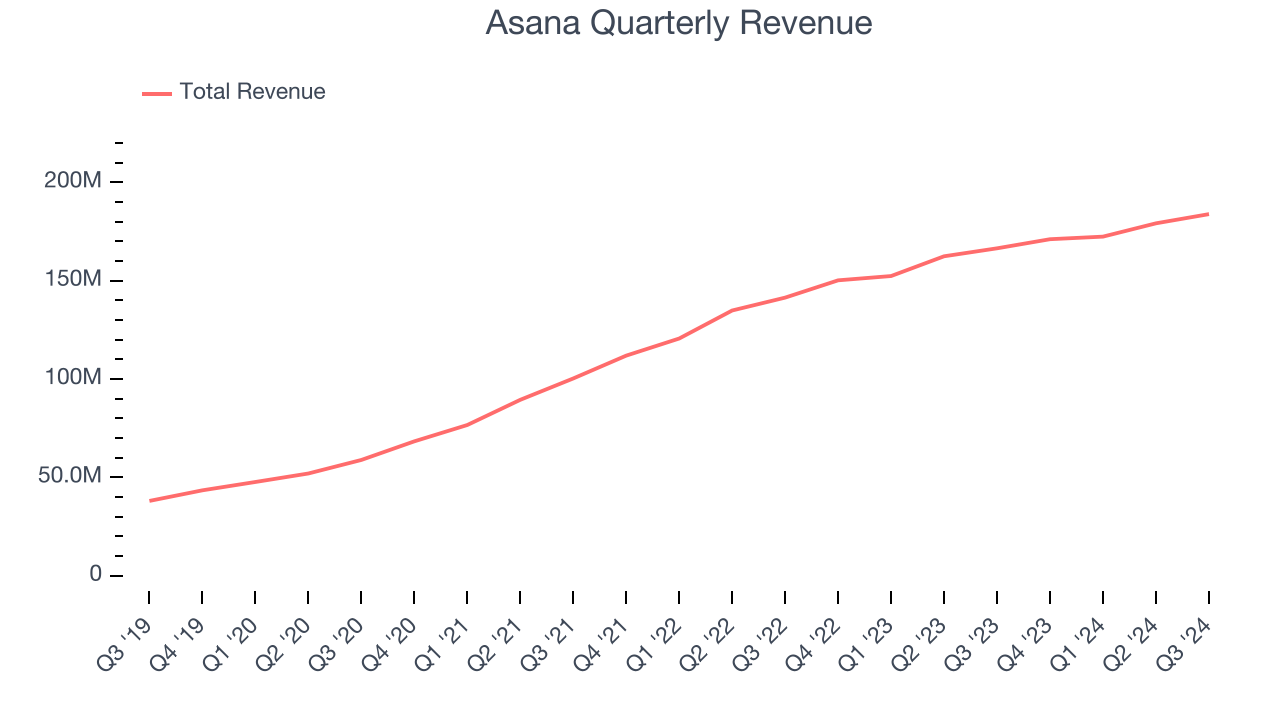

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Asana’s 28.3% annualized revenue growth over the last three years was impressive. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Asana reported year-on-year revenue growth of 10.4%, and its $183.9 million of revenue exceeded Wall Street’s estimates by 1.8%. Company management is currently guiding for a 9.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.9% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

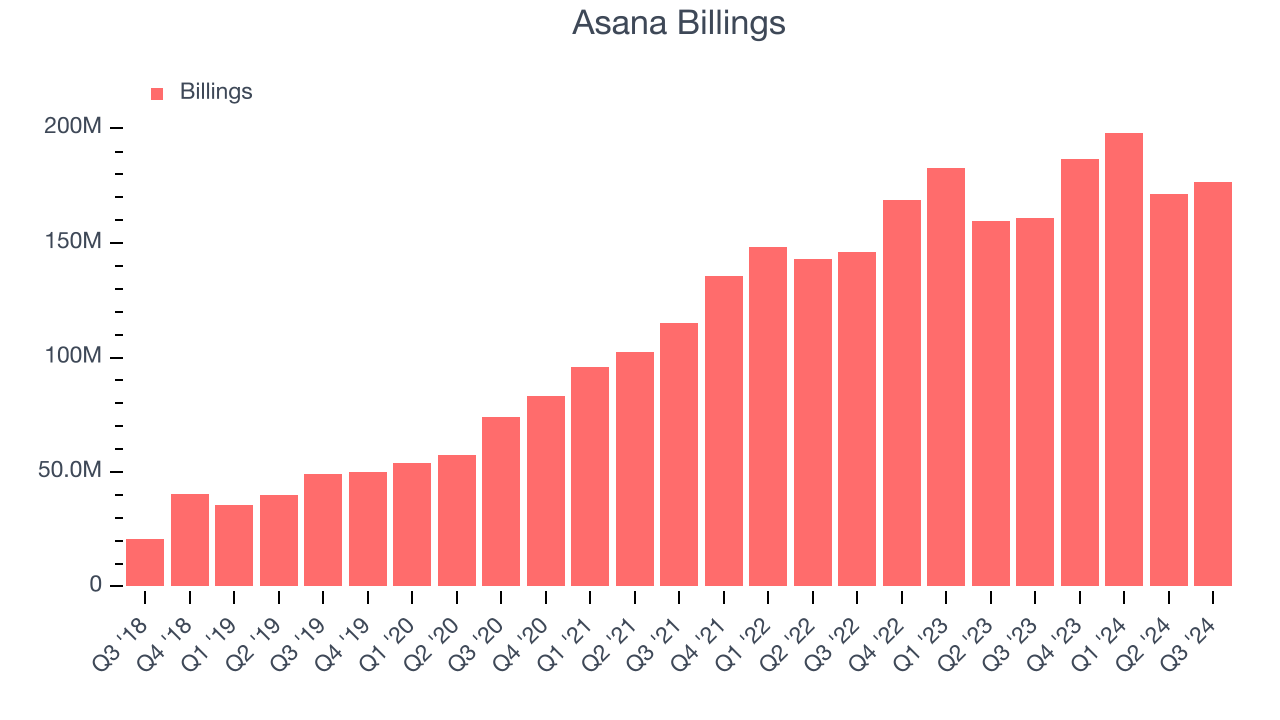

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Asana’s billings came in at $176.8 million in Q3, and over the last four quarters, its growth slightly lagged the sector as it averaged 9.1% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

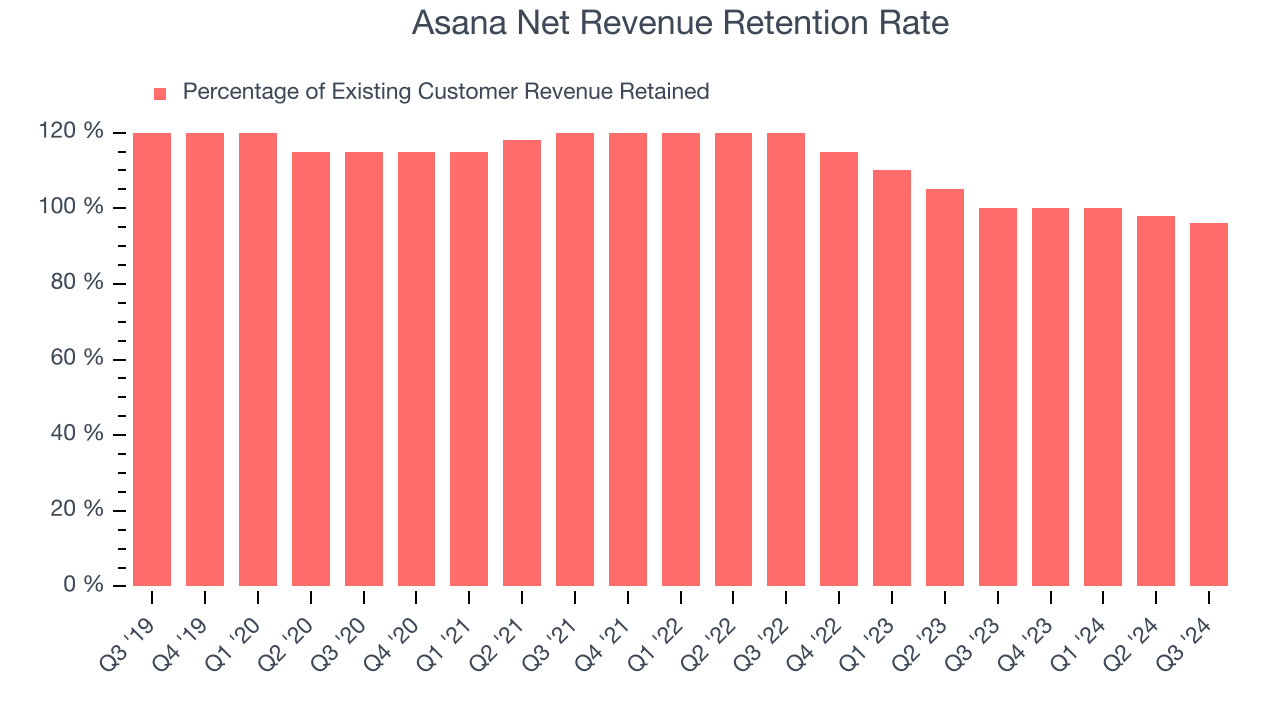

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Asana’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 98.5% in Q3. This means Asana’s revenue would’ve decreased by 1.5% over the last 12 months if it didn’t win any new customers.

Asana’s already weak net retention rate has been dropping the last year, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

Key Takeaways from Asana’s Q3 Results

Revenue in the quarter beat by a comfortable amount, and operating profit beat convincingly. We were also impressed by Asana’s optimistic EPS guidance for next quarter and the full year, which beat analysts’ expectations. Overall, this quarter was quite solid. The stock traded up 19% to $18.40 immediately after reporting.

Asana had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.