Athletic apparel retailer Lululemon (NASDAQ: LULU) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 8.7% year on year to $2.40 billion. The company expects next quarter’s revenue to be around $3.49 billion, close to analysts’ estimates. Its GAAP profit of $2.87 per share was 5.5% above analysts’ consensus estimates.

Is now the time to buy Lululemon? Find out by accessing our full research report, it’s free.

Lululemon (LULU) Q3 CY2024 Highlights:

- Revenue: $2.40 billion vs analyst estimates of $2.36 billion (8.7% year-on-year growth, 1.7% beat)

- Adjusted EPS: $2.87 vs analyst estimates of $2.72 (5.5% beat)

- Revenue Guidance for Q4 CY2024 is $3.49 billion at the midpoint, roughly in line with what analysts were expecting

- EPS (GAAP) guidance for the full year is $14.12 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 20.5%, up from 15.3% in the same quarter last year

- Locations: 749 at quarter end, up from 686 in the same quarter last year

- Same-Store Sales rose 4% year on year (13% in the same quarter last year) (large beat vs. expectations of 1% year on year)

- Market Capitalization: $42.02 billion

Calvin McDonald, Chief Executive Officer, stated: "Our performance in the third quarter shows the enduring strength of lululemon globally, as we saw continued momentum across our international markets and in Canada. Looking to the future, we are pleased with the start to our holiday season, and we remain focused on accelerating our U.S. business and growing our brand awareness around the world. Thank you to our dedicated teams for continuing to deliver for our guests and stakeholders. "

Company Overview

Originally serving yogis and hockey players, Lululemon (NASDAQ: LULU) is a designer, distributor, and retailer of athletic apparel for men and women.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Lululemon is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it’s working from a smaller revenue base.

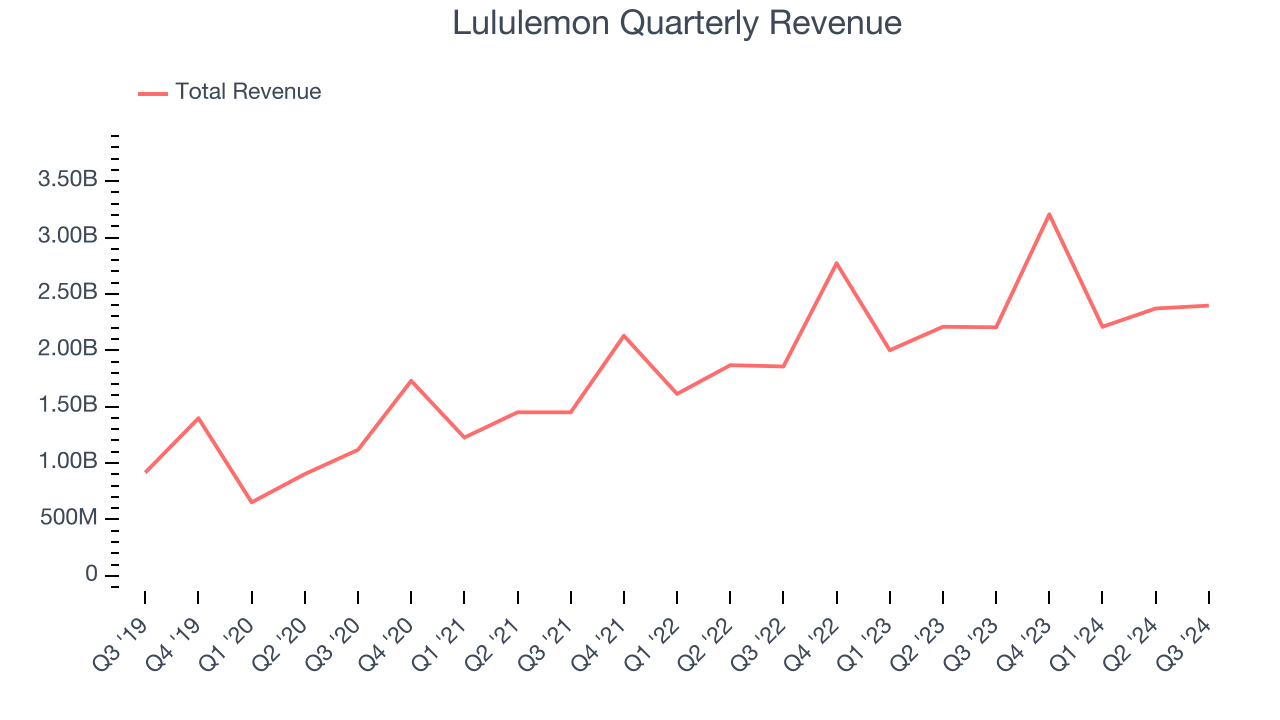

As you can see below, Lululemon’s 22.1% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was exceptional as it opened new stores and increased sales at existing, established locations.

This quarter, Lululemon reported year-on-year revenue growth of 8.7%, and its $2.40 billion of revenue exceeded Wall Street’s estimates by 1.7%. Company management is currently guiding for a 9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.3% over the next 12 months, a deceleration versus the last five years. We still think its growth trajectory is attractive given its scale and implies the market is baking in success for its products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

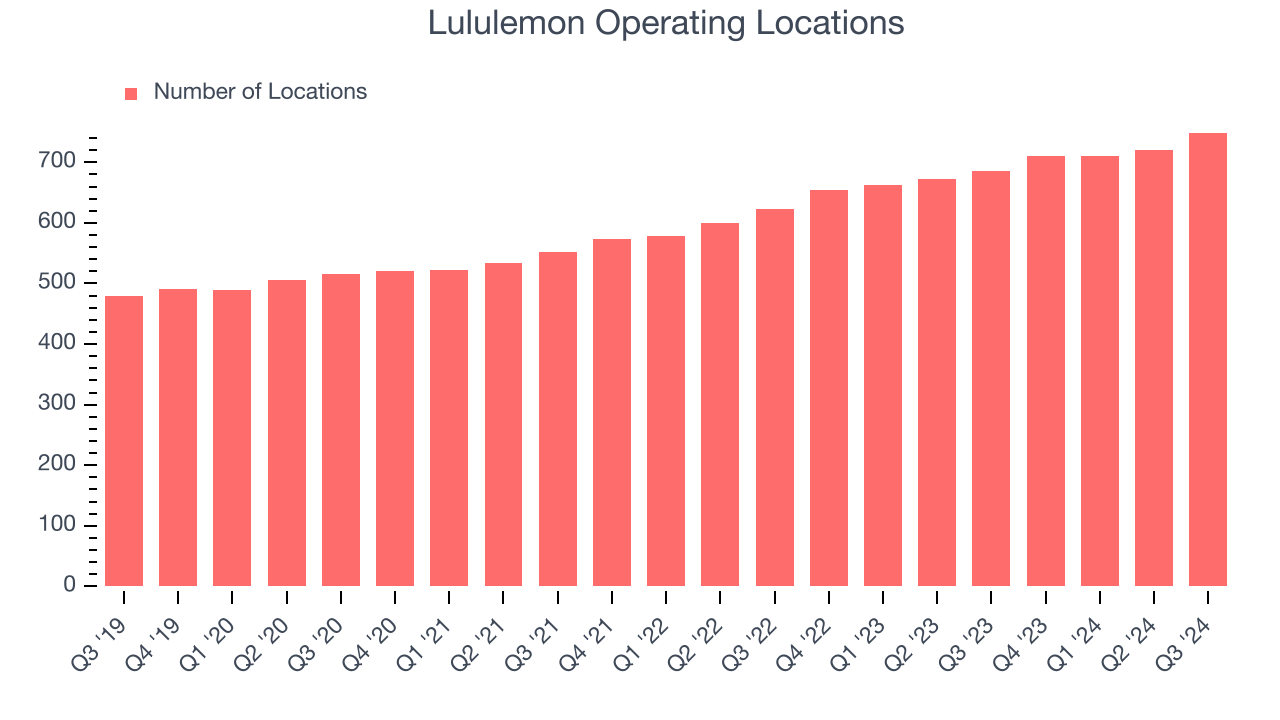

A retailer’s store count often determines how much revenue it can generate.

Lululemon operated 749 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years by averaging 10.4% annual growth, much faster than the broader consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

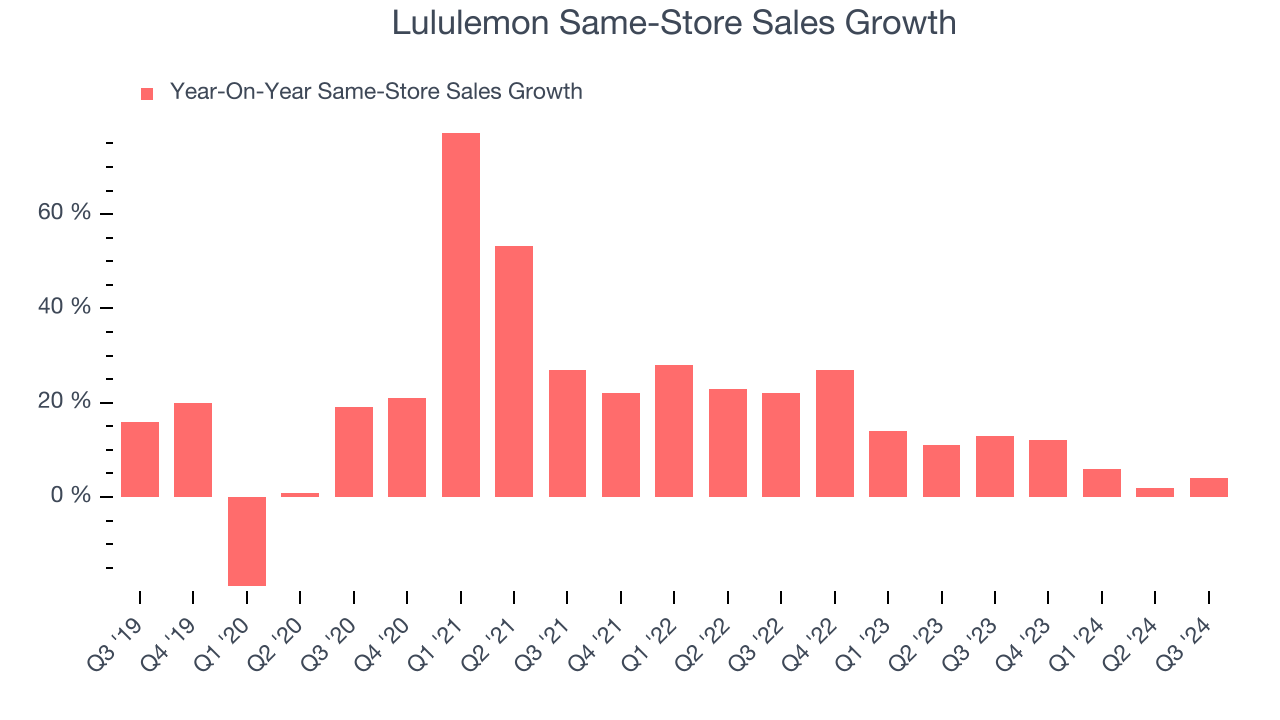

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Lululemon has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 11.1%. This performance along with its meaningful buildout of new stores suggest it’s playing some aggressive offense.

In the latest quarter, Lululemon’s same-store sales rose 4% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Lululemon can reaccelerate growth.

Key Takeaways from Lululemon’s Q3 Results

It was encouraging to see Lululemon surpass analysts’ revenue expectations this quarter on a convincing same-store sales beat. We were also happy its gross margin outperformed Wall Street’s estimates. Guidance was roughly in line. Overall, this quarter had some key positives. The stock traded up 10.4% to $380.84 immediately after reporting.

Big picture, is Lululemon a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.