Clothing and footwear retailer Zumiez (NASDAQ: ZUMZ) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 2.8% year on year to $222.5 million. The company expects next quarter’s revenue to be around $286 million, coming in 0.9% above analysts’ estimates. Its GAAP profit of $0.06 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Zumiez? Find out by accessing our full research report, it’s free.

Zumiez (ZUMZ) Q3 CY2024 Highlights:

- Revenue: $222.5 million vs analyst estimates of $222 million (2.8% year-on-year growth, in line)

- Adjusted EPS: $0.06 vs analyst estimates of $0.03 (significant beat)

- Adjusted EBITDA: $7.82 million vs analyst estimates of $6.95 million (3.5% margin, 12.6% beat)

- Revenue Guidance for Q4 CY2024 is $286 million at the midpoint, above analyst estimates of $283.5 million

- EPS (GAAP) guidance for Q4 CY2024 is $0.88 at the midpoint, missing analyst estimates by 12.9%

- Operating Margin: 1.1%, up from -0.1% in the same quarter last year

- Free Cash Flow was -$22.31 million compared to -$2.99 million in the same quarter last year

- Locations: 752 at quarter end, down from 768.5 in the same quarter last year

- Same-Store Sales rose 7.5% year on year (-9.2% in the same quarter last year) (large beat vs expectations of up 2% year on year)

- Market Capitalization: $433.7 million

Rick Brooks, Chief Executive Officer of Zumiez Inc., stated, “The strategic initiatives we have been executing this year have contributed to a noticeable increase in sales trends. Fueled by growing strength in our North American business, consolidated comparable sales sequentially accelerated 390 basis points to high-single digits in the third quarter. We experienced strong gains in our apparel and footwear categories as consumers have responded favorably to our refined product assortments and enhanced customer engagement tactics. We still have much work to do improving profitability and capitalizing on the opportunities we have created for the Company. Our results during back-to-school and the start of the holiday season represent solid progress toward these goals and we are committed to building on our momentum to deliver greater value for our shareholders next year and over the long term.”

Company Overview

With store associates called “Zumiez Stash Members”, Zumiez (NASDAQ: ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

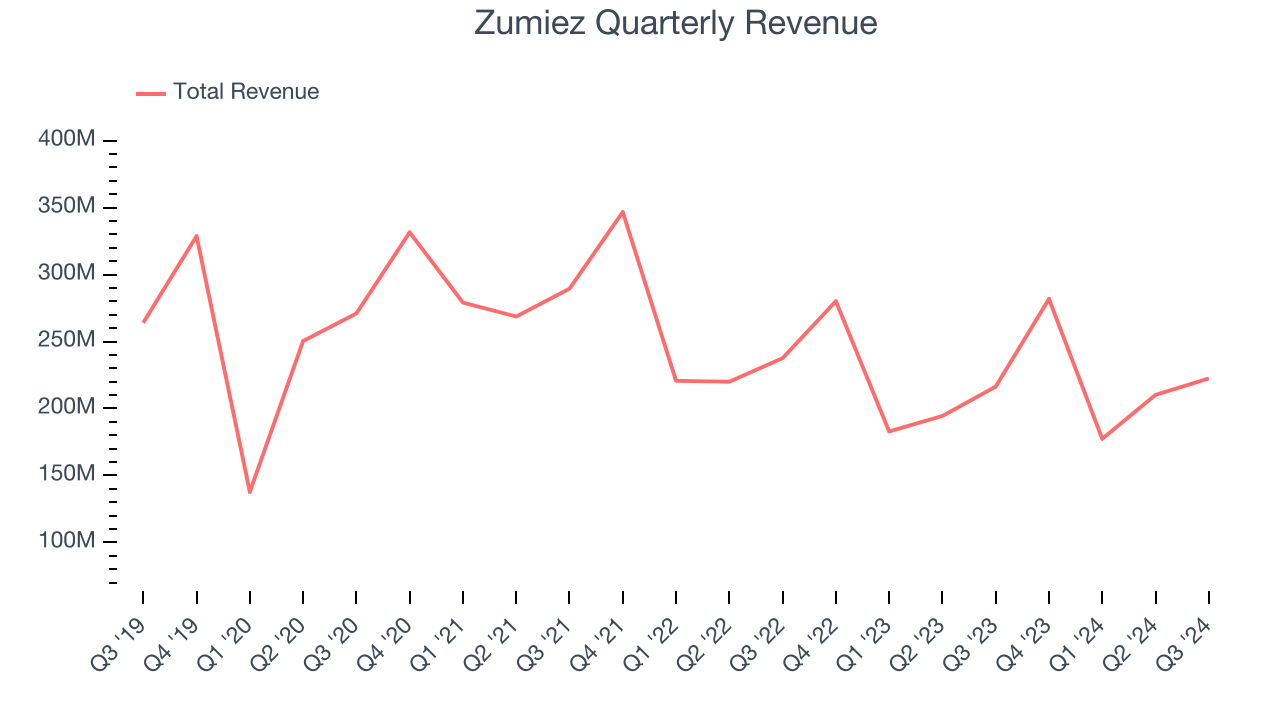

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Zumiez is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

As you can see below, Zumiez struggled to generate demand over the last five years (we compare to 2019 to normalize for COVID-19 impacts). Its sales dropped by 2.5% annually as it didn’t open many new stores and observed lower sales at existing, established locations.

This quarter, Zumiez grew its revenue by 2.8% year on year, and its $222.5 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 1.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months. While this projection suggests its newer products will catalyze better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

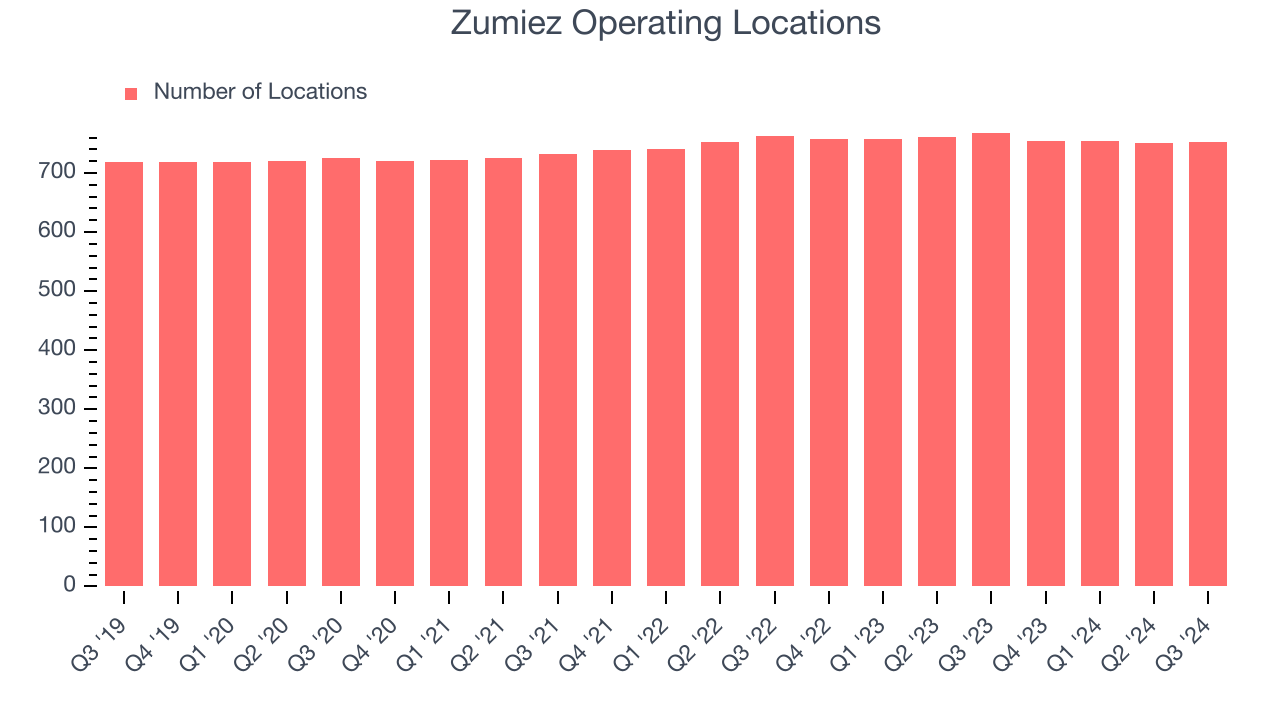

Zumiez listed 752 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

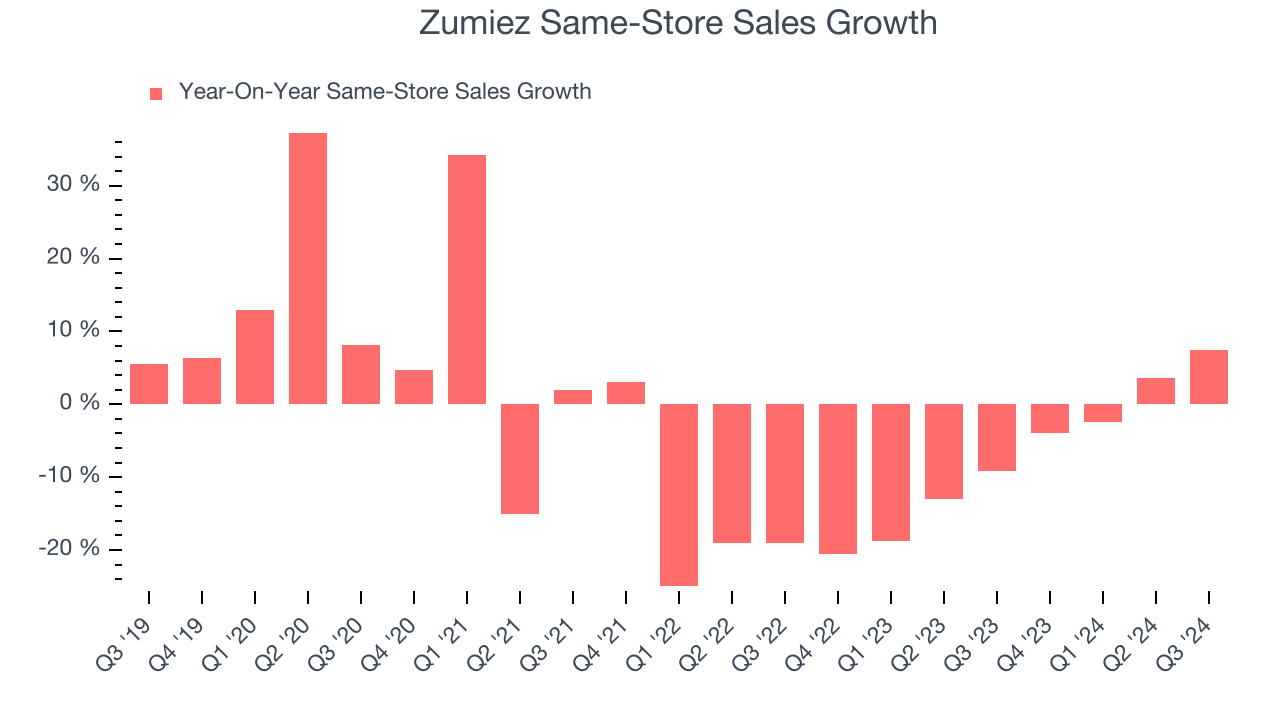

Zumiez’s demand has been shrinking over the last two years as its same-store sales have averaged 7.1% annual declines. This performance isn’t ideal, and we’d be concerned if Zumiez starts opening new stores to artificially boost revenue growth.

In the latest quarter, Zumiez’s same-store sales rose 7.5% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Zumiez’s Q3 Results

We were impressed by how significantly Zumiez blew past analysts’ same-store sales and EPS expectations this quarter. On the other hand, its EPS guidance for next quarter missed significantly. Overall, this quarter had some key positives. The stock traded up 10.6% to $22.25 immediately after reporting.

Zumiez may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.