Financial services provider CBIZ (NYSE: CBZ) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 58.1% year on year to $693.8 million. On the other hand, the company’s full-year revenue guidance of $2.88 billion at the midpoint came in 2.6% above analysts’ estimates. Its non-GAAP profit of $1.01 per share was 12.6% above analysts’ consensus estimates.

Is now the time to buy CBIZ? Find out by accessing our full research report, it’s free for active Edge members.

CBIZ (CBZ) Q3 CY2025 Highlights:

- Revenue: $693.8 million vs analyst estimates of $709.2 million (58.1% year-on-year growth, 2.2% miss)

- Adjusted EPS: $1.01 vs analyst estimates of $0.90 (12.6% beat)

- Adjusted EBITDA: $120 million vs analyst estimates of $115 million (17.3% margin, 4.4% beat)

- The company reconfirmed its revenue guidance for the full year of $2.88 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $3.63 at the midpoint

- EBITDA guidance for the full year is $453 million at the midpoint, in line with analyst expectations

- Operating Margin: 8.5%, down from 11.5% in the same quarter last year

- Market Capitalization: $2.77 billion

“We are pleased with our third quarter results, which were largely in line with our expectations. Our core, recurring essential businesses continued to perform well, and improved market conditions also resulted in improved growth within our non-recurring businesses,” said Jerry Grisko, CBIZ President and CEO.

Company Overview

With over 120 offices across 33 states and a team of more than 6,700 professionals, CBIZ (NYSE: CBZ) provides accounting, tax, benefits, insurance brokerage, and advisory services to help small and mid-sized businesses manage their finances and operations.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $2.68 billion in revenue over the past 12 months, CBIZ is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

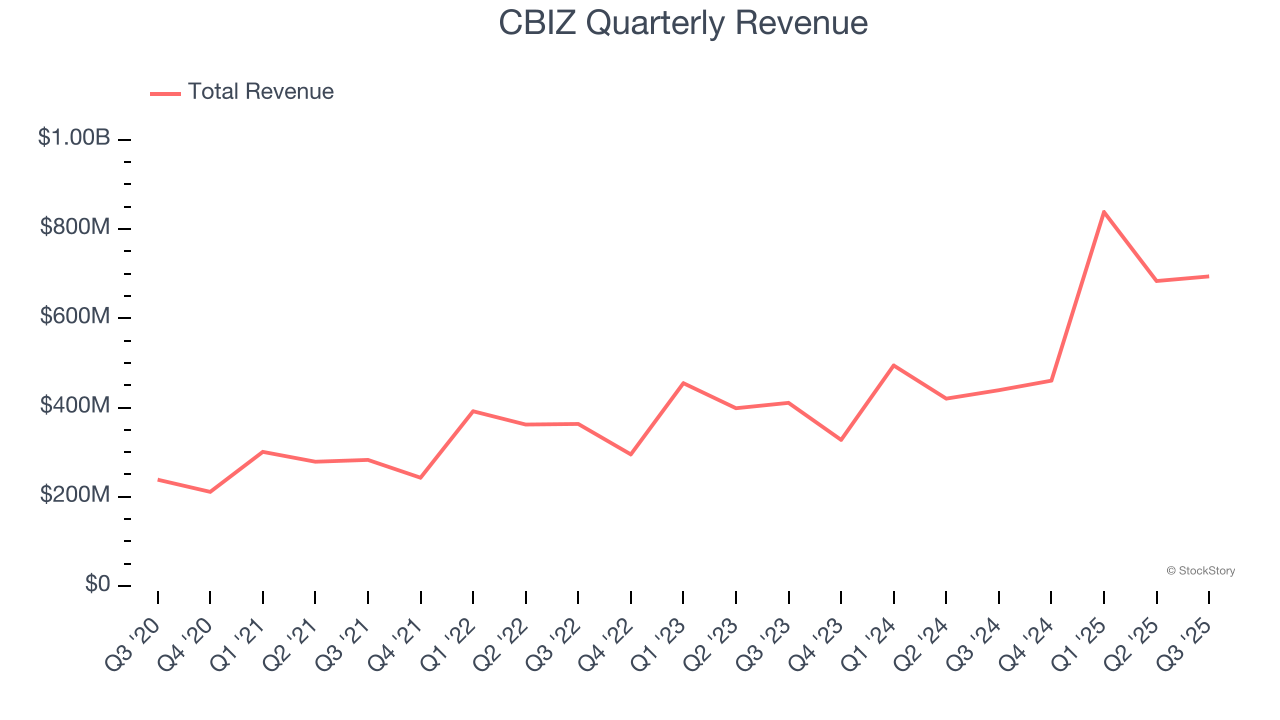

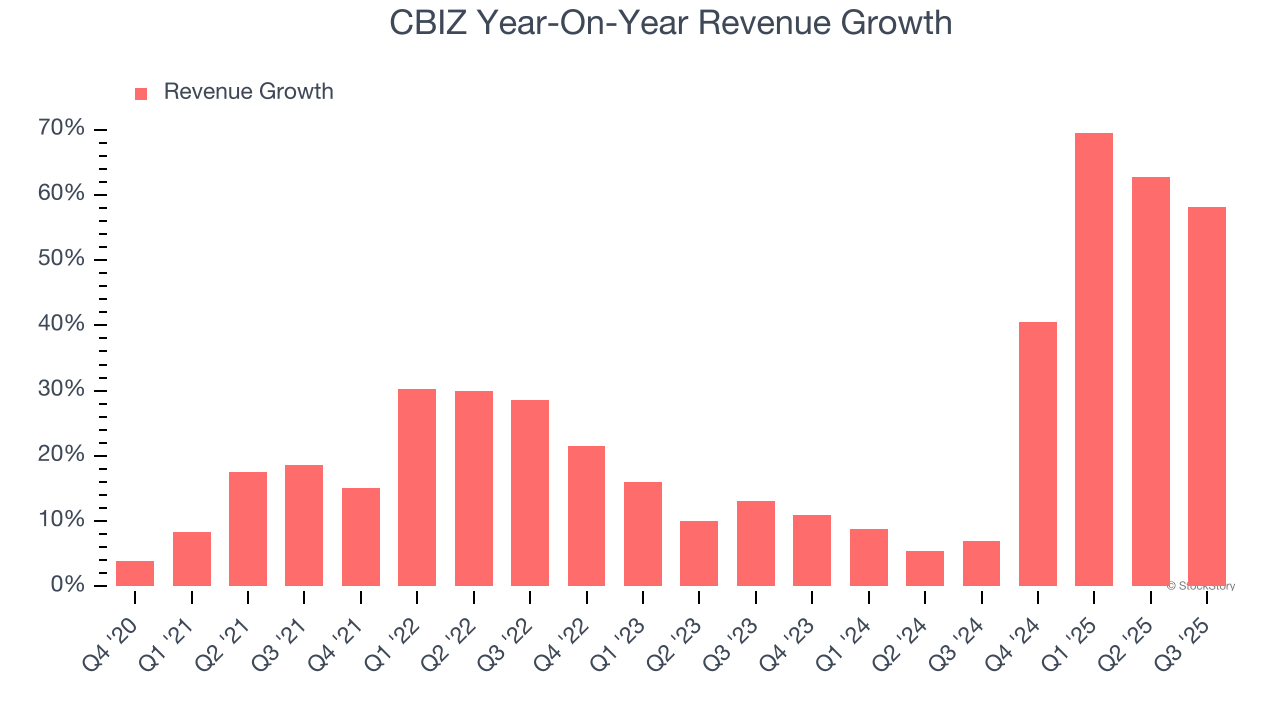

As you can see below, CBIZ grew its sales at an incredible 22.9% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows CBIZ’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. CBIZ’s annualized revenue growth of 31% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, CBIZ achieved a magnificent 58.1% year-on-year revenue growth rate, but its $693.8 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and suggests the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

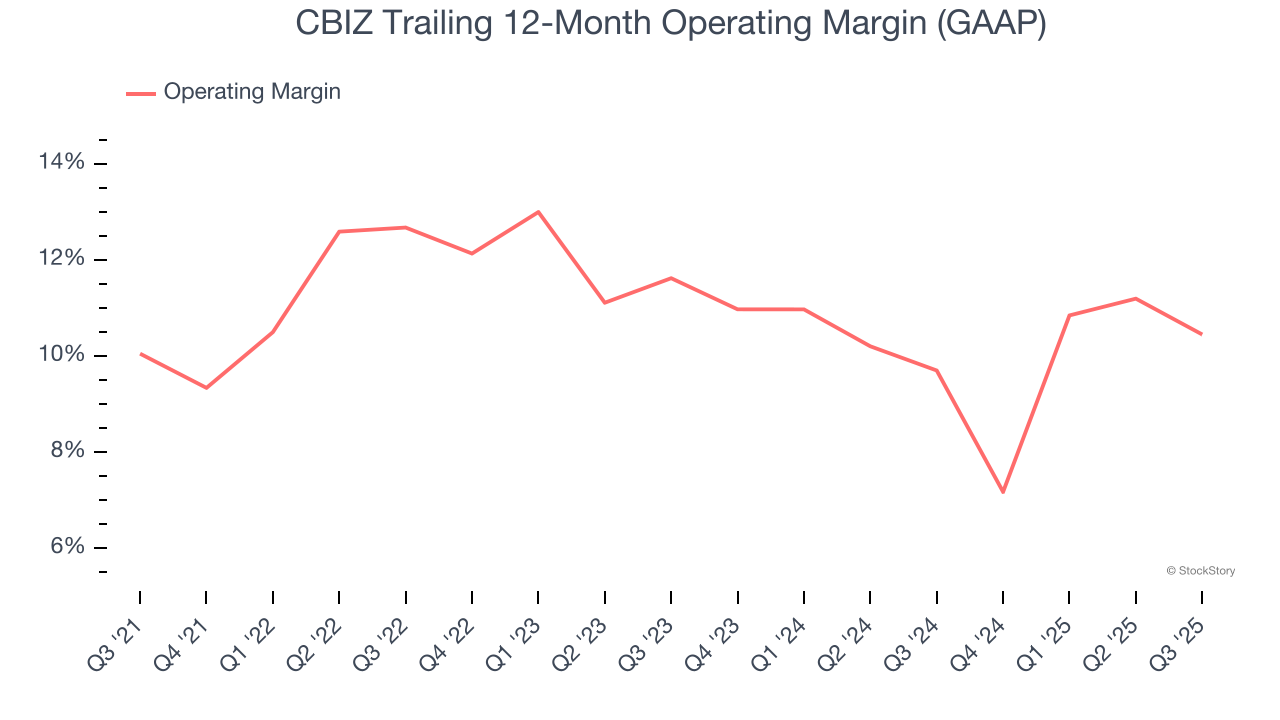

CBIZ’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 10.8% over the last five years. This profitability was higher than the broader business services sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, CBIZ’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, CBIZ generated an operating margin profit margin of 8.5%, down 3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

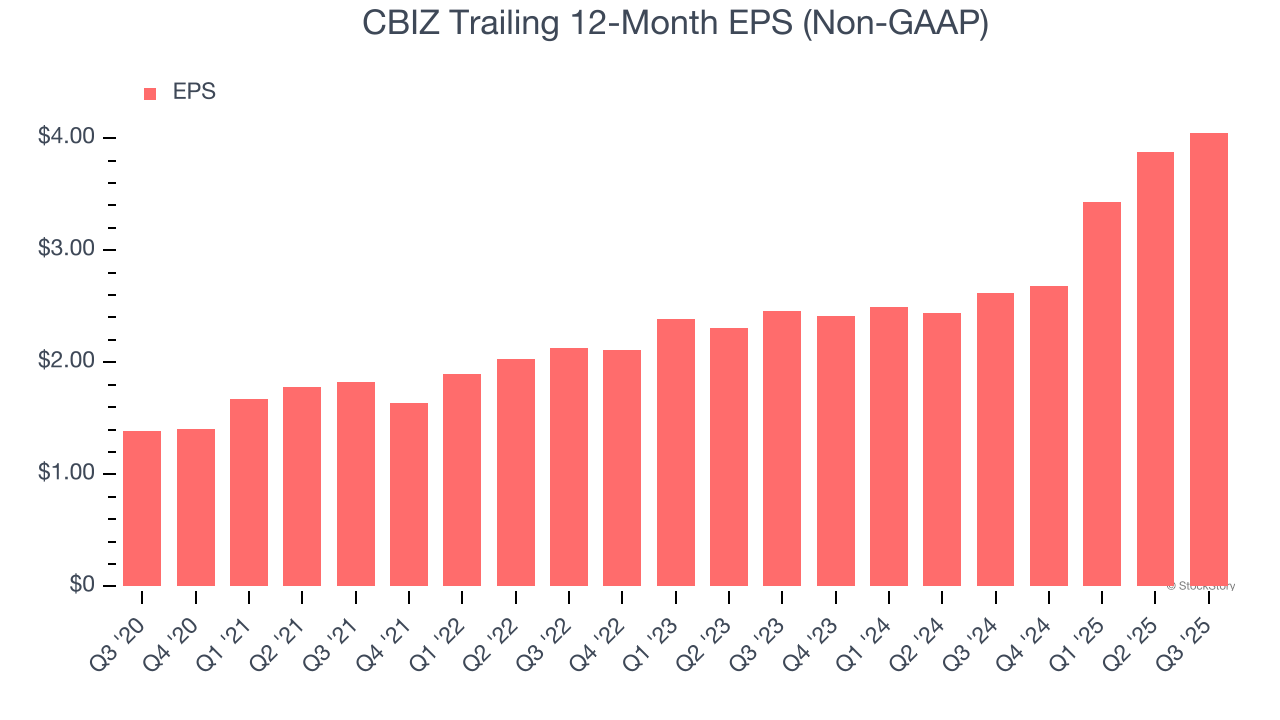

CBIZ’s astounding 23.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Although it performed well, CBIZ’s two-year annual EPS growth of 28.3% lower than its 31% two-year revenue growth.

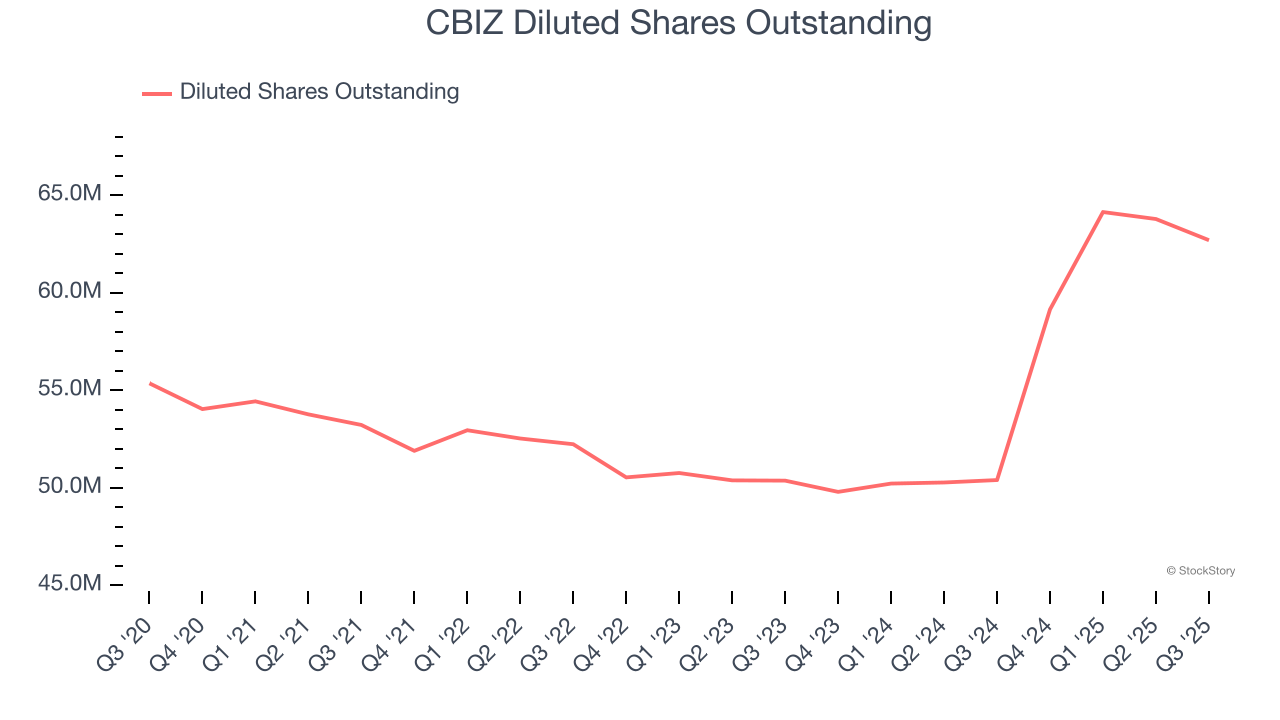

We can take a deeper look into CBIZ’s earnings quality to better understand the drivers of its performance. CBIZ’s operating margin has declined over the last two yearswhile its share count has grown 24.5%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, CBIZ reported adjusted EPS of $1.01, up from $0.84 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects CBIZ’s full-year EPS of $4.05 to shrink by 2.9%.

Key Takeaways from CBIZ’s Q3 Results

It was good to see CBIZ beat analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its revenue missed. Overall, this print had some key positives. The stock traded up 1.9% to $52.33 immediately following the results.

Is CBIZ an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.