Credit scoring and analytics company FICO (NYSE: FICO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 13.6% year on year to $515.8 million. On the other hand, the company’s full-year revenue guidance of $2.35 billion at the midpoint came in 1.9% below analysts’ estimates. Its non-GAAP profit of $7.74 per share was 5.2% above analysts’ consensus estimates.

Is now the time to buy Fair Isaac Corporation? Find out by accessing our full research report, it’s free for active Edge members.

Fair Isaac Corporation (FICO) Q3 CY2025 Highlights:

- Revenue: $515.8 million vs analyst estimates of $513.6 million (13.6% year-on-year growth, in line)

- Adjusted EPS: $7.74 vs analyst estimates of $7.36 (5.2% beat)

- Adjusted EBITDA: $286.6 million vs analyst estimates of $278.3 million (55.6% margin, 3% beat)

- Operating Margin: 46%, up from 43.4% in the same quarter last year

- Free Cash Flow Margin: 40.9%, down from 48.3% in the same quarter last year

- Annual Recurring Revenue: $747.3 million vs analyst estimates of $757.6 million (3.6% year-on-year growth, 1.4% miss)

- Market Capitalization: $41.39 billion

Company Overview

Creator of the three-digit number that can determine whether you get a mortgage or credit card, Fair Isaac Corporation (NYSE: FICO) develops analytics software and the widely used FICO Score, which is the standard measure of consumer credit risk in the United States.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.99 billion in revenue over the past 12 months, Fair Isaac Corporation is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

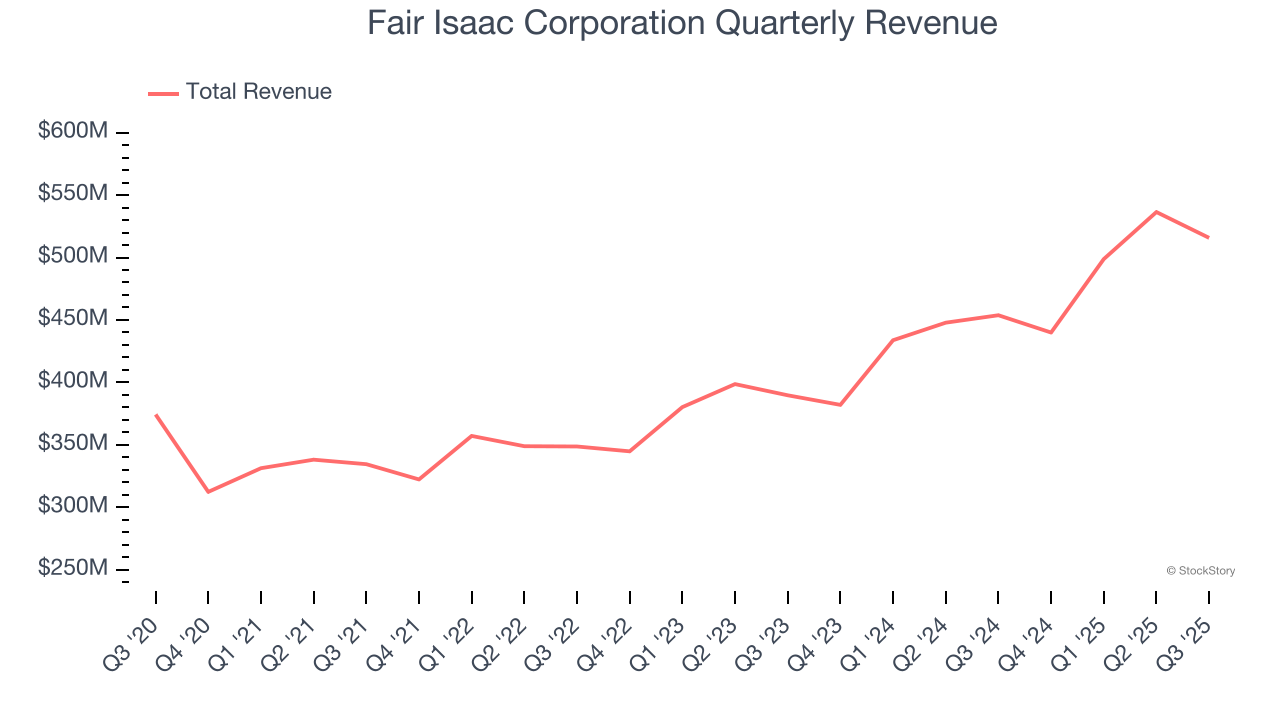

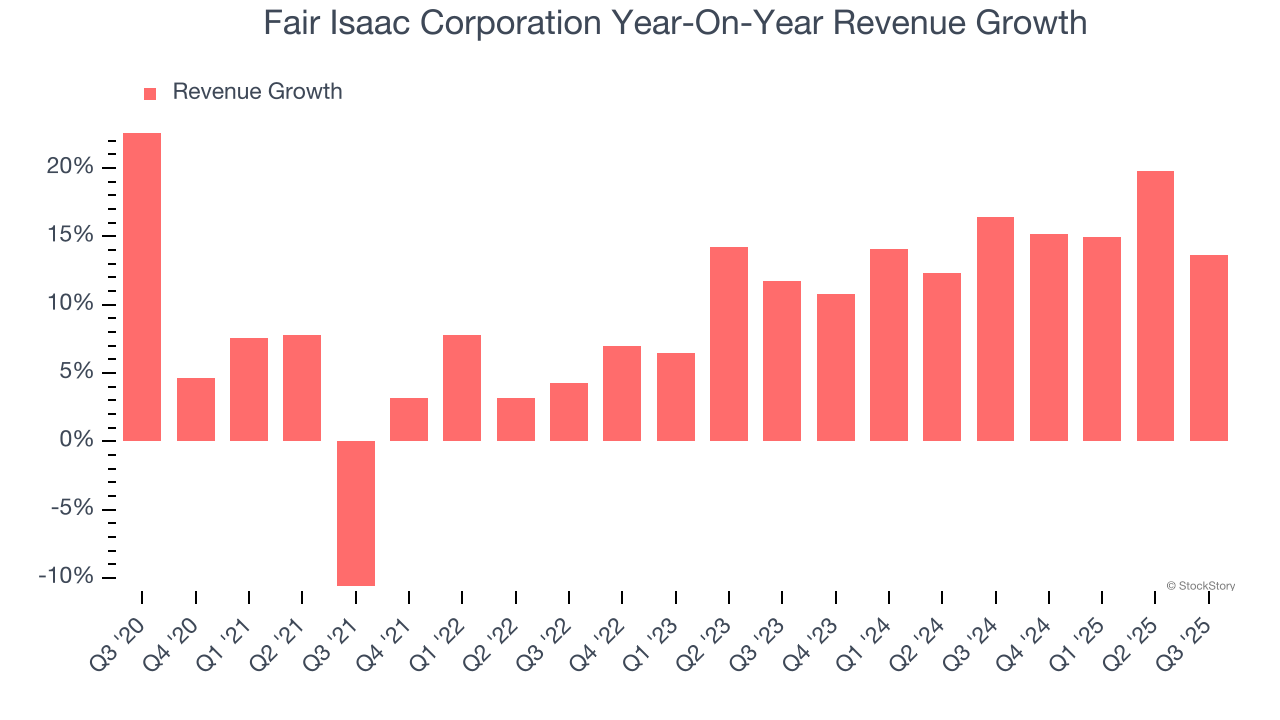

As you can see below, Fair Isaac Corporation grew its sales at a solid 9% compounded annual growth rate over the last five years. This is a good starting point for our analysis because it shows Fair Isaac Corporation’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Fair Isaac Corporation’s annualized revenue growth of 14.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s sales dynamics by analyzing its annual recurring revenue (ARR), or the revenue it expects to generate from its existing customer base in the next 12 months. Fair Isaac Corporation’s ARR reached $747.3 million in the latest quarter and averaged 8.2% year-on-year growth over the last two years. This number is lower than its normal revenue growth. If ARR growth continues to trail revenue growth, the company could see lower valuation multiples because topline growth will be coming from less recurring sources. Holding everything else constant, this is a negative sign as it should lead to better multiples over time.

This quarter, Fair Isaac Corporation’s year-on-year revenue growth was 13.6%, and its $515.8 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 21.8% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will fuel better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

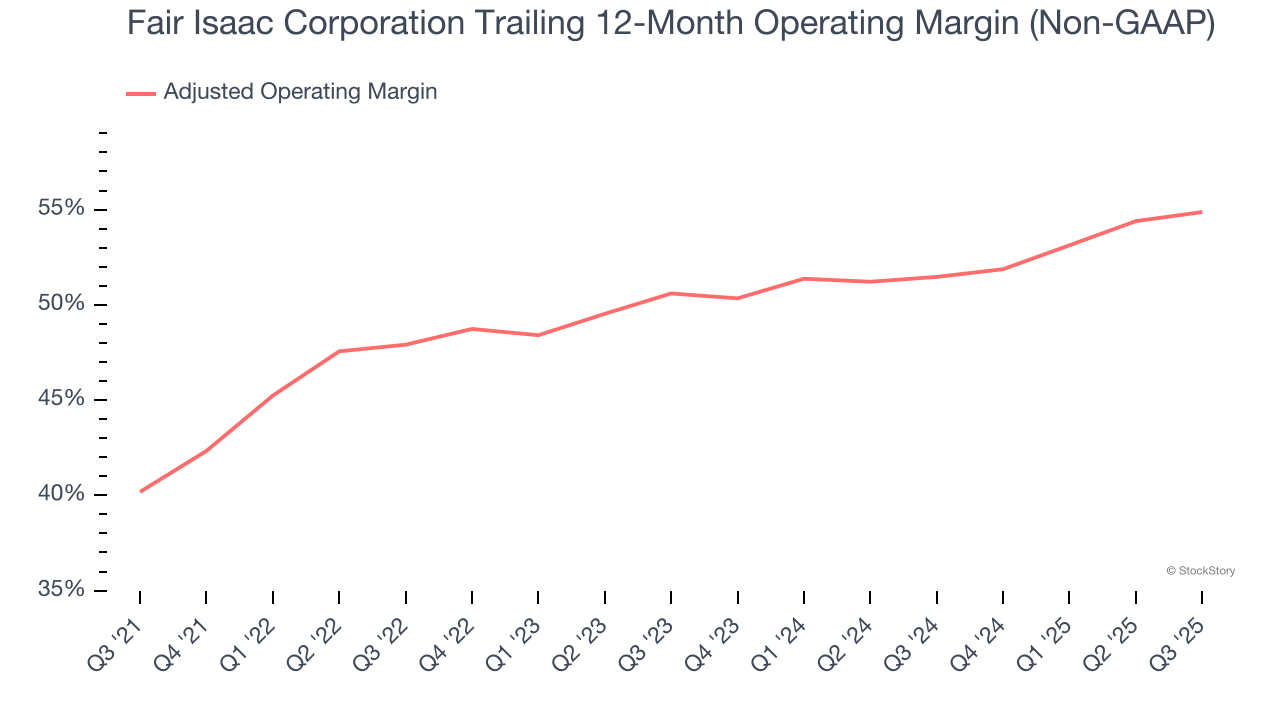

Fair Isaac Corporation has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average adjusted operating margin of 49.7%.

Looking at the trend in its profitability, Fair Isaac Corporation’s adjusted operating margin rose by 14.7 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Fair Isaac Corporation generated an adjusted operating margin profit margin of 54.4%, up 2.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

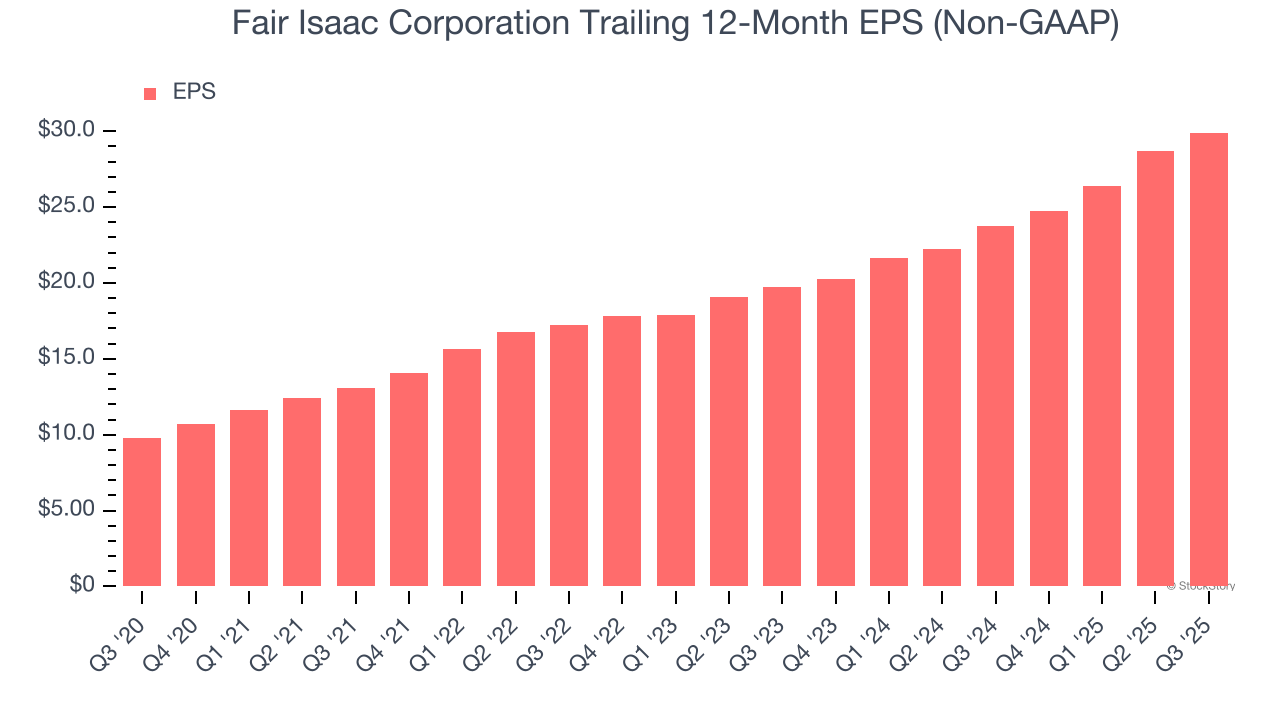

Fair Isaac Corporation’s EPS grew at an astounding 25.1% compounded annual growth rate over the last five years, higher than its 9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Fair Isaac Corporation’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Fair Isaac Corporation’s adjusted operating margin expanded by 14.7 percentage points over the last five years. On top of that, its share count shrank by 19%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Fair Isaac Corporation, its two-year annual EPS growth of 23.2% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Fair Isaac Corporation reported adjusted EPS of $7.74, up from $6.54 in the same quarter last year. This print beat analysts’ estimates by 5.2%. Over the next 12 months, Wall Street expects Fair Isaac Corporation’s full-year EPS of $29.91 to grow 35.5%.

Key Takeaways from Fair Isaac Corporation’s Q3 Results

It was good to see Fair Isaac Corporation beat analysts’ EPS expectations this quarter. On the other hand, its full-year revenue guidance missed and its ARR fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.4% to $1,721 immediately following the results.

The latest quarter from Fair Isaac Corporation’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.